Introduction

Caterpillar, Inc. is an American manufacturer of construction and mining machinery. The company is highly ranked in industries that include, but are not limited to, transportation, mining, energy, electrical power generation, and finance (CNN Money, 2017). As of 2016, its market capitalization was $69.5B (CNN Money, 2017). This paper aims to analyze the company’s segmentation strategies and target markets. It will also assess Caterpillar, Inc.’s main competitors, and discuss the manufacturer’s future.

Discussion

Segmentation and Target Markets

Segmentation and targeting are of paramount importance for businesses that are willing to increase the effectiveness of their marketing efforts. In addition, marketing strategies based on particular characteristics of target markets always attract more customers (Kotler & Keller, 2016). The company operates in the following industry segments: residential and commercial constructions, power systems, financial products, and energy. It is clear that due to its broad reach, Caterpillar Inc. cannot effectively target a wide range of niches associated with it.

The organization’s marketing specialists have to rely on psychographic segmentation in order to better understand priority initiatives and decision criteria of the company’s customers. By utilizing 5 Rings of Buying Insight framework the manufacturer’s marketing specialists, have identified two primary market segments that stretch across all industry segments: high-information customers and result-oriented customers (Buyer Persona Institute, n.d.).

It has helped the organization to obtain better control of its brand management strategies. Caterpillar Inc.’s website reveals that the company “owns a complex portfolio of brands” (Caterpillar, 2017a, para. 1) that support its growth.

Taking into consideration the fact that Caterpillar Inc. is a corporation that was first introduced as a tractor manufacturer that has managed to extend its brand to products such as shoes, financial instruments, engines, and bags, its two-pronged approach to segmentation is extremely effective. This approach allows the company to “use the leverage of a well-known brand name in one category, to launch a new product in a different category” (Soomro, Issani, & Nasim, 2016, p. 348). In terms of targeting, its advertisements and marketing efforts are tweaked to different groups of buyers for each brand. However, despite their demographic, behavioral, geographic, and other differences all target markets can be subsumed under two categories: high-information customers and result-oriented customers.

Competition

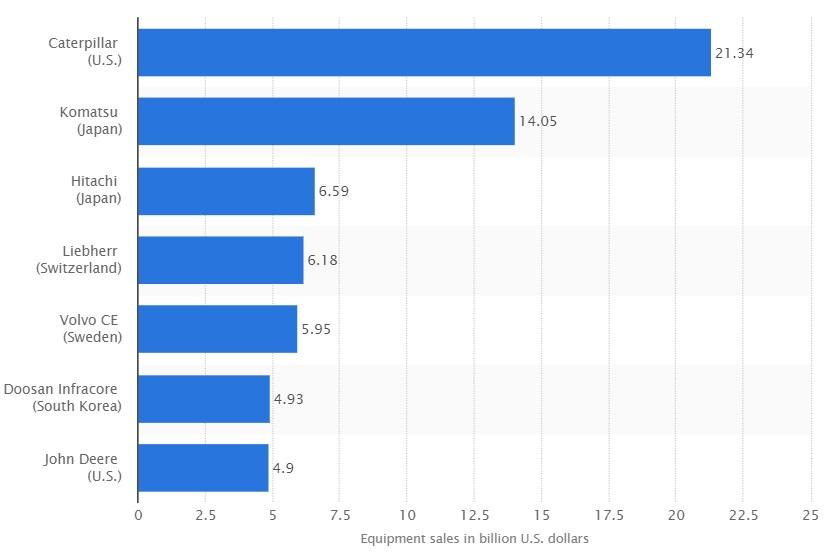

Caterpillar Inc. is the world’s largest manufacturer of construction equipment and machinery. The company’s direct sales in this particular market surpassed $21 billion in 2016, which is a substantial portion of its total sales (Statista, 2017). The company’s key competitors in the industry are Komatsu, Hitachi, and Liebherr. Figure 1 shows equipment sales of Caterpillar Inc.’s top rivals.

It is clear from the picture that Caterpillar Inc. outperforms all competitors by a wide margin. The company’s retail statistics are a testament to the efficiency of its product strategies and show that global sales increased from 4 to 12 percent in the last quarter of 2017 (Caterpillar, 2017b). In addition, it is expected that the manufacturer’s sales will reach $32 billion by 2020 (Statista, 2017). Caterpillar Inc. is effective in pooling customers from different industries that its rivals. It also has a stronger portfolio of well-established products.

Despite its numerous advantages, Caterpillar Inc.’s position as the undisputed leader in sales of heavy equipment might be undermined by China’s economic slowdown (Lee, Sun, & Varshney, 2016). This slowdown is associated with a lack of meaningful post-coal growth of the country’s economy, which also poses a threat to Caterpillar Inc. that produces mining equipment (Qi, Stern, Wu, Lu, & Green, 2016).

On the other hand, mining and construction equipment businesses of Komatsu, Hitachi, and Liebherr are less reliant on the Chinese market. For example, in the third quarter of 2016, Komatsu’s sales in China amounted to ¥18, 733M, which is only a fraction of its sales in Japan and Americas—¥59, 657, and ¥124, 668, respectively (Komatsu, 2016). Overreliance on the Chinese market is a substantial disadvantage that has to be eliminated by Caterpillar.

Successful Strategy

Caterpillar Inc. has come a long way from being an obscure tractor manufacturer to becoming the industry leader. The company’s breakthrough products are distinguished from those of its competitors by a large set of local features that are tailored to the specific needs of foreign markets (Hill & Jones, 2012). In order to execute its international strategy, the company decentralized its decision-making function in 1988 (Neilson, Martin, & Powers, 2008).

By doing so, the manufacturer improved its performance management and scaled up its capacities. A series of mergers and acquisitions were also key to Caterpillar Inc.’s success. Ken Gray, the company’s director of innovation, reveals that in order to successfully develop a solution for Caterpillar Inc., its engineering team socializes all projects (as cited in Baskin, 2015). In addition, all innovative processes are paralleled, which helps to solve shared problems.

Future Direction

The most promising prospect for the future growth of the company is the construction equipment sales in Europe and Africa. Sjodin, Granskog, and Guttman (2016) argue that these region’s markets and aftermarkets will continue to grow in the following years. Therefore, Caterpillar Inc. will remain the industry leader in the foreseeable future. The company is recommended to focus more on pollution prevention with its product line, thereby minimizing its impact on the environment and attracting new customers and investors.

Conclusion

The paper has analyzed segmentation and targeting strategies of the world’s leader in construction machinery—Caterpillar Inc. It has been argued that the company will retain and strengthen its position on the market in the foreseeable future if it explores new growth strategies.

References

Baskin, J. (2015). Caterpillar turns fast to fail into sustainable success. Forbes. Web.

Buyer Persona Institute. (n.d.). How many segments does Caterpillar have? Buyer personas supply the correct answer. Web.

Caterpillar. (2017a). Brands. Web.

Caterpillar. (2017b). Retail statistics. Web.

CNN Money. (2017). Caterpillar Inc. Web.

Hill, C., & Jones, G. (2012). Strategic management: An integrated approach. New York, NY: Cengage Learning.

Komatsu. (2016). Consolidated business results for three months of the fiscal year ending March 31, 2017 (U.S. GAAP). Web.

Kotler, P., & Keller, K. L. (2016). Marketing management (15th ed.). Upper Saddle River, NJ: Pearson.

Lee, J., Sun, Y., & Varshney, S. (2016). A weakening chain? Impact of China’s economic slowdown on global supply chain management of US multinational enterprises: A capital market’s perspective. Journal of Supply Chain and Operations Management, 14(1), 68-74.

Neilson, G., Martin, K., & Powers, E. (2008). The secrets to successful strategy execution. Harvard Business Review. Web.

Qi, Y., Stern, N., Wu, T., Lu, J., & Green, F. (2016). China’s post-coal growth. Nature Geoscience, 9(8), 564-566.

Sjodin, E., Granskog, A., & Guttman, B. (2016). Reengineering construction equipment: From operations focused to customer centric. Web.

Soomro, Y., Issani, M., & Nasim, S. (2016). Consumer perceived brand concept & close brand extension: A multi-mediation model analysis. Journal of Business Studies, 12(1), 347-359.

Statista. (2017). Largest construction machinery manufacturers globally in 2016, based on construction equipment sales (in billion U.S. dollars). Web.