Executive Summary

The purpose of this paper is to analyze the business strategies of Etisalat Group; as a result, it conducts the industry and company analysis and assesses the strategic options, market shares, sales projections, and various business scenarios of the last three years to understand the company’s performance. The outcome of this report would assist the top management of Etisalat Group to have an expert opinion that would help it to review and restructure the existing strategies, improve the service quality and performance, and identify the new areas of investment.

Introduction

Etisalat Group is one of the multinational giants in the telecommunications and ICT sector, which started its journey in 1976 as an analog operator in the United Arab Emirates market; now, it is operating in seventeen countries with a market capitalization of the US $36 billion, and working with various technical experts to bring out innovative products and high-quality services. The company established its headquarters in Abu Dhabi, and for the last four decades, it has been consistently fostering its innovative technologies and exploring those in the markets; this has helped it to become the pioneer in the fifth-generation (5G) ICT platforms, and to gain a strong customer base of 163 million globally. The objective of this report is to provide further insight into how the top management of Etisalat Group reviews and renovates the business strategies for sustainable growth in the UAE.

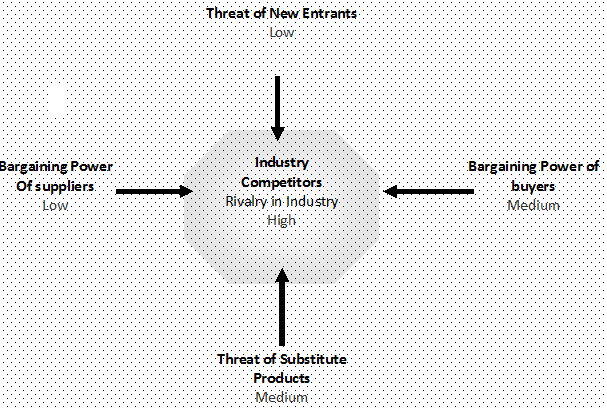

Porter’s Five Forces Analysis for Etisalat

The threat of New Entrants

The risk of new entrants is considerably low since new companies require a large investment to take part in the telecommunication industry; therefore, starting a business in this sector is very hard (Abdullah 1). On the other hand, existing multinational companies have sufficient financial capabilities to enter the UAE telecommunication sector using different entry route strategies; therefore, the government of this country imposed various restrictions and legal barriers in order to decrease the number of competitors in this segment. Abdullah stated that multinational companies implement merger and acquisition strategies ‘to gain competitive advantages’ and share common resources to capture the market share in the UAE; moreover, the government has changed its policy because of the global financial crisis and the new revenue stream (1). However, the government of the country has encouraged new entrants with the incentive of low licensing fees; consequently, new entrants could take the chance to enter in this prospective telecommunication market (Abdullah 1). Conversely, new entrants will face severe challenges because Etisalat has a good infrastructure and strong brand awareness for providing quality solutions to the local customers, for which it would be able to retain loyal clients.

Bargaining power of buyers

The bargaining power of Etisalat’s customer groups varies in different countries, for instance, it has a large number of loyal customers in the UAE because it is the mere competitor here, but the scenario is different in Saudi Arabia and Morocco. At the same time, the customers could switch to other companies while the switching expenditure is minimal; in addition, they are concerned about the price of the products; thus, the overall bargaining power of the buyers is medium.

Bargaining Power of Suppliers

According to the annual report of Etisalat, the company has significantly reduced its operating costs by negotiating with its dependable suppliers to decrease procurement expenses. It has been argued that it is one of the largest business organizations in the UAE, which gives it the opportunity to exercise huge bargaining power over the suppliers; moreover, new product development depends on the innovatory solutions of the suppliers. On the other hand, mainly two companies control the telecommunications industry in the UAE, for which the bargaining power of the suppliers is relatively low; however, Etisalat should include flexible provisions in the agreements with suppliers.

Threat of Substitutes

The threat of substitute products is comparatively high in the telecommunication industry of the country because the customers are free to use e-mails, Facebook, Google, or Yahoo messengers, twitter, and many other social networking solutions to communicate instantly with each other. It is notable that Etisalat provides both landline and mobile telephony services, for which it has to face minimal risks from substitutes; in addition, new invention always attracts the customers of the telecommunication industry (Abdullah 1).

Competitive Rivalry

According to the statement of the Chief Executive Officer of Etisalat, the company is in a strong position to overcome the possible challenges and carry on mega and complex digital projects. The competition between the two existing companies is extremely high because both companies intend to capture the leading position by attracting the customers of other companies since these organizations have the financial stability to compete with the latest technology. It is important to argue that according to the annual report of 2016, Etisalat has launched the first-ever 3G network in the Middle East market and introduced 4G (LTE) for the customers in the UAE.

Industry Analysis

It has been reported that the telecom industry giant and the ICT service provider Etisalat has successfully continued its uninterrupted growth by collaborating with the third parties in introducing new business solutions to leverage broadband infrastructure, and such growth trend would persist until Expo 2020 Dubai (Growing Market Saturation in Dubai Telecoms Increasing Competition for High-Quality Content 1). Irrespective of the challenges in the telecom industry, Etisalat and DU continues to be the two major duopolistic players in the UAE market, even though Al Yah Satellite Communications, Al Yah Satellite, and Media Zone have recently entered the market for satellite services and LG Electronics has penetrated through collaboration with Etisalat for IP-based security.

Company Analysis

Current ratio

Table 1: Current Ratio. Source: Self generated.

The current ratio of the company has been improving gradually from 2014 to 2016; whilst in 2014 and 2015, the ratio was less than one; it rose above one in 2016. This indicates that the company has recovered from the potential risk of bankruptcy in recent years because a current ratio below one represents that the liabilities are higher than assets.

Quick Ratio

Table 2: Quick ratio. Source: Self generated.

It is crucial to note that the business’s liquidity position has enhanced in the previous year since the higher the quick ratio, the better is the company’s liquidity situation. In 2016, it was above one, even though in the 2014 to 2015 period, the ratio was much lower.

Debt-to-Worth Ratio

Table 3: Debt-to-worth ratio. Source: Self generated.

Throughout the three years, there were fluctuations in the debt-to-worth ratio – it is necessary for companies to keep this ratio lower because a higher ratio could indicate a risky situation for the creditors of the business. The ratio finally developed in 2016 and it is highly essential for the company to maintain this scenario in the longer run.

Gross Profit Margin

Table 4: Gross profit margin. Source: Self-generated.

The gross profit margin has been noticed to decrease gradually; in 2014, it was much higher than in 2015, and in 2016, it again lowered slightly. It is highly essential for the company to increase this figure in the upcoming years in order to attract new investors.

Net Margin

Table 5: Net profit margin. Source: Self generated.

NPM is a vital ratio and it directly shows the real condition of a firm’s financial health – as a result, from the above table, investors can get a quick glimpse of the company’s internal scenario, and allow the business to decide whether the current strategies are working or not. It is notable that the company’s net profit margin has slowly lessened over the period, and it reached the lowest point in 2016. This should be revitalized as quickly as possible in order to bring back the business to its full form.

Return on assets (ROA)

Table 6: Return on total assets. Source: Self-generated.

The return on total assets has developed in 2016 in comparison to 2015; this is indeed a noteworthy improvement since ROA remains a vital point of reference for the investors. However, the company should seek ways to develop it further in the upcoming financial years through the adoption of suitable strategies.

Total assets turnover

Table 7: Total assets turnover. Source: Self generated.

The above figures illustrate how competent the firm is at the utilization of its existing assets in order to accumulate the sales revenue; it is apparent from the table above that the business remained successful in boosting up this figure in the 2015 to 2016 period.

Return on Investment (ROI)

Table 8: Return on total assets. Source: Self-generated.

The return on investment ratio shows the extent to which an investment remained successful; it is essential to argue that the company’s efficiency has increased in terms of ROI in the recent years in comparison to 2014 – this effectiveness should be maintained over the longer period.

Debt Equity Ratio

Table 9: Debt Equity Ratio. Source: Self-generated.

This ratio would indicate a firm’s financial leverage; it is apparently arguable from the table above that the debt-equity ratio of the business has increased throughout the period, and in 2016, it reached the highest point. This indicates that the business is trying to be more capital intensive in the current year in comparison with the previous years.

Customer Analysis

According to the annual report (2016), the company enjoys a strong base of 162 million satisfied consumers both in-home and foreign markets, and it has been able to come up with apt business organizations, smart individuals, retail outlets, and governmental agencies, whilst striving for the highest level of customer satisfaction by meeting the increasing demands of people for a better experience. With its innovative solutions in the fields of LAN, GSM, 4G, 5G, Internet connectivity, security, and cloud service, it has been able to boost its customer base every year in 17 countries; for instance, its customer base was 54 million in Morocco, nearly 20 million in Nigeria, and 22 million in Pakistan, representing a total increase of 8% in 2016.

SWOT Analysis of Etisalat

Strengths

- Brand Awareness: being a government-owned company, Etisalat has a strong brand image in the national market, and it operates in 19 countries all over the world with huge success (Haseeb 1);

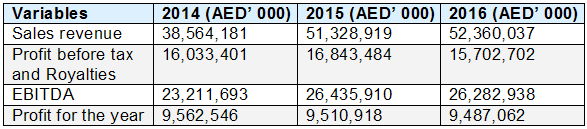

- Financial strength: According to the annual report (2016), Etisalat has demonstrated extraordinary financial performance in the last five years. Here, the following table gives more information regarding the financial capabilities of the company:

- Rapid Expansion: Etisalat is one of the fastest-growing telecom operators in the global market since the number of customers was only four million in 2006, and this figure suddenly increased to 136 million from 2007 to 2016;

- Technology: As per the annual report of Etisalat Group, the company is committed to provide differentiated products and offer innovative services using the most advanced technological applications;

- Customer relationship management: Understanding the customers appropriately and generating adequately trustworthy relationships are the main objectives of the company;

- Quality: For the last four decades, Etisalat has provided reliable and high-quality services to the customers

Weaknesses

- Operation in the global marketplace: Because of the adverse political and economic scenarios in certain markets, it is often difficult for the company to control the operating costs and to reduce other financial risks (Haseeb 1);

- Others challenges for the company include managing the global operations and internal business environment, ensuring service quality in the overseas markets, expatriates management, and so on

Opportunities

- Business expansion: Etisalat has an opportunity to promote its products and services in some new countries in the Middle East, Africa, and Asia;

- Diversification: According to the yearly reports of the company, Etisalat concentrates on the diversification of its products and services to sustain as a market leader in the telecommunication sector of the UAE;

- Merger and acquisition strategy: Implementation of this strategy will give the company an opportunity to expand the business rapidly in the international market;

- Long experience: Etisalat has the scope to learn from previous mistakes and develop a professional management team to save innocent customers from unexpected troubles

Threats

- Competitors: The strong performance of the competitors is the main threat for this company since competitors like Vodafone, Three Mobile, AT&T, and Telenor have the required financial strength to develop new products and to enhance networking, internet, and telecommunication services for the customers of the UAE;

- Contract with foreign companies: Joint ventures with international market players may cause financial risks. In addition, it may become difficult for Etisalat to ensure the quality and originality of its product line, which can adversely affect the performance of the company

Strategy, Objectives, and Goals

In 2017, Etisalat Group adopted a new strategy of accommodating the core mission and visions of the company, which were based upon the five aspects; these features included operational excellence, portfolio management, the brilliance of offered services, wonderful customer experience, fair treatment towards the employees, and harmonized organizational culture both in foreign and domestic markets. In 2012, the company introduced its corporate-level strategy that aimed to enhance its global market without hampering the steady growth rate in the local market; in doing this, it achieved successful outcomes by rapidly developing its market share in the global telecom industry.

Etisalat has adopted some new strategic goals and objectives, and these are briefly analyzed below:

- Business strategy: Etisalat initiated its business strategy on the basis of brilliant performance, superior quality, and a high degree of collaboration with stakeholders and integration of contemporary HR practices; moreover, it believes that continuous internal improvement is the driver of progress;

- Marketing and sales strategy: This strategy focuses on providing the right product in the right place during the correct time, whilst coordinating with brand loyalty and engaging with the best deals;

- International expansion strategy: This strategy has been organized through a solid structure of good governance to carry out the standards of corporate discipline smartly in the overseas market by appointing tested and trusted employees;

- Digital transformation strategy: Being the pioneer of the 5G network in the local market of the UAE amid the adverse business environment of the modern telecommunication industry, the digital transformation strategy of the company has driven it to collaborate with Dubai Parks and Resorts to generate long-term value for its stakeholders in all spheres;

- Versatile and balanced strategy: The versatile and balanced strategy allows the company to enhance its core services to uphold its leadership in the ICT market by introducing newfangled technologies that make its portfolio smarter than ever; moreover, its customer-centric operations allow it to become the most competitive network infrastructure in the GCC and MENA region;

- Segment-based strategy: Etisalat has aligned the segment-based strategy with its subsidiaries to provide sophisticated services to the ‘high-value’ customer segments rather than the ‘high volume’ customer segments; these helped it to maintain its rate of customer retention;

- Long-term strategy: The long-term strategy has allowed Etisalat to organize the global mega-event called ‘Expo 2020 Dubai’, and it is anticipated that over 25 million visitors from around the world would visit the event and share their digital experiences; Etisalat would use its technological resources and capabilities to handle this complex project within the short time.

Business Strategy

Cost Leadership

In the UAE market, Etisalat Group is the market leader and it has strong customer base outside the domestic market as well; however, the purchasing power of the customers in the target market is comparatively high, for which they are not interested in cheap products – rather they prefer standard and branded items (Etisalat 61). The management of the company concentrates more on the requirements of the customers, the quality of the products, and the incorporation of the latest technologies in their products and services; therefore, it requires large investments to manufacture the products, upgrade the technologies and advance the networks. As the production and the operating expenses are high, it is not feasible for the company to seek the lowest prices for their customers; in addition, cost leadership strategy could limit Etisalat to charge a premium on the products, which may cause financial loss.

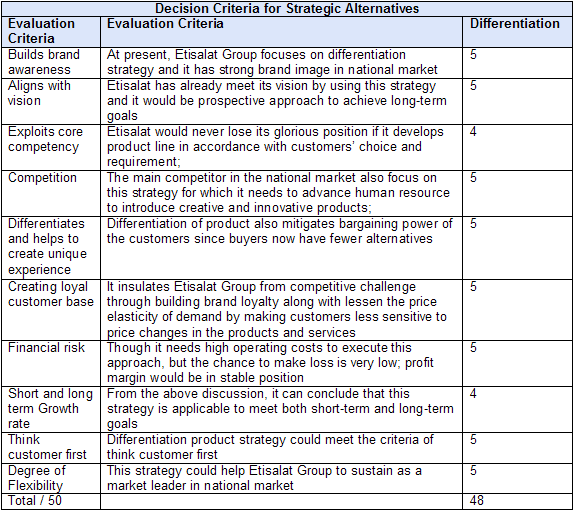

Table 10: Decision criteria for strategic alternatives. Source: Self-generated.

Differentiation Strategy

Differentiation of the products will assist the organization to become an innovative operator, which is customer-oriented and willing to deliver value for money; at the same time, the company is committed to offering quality services by meeting public requirements and balancing operating costs; therefore, to bring variations, it offers digital services, for example, eCommerce, M2M, and cloud solutions. According to the study of Abdullah, to rise above the competition, this organization should pursue the differentiation approach to increase the sales volume by balancing the production costs and charging extra premium; however, this strategy will be feasible if the buyers are willing to pay the premium for smart and high-quality digital services (1).

Differentiation and Cost Focus Strategy

Table 12: Differentiation and cost focus strategy. Source: Self-generated.

Implementation – Competitive Advantages of Etisalat

- Performance: Being the leading telecom operator in the UAE, Etisalat began its journey in 1976 with fixed telephony services, and continued to launch new and innovative products to expand its operations outside the country.

- Ownership structure: The government of the UAE holds 60% share of the company, and this plays a vital role in the successful operation of the business since the legal barriers and competitions can be easily minimized, and the policymakers can focus on the reduction of market players to establish a monopoly grasp over the telecom sector;

- Customer base: Because of being the market leader in the telecom industry, the company can easily access the customers and build an enduring relationship with them; according to the annual report of 2016, it has more than 162 million customers in 19 different countries;

- Execution of business objectives: The successful implementation of the short-term and long-term projects even during the challenging external environment is one of the most important competitive advantages of this company;

- Financial growth: As a result of the strong financial and operational performance, Etisalat finds it easy to adopt new strategies, introduce innovative products and services, and update the products at regular intervals – all these activities help the business to boost its overall turnover and facilitate growth over the longer period; for example, the consolidated revenue of this firm grows by 2% every year;

- Network: The aim of this company is to increase its investment in order to provide an excellent network where both fiber-to-the-home (FTTH) and LTE rollout would exceed 92% and 96% coverage of the population; in addition, it introduced the first 3G network in the Middle East and it concentrates on the creation of the best networks in the globe. As a part of this process, in 2011, it began its 4G (LTE) experience for the buyers, and has made an excellent development on the trial sessions of the 5G network in the country to attain amazing growth;

- Committed logistics to meet customers’ demand: It is another great competitive advantage of Etisalat Group to uphold the triumphant supply chain and meet the requirements of the existing and future buyers

Conclusion

From the above discussion, it can be concluded that Etisalat is trying to retain its position as a market leader in the telecom industry of the country; in addition, it is executing different business-level strategies to achieve the organizational goals. This firm operates its business in a suitable external environment since the government of the UAE has enforced several restrictions and legal obligations to decline the number of competitors; in addition, the rivalry between the competitors is comparatively low as well. However, it is trying to pursue the international expansion strategy through a wide range of strategic partnerships and differentiation approach, while concentrating on innovation and quality.

Future Outlook and Recommendations

To continue its uninterrupted growth, Etisalat needs to increase its investments on digital transformations and networks, and advance the Internet and the Clouds as well as customer-oriented differential products to generate long-term value for the stakeholders globally, whilst also welcoming partnership, mergers, or acquisitions. Etisalat has to ensure stronger performance to articulate its strength for the next generation of technological capabilities in the course of its role as a Major Partner of “Dubai Expo 2020” by emphasizing on its innovation and transformational growth. The long-term strategy of the company requires immediate execution of digital educational platform for both teachers and students of the country through joint collaboration with the Ministry of Education; moreover, there is enough space for further digitalization of the health systems, e-governance, entertainment, and trade environment.

Works Cited

Abdullah, Huzaifa. “Strategic Analysis on Etisalat.” huzaifaabdullah. Web.

Etisalat. “Annual Report 2016 of Etisalat.” Etisalat. Web.

Haseeb. “SWOT Analysis of Etisalat.” Marketing dawn. Web.

“Growing Market Saturation in Dubai Telecoms Increasing Competition for High-Quality Content.” Oxford business group, 2017. Web.