Introduction

The last day of 2012 will remain one of the most significant days in the memoirs of the recently re-elected American president Barack Obama. This is because the American economy may revert to recession if the country’s legislature fails to agree on some changes to the tax code and some spending.

One of the potential effects of falling over the fiscal cliff is that America may fail to attract the levels of Foreign Direct Investment (FDI) it needs to create jobs. FDI plays a vital role in all the economies of the world. Foreign capital supports job creation and leads to better economic conditions in a country.

This paper takes a historical look at the DFI patterns based on certain countries and regions of the world. The paper will seek to explain the changes in the volumes and distribution of FDI since 1990.

Theoretical Framework

A number of scholars developed theories and models to describe the economic dynamics of international trade.

The Heckscher-Ohlin model of international trade stresses that countries tend to export products made from resources that are cheap and abundant within their territories, and to import products that consume expensive and rare resources .

This model stresses the comparative advantages of different nations as their source of competitive advantage in international trade. This model suggests that FDI is one of the means of exploiting local resources.

For instance, an investor interested in software development will find competitive pricing in India, and competitive quality in America.

The second theory relevant to the impending analysis is the OLI paradigm that assigns the competitiveness of a firm to three factors. The OLI paradigm opines that the competitiveness of an international firm depends on its Ownership (O), its Location (L), and on Internalization (I) of its competitive advantages.

Ownership (O) refers to specific characteristics that the firm enjoys relating to the organizational culture and internal dynamics. The advantages dues to the Location (L) refer to geographical advantages associated with the locality of the company. It is impossible to transfer these advantages.

The third source of competitiveness is Internalization (I) that refers to the process of harnessing internal resources and sources of competitive advantage to benefit from a larger market.

The implication of the OLI paradigm to FDR is that companies that feel confident that they can harness their (O) and (I) components can profit from operating in foreign soils.

Porter’s diamond seeks to move the discussion on competitive advantage of nations from the traditional factors of production by arguing that a country can develop capacity to handle any shortfalls in its endowments. For instance, the model proposes that a country can make the availability of labor a factor in its competitiveness.

Further, the model proposes that a country can develop capacity to produce certain products and services if there is demand for it. Local producers can find ways of producing an affordable product based on the local needs. These theories undergird the analysis of trends in FDI across various regions of the world.

Factors Affecting the Attractiveness of Countries for FDI

The lists of factors that influence the decision to invest in a country are long and varied. It is impossible to carry out a detailed analysis of these factors within this work. This section mentions the most significant factors.

The political factors that influence FDI decisions include stability of governments, and the political environment in the country.

Most western investors prefer democratic states as investment destinations while eastern investors do not make this an important consideration, provided the country is stable. The presence of trade embargoes imposed by international bodies may affect the decision of international investors.

Legal factors also play a very important part in DFI decisions. The presence of clear legal procedures for opening and operating a business, labor laws, tax laws, land and property laws, and the legal arbitration laws gives some countries competitive advantage.

Banks in countries such as Switzerland and the Cayman Islands have a strong reputation for not disclosing client financial information. As a result, people who prefer complete privacy of their financial operations work with Swiss accounts. This is an example of a competitive factor in FDI created by legal systems.

Some countries develop special economic zones that offer reprieves and legal guarantees to make the country more attractive for FDI.

Socioeconomic factors also influence FDI decisions. While country may not make the decision to invest in another country based on the market there, it is desirable to sell locally.

Companies such as Coca-Cola produce their soft drinks within the markets that they sell their products. Asian countries on the other hand, are ideal candidates for FDI to produce products for consumption in other markets.

Other important factors that influence FDI include government policy on issues such as repatriation of profits. In addition, the infrastructure available in a country influences issues such as supply chain management, and marketing strategy. Security is also an important concern in DFI decisions

Analysis of Changes in Volume and Distribution on FDI

The last two decades presided over aggressive changes in the economic climate of the entire word. The period started with the collapse of the USSR, and communism as an influential political system. In addition, it saw the fall of the Berlin Wall, and reunification of Germany.

The period also saw the initial steps towards the development of the open internet. These developments affected the economic organization of the entire world. This section analyses the events of the last twenty years in four blocks and their impact on FDI.

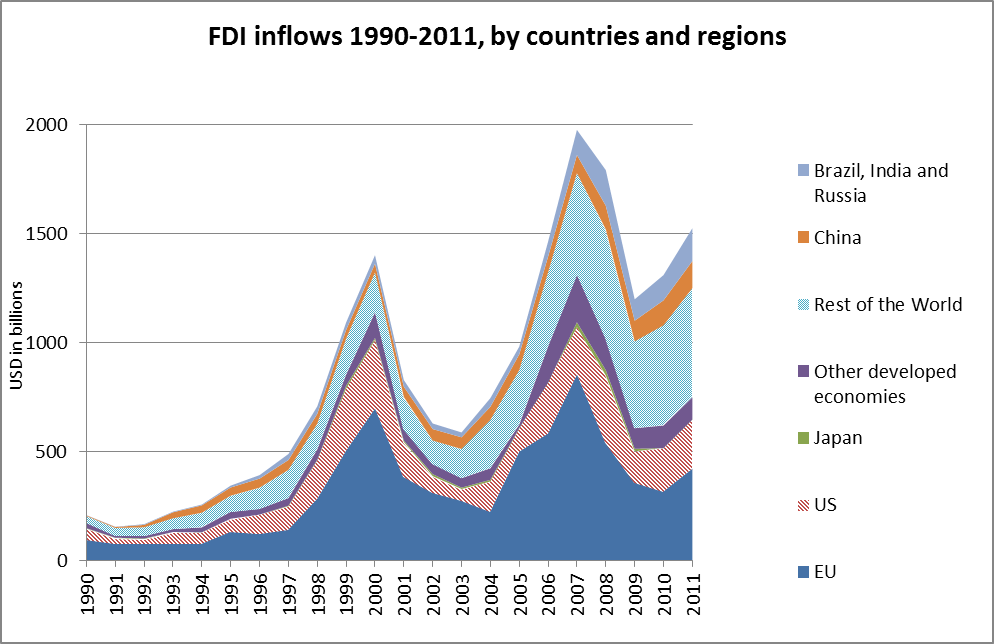

The blocks correspond to the major changes in the direction of DFI as depicted in Figure 1. The figure shows that global FDI figure rose steadily from 1991 to 2000, and then dipped between 2000 and 2003.

The flows rose again between 2003 and 2007, and then fell up to 2009. The DFI increased again in 2010 and 2011. The two peaks correspond to the dot-com bubble and the global financial crisis of 2008.

Figure 1: Global FDI Inflows Since 1990

1990-2000

The year 1991 was very significant politically. This is the year when the USSR collapsed signaling an end to the cold war. In the same period, the Berlin wall collapsed further invigorating the march towards the emergence of the Euro zone as an economic unit. In the same decade, Bill Clinton was the President of America for most of the years.

His term coincided with some of the best economic conditions America experienced in the second half of the twentieth century. Unemployment rates and inflation were very low in the country at the time.

The sense of stability in America during the Clinton years was responsible for the growth in FDI in the country. During his tenure, America enjoyed the most consistent peacetime growth in its twentieth century history.

The last years of that decade coincided with the rapid uptake of the internet. The dot-com period attracted FDI to America since America was the epicenter of the dot-com boom.

In the same years, Europe saw strong growth in its DFI, especially in the latter half the decade. Germany and France were unstable at the time, with Germany dealing with the problems of reunification while France was dealing with a recession.

The UK on the other hand was bullish during this decade. The stability in Europe attracted FDI from international investors seeking safe investment destinations.

China started the decade on a subdued state after the events of Tiananmen Square. Most western countries shunned China because of the massacre that took place at the square. These events, coupled with the protectionist policies of the Chinese government, led to very poor economic performance by China.

It was not an attractive investment destination at the time. However, China found its footing towards the end of the century and experienced very rapid economic growth. However, the country did not attract much growth in FDI because of local policies.

2000-2003

The main events that took place between 2000 and 2003 were the global scare that computers would fail at the turn of the century, and the September 11 bombing of the World Trade Center in lower Manhattan.

The dot-com bubble burst on March 10, 2000. On this day, the shares of a number of internet companies started a downward spiral to annihilation. The sector seemed so promising that many people failed to carry out due diligence when investing in dot-com stocks. The result was the over-valuation of the stocks to very high artificial levels.

The busting of the dot-com bubble had a profound effect on FDI. American and European companies that derived their capital worth from the internet lost value in the stock markets. International investors started shying away from these companies.

The effects of the September 11 bombings on FDI arose from the fear and uncertainty. The terror strike at the heart of America made many investors feel insecure. FDR dropped and went to other countries. Europe also suffered immense loss of confidence in the period because difficulties associated with the dot-com bubble.

In the same period, a resurgent China saw the rise in its FDR value. While America and Europe dealt with reducing inflows, China was in the early years of strong economic growth. China had other competitive advantages in relation to the other countries.

The country was establishing itself as a manufacturing hub, while high spending in infrastructure made it an ideal investment destination for foreign investors. China did not have a history of terrorist activity and there were not threats against it. Investors felt safer investing in China.

Chinese manufacturing sector grew in leaps and bounds in the same decade. In the period under review, overall FDI flows slumped in volumes. However, while the EU and America saw a reduction in the volume of FDI levels, China, and the rest of the world experienced growth in FDI levels.

2003-2007

The period between 2003 and 2007 saw a growth in the overall spending in FDI across the world. The EU did not recover from the previous slump until 2004. FDI to America grew steadily throughout the period.

The EU also saw its FDI levels grow by more than 100 %. Partly, the growth came from countries previously not part of the EU such as Turkey. Their inclusion in the EU led to the increase in the overall amount of money reaching the expanded EU.

The growth of the FDI levels in China remained steady throughout although it somewhat reduced in 2005. This shows that traditional investors in the EU and America explored investing in China in 2003.

The levels of the DFI reaching the EU fluctuated very strongly in the last two decades. The EU is a collection of separate economies that operate under different administrations. There is an effort to handle all EU economic issues a via powerful central bank that will have power to set budget limits for all EU states.

Discussions are still at a very early stage and opposition to the idea will take time to fade. However, stability of the EU is very critical to attractiveness of the EU as an investment destination.

2007-2011

The global financial crisis took place in 2008. While most of the countries affected by the global financial crisis had economic exposure to this crisis, events in America triggered the collapse. The subprime mortgage market in America underwent similar overvaluing to the dot-com era companies.

At some point, the value of the properties were higher that their real value. People took out mortgages to finance their purchases. However, rising interest rates made it impossible for people to keep up with their mortgage payments. This situation led to the foreclosure of mortgaged homes.

In its wake, financial institutions that had given out the mortgages found themselves holding a large amount of assets that they could not sell in the markets. This hit the financial sector leading to the collapse of several banks.

The slump in the American economy coincided with the war in Iraq and the beginning of hostilities in Afghanistan. These two wars ate into the national resources of the country. The international image of America as a safe investment destination suffered in the mean time. Overall levels of FDI dropped across the world.

However, FDI to other regions in the world did not reduce with the drop in American and European levels. The rates remained consistent for China. Europe tends to suffer along with America whenever there is an economic issue because of the close political and economic ties.

The trend up to 2009 was a strong reduction in FDI levels. However, the rates of FDI went up globally from 2009 with the EU catching the trend in 2010. The rates as at 2011 were in favor of China and the rest of the world.

Brazil, India, and Russia have grown from obscurity in the mid nineties in the DFI scales to become a significant player on the FDI marketplace.

FDI Changes in Industries

When analyzed by industry, the industries driving DFR are energy and technology. China and India have received FDR to establish industries to take advantage of the attractive labor conditions in these countries.

The establishment of NAFTA saw the emergence of Canada and Mexico as strong player in the world Markets especially in the Americas. Mexico now houses many manufacturing plants that supply the American market.

In the area of energy, China, India, and America lead the world in investing resources in other countries to secure oil and gas supplies. China also receives FDI targeting manufacturing. Companies such as Apple operate assembly facilities in China. Apple is simply one American company with interests in China.

In the technological field, India is a net recipient of FDR in the area of computer and software development. India is currently one of the top off shoring destinations in the area if IT, call center management and back office functions.

This is the situation predicted by Porter’s diamond. India uses its vast human resource as a source of competitive advantage in the world economy. Companies invest in infrastructure such as software development facilities, call centers and other back office infrastructure in order to take advantage of Indians resources.

Changes in International Business Environment

The most exciting element of the international business environment is the emerging role of China as a world power. China is becoming a very important player in world trade both as an international investor and as an investment destination. The rising middle class in China will drive demand for goods and services.

This means that China will receive more attention from international investors because of the business potential in the country. On the other hand, China is becoming a significant investor across the world in an effort to find trading opportunities and resources to feed its industries.

China is cementing relations with many developing countries. The African Union headquarters in Addis Ababa stands as a testament of Chinese international interests.

Secondly, America is on a recovery path after the difficult years immediately after the global financial crisis. America is the most powerful economy in the world. The prosperity of America leads to more FDI outflows from America. In addition, the stability of America is attractive to international investors from Europe and Canada.

The EU is facing a difficult time with the need to reorganize the entire Euro zone. Countries such as Greece are recovering from the worse financial crisis in modern times. Spain, Portugal, and France are implementing a raft of measure to assure the countries of long-term stability.

These countries are dealing with financial issues that threaten the Euro as a common currency.

The emergence of Brazil, Russia, India, China, and South Africa (BRICS) as the influential emerging economies is also shaping the emerging world economy. These countries will join the ranks of the developed world in the next two decades if they retain their current growth trajectories.

They are already very important players in their regions. They will have a significant influence in the direction of DFI flows in the interim.

Conclusion

International economies will undergo greater integration in the coming years because of the process of globalization. As such, the role of FDI will become more important with time. Countries that can leverage their competitive advantages will stand a better chance of attracting foreign capital.

Reference List

Bond, P 2008, ‘Global Uneven Development, Primitive Accumulation, and Political Economic Conflict in Africa: The Return of the Theory of Imperialism’, Journal of Peace Building and Development, vol 4, no. 1, pp. 1-14.

Dunning, JH 2001, ‘The Eclectic (OLI) Paradigm of International Production: Past, Present and Future’, International Journal of the Economicsof Business, vol 8, no. 2, pp. 173-190.

Dunning, JH 2008, ‘Location and the Multinational Enterprise: John Dunning’s Thoughts on Receiving the Journal of International Business Studies 2008 Decade Award’, Journal of International Business Studies, vol 40, pp. 20-24.

Faulkner, D & Segan-Horn, S 2004, ‘The Economics of International Comparative Advantage in the Modern World’, European Business Journal, pp. 20-31.

Jeyarathmm, M 2008, Strategic Management , Global Media, Mumbai, India.

Kotrba, B 2011, ‘Yieldable Versus Priceable-What Does it Mean and Who Cares?’, Thought Leadership, pp. 1-16.

Leeman, JJA 2010, Supply Chain Management: Fast, Flexible Supply Chains in Manufacturing and Retailing, Books on Demand, Dusseldorf.

Meon, P-G & Sekkat, K 2012, ‘FDI Waves, Waves of Neglect of Political Risk’, World Development, vol 40, no. 11, pp. 2194-2294.

Meredeth, JR & Mantel, SJ 2011, Project Management: A Managerial Approach, 8th edn, John Wiley and Sons, Hoboken, NJ.

Montgomery, CA & Porter, ME 1991, Strategy: Seeking and Securing Competitive Advantage, Havard Business Press, Boston MA.

OECD 2010, OECD Economic Surveys: Sloval Republic, OECD Publishing, Paris.

Rodrick, D 2006, ‘Goodbye Washington Consensus, Hello Washington Confusion? A Review of the World Bank’s Economic Growth in the 1990s: Learning from a Decade of Reform’, Journal of Economic Literature, vol XLIV, pp. 973-987.

The Economist 2011, The Chinese in Africa Trying to Pull Together: Africans are Asking Whether China is making their Lunch or Eating it, <https://www.economist.com/briefing/2011/04/20/trying-to-pull-together>.

The Observer 2012, Sharks Circling Apple after Success Story Heads off the Map, <https://www.theguardian.com/business/2012/nov/11/sharks-circling-apple-after-maps-debacle>.

UNWTO 2011, ‘Tourism and Climate Change’, United Nations World Tourism Organization, Geneva.

Wade, R 2009, ‘Is the Globalization Consensus Dead?’, Antipode, vol 41, no. 1, pp. 142-165.

Walker, DM, Walker, TD & Schmitz, JT 2003, Doing Business Internationally: The Guide to Cross-Cultural Success, McGraw-Hill Professional, New York, NY.

WHO 2007, ‘Provider Payments and Cost-Containment Lessons from OECD Countries’, Technical Briefs for Policy Makers, vol 2, pp. 1-7.