Introduction

This paper will deliberate on position held by both structuralism and monetarism as movements in the field of social sciences. From the monetarist point of view, causes of inflation and policy framework are worth discussing with reference to various economies i.e. China, Argentina, and USA.

Consequences of inflation both to an individual consumer and to various investors merit noting in the paper. The role played by money supply, (MV=PT), in inflation and economic growth will be clearly demonstrated with the use of endogenous variables and graphical representations.

Inflation

This economic term refers to an incessant swell in the price level of goods and services in an economy. CPI and GDP deflator indicates the economic inflation. Any government mandates a central body like the Federal Reserve Bank to regulate on the rates of inflation by influencing the interest rates of the banks.

With reference to January 2007, the price index of the consumer was slightly above 200 while at the beginning of 2008 registered an index of 211. On calculating the inflation there is an increase by approximately 4.5 %. These are some of the indicators of inflation.

‘‘Beginning the 2nd half of the 15th century, Western Europe went through price revolution which lasted till the 1st half of the 17th century’’ (Seers, 1983, P 103). This was termed by economist as one of the major inflationary circle to happen in six fold for approximately 150 years.

In a research to find out the cause of the inflation, findings showed a flood of precious metals (gold, silver) from the so called new world. Consequently, the wealth of Habsburg Spain rose to a higher level. In the same vein, silver which had been spent found their way into Europe leading to further inflation.

‘‘Another factor which contributed to widespread of inflation was growth in demographic factor after Black Death pandemic’’ (Seers, 1983, P104). Private notes during the American civil war also caused inflation.

Hyperinflation is commonly stated as inflation that is beyond control by a man. One of the features of this kind of inflation is a rapid rise in the price level with the currency loosing its value. If inflation goes beyond 50% in a month then this is referred to as Hyperinflation. Most economist defines hyperinflation as ‘‘an inflationary succession lacking any predisposition in the direction of equilibrium’’ (Killick, 1984, P54).

To substantiate this definition, hyperinflation generates a fierce circle where intense inflation manifests with each circle. This kind of inflation is usually correlated with war, crimes against humanity, depression of an economy and social- political disorder. One of the countries where hyperinflation has manifested itself is Zimbabwe following crime against humanity and uncalled for violation of the constitution.

Structuralisms

This is an approach used by analyst to study topics in social sciences such as inflation. It featured in the academic field during the 20th century and has continuously gained recognition by researchers in various fields of social sciences.

The movement is as a result of mental creation where people propounding structuralism creates mental models after a concrete reality. Kolodko (1987) explains that the model calls for an in-depth understanding of various ideals of a phenomenon like inflation.

Monetarist

Monetarism is a movement by monetarist addressing the fact that manipulation of money supply by the Federal Reserve Bank, have a propositional effect on the national output (Y) in the short run and consequently on the price (long run period of time). The objects of the monetarist are best achieved by focusing on the growth rate of money supply in the market place.

Graziani, (2003) states that Milton Friedman is an icon propagating monetarism and was among the economist who accepted Keynesian economics. In a study by Seers (1983), Friedman and Schwartz were strong advocates for a regulatory body maintaining money supply and demand in order to keep equilibrium in the economy during 1960s.

Their position was that inflation is a clear phenomenon of monetary policy. David laidler concurred with monetarist view that demand for money depends on the stability of supply.

Keynesian theories

Keynes propounded that market responds to changes in the market situation automatically so to reach the equilibrium level. Some of the theories used by Keynes to justify their view include: the labor market, the multiplier effect, and Keynes inflation theory.

In this paper focus will be on the Keynesian view of inflation where the key point is the quantity theory of money. The theory addressed the Fisher Equation of Exchange demonstrated by: MV=PT, where M is the amount of money in circulation, V represents the rate of money in transmission, P is the price on average and T is the quantity of dealings taking place.

The Keynesians – AD and AS

Keynes in contrast to classical economist did not distinguish between the long run and the short run period of time. His position was that an economy could reach an equilibrium state at any time without inferences to the short run or long run period of time.

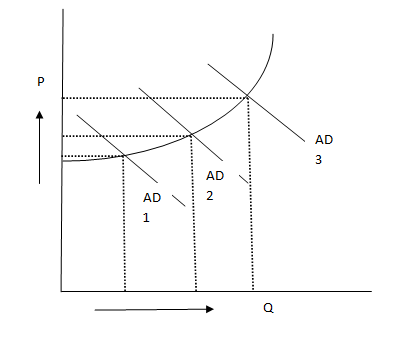

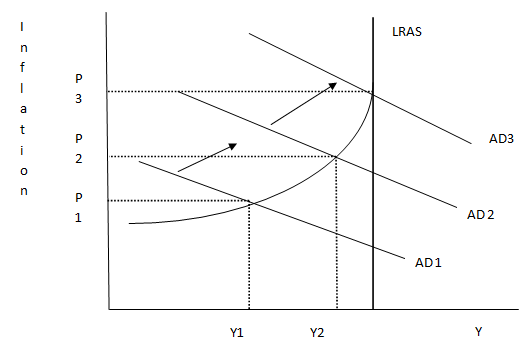

It is upon the government to use appropriate policy framework to ensure that the equilibrium reached is a good one for the nation. The aggregate supply and demand curves below supplements on this Keynesian stand point.

In figure 1below, Graziani (2003) graphically illustrates AD and AS

An economy may possibly stay at any of the equilibrium shown in the graphical diagram (Q1-Q3). At Q1 the amount of output given by Q is at a deceased level with less factors of production. The situation is not good for the progress of a nation. The orientation is likely to continue for a long time unless the government employs the use of policy framework to stimulate the economy.

As the aggregate demand grows, the level of output likewise magnifies itself. A study by Kirkpatrick, (1987) reveals that with the economy approaching full employment of factors of production, price begins to increase signifying demand pull inflation.

In the context of the labor market, more pressure will be exerted as most of the people have a job. In the same note, wages rises since firms have to offer more to get people of their choice. The subsequent effect is a rise in the company cost resulting to cost push inflation.

Policies by Keynesians

Keynesians participated in formulation of policies with an aim of managing well the economy. This management style calls for adjustment to be made on the level of demand so that the economy can reach full employment of factors of production. If a shortfall in demand is recorded (recession), then the government has to pump the economy.

Seers (1983) affirm that in a situation of excess demand, such as in boom, the government has to formulate a policy aimed at reducing economic development. Increased government spending can also improve the economy. Taxation can also be reduced to act as a motivating factor to people to invest in specific areas of the economy. It is evident that cuts on taxes encourage people to spend.

Another instrument available to be used by government is instituting reduction on the rates of interest with an aim of discouraging saving and encouraging spending. With an encouraged growth in money supply, more goods and services will be demanded as there is excess money in circulation.

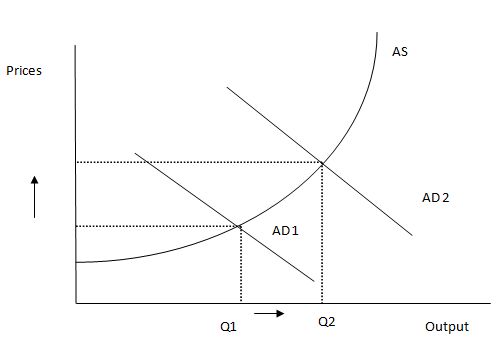

In a summary by Kirkpatrick, (1987) more government spending and cuts on taxes is among the expansionary fiscal policies while regulation on the interest rates and allowing more money in circulation reflects the use of expansionary monetary policy. The impact of these two policies is to increase the aggregate level of output as shown in the graphical demonstration below.

In figure 2, Graziani (2003) shows graphical explanation of shift in AD to the right subsequently increasing output.

Policies to pump the economy have increased the output from Q1-Q2. The effect on the price level is small but if the demand increases much more the subsequent effect is inflationary features as the AS curve takes up a near perfect vertical line.

Deflationary policies

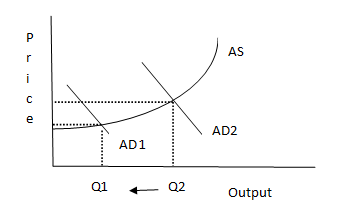

These include the policy framework to reduce on the level of economic activity. Kirkpatrick (1987) was conclusive in his study, consequently mentioning that a fiscal measure to be assumed by the government is a reduction in spending and increased taxation to reduce demand in an economy.

If interest rate is increased, people are motivated to hold their funds for speculative purposes thus exercising an aspect of savings and reduced spending. The government can also reduce growth in money supply as a monetary policy.

In Figure 3, Graziani, (2003) illustrates a deflationary measure

The graph above shows an initial level of aggregate supply at an inflationary level where prices were increasing at a faster rate. AD moved to the left following a deflationary measure.

Internal imbalance

The gab between expenditures and revenues for a specific government over a given time period is one of the internal imbalances referred to as fiscal deficit. A government usually finances its development agenda by the use of taxes. In a situation where government earnings are less than the expenditure the result is a fiscal deficit.

India and Argentina runs its divisions with deficits in fiscal policy. Deficit at local, state and federal units results cumulatively to internal deficits. Keynesian and Neo-Keynesian theory, proposes the effectiveness of deficits in stimulating economic growth and development in a nation.

Economic causes of inflation

Inflation result from push of costs

For a business experiencing rising cost of production, it has to increase their prices if profits are to be realized. The rising costs of raw materials results from inflation in countries that depends on exports of the expensive commodities. A fall in the value of pound has a subsequent effect on the price of commodities in the international market.

An example of cost push inflation happened in the year 2005-2006 where the price of gas and electricity was raised by British gas and other energy suppliers. Where the price of labor is increasing following wage increases, inflation is likely to check in since productivity is not elevated higher.

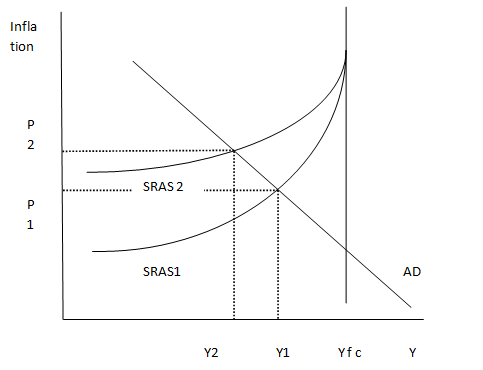

Increased indirect taxes will result in passing on the impact. The incidence of the taxes is initially on the suppliers who may decide to pass on the taxes to ultimately have an impact on the consumers. The following diagrammatic expression shows an inward shift in the aggregate supply curve.

Figure 4 demonstrates Cline (1981) Inflation from cost pushes

AD From the diagram an inward shift in SRAS following a rise in the price of crude oil or an increase in cost of a wage imparts on the price level causing a contraction of the AD. Y f c represents full employment of factors of production.

Inflation resulting from Demand pulls

Inelastic SRAS and maximum factors of leads to demand pull inflation. In such a situation, an increase in the AD will result to an augment in prices. A depreciation of the rates of exchange can lead to increase aggregate demand. For an AD to rise, consumers must have purchased foreign goods while on the other hand more exports are made.

A reduction in the direct taxes means that consumers are left with more money to spend in purchasing their needs. Killick, (1984) compares this with an aspect of demand creation. A reduction of direct taxes increases the probability that the consumer will buy more goods because of the subsidized prices. The stated factors have the effect of increasing AD and real GDP.

The results of an increase in AD on the price level can be analyzed using a graphical sketch.

In figure 5, Rudebusch (2002) point up demand pull inflation.

Rudebusch, (2002) explains that when the SRAS is elastic, prices are likely to change at a faster rate. After an outward shift in AD, a new equilibrium is achieved. Cline, (1981) focuses the outward shift in the demand curve with creation of an inflationary gab which then activates more wage and other costs of production.

The resultant is an inward shift in the SRAS moving the real national output towards equilibrium position with a greater price higher than the original price.

The wage -price spiral

If people are expecting the prices to rise in the future, they will decline fewer wage because they are aiming to protect their real purchasing power. An example is a booming economy of say china recording an inflation rate of 5% up from 4%. This results from a rising rate of inflation.

In such an economy, workers must negotiate for more wages in order to be maintaining their purchasing ability. Cook (1990) proposes that to minimize the effects of wage- price spirals, deflationary measures are strictly used as policy measure by enhancing interest rates and an increasing direct tax.

Consequences of inflation

In a context of inflation, lenders or borrowers on fixed rates of interest will automatically not be able to purchase because of less earnings from interest. In the same note, persons with cash assets will face a reduced power to purchase since the notes and coins loose their value.

On the contrary, inflation has no effect on the ‘‘non monetary goods and services such as gold, real estate’’ (Griffith, 1985, P35) Following inflation, it becomes difficult for producers to decipher the source of the changes in price. For a context where inflation is caused by changes in demand, producers are supposed to hold constant their long term output.

Inflation can cause producers to misallocate resources. Cline (1981) in his book puts forward that money illusion resulting from inflation orients people to be unreasonable when making decisions i.e. making choices with regard to nominal rates instead of real price rate. Further discussion on the consequences of inflation demonstrates that the future prices are likely to be uncertain.

This creates problem with the long term contract in terms of agreements for wage levels and loans to finance a project. Investors are therefore reluctant to sign multi period projects as the risks are more pronounced. This reveals that inflation pulls down productivity as companies shift resources to minimize loses and try to retain profits. Projects which were in progress are likely to stop for luck of financiers.

‘‘inflation at a high level purchasing power of those on fixed incomes (pensioners) is redistributed towards the inconsistent proceeds earners whose returns may rhyme with inflation’’ (cook, 1990, P61).

The same case of redistribution of power to purchase can happen with traders in an international market arena. To explain this point, fixed rates of exchange with rising inflation makes exports to be more costly consequently affecting the nations balance of payment deficit.

Role of money supply in inflation (endogenous and exogenous)

Diverse number of economist argues that excessive supply of money in the market can result to inflation. This position was originated from Milton Friedman who did research in Chicago University. Cline (1981) further expounds that the quantity theory of money addresses the effect of a faster supply of money in the market compared with the growth in the level of potential output.

A consideration made by Federal Reserve Bank is that a climb in interest rate is considered as tighter monetary policy while a fall in the interest rate is a an cheaper monetary policy. If cheaper monetary policy is expected to give rise to inflation, then lenders press for higher interest rate so as to reimburse for inflation. On the contrary, borrowers are willing to give a higher interest rate since inflation reduces the worth of dollars.

MV = PT is an expression of magnitude theory of funds. an expression of magnitude of funds with references to purchases gives rise to such an equation as (M/P)= k Y, where k is a constant that shows money people want to hold for each income.

Bahmani-Oskooee (1991) emphasizes that holding velocity (V) at a constant value will convert the equation into quantity theory of money. A further manipulation of the equation would give: P= PY/Y, meaning that % change in price gives the inflation rate.

Policy recommendation

One of the available policy instruments available for use in controlling inflation is the monetary policy. Monetary theory proposes keeping supply of money at a constant rate. Keynesians propounds reducing AD for a period of economic expansion and consequently reducing demand during an era of recession to calm inflation. Both monetary and fiscal policy can be used to manipulate aggregate demand.

Controls can also be done with the use of wage and price. This approach is effective in a war torn region as it is combined with rationing. Killick (1984) gave some of the successful price-wage controls as: ‘‘the Australian price- income accord and the Wassenaar Agreements in the Netherlands’’.

Cost of living allowance can also be employed as a policy measure to reduce the adverse effect of inflation. This approach involves an adjustment made on salaries with references to the cost of living. The process of adjustment is done on an annual basis and can be varied with the geographical location of a person.

Conclusion

This paper has offered an explicit discussion of inflation and its consequence. The first part of the paper illustrates views held by various economic movements such as structuralism and monetarism. Structuralism propagates the creations of models in the minds of economist while investigating economic phenomenon. Monetarism addresses the effects of money supply on an economy.

The paper also presented graphical illustrations of Keynesians AD and AS in the short run and long run period. Furthermore, causes of inflation where scrutinized. Some of the causes as discussed in the paper include: cost push inflation, demand pull inflation and wage- price spiral.

Consequences of inflation were deeply examined with reference to price uncertainty, misallocation o resources and deteriorating investor confidence. The final part of the paper is the role of money supply both in inflation and growth and development.

References

Bahmani-Oskooee, M. (1991) Effects of Exchange Rate Variability on Inflation Variability. World development journal, Vol.19. No. 6, 729-733.

Cline, W. et al. (1981) World Inflation and the Developing Countries. Washington DC, Brookings Institutions.

Cook, P., & Kirkpatrick, C. (1990) Macroeconomics for Developing Countries. Hemel Hempstead, Harvest/ Wheat sheaf.

Graziani, A. (2003) The Monetary Theory of Production. Cambridge, Cambridge University Press.

Griffith, S., & Harvey, C. (1985) World Prices and Development. London, Gower.

Killick, T. (1984) The Quest for Economic Stabilization: the IMF and the Third World. London, Heineman.

Kirkpatrick, C., &Nixon, F. (1987) Inflation and Stabilization Policy in LDCs, in Gemmel, N.,ed Surveys in Development Economics. London, Macmillan.

Kolodko, G. (1987) International Transmission of Inflation: Its Economics and Its Politics. World Development Journal, V. 15, N.8, 1132 – 1136.

Seers, D. (1983) Structuralism versus Monetarism in Latin America: A reappraisal of a Great Debate with lessons for Europe in the 1980s. London, Frank Cass.

Rudebusch, G. (2002) Asseaaing Norminal Income Rules for Monetary Policy with Model and Data uncertainity. Economic Journal, Royal Economic Society, vol. 112(479), p 402-432.