Executive Summary

Chevron Corporation (Chevron) is a leading multinational company operating in the integrated energy sector. The company deals in oil, gas, and geothermal energy. It was established in 1926 and is headquartered in San Ramon, California. It has an operation in 180 countries worldwide. It operates in the upstream and downstream markets. Though, historically the company has shown excellent performance, it has deteriorated considerably in the last two years (2014 and 2015).

The global oil and gas industry is highly volatile and susceptible to fluctuating energy prices. Both macro and microeconomic factors affect industry performance. High global crude prices since 2014 have affected the industry adversely. Further, the global financial crisis of 2007 that crippled most of the industries had also taken a toll on the energy sector. Notwithstanding the high industry pressure, Chevron has performed significantly vis-à-vis its closest competitors Dutch Shell Company (Shell) and Exxon.

The present financial analysis of the company demonstrates that Chevron has performed satisfactorily as compared to the industry averages. However, Free Cash Flow continues to give negative results. According to our analysis, this is probably due to the downward trend in oil prices. Overall, Chevron can be considered as a stable company for investment, though it cannot be considered completely risk-free.

The Industry

Chevron operates in the oil and gas sector. Its main operations are mining and refining of crude oil and gas. In addition, this sector includes all other industries that operate as ancillary industries. It is evident that this sector is highly important in establishing the infrastructural backbone of society.

History

The history of the oil and gas industry in the US dates back to the Industrial Revolution in the 19th century. The sudden rise in demand for oil due to the commercial usage of railroads, iron and steel industry, and construction industry, increased the necessity to supply energy. This resulted in the proliferation of oil drilling companies in the US. However, Standard Oil was the first company to secure the first contract to drill oil in Saudi Arabia (Wall).

This opened the road for other companies to operate globally. By the 1950s, four companies were the global leaders in the oil industry – Standard Oil, Exxon, Shell, and British Petroleum (Eden 73). These four companies retained the lion’s share (almost 70 percent) of the global oil market (Eden 73). Currently, the two main drilling destinations for the oil companies are the Middle Eastern region and Venezuela.

Challenges

The oil and gas sector faces high demand due to increasing developmental needs around the globe. However, the companies that operate in the industry are large, as operations require large infrastructural investment. This increases the rivalry in the market. Further, the industry also faces the threat of new entrants who want to make their mark in the industry. Further, crude oil prices have been declining since 2014. Crude oil prices have recorded a 10-year low in 2016 increasing the challenges for the oil and gas industry (Chevron, “Chevron Annual Report”). This has reduced profit margin of most of the companies. As the profit margin of the incumbents reduced considerably, this has attracted many new operators, further increasing competitive pressure on the industry.

Another challenge faced by the industry is the political unrest in the Middle Eastern countries that raises the risk of drilling in the region. The Middle East is one of the main drilling grounds for the industry. The proliferation of violence in the region escalates risk for the company operating in the region.

Environmental regulations and litigations pose a big challenge to the continuation of operation in the industry. Laws pertaining to greenhouse gas and safer environment have continually increased pressure on the industry to become more environment-friendly. Further, increased environmental awareness raises the possibility of alternate sources of energy as a potential competitor.

Outlook

According to the World Energy Outlook 2016, published by the EIA (US Energy Agency), the industry will face increased challenge from the environmental lobby to push lesser emission and clear air. In its 2016 edition, it forecasted the rise of global energy demand by 48 percent from 2012 to 2040 (EIA 7). The demand for oil will increase drastically from the OECD and the developing countries in Asia (EIA).

Overall, the WEO for 2016 provide the three key areas of important for energy and climate trends in the energy sector. First, the achievement of “universal energy access”; second, the development in “subsidies to fossil fuels and renewables”; and last but not least the impact of “energy use on climate change” (EIA). The 2016 report suggests that the energy sector will grow tremendously due to the development in the Asian and Latin American countries, boosting the energy sector as more energy will become a necessity for rapid industrialization (EIA). The OECD report on energy outlook suggests that there will be an increase in consumption of fuel but a large amount of investment in the sector is necessary to revamp the capacity to meet the future demand (OECD).

Current Position

The oil and gas industry has generated $1823.5 billion in 2015 in revenue at a compound annual growth rate (CAGR) of -14 percent between 2011 and 2015 (MarketLine 7). The fall in the crude oil prices since 2014 has adversely affected the industry growth rate. Further, the global oil and gas market has reduced by 44 percent in 2015 but has increased marginally in terms of volume trade (MarketLine 9-10). The energy sector is adversely affected due to the low prices of oil. This has adversely affected the performance of the industry.

Therefore, as the global economy recovers from the financial crisis, the energy sector finds itself in unstable grounds as the recession has reduced prices and consumer demand affecting both production and demand in the market. Currently the industry has shown sluggish growth, however, the market forecast predicts that it will increase by 27 percent from 2015 to 2020 and attain a CAGR of 4.9 percent (MarketLine 13).

Influences

The industry is affected by three main factors –

- political,

- regulatory,

- economic.

Economic and political stability play a major role in the stability of the industry. The recent economic crisis from 2007-2008 has profoundly affected the industry. The sharp decrease in investments has led to a decrease in demand (MarketLine 7). When the economy faced a global financial crisis, dampening consumer demand, the demand for oil also fell sharply, adversely affecting the industry. Similar situations have been encountered during the 1973 oil crisis and the 1979 oil crisis.

Political stability also plays a key role in the functioning of the industry. During the Gulf War of 1990, the whole oil industry was negatively affected as the Suez Canal one of the main routes for cargo ships was closed. The industry was severely affected. The energy crisis puts the industry in a volatile situation, as the industry has to face political and economic instability.

The oil and gas industry faces issues of the environmental regulations and changes. Some of the key factors influencing it are the “micro and macroeconomic downturns, demographics, and government regulations” (Clark et al. 7). Governments have employed varying regulations to protect the environment and this has put immense pressure on the oil and gas industry. A few of the regulations formulated by the governments are the “Climate Change Agreement (CCAs) and the EU Emissions Trading System (EU ETS)” (Clark et al. 9).

Chevron – about the company

Chevron is world’s second largest oil and gas company in the world and the largest in the US with a market capitalization of $190.2 billion (Carmichael). Exxon Mobile is its biggest competitor. The company has a market share of 6.9 percent in 2016 (CSI Market).

The business segments of Chevron are – upstream and downstream. The upstream business of Chevron consists of 88 percent of the company’s net income and the downstream segment forms 23 percent of its business (Chevron, “Chevron Annual Report”). The upstream business segment mainly looks into the production and sale of crude oil, while the downstream segment deals with the market operations.

Earnings from the downstream segment are from refining, manufacturing, and marketing of the products, which primarily include gasoline, diesel, jet fuel, lubricants, petrochemicals, fuel oil, and additives (Chevron, “Chevron Annual Report”). The profitability of the segment is often affected by the volatile condition of demand and supply for petrochemical and refined oil products in the regional and global market. Further, the level of inventory, geopolitical events, the cost of raw material, and optimal plant utilization affect profit margins (Chevron, “Chevron Annual Report”). Further, customer perception and reliability on the company’s refineries also play a major role in increasing revenue.

The company has also started expanding its operations in the midstream segment. This segment consists of drilling and marketing of LNG. They are committed to making the largest LNG ship carrier by 2017 to show their commitment to expanding in this segment (Chevron, “Chevron Annual Report”).

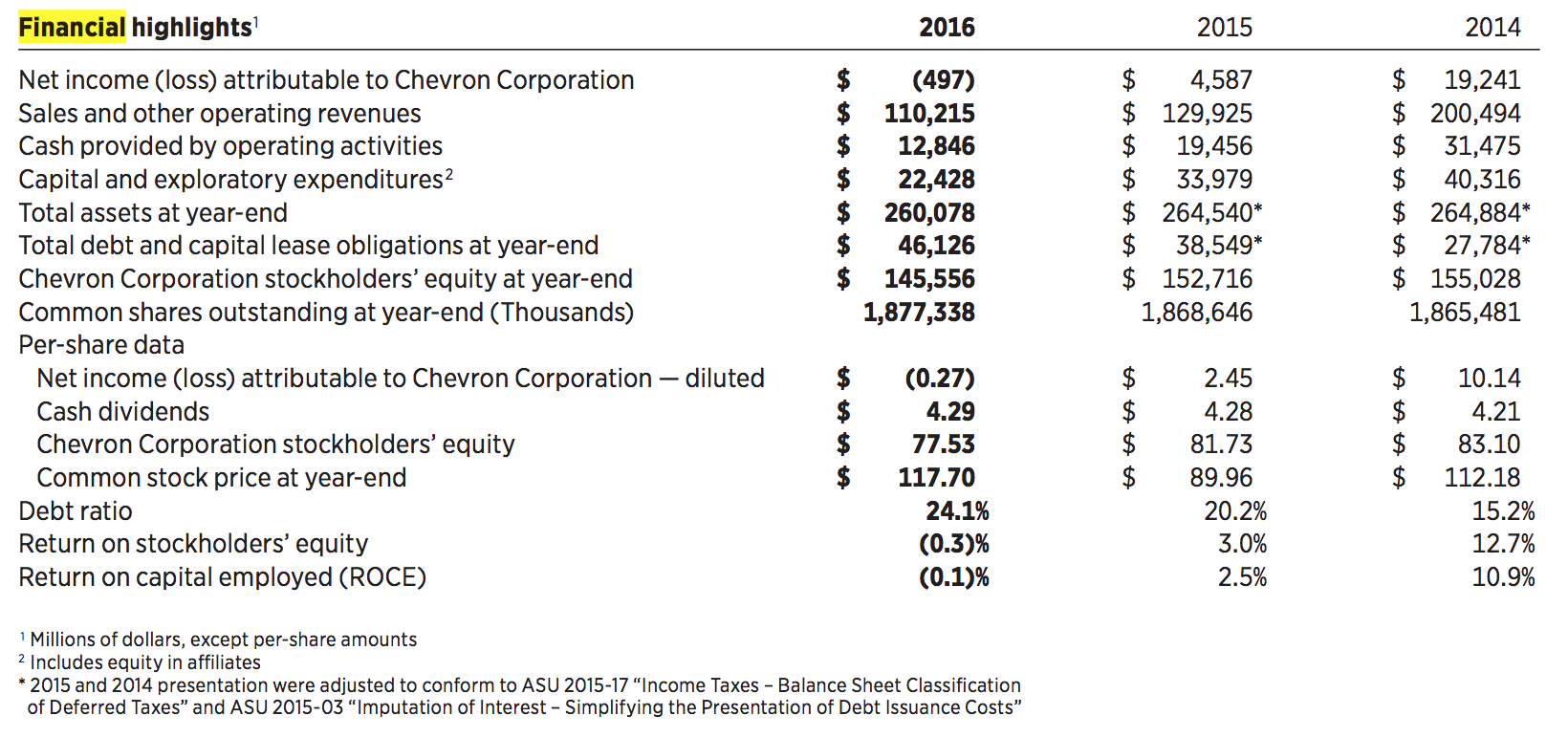

Figure 1 demonstrates the key financial highlights of Chevron. It shows that the company has undertaken a structural shift by streamlining its operations. Chevron has posted a fall in the net income and revenue from sales. This is presumably due to the uncontrollable macroeconomic and geopolitical factors that affect the operations of the company. The company reported a loss of $497 million in 2016 as opposed to a profit of $4.6 billion in 2015 (Chevron, “Chevron Annual Report”).

Chevron CEO, John S. Watson mentions in his letter to the shareholders printed in the Annual Report of 2016 that the fall in the revenue and profit was due to the low commodity prices in 2016 that have “reduced earnings across the industry” (Chevron, “Chevron Annual Report”).

Currently, the main aim of the company is to finish the projects it has such as those in Gorgon, Chuandongbei, Bangka and Alder, reducing capital spending and increasing revenue for the company (Chevron, “Chevron Annual Report”). Further, the company has undertaken cost cutting measures to reduce operating expenses (Chevron, “Chevron Annual Report”). In 2016, the company reported the lowest operating expense in last six years (Chevron, “Chevron Annual Report”).

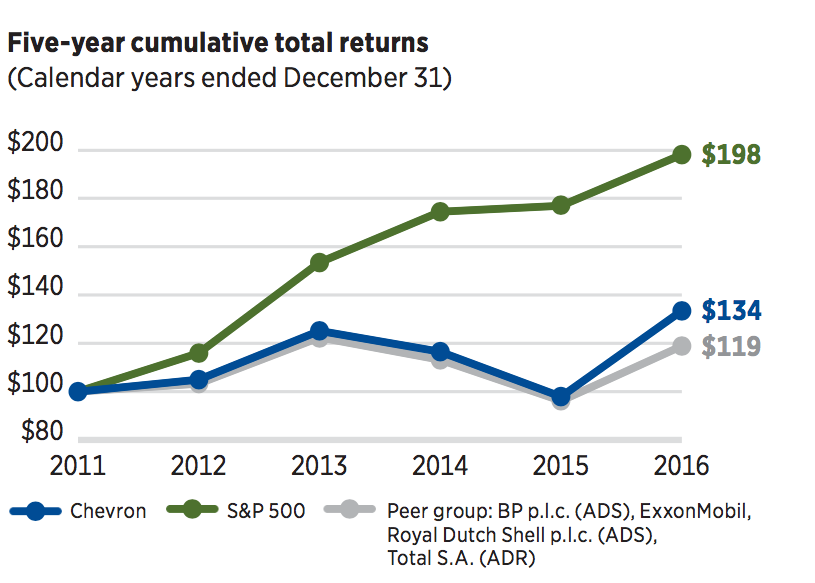

They aim to reduce capital spending and complete asset sales (Chevron, “Chevron Annual Report”). Further, Chevron refineries and drilling projects have reported no accidents making it one of the safest oil and petroleum company. In addition, the company has reported the highest stockholder return when compared to its competitors in the last 25 years (Chevron, “Chevron Annual Report”). See figure 2 to understand how Chevron’s stock has yielded a higher return than its competitors mainly Exxon, Shell, and BP (British Petroleum).

Challenges

The political and economic condition of the global oil and gas market and volatile market demand poses a great challenge to the company’s performance. Further, pressure from environmental groups and regulations for a safer environment also poses a challenge to the company’s operations.

Chevron has faced a lot of challenges in the past few years. The most recent being the fall in the crude oil prices since 2014. The average oil prices have hit a10-year low. The prices have been persistently low even in 2016. The energy sector overall could be accepted as an inherently risky one to be operating in due to the harnessing fossil fuels. Therefore, one of Chevron main goals has always been the safety of the employees, suppliers and the environment overall. However, employing more than 64,500 employees and 200,000 contractors and maintaining the overall environmental health and safety parameters becomes an extremely difficult job (Chevron, “Chevron Annual Report”).

The company is subject to various international, federal, local, regional environmental, safety laws, and regulations. These laws are increasing in number every year and are expected to become more complex in future. The company has to follow the regulation stipulated by international treaties such as Paris Agreement and the Kyoto Protocol as well as follow national laws such as carbon tax, cap-and-trade, etc. Further, the company is also subject to local and state laws such as California AB32 (Chevron, “Renewable Energy and Emerging Technology”).

The company is subject to strict environmental regulations and has faced lawsuits for environmental contamination (Chevron, “Renewable Energy and Emerging Technology”). Chevron is facing a lawsuit for contaminating the Ecuadorian Amazon rainforest and had to pay $27 billion to the plaintiff in 2015 (Chevron, “Renewable Energy and Emerging Technology”). It has also faced problems due to the political instability in Nigeria (Chevron, “Renewable Energy and Emerging Technology”). Thus, maintaining energy efficiency standards and adherence to the environment and climate-related policies if a huge challenge for the company.

Another challenge faced by the company is the rising competition from natural oil substitute such as renewable for of energy. A rising environmental awareness has pushed many governments and organizations to adopt renewable sources of energy that poses a direct threat to the operations of Chevron. Nevertheless, Chevron is one of the few petrochemical companies that have pledged to undertake alternate sources of energy (Chevron, “Renewable Energy and Emerging Technology”). It has made investments in wind energy and biofuels. However, in 2014, the company has sold its stake in Chevron Energy Solutions (Elgin). It has also sold two geothermal units in Thailand (Richter). This raises questions regarding the company’s commitment towards alternate sources of energy.

Time Trend, Peer Group Analysis

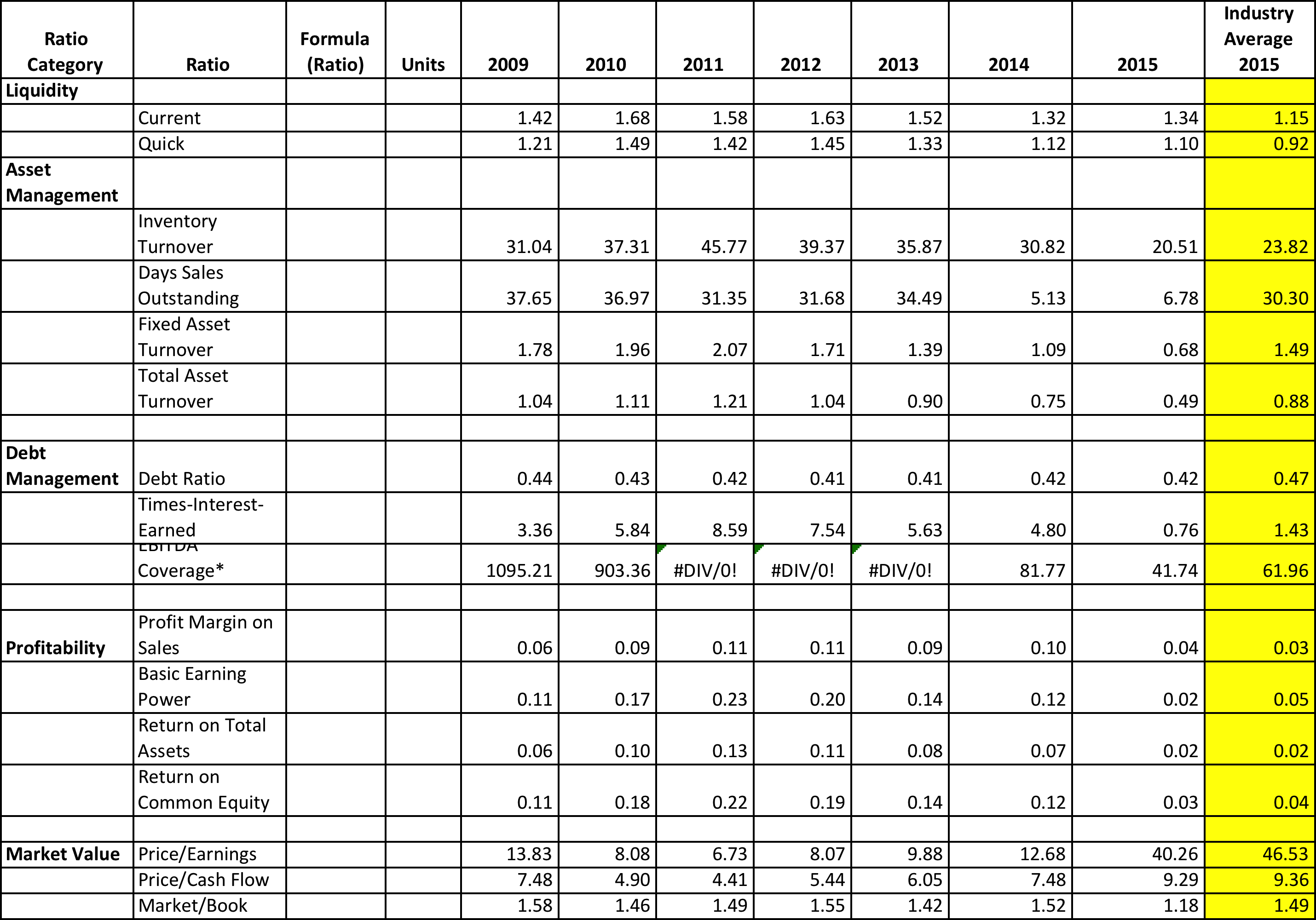

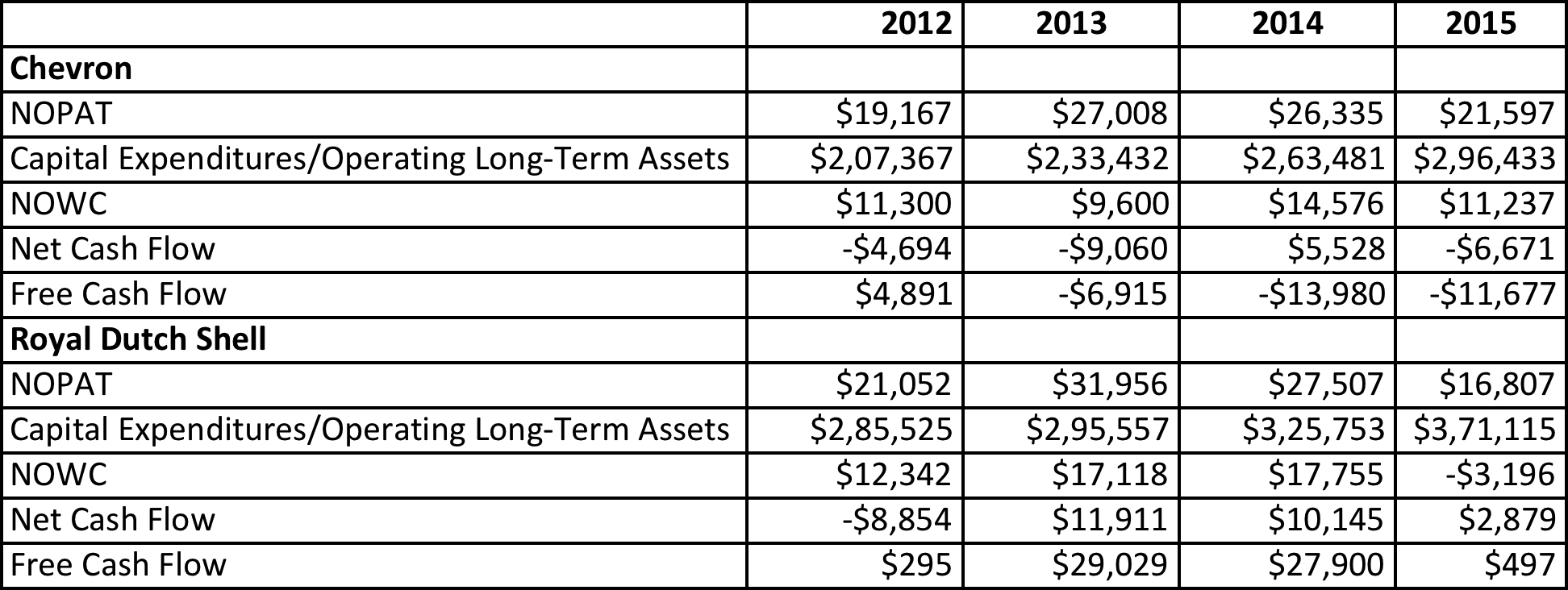

Figure 3 shows the ratio analysis of Chevron from 2009 through 2015 along with the industry average. The industry average is calculated as the average of the ratios of 3 companies namely Exxon, Shell, and Chevron. According to our analysis, we have selected Royal Dutch Shell Company. Exxon was chosen as a supplementary company to provide an approximate average of the industry ratios because it is difficult to find ratios for the whole industry.

When the ratios of 2015 for the industry average and Chevron are compared, it shows that the performance of the company has been better than that of its peers in most of the cases in 2015.

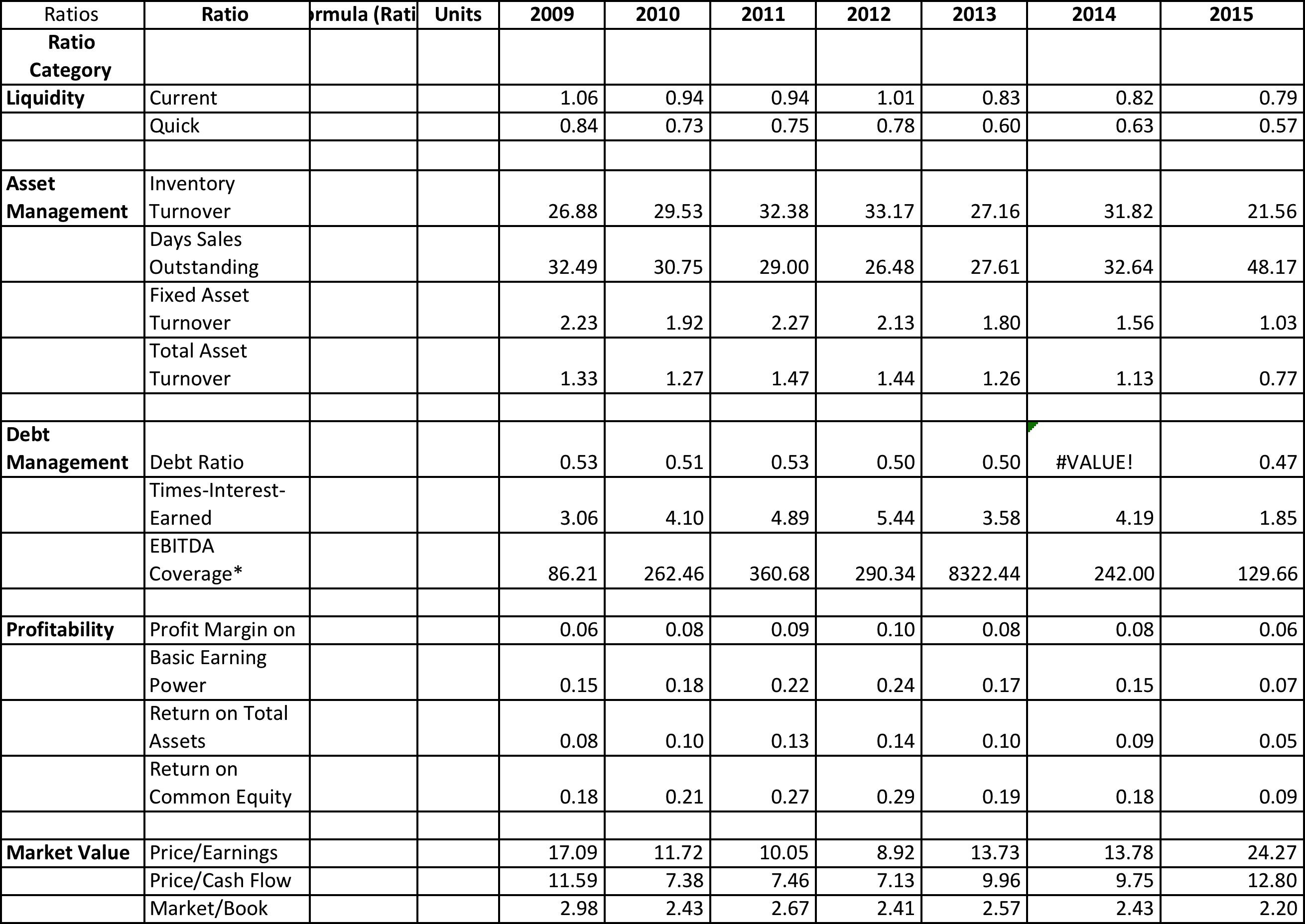

Figure 4 shows the ratio analysis of Royal Dutch Shell Company. The 2015 performance of Shell when compared to the industry average and that of Chevron shows that the company’s performance had failed badly. Shell has shown a downturn in all its critical ratios.

The following section undertakes a comparison of the two selected companies, Chevron and Shell, using time-trend analysis.

Liquidity performance

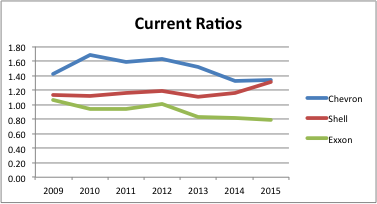

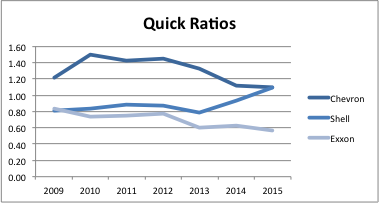

Figure 5 and 6 demonstrate that Chevron has been consistently performing better than the industry. Chevron’s quick ratio has been between 1.1 and 1.49, indicating that the company would not have had problems with solving its current debt with its current inventory as it has a lot of liquid cash in hand. Further, in the case of both the liquidity ratios, Chevron is higher than Shell or Exxon through the period under analysis.

Asset Management

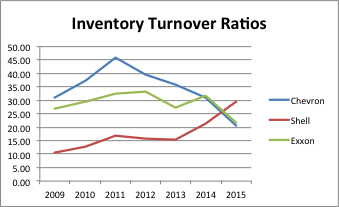

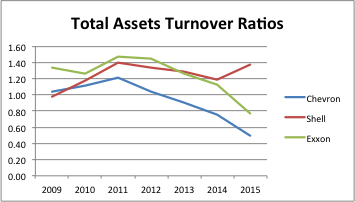

The company has a high amount of receivable, atypical of the industry. Further, Chevron keeps a high amount of assets, which the company is trying to reduce according to its annual report (Chevron, “Chevron Annual Report”). As has been observed in the case of the liquidity ratios, in asset management too, Chevron maintains a higher ratio than the industry and immediate rivals. The inventory turnover rate demonstrates that though Chevron has very high inventory, it has the capability to dispose of it rather quickly due to a high turnover. This implies inventories do not become an impediment to outstanding current debt.

Asset Management Performance

Figure 7 show that Chevron has outperformed its closest peers in inventory turnover ratio. A high level of turnover indicates high demand for Chevron products in the market resulting in reduced inventory.

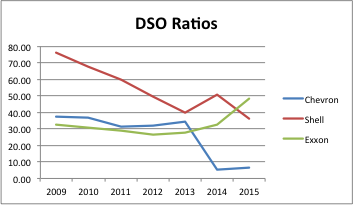

The lower the DSO ratio, the better is the company’s debt clearance mechanism. According to this ratio, Chevron has outdone Exxon and Shell, as the company’s DSO is much lower than that of the industry average and that of its peers.

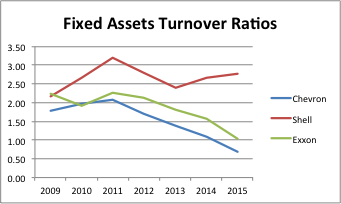

Figure 9 show that Shell has more revenue generating assets. This may be because Shell has operated since 1907 and Chevron since 1984. As the latter is a younger company, its assets have not matured enough to translate into a high turnover.

Here Shell’s performance is better than that of Chevron since the fixed assets are used much more intensively while Chevron has remained a back runner due to their fewer revenue generating assets.

Debt Management

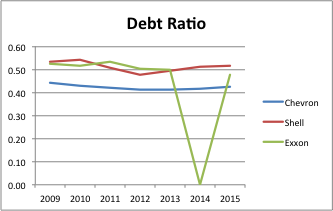

Chevron’s debt ratio has been consistently good as the company maintained a lower ratio than the industry average indicating a greater capability to pay off debtors. Although the company’s competitors are close to the industry average, yet they are in a worse position vis-à-vis Chevron.

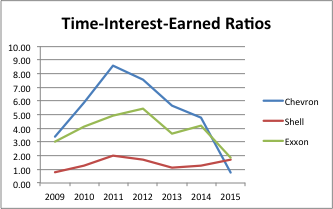

Over the years, Chevron had a larger cushion when it came to fulfilling its interest payments as opposed to its competitor. However, in 2015, the situation drastically changed when Chevron’s time-interest-earned ratio fell below the market average. This implies debt payments would reduce a large amount of the company’s pre-tax income in 2015.

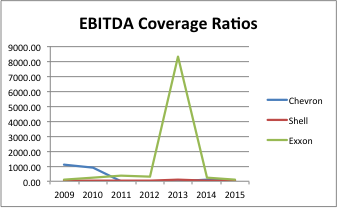

The EBITDA coverage of Chevron is lower than that of the industry average. That of Shell is much lower. All the three companies are capable of paying off their debt at ease. However, their capability of paying it off faster differs. Shell’s is the lowest and then comes Chevron. Exxon has the best EBITDA ratio. This may be due to the organizational restructuring Chevron is undergoing which shift a lot of their profit to revamping its infrastructure and equipment.

Profitability

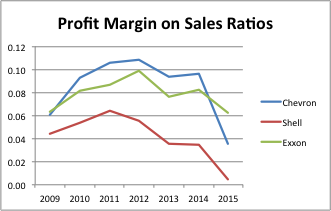

Chevron’s profit margin on sales is 4 percent, marginally higher than that of the industry in 2015. Shell’s profit margin has been at 3 percent in 2015. However, these numbers may not be accurate as to the interest expense on Chevrons income statements has been absent for the last 5 years.

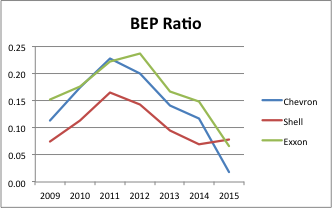

BEP or basic earning power ratio shows earning power of the business to total assets before tax. In this category, Exxon’s earnings are greater than that of Chevron. Shell’s performance has been low throughout, however, it has increased than that of Chevron in 2015 (see figure 15).

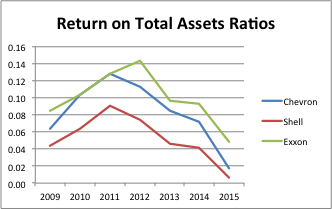

Return on total assets shows the company’s earning before tax as a ratio of total net assets. This shows if the company assets are effectively being used to generate income. Chevron has been at par with the industry standard. However, the performance of Exxon has been much better. Shell’s ratio has been lower than the industry average and that of Chevron. This may be because it has a larger amount of asset.

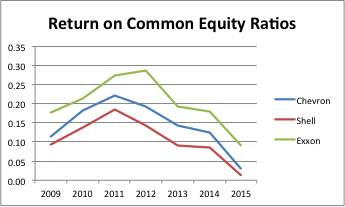

Chevron has successfully generated profit for its shareholders from 2009 through 2014 (figure 17). However, its performance in 2015 dwindled below the industry average. However, it has outperformed Shell but has been below Exxon’s performance.

Both the return ratios show a reliance on debt indicating that Chevron performs better than Shell in this area. Further, in both the cases Chevron has continually posted a ratio over and above the industry average representing the company’s consistent performance.

Market Value Evaluation

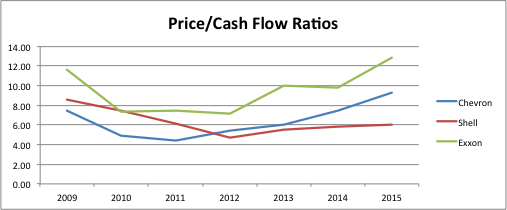

The above figure shows that Chevron has performed below the industry average on both Price/Earnings and Price/Cash Flow Ratios. This shows that Chevron has increased its growth, which may be due to its initiative towards structural change. However, both the ratios are lower than the industry average in 2015, though its performance has been better than that of Shell.

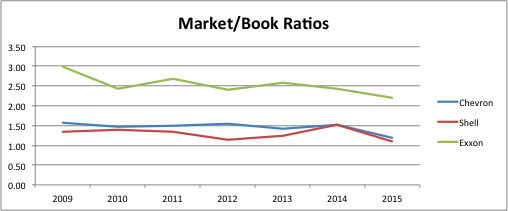

The market to book value ratio of Chevron shows below average performance. However, a market to book value ratio greater than 1 indicates that the market considers Chevron a reliable investment option.

Free Cash Flow and Net Cash Flow

The above figure shows that Chevron has posted a negative result for Free Cash Flow as well as Net Cash Flow in 2015. This may be due to the increase in expenditure in Fixed and Long Term Assets, which would explain the negative outcome. A negative cash flow may indicate that Chevron has been ineffectively managing its credit. This may not attract investors.

Conclusion

The financial analysis of Chevron indicates that the company has a solid foundation, though its current financial ratios are not very attractive. This may be due to the persistent low prices of crude oil and other macroeconomic factors over which the company has no control. Comparison with its closest competitors demonstrates that almost all companies operating in the oil and gas industry have been affected by the bad market conditions. However, the company’s low reliance on debt and high profitability show that its restructuring initiative to face the market conditions is helping it to improve its performance. Further, the analysis shows that Chevron has a loyal customer base, which Shell definitely lacks. Further, we would recommend Chevron to continue its initiative to adapt to and invest in forward-looking projects to increase shareholder reliability on the company.

Works Cited

Carmichael, Chase. “Chevron Stock: Capital Structure Analysis (CVX).” Investopedia. 2016. Web.

Chevron. “Chevron Annual Report.” 2016. Web.

—. “Renewable Energy and Emerging Technology.” 2017. Web.

Clark, Andrew, et al. “2016 Oil and Gas Trends: Are you Prepared for a Future that Limits Fossil Fuels?” PWC, 2016. Web.

CSI Market. “CVX’s Competition by Segment and its Market Share.” CSI Market, 2016. Web.

Eden, R. J. Energy Economics: Growth, Resources and Policies. Cambridge UP, 2012.

EIA. “International Energy Outlook 2016.” U.S. Energy Information Administration, 2016. Web.

Elgin, Benjamin. “Chevron Makes It Official With Sale of Renewable-Energy Unit.” Bloomberg. Web.

MarketLine. Global Oil & Gas. Industry Profile, MarketLine, 2016.

OECD. “World Energy Outlook 2016.” IEA, 2016. Web.

Richter, Alexander. “Thailand-based EGCO Takes 20% Stake in Chevron Geothermal Assets in Indonesia.” Think Geoenergy. 2017. Web.

Wall, Bennett H. “Oil indsutry.” History, 2010. Web.