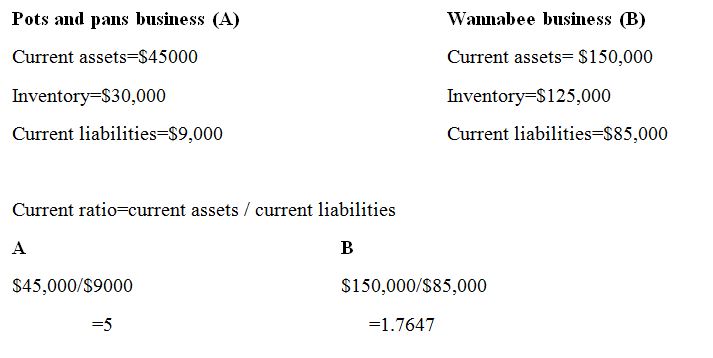

Pots and pans is likely to get the loan unlike Wannabee because the higher the ratio, the lower the liquidity risks since pots and pans has enough liquid assets to meet its short term obligations unlike for Wannabee.

The difference between assets and liabilities is that assets are the resources that the company owns while liabilities are the obligations that the company has which must be met through repayment. The key financial statements that features the assets and liabilities include the statement of financial position and statement of comprehensive income.

The accounting cycle has various steps which include; the presence of transactions, the transactions are then recorded as entries in the journals, the journal entries are then posted to the general ledger for the preparation of a trial balance that is not adjusted. From the trial balance, the debit and credit entries are recorded, the entries are then adjusted to match the debit and credit to be equal. After matching of the debit and credit entries, the financial statement, statement of financial position and statement of comprehensive income are then prepared. Lastly, the revenue and expenses are closed based on the net profit or net loss from the financial statements.

Firms do ratio analysis for various reasons which include; to help in formulation of plans and policies that will help the business to prosper. Ratio analysis helps the firms to evaluate their liquidity positions if they can meet short term obligations.