Executive Summary

The report explores the contemporary context of running a family business with the aim of the identification of threats concerning the integrity relationships between the family members involved in the same business. The paper starts with an introduction to the problem’s background with the following identification of the main goals of the report. The description of the meta-analysis approach and its results are presented in the methods and findings sections. The paper ultimately concludes by summarising points and three main recommendations aimed at minimization of family disintegration. The purpose of the study is to analyze the existing literature on the topic of family relationships and a family business, estimate the potential threat such relationships might impose, and introduce relevant recommendations for future use.

Introduction

The history of family business research presents a variety of case studies that investigate the issues of relationships between family members. Many works examine the problems of children-parents relationships within the succession paradigm, sibling conflicts, generation gaps, and the moral side of the controversy between family well-being and wealth (Ayranchi 2014; Chalus-Sauvannet, Deschamps & Cisneros 2016; Helin & Jabri 2015; Leppäaho, Plakoyiannaki & Dimitratos 2016). Despite the broad scope of academic attention to the problem, there are still gaps that need to be filled, including the lack of accurate analysis of the reasons for negative outcomes of such relationships, as well as recommendations for properly addressing the shortcomings. The relevance of the topic is great due to the overall popularity of family businesses all over the world and the frequent occurrence of conflicts and challenges between different family members that obstruct the flow of inside business affairs and the financial performance of an enterprise. The purpose of the report is to collect and analyze existing literature that examines the discussed problem to use the former experience and carry out the proper strategy to eliminate threats and foster healthy relationships inside a family firm.

Aims

The purpose of the report might be achieved by clear identification and following several specific aims. Firstly, they include a thorough investigation of the problems imposing family disintegration as a result of the common work of several family members inside one firm. Secondly, it is essential to contrast the positive and negative outcomes of being involved in a family business as portrayed in the analyzed research studies. Finally, the report aims at developing a sufficient number of recommendations which would amplify positive predispositions of a family business for the interpersonal connections between family members, as well as introduce some strategies to eliminate the flaws of such a type of business.

Methods

Meta-analysis was utilized to examine the general characteristics of family business marked with family subordination and particular issues frequently occurring in a family business and obstructing family integration. The statistical data show that family business embraces approximately 90% of “the business in the worldwide free economy” and employs 75% of the workforce in the world (Dana & Ramadani 2015, p. 10). Thus, it is vital to pay close attention to the issues concerning this sphere. Ten literary sources were found and analyzed to collect the necessary information. The literature used for the analysis is dated from 2015 till 2019, which makes the findings up-to-date and relevant for the recommendation presentation and the ultimate use of the results of the work.

Findings

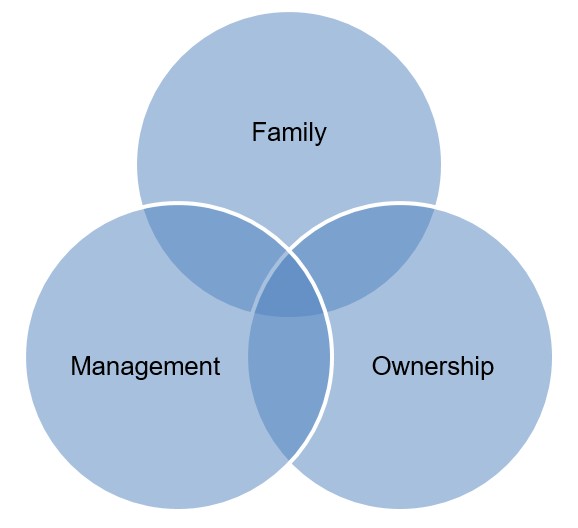

The research on family business-related issues is growing rapidly. The majority of studies concern multiple dimensions in which family-owned firms perform and the challenges the family members experience (Payne, Pearson & Carr 2017). The overall findings in the field of a family business and relationships imply the collision of several aspects characterizing family involvement in common business work. These aspects are shown in Figure 1, which is developed on the basis of the information retrieved from Neubauer and Lank (2016, p. 39-41).

As the figure implies, the conflicts in different spheres might overlap and cause family disintegration, as well as a business failure. Indeed, the long-lasting traditions concerning management style and owns shares of family companies with long history might become a root of the conflict. The generation gap can bring disparity of views that different family members have about business management (Hamilton, Cruz & Jack 2017). The intertwined relationship styles characteristic of family and business need a specific approach to be successfully regulated throughout the working process.

As Neubauer and Lank (2016) state, good governance of a family-owned firm guarantees its financial growth, strategic succession planning, and competitive performance. However, often, different family members experience the collision of the three abovementioned primary interests that leads to conflicts and family disintegration. Succession as the way of ensuring the longevity of a business is one of the most beneficial and, at the same time, most difficult issues when it comes to the family business (Dana & Ramadani 2015; Chalus-Sauvannet, Deschamps & Cisneros 2016; Ward 2016). Effective succession is impossible without proper maintaining the interests of the family, management, and ownership.

Functional communication is the core of the effectiveness of family business performance in its short- and long-term perspectives. According to Helin and Jabri (2015), failure to communicate important issues in an unbiased manner might cause problems with firm performance. For example, the case of Brunsalla Ltd shows how communication impairment threatens business growth (Helin & Jabri 2015). The tenth generation of the family that has long been in charge of Brunsalla Ltd consists of several cousins whose relationships are marked with conflict. On the one hand, the successors are proud of the work of their ancestors. On the other hand, the conflict between several cousins and their disability to communicate the issues effectively not only threatens the future of the firm but also paralyzes any attempts to resolve the issue.

Conclusions

In summary, a family business is a crucial constituent of the worldwide economy that implies its great importance in the modern economic environment. It is obvious that the effectiveness of research in this field might ensure the improvement in performance and keep families integrated despite business-related conflicts. The majority of issues threatening the unity of a family are related to communication difficulties connected with the discussion of succession or management style. Therefore, it is vital to eliminate the adverse outcomes of the conflict between family, management, and ownership by implementing several techniques articulated in the recommendations section.

Recommendations

Functional communication practice is essential for a family business to succeed and to protect a family from disintegration. Thus, the first recommendation is to engage in multi-voiced conversations during the meetings to ensure effective listening and flexibility in strategic decisions. Such a technique will affirm the inclusion of each family member in the decision-making process and foster conflict resolution in its early stages. Secondly, an effective way to eliminate family disintegration as a result of family business conflicts is by writing a constitution (Kets de Vries 2017). An official document in which the rules and laws of business relationships are written could be a beneficial tool in managing possible disputes. Finally, constant orientation on the future with great attention to moral priorities could be articulated as a company’s vision to guarantee respectful cooperation between family members through the years of successive management.

Reference List

Ayranchi, E 2014, ‘A study on the influence of family on family business and its relationship to satisfaction with financial performance, Business Administration and Management, vol. XVII, no. 2, pp. 87-105.

Chalus-Sauvannet, MC, Deschamps, B & Cisneros, L 2016, ‘Unexpected succession: when children return to take over the family business, Journal of Small Business Management, vol. 54, no. 2, pp. 714-731.

Dana, LP & Ramadani V (eds.) 2015, Family businesses in transition economies: management, succession, and internationalization, Springer, New York, NY.

Hamilton, E, Cruz, AD & Jack, S 2017, ‘Re-framing the status of narrative in family business research: towards an understanding of families in business, Journal of Family Business Strategy, vol. 8, no. 1, pp. 3-12.

Helin, J & Jabri, M 2015, ‘Family business succession in dialogue: the case of differing backgrounds and views,’ International Small Business Journal, vol. 34, no. 4, pp. 487-505.

Kets de Vries, MFR 2017, ‘Saving a family business from emotional dysfunction’,Harvard Business Review, Web.

Leppäaho, T, Plakoyiannaki, E & Dimitratos, P 2016, ‘The case study in family business: an analysis of current research practices and recommendations’, Family Business Review, vol. 29, no. 2, pp. 159-173.

Neubauer, F & Lank, AG 2016, The family business: its governance for sustainability, Springer, New York, NY.

Payne, GT, Pearson, AW & Carr, JC 2017, ‘Process and variance modeling: linking research questions to methods in family business research’, Family Business Review, vol. 30, no. 1, pp. 11-18.

Ward, J 2016, Keeping the family business healthy: how to plan for continuing growth, profitability, and family leadership, Palgrave Macmillan, New York, NY.