Abstract

Resort in Bari, Italy has a good prospect. Its sources of financing are better as US and France are showing their interest. Factors like transportation, airport, heritage and government are in a favorable condition. The feasibility study shows the resort needs extremely upgraded and unique advantages. If the resort finds no interest after conducting its operation it may exit with favorable conditions. The external governance is defined to ensure the soundness of financial and economical stability. The organizations decision making power will be centralized to its top level management and instant or less significant decision making power is delegated to mid level management.

Potential domestic and international sources of financing for a resort in Bari, Italy

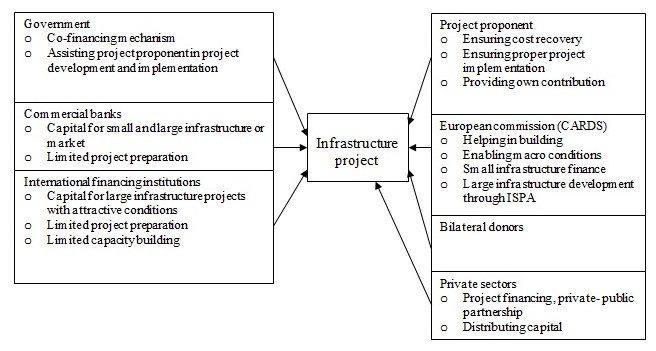

Financing is required for building initial capital, fulfilling working capital and sudden needs. Sources of finance can be evaluated in two ways; Debt financing and Equity financing. Debt financing means, financing can be arranged from money market and capital market. Money market is used for short term capital needs. As working capital is required for short term and suddenly, money market is used. Major element of money market for the proposed resort is commercial paper. Through commercial paper the resort can raise its fund for short term, nearly about for 1 day to 270 days. It is issued only for sudden needs. Another form of debt financing is using bonds. Bonds are normally matured within 10 to 30 years. So, long term capital requirement can be met through this. The commercial banks and financial institutions and non banking financial institutions are one of biggest source for long term financing. Equity financing is another form. The equity can be divided two ways; ordinary and preference share capital. If the hotel wants to raise its fund from stock market, it can be enlisted in domestic and foreign market. Equity financing has no maturity. Therefore, it can be considered as perennial until redeemed. The overall foreign sources of financing can depicted as below:

The role of external governance and its impact to the organization

Corporate governance is the system by which business corporations are directed and controlled. The corporate governance structure specifies the distribution of rights and responsibilities among different participants in the corporation, such as, the board, managers, shareholders, and other stakeholders, and spells out the rules and procedures for making decision on corporate affaires.

From the above definition the role of external corporate governance can be comprehended. Consumer group, clients, government regulations, demand for and assessment of performance information, debt covenants, government regulations, media pressure, takeovers, competition, managerial labor market, telephone tapping are the major elements of external governance. Role and impact of corporate governance is listed below:

- External corporate governance ensures the accountability towards its stakeholders and reduces the principal-agent problem. So, the impact is, the certain person or persons implement their liability with responsibility.

- It strengths economic efficiency. Hence the resort value is increased and stakeholder interest is maintained.

The degree to which the firm will operate as a Centralized or Decentralized Organization

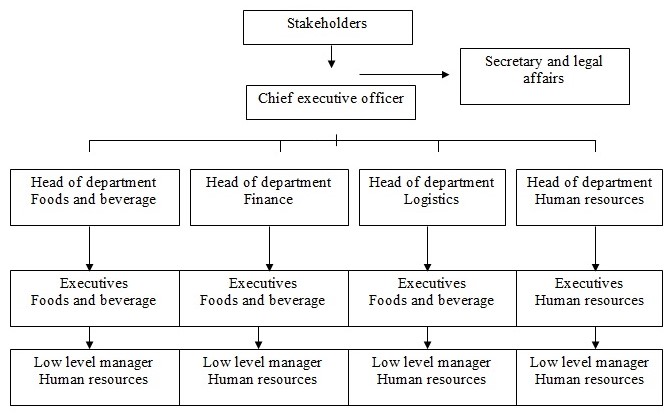

In the large organization the combination of centralization and decentralization is required. According to Grey and Strake “Absolute centralization and decentralization is fictitious in practice, it is a matter of degree along a continuum”. In the proposed hotel management, decentralization is beneficial. According to R. M Hodgetts, the ways for determining the degree of decentralization are:

- Quantity of decision

- Quality of decision

- Impact of decision

- Amount of control

In our proposed organization the limited decentralization will be used. In this procedure, important decisions are taken by top level management board and some power of taking related decision are given to mid level management. The decision are required to taken immediately, is delegated to low level and mid-level management. The major planning and expansion decision are taken by top level management.

- Cash sales to third party: This is a poor technique for liquidating instantly. This is immediate separation from business.

- Divestiture of assets: The hotel distributes shares of a subsidiary to its shareholder. As a consequence, the shareholders end up with a stake in the parent as well as the subsidiary. The stock in the subsidiary is distributed pro rata to the parent- company shareholders. No actual asset sale is involved and the subsidiary becomes a completely separate company.

- Acquisition: The hotel may be sold to another company or maximum amount of shares can be sold.

- Buyout or recapitalization: Another interested party may borrow funds to acquire the hotel. This method is effective if there is a multiple ownership.

The feasibility of this global venture

The feasibility study is a procedure to determine and examine the projects viability. The dimension of business viability includes:

- Technical feasibility study: It includes the technology used in the organization. The proposed resort requires updated technology like state-of-art call center, updated equipments like elevators, satellite, and computer system. The updated system requires inputs, processing, outputs, fields, programs and outputs. In this segment, the essential experience to operate and handle is required.

- Schedule feasibility study: How much time will require building up the system is determined in this segment.

- Cultural feasibility study: In this segment, the environmental scanning is required. Whether the global or native culture will be pursued, is determined in this segment. Naturally as the resort will be gathered with foreigner, the mixed culture is required and this is possible. Recently the Italian government is emphasizing more on its heritage and trying to discover the resources in southern part.

- Marketing feasibility study: This includes economic, legal, operational and schedule. These items have direct impact over the project undertaken. The resort can mange more loan as France and US are interested to invest in Italy. The legal aspects are quite flexible as government is conducting concession in different legal aspects.

Recommendations about the feasibility of this global venture

The feasibility of the resort is not good enough as competitors are stronger. If the resort is in the southern part of the area, it will be benefited more. Nevertheless, if the foreign investments can be hired and more upgraded infrastructure can be developed, it has prospect because tourism sector is contributing 6.5% in GDP and Italy is the 5th most visited country. So, government is introducing tax holiday, flexibility of legislation. Italy government is thinking to expand its resort market in southern part.

Impact of Contemporary trends in the global environment in the feasibility

Contemporary trends in global environment include environmental, demographical, technological, economical, political, and ethnical changes. The environment is greatly affected by slash-and-burn horticulture, overgrazing, soil erosion, and species extinction. As a result food crisis is emerging and people spend lots of their income on staple foods. So, there may be an adverse impact on the number of tourist in a decreasing rate. Fertility and morality rate is decreasing and therefore growth rate of population is decreasing. Western society has adopted zero population growth and china is in on child policy. This has a positive and negative impact on the feasibility study as the amount spends on tourism may increase or the amount of population may decrease. Another contemporary issue is energy consumption and people are in search for alternative energy. So, it is increasing the prices of essential item and raw materials. So, the technical and economical feasibility study may be hampered as cost is soaring.

Conclusion

The proposed resort has good prospect as factors like government legislations, labor laws, financing, and feasibility study are in a favorable condition though the recent contemporary changes has an adverse impact over the organization. The major problem is facing the competitors as they are enough stronger. So, our proposed resort has to be appeared with unique feature like Dubai is attracting its customers by setting up hotels in the sea.

Bibliography

Dibb, S. Simkin, L. Pride, W.M. & Ferrell, O.C. (2001), Marketing Concepts and Strategies, 4th edition, Boston, USA: Houghton Mifflin, Page 691.

Hill, C.W.L., (2007), International Business: Competing in the Global Marketplace, 6th ed, McGraw-Hill.

Kotler. P and Armstrong. G (2005), Principles of marketing, 11th ed, New Delhi: Prentice Hall of India, (Pg194-233).

Thompson, A. Arthur & Strickalnd, J, (2007), Strategic management, 13th ed, India: Tata Mcgraw- Hill Publishing Company limited.

Small Business Notes (2008), Exit Strategies, Web.