Introduction

Economic exchange is a common practice in each country. The trading mainly involves goods and services between different countries. The exchanges always come with either losses or profits while they are displayed in the Bop commonly referred to as the balance of payment. In fact, the balance of payments shows all the records of cash inflow and outflow incurred in trade transactions. The balance of payments has got two sections namely the capital and the current accounts.

However, China has been strained over the past years in both their exports as well as their imports, which constitute the BOP. Considering the rapid downfall of China, wealthy country partners are withdrawing their investments from the country to avoid further experience of more losses. However, there are certain factors that contribute to the continuous deficit in China’s economic exchange rates. The essay explains key economic challenges facing China today from this country’s balance of payment perspective.

Main Body

In the past years, China has been balancing its current accounts along with the capital. Most of the times, it handled its resources mostly by marketing them overseas. In fact, either the profit made through trade that accrues from the current or capital account would then uplift the country’s monies. The practice of netting both the current and capital accounts benefits the country’s currency. Alternatively, they could acquire foreign currencies by purchasing them directly by the profits obtained.

However, the management of the exchange rates must be observed. In reality, it should be maintained such that the rate should be at least high since its can be a threat to destabilize the country. The building of factories and buying of properties by other countries from China brought Chinese large flows of cash. In as much as China discourages this “foreign direct investment”, the practice has added up to the country’s wealth as well as cumulative capital to other countries.

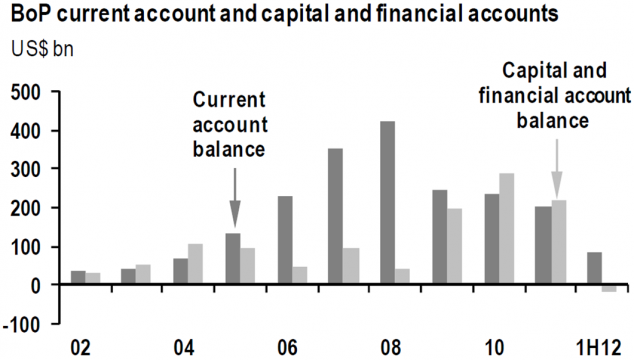

As a result, avoiding the rise of the renminbi against the foreign exchange rates had a hand in the poor reserves of this country. Most research studies indicate that the capital account surplus for China has been dropping as well as the current account surplus. In the chart below, the amount of the supplied quantity, which is excess from the overseas exchanges is indicated by the total of the perpendicular bars above the market demands.

The renminbi would have risen if it had left in the market with approximately 20.0 to 30.0%. If the shortfall continues due to the less demand from other countries, the stability will be affected since the capital flow is going out of the country. When the situation happens, it means that China’s bank will have to decide on using its money to cover up the balance or to hike up the value of the renminbi. Besides, China’s lagging development will have effects on the imports to allow the surplus rise.

The high growth of China’s exchange rates has been constantly recording deficits as the country as experienced in the recent years with a surprise. The summary of the exchange rates shown in the balance of payments should provide a suitable and reliable reason for any country’s loss or surplus.

Products, income payments and revenue are recorded in the current accounting records while the financial streams are indicated in the capital records of accounts. The current account always needs much attention since it reflects the expenses as well as the incomes. The current accounts can never be managed with a continuous deficit without payments, as is the case of China. However, countries that have stable sales abroad are capable of maintaining an overflow of the current account.

At one time, China’s large products and services are now facing shortfall in its current account. The services exchange rate is often minimal in terms of losses. The inflows and outflows appeared to be reasonable for the period. The losses and profits have no doubt had effects on the country itself as well as the country partners that it incorporated in its trade dealings. The high surplus in the China’s current account was motivated via the overseas trading. The IMF “development and finance” chart elaborates the current account structure.

Another factor that poses a challenge to China’s economy is the asset account. The account entails the amount of flow in terms of investments from other trading countries. A country can maintain an asset account by either importing or exporting goods and services. The loaning of funds is also another way of running the account. On the other hand, it should be noted that borrowing huge sums of either goods or services could be defective to a country.

When the debt goes up, and the country is unable to complete the payment, it might bring the country to a standstill. The situation is on the contrary, a benefactor to the lender as it increases their economic growth and welfare. The situation currently experienced in China can be compared with the 1970s where Latin American countries had huge loaned capital surpluses to manage their countries’ economies.

However, the countries were later unable to settle their dues. Actually, being unable to pay back the United States government, the States government had the advantage to maintain their economic development. Countries, which support others by loaning them, tend to face losses due to late payments or defaults. Thus, this appears as a major factor that made the Chinese to oppose to direct foreign investments even though it has not been completely stopped.