Executive Summary

The report seeks to analyse the shutdown of the Clyde oil refinery using economic concepts. Clyde oil refinery is the oldest oil refinery in Australia and as such, the report gives the viable economic factors that could have led to this shutdown. Several assumptions have been made.

The findings of the report are that competition from Asian mega refineries was the major cause for the shutdown. It has also been assumed that the company had been operating under near-shutdown conditions for the last few years.

The entry of other competitors in the oil industry brought about the strong competition, and hence another risk factor. Its size and the inability to adopt new technology is also another cause for its closure. The shut down would lead to increase in prices and hence abnormal profits. It would also force the remaining companies to produce more in order to meet the industry demand.

Introduction

The announcement of the closure of Clyde oil refinery has brought different views. Shell Australia has been forced to shutdown Clyde oil refinery due to intense competition.

This will leave the refining industry with a production deficit of 75,000 barrels daily. The move had been unexpected and the shell Australia believes that Asia mega refineries will replace the output. The report looks at the economic reasons that may have led to the shut down and the impact it may have on the competitors.

Body (Analysis)

The Clyde oil refinery shutdown was caused by high competition and increase in demand and supply in the region (Murphy 2011). 260 employees will be laid off, leaving only 50. In order to analyse the shutdown of the firm some assumptions have been made. The Clyde oil refinery had been operating under shutdown point for the last few years.

A firm reaches a shutdown position when output (revenue) is just adequate to cover the total variable cost of the firm. According to Wessels (2000, p.345), the shutdown of a firm or a company occurs when the total variable costs exceeds the total revenue. The rules of shutdown in the long run are that TR

According to Murphy (2011), the Clyde oil refinery vice-president Andrew Smith said that the shutdown was necessitated by “increased competition from mega-refineries in Asia, supply and demand in our region”2011).

The vice president also added that because of its size it could no longer compete regionally and significant investment was required. This can be explained by costs and output in the long run.

Firm industry

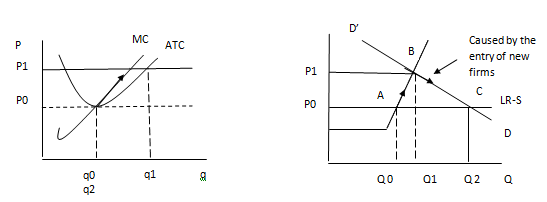

The assumption is that all the firms operate under the same cost curve in the long run.

Upon entry in the market the firm was making huge profits. This attracted other key players in the industry. As time goes (long run) the demand increases to DD. The entry and competition pushes the prices down from B to C and the output increases from Q1 to Q2.

At this point firms are making zero profits. Increased competition from companies that have high output capacity pushes the prices further down. This affects the weaker companies with high avoidable costs.

When the industry is operating under a loss, this pushes some firms to shut down. This is the case with the Clyde oil Refinery where competition, demand, and technology pushed it until it had to shut down its operations.

The shutdown has an impact on the remaining firms as well as the industry itself. Given that Clyde oil refinery produces 75,000 barrels per day (Edwards 2011), the output in the industry would be pushed down further. This would force Asia refineries to produce more to fill the market demand of oil.

The remaining firms in the industry would the have to raise their prices returning to p0 (Wessels 200, p.354). At this point, the supply is elastic than in the short run (LR-S). If the Asians producers cannot meet the market demand of oil in Australia, then there could be an oil crisis.

When a commodity is scarce or in high demand prices go up and companies are more likely to make abnormal profits.

Conclusion

The shutdown of the Clyde oil refinery was as a result of high competition from Asian mega refineries. It may also have been caused by increase in demand in which it was not able to produce an output required by the industry.

Reference List

Edwards, M., 2011. Refinery closure cuts national fuel security. ABC Sydney. Web.

Murphy, M., 2011. Shell shelves refining at Clyde. Sydney.

Morning Herald. Web.

Mankiw, N. G., 2009, Principles of economics. Mason, OH: South-Western Cengage Learning.

Wessels, W. J., 2000,. Economics. Hauppauge, NY: Barron’s.