Inflation refers to the progressive rise in the prices of goods and services. This makes living costly and results in a reduction in money’s power to purchase. The rate of inflation is the adjustment in the index of price in a single year to a new one expressed in percentages. A reduction in the rate of inflation is not directly proportional to the items’ prices.

Consequently, it leads to high unemployment rates, lowered standards of living, reduced balance of payment, and obstructed economic growth. It is currently set at 2% in Britain. To control the inflation, the causes must be known and dealt with. This paper argues that policies adopted by a government may be more detrimental than helpful to its economy.

The major factors that can trigger inflation include the availability of items for purchase against the command of the same, and vice versa. This is in addition to domestic and peripheral occurrences. Moreover, continuous variation in the rate of replacement of different currencies during trade can also influence inflation. These also make yearly prediction of the rate of inflation intricate.

The policies adopted by a government should help it realise high rates of employment, improved standards of living, reduced inflation, and continuous economic expansion. This essay argues the need of the government to minimise cumulative demand and increase collective supply to facilitate this.

- Economic/monetary policy requires the government to initiate moments where the rates of interest shoot, thus, minimising prospective expenditures. This is purposed at obtaining minimum prices of imports and attractive exports. The results would be positive because the fixed high interest rates may in turn lead to increase in the value of the rate of exchange. It also involves instances where money circulation is minimised. It results in money scarcity and, thus, a decrease in aggregate demand. High rates of interest stimulate inflation.

- A policy that is concerned with making items available as the objective of this policy is to sustain reduced costs. It is ensured by a boost in production through diminution in levies, creating opportunities for more rival firms that would increase supply and cause a fall in prices. Furthermore, there is a decrease in company duties that in turn would encourage novelty. This causes demand for increase in remuneration. In order for employers to keep up with this, they require to reduce their workforce that leads to unemployment.

- Financial/fiscal policy concentrates on a demand as a way to control inflation. It is done by minimising the rate of expenses on communal and value goodsand raising interests. It is also achieved through increasing express taxes, thereby, resulting in a decline in actual disposal earnings. This would in the short term reduce demand and, thus, price cuts. However, the effects of government’s withdrawal or reduction in public expenditure would affect the market and hamper development. In addition, high taxation would leave consumers with less money to spend, thereby, influencing their living standards negatively. There would be an increase in unemployment since most firms would lay down workers to keep up with the tough economic trends. This policy affects investments and expansion of industries, which in turn reflects negatively on the economy. Contrary to the expectation, instead of controlling inflation, unemployment would increase. This has similar or even worse economic impacts than inflation.

- A policy concerned with the rate of exchange: improved exchange rates cause reduction in the price of imports. It hinges on the aggression of the government. This in turn reduces production cost, which calls for a fall in prices and, thus, minimised profit margins. The result is improved economy since there are lower import costs and higher export charges. However, this largely depends on the countries sustained balance of payments.

It is essential to note that inflation has a way of negatively affecting other macroeconomic components such as employment and balance of payment.

A government needs to know how to juggle the above policies in order to keep its economy healthy. This is because the first and third policies, in a bid to control inflation, would lead to other macroeconomic predicaments such as a lack of employment. It can be concluded that the weight of inflation would then greatly press on this group of people. It, therefore, calls for adoption of the right policy instruments.

List of References

- Adam Smith Economics Tuition Agency, Inflation, 2009. Web.

- Amos WEB Encyclonomic WEB*pedia, Inflation. Amos WEB LLC, 2000-2013. Web.

- Baxter, M., ‘the role of expectations in stabilizing policy’, journal of monetary economics,Vol. 15, University of California, North Holland. 1985, pp 343-362

- Broadly, D., A low and stable rate of inflation, 2013. Web.

- Corbo, V., ‘Reaching One digit inflation: the Chilean experience’, Journal of applied economics, Vol 1, No. 1, 1998.pp 123- 163.

- Feldstein, M. S., ‘The welfare cost of permanent inflation and optimal short run economic policy’, Journal of political economy, vol 87, no.4, University of Chicago press, 1979. Pp 749.

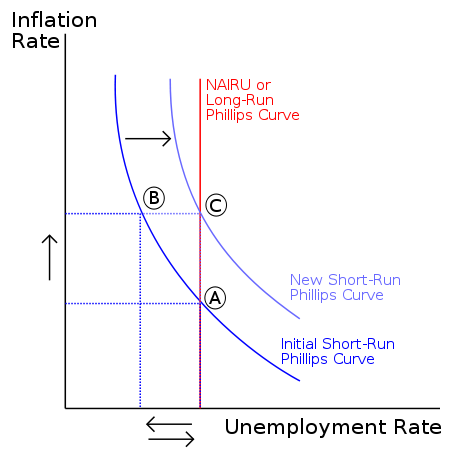

- How the Phillips curve relates to aggregate supply and demand. Web.

- Lawrence, J., ACopp& S Stoddard, AQA economics AS: Student Book: AS: Exclusively endorsed by AQA, Nelson Thornes Ltd, 2008.

- Margetts, S., Economic policies to control inflation. Web.

- Pettinger, T., Policies to reduce inflation, 2007. Web.

- Policies to control inflation. Web.

- Riley, G., AS Macroeconomics/ International economy: Government macroeconomic policy, Eton College, 2006. Web.

- Riley, G., AS Macro revision: policies to control inflation, 2010. Web.

- Riley, G., Inflation, 2012. Web.

- Tutor2u, economics policies to control inflation. Web.