Introduction

Most banks have very explicit credit score policies. Presently, most employees including interns, struggle with high financial debts. This situation affects their likelihood of acquiring employment within most institutions (Mays 11). There is a clear indication that certain category of employees that lacks adequate knowledge about the concept of credit scores.

Employees within the human resources department have critical responsibilities. Some of these include creating a comprehensive awareness on issues about credit scores. This business memo targets the student interns within a local bank. The memo contains general information about the credit scores. Apart from this, it also explains the importance of credit scores. Lastly, it outlines the various measures required to increase the points for the credit scores.

Credit Scores

A special number is normally attached to an individual’s credit score. The number is generated from an algorithm system. The data obtained from a person’s credit report is very critical. It is applicable in the mathematical computation of the credit score. There are several considerations in the development and setting of the credit score.

For instance, it has an important ability to predict risks. The risk approximation period usually extends to about two years (Weston 20). The system is designed to help in the prediction of an individual’s likelihood to become severely delinquent. Principally, the system is applied in the scrutiny of a person’s credit obligations within a specified time interval. Several models are applicable in the credit-scoring process. However, competitive models such as the “FICO credit score” model are widely applicable.

The system dominates the domestic and global environments. The US is one of the leading nations in which the FICO scoring model is in current use. All employees must be aware of the modes of operation and impacts of the credit score (Fair Isaac Corporation 2012). Most organizations have different policies and operational frameworks regarding the credit score.

According to the “FICO scores,” there are various ranges provided in the system. The ranges vary from three-hundred to 850. Therefore, it is upon the individuals to be aware of the most suitable credit score. Nonetheless, most systems indicate that the higher numbers depict very low risks. Most individuals have three of the FICO scores.

These scores are provided by three different agencies. These include the “Equifax, Experian and TransUnion” (Mays 36). It is important to note that most individuals may only access the scores generated from “Equifax and TransUnion FICO.” This follows the exclusion of the third firm from the credit-scoring scheme by myFICO.com.

The exclusion of Experian occurred in 2009. The creditors apply this concept in the determination of an individual’s level of creditworthiness. On the other hand, there are different institutions and employment agencies that apply the credit scoring method within their recruitment processes (Fair Isaac Corporation 2012).

The system contains all relevant financial information concerning an individual. These might include an individual’s record of paying bills. In addition, the system portrays all the types of accounts managed by persons. Other valuable information available in the system includes the debts, age of the accounts, and the debt clearance system. All this critical information is found within the credit report.

The creditors apply empirical processes in the comparison of basic information. This concerns information pertinent to the credit history of an individual. Statistical programs are used in these initiatives.

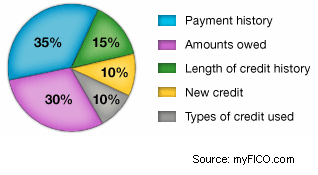

The scoring system is critical in the prediction of the capacity of people to submit their debts (Weston 34). Different agencies use the credit system in achieving various goals. Some of these include the insurance companies. The information is applicable in the determination of the possibility of providing certain insurance cover. The pie chart below indicates some elements in the credit score:

(From: myFICO.com)

The Importance of Credit Scores

The credit scores have great significance to individuals and institutions. However, these vary within different environments. Specifically, in the US all persons must have the credit score. However, this is only applicable to persons of a particular age. There is a special security number assigned to all persons under this age category (Weston 61).

This number is connected with an individual’s history of credit. The number is very crucial. For example, the relevant agencies seek the security number in the process of assessing the person’s credit worthiness. The name of the person is also important in the process. All these are significant during the identification of the various credit scores.

Most banks use the credit scores in defaulter tracing processes. These initiatives occur within the loan departments. They are also important in security systems. Specifically, these relate to the major economic crimes. It is also a process of monitoring and evaluating the historical financial undertakings of individuals.

The process helps recruitment operations of the company. The credit scores may also be applicable in the validation of a person’s level of integrity. It is also applicable in assessing the financial responsibility of different personalities. The credit score provides crucial information whether certain individuals deserve credit cards (Weston 76). Presently, most employers inquire about the credit score of all their prospective employees.

The trend is observable within jobs that involve handling large sums of money. These might include banks and other institutions dealing in finances. In such cases, the hiring certain employees usually depends on the level of their credit score. Those with high credit scores are more likely to access employment (Mays 91). Property owners have also applied the credit score system to assess the credit worthiness of their potential tenants. This process gauges the competency of various prospective tenants in meeting the monthly costs such as rent.

Measures for Raising the Credit Scores

There are diverse strategies for increasing the credit scores. Foremost, it is advisable for individuals to settle down their bills promptly because the delinquent payments may cause a detrimental effect on the average score (Weston 88). The process leads to a consequent rise in the level of credit score.

The balance in the credit cards must also be kept at very low levels. Generally, a high level of debt balances may have negative impacts on the credit score. Individuals must also restrain from opening many unnecessary credit cards. Additionally, there is need for responsible management of all the credit cards. Most people operate without credit cards. This is dangerous for the effective operation of the credit score.

However, an adequate financial management system is necessary (Weston 94). This explains why individuals require proper fiscal training. It is upon the employers to launch effective capacity building initiatives based on the credit system. In general, personal financial responsibility is a key factor. It helps in the development of an efficient credit score.

Works Cited

Fair Isaac Corporation. Credit scores. 2012. Web. Web.

Mays, Elizabeth. Handbook of Credit Scoring. S.l: Publishers Group UK, 2005. Print.

Weston, Liz P. Your Credit Score: How to Improve the 3-Digit Number That Shapes Your Financial Future. Upper Saddle River, N.J: FT Press, 2012. Print.