Introductory to Capital Budget

Capital budgeting is the vital fact for investment decision. It is concerned with a process of evaluating and choosing project for long-term which are better consistent with the goal to maximize the wealth of the owner. A business organization focuses on various types of long-term investment decision. Most common of them are property, equipment and plant.

“A capital expenditure is an outlay of cash for a project that is expected to produce a cash inflow over a period of time exceeding one year” (Net MBA Business knowledge center, 2002-2007).

There are many reasons and motives for which the capital expenditure is made. These are expansion, replacement, renewal, and so on.

The renowned author Gitman (2002) has mentioned five steps in his book named Principles of Managerial finance in the 10th edition published by recent book House In 2004-2005.

Steps of Capital Budgeting

The five steps are:

- Proposal generation. Proposals are made at all levels with a business organization and are reviewed by finance personnel. Proposals that require large outlays are more carefully scrutinized than less than costly one.

- Review and analysis. Formal review and analysis is performed to assess the appropriateness of proposals and evaluate their economic viability’’ (TermPapersMonthly, 2007).

- Decision making. Firms typically delegate capital expenditure decision making on the of dollar limits. Generally, the board of directors must authorize expenditures beyond a certain amount. Often plant managers are given authorized to mark decisions necessary to keep the production line moving.

- Implementation. Following approval, expenditures are made and projects implemented. Expenditures for a large project often occur in phases.

- Follow-up. Results are mentioned and actual costs and benefits are compared with those that were expected. Action may be required if actual outcomes differ from projected ones.

Basic Terminology for Capital Budgeting

Here we just focus on the four basic terminology for capital budgeting which are related to the capital budgeting process. The four terminologies are:

- Independent versus Mutually exclusive project.

- Unlimited funds versus capital rationing

- Accept-reject versus ranking approaches

- Conventional versus non conventional cash flow pattern.

Key Financial Metrics for Capital Budgeting

We have already stated the basic terminology of capital budgeting here our focus will be on the techniques which is used fir evaluating and selecting a project.

- Pay back period.

- Net present value.

- Internal rate of return (IRR).

Pay back period

The term pay back period denotes an amount of time needed for a business organization to recollects its initial investment of a project. For calculating the pay back period of a firm’s investment it is needed to divide the initial investment by the annual cash flow.i.e:

Pay back period = initial investment/annual cash flows.

This technique is treated as unsophisticated because it does not take into account the time value of money though pay back period is one of the most popular techniques.

Decision Criteria

Whether a proposed investment project will be select or not it depends upon how much time is needed to recover the initial investment.

- If the calculated payback period is less than the maximum pay back period then the project should be accepted.

- And if the calculated pay back period is greater than the maximum acceptable pay back period then the project should be rejected (EUGENE, 2001).

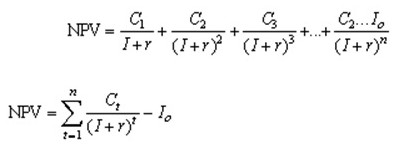

Net Present Value (NPV)

Net present value is considered the most sophisticated technique of capital budgeting because it takes into consideration the time value of money. The net present value can be calculated by subtracting a project’s primary investment from the cash inflows calculated in present values.

Where:

- Ct = the net cash receipt at the end of year t

- Io = the initial investment outlay

- r = the discount rate/the required minimum rate of return on investment

- n = the project/investment’s duration in years.

Decision Criteria

- Net present value is generally compared to the amount zero (0). A proposed project would be accepted whenever the net present value is greater than zero.

- The project would be rejected if the net present value is less than zero.

Internal Rate of Return (IRR)

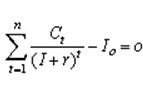

The internal rate of return is the most hard and sophisticated technique used in capital budgeting. The IRR is the discount rate at which the net pre sent value of an investment opportunity equals zero.

The IRR can be calculated by trial and error.

Where:

- r = IRR

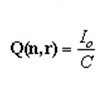

IRR of an annuity

Where:

- Q (n, r) is the discount factor

- Io is the initial outlay

- C is the uniform annual receipt (C1 = C2 =….= Cn).

Decision Criteria

- A proposed project would be accepted if IRR accedes the cost of capital.

- A proposed project would be rejected if IRR is less than the cost of capital.

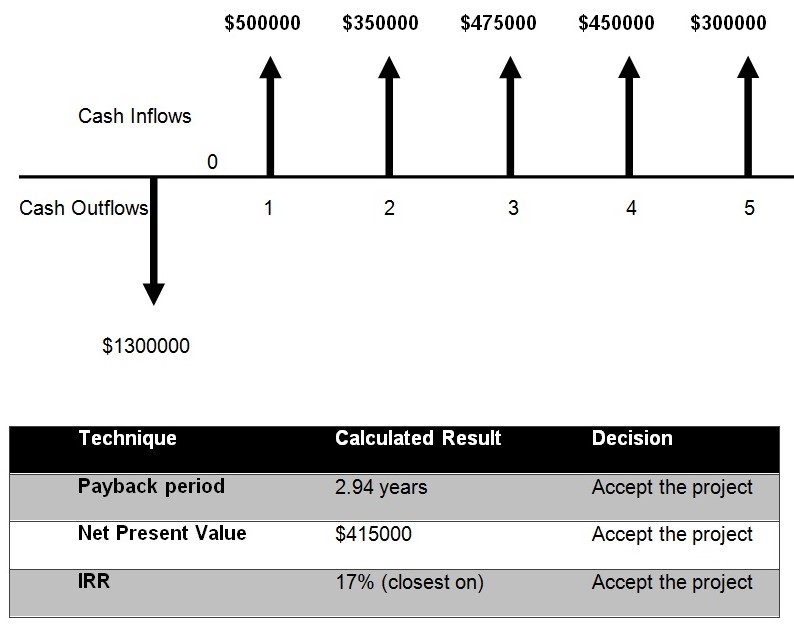

Evaluation the proposed investment project for STRIDEN MARKS

Striden Marks should accept the project because it has a favourable payback period (2.94 years) which is much shorter than five years and it has higher NPV and the most sophisticated calculation is the 17% IRR. Finally, if Striden Marks makes their investment on this project they will be highly benefited.

References

Eugene, F. Brighamand Joel F (2001). Fundamentals of Financial Management. 9 th ed., Harcourt College Publishers.

Lawrence J. Gitman. (2002). Principles of Managerial Finance. 10th ed., Addison Wesley.

Net MBA Business knowledge center. (2002-2007). Capital Budgeting. NetMBA. Web.

TermPapersMonthly (2007). Risk Analysis on Investment Decision Papers. Papers, Research Papers, and Essays for Students. Web.