Introduction

Investing in a country’s economy is a step that needs a cautious and critical approach to guarantee a sustainable return on investment. Such a path should not be decided in an ‘instant coffee’ approach as there are many risks involved in making a large investment in a country’s economy, as many factors influence growth of a business.

Any company that wishes to invest in a country must conduct a thorough study of the country’s economic conditions to ensure success of the investment. Romania is one country with blurred economic, social, and political trends, which determine the risks of investing in the country.

Therefore, a clear knowledge of the economic, social, and political environment of the country is important to ensure a steady return on investment.

Assessment of the Current Economic Climate of Romania

Macroeconomic and Financial Position

The macroeconomic and financial profile of Romania has deteriorated remarkably, as its access to outside financial sources declined leading to a fall in its exports.

The quick slowing of investment inflows reflects a generalized rise in risk aversion, in part, towards mushrooming markets, simultaneous with influence from the financial disasters in other European economies.

The country had recently experienced a decrease in its international credit ratings by a larger margin than those of other European countries.

This is attributable to increased concerns on the sustainability of the country’s immense current account arrears, the position for wage and financial policies, and the fitness of foreign banks with subsidiaries in Romania.

Market Confidence

The decline in market confidence is responsible for the persistent spells of downward force on rate of exchange, upward force on rates of interests, and considerable falls in equity values. In some instances, the leu can depreciate 25% against the Euro, even with immense increases in local interest rates.

Upward forces on rates of interest indicate interplay of structural and transient factors. Transient factors encompassed augmented segregation of the bank-to-bank market leading to a loss of confidence within the banking industry.

Structural factors, on the other hand, represent the transition of the banking system to net adverse liquidity position, concurrent to the increase in liquidity demand in the context of uncertainty concerning the economic outlook.

The degenerate economic position, in conjunction with pulling out by foreign investors, resulted to a significant fall in capitalization of the stock exchange.

Strengths and Weakness

Romania has some distinct strength. The membership in the EU has improved its economic position. This condition, without doubt, favours its prominent domestic market. Romania has skilled workforce supported on a low wages.

The foreign debt and public sector has maintained at a practical level despite increasing FDI inflows and plenty of reserves of foreign exchange.

On the other hand, the weaknesses of Romania are unique. First, its economy is characterised by deficient discipline with regard to policies concerning fiscal matters and wages. The IMF has criticised this condition.

Second, macroeconomic disparities have been escalating, especially in external accounts. Third, persistent effort on reforms will delay a steady growth, fiscal market confidence, and accession into the EU.

Industry and Market Conditions

The current population of Romanian is 21,848,500. This is significantly a sufficient number of people to sustain a steady market for coffee products. The ethnic distribution of the citizens of the country differs by a large margin.

The Romanians, which is the largest ethnicity, represents 88.6 percent of the population. The Hungarians are the second largest ethnic group comprising 6.5 percent of the population. Other many small ethnic groups make up for the remaining proportion 4.9 percent.

These large ethnic groups influence the demand for coffee products. The cultural and religious orientation of these groups determines the rate of consumption of coffee products.

Industry

Romania has advanced telecommunication, aeroscope and weaponry industries. Industry combined with construction sector represents 32 percent of the GDP in the past few years. This ratio is relatively large share without related services. The industry represents 26.4 percent of the labour-force.

Romania is the twelfth major manufacturer of automobiles in Europe. In addition, it boasted of 5.3 percent global market share of machinery. Some prominent companies in Southeast Europe, including Bitedefender, Rompetrol, Petrom, and Automobile Dacia are based in Romania.

Nevertheless, small and medium-sized producing companies constitute a large share of the sector of manufacturing. Two-thirds of the total workforce in Romania works in this sector.

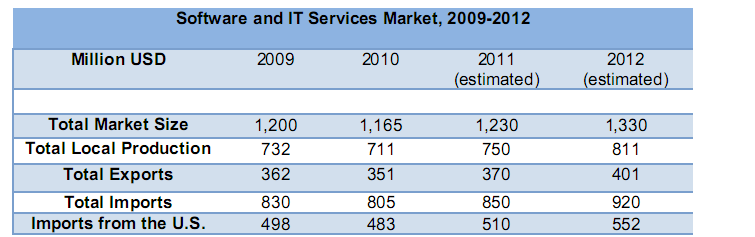

According to business forecasts, different economic activities have a potential for growth. The forecast projected a growth potential of 9 percent for industrial output and 12 percent growth in agricultural output as the table below indicates.

Overall consumption of the final product has a growth potential of 11 percent. In addition, domestic demand has a growth potential of 12.7 percent.

Worth of note, the expansion of the industrial sector is the primary drive for economic growth in Romania. As of 2007, manufacturing industry constituted 35% of the country’s GDP and employed 29 percent of the total workforce.

Majority of the industries are situated in the urban areas of Southeast and Northwest, while mining industries operated in rural areas. Heavy manufacturing industries are situated in South of Romania.

Importantly, Bucharest-based factories accounts for 26 percent of the total manufacturing sector in Romania. These factories employed 12% of the country’s workforce in factories.

Coffee Market Analysis

Coffee is the key beverage in Romania and its performance in the market influence the performance of all other beverages. However, it continues to be customary commodity and consumption is low relative to other members of EU. Lower consumer purchasing power in Romania than in other European country, and the high ratio of populations residing in rural centres and small cities, account for the low consumption of coffee in this country.

The quality of live in Romania deteriorated significantly in 2011 because of endeavours to alleviate the deficit in the national budget, and the development of VAT. These strategies influenced accessible disposable incomes, adversely. Prices in coffee products increased because of decline in the RON and expansion in price of green coffee beans, thereby leading to a decrease in coffee sales in terms of volume.

Competition

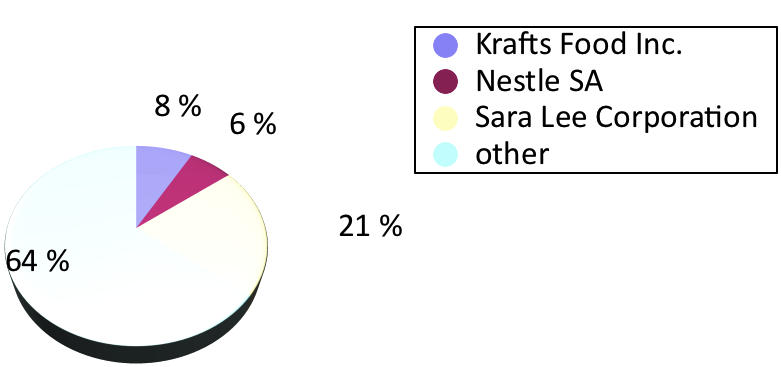

In Romania, key major companies dominate the coffee market share of the country. These companies are Kraft Foods Romania SA and Strauss Romania SRL. Other important players retain a relatively lesser market shares. The leadership in coffee dominance shifted in value share and volume of coffee product.

The top two companies led in value share and volume terms respectively. Strauss retained the leading position in volume terms because of a very stable network of distribution and the capacity of the company to satisfy income fragments.

Jacobs brand of Kraft Food led in 2011 in value terms as well as in volumes because of its view as a premium brand, which is affordable, and promotion through established campaigns.

Conclusion

Importing coffee into Romania is not a sound decision as the purchasing power of the general population is low to sustain a high return on investments. The low exchange rates of leu against the euro and other prominent currency in the world will make the return on investment decreases.

Because other neighbouring Europeans country consume coffee in larger amounts than Romanians do, it is practical to establish the company in another EU country with a higher consumption of coffee than Romania, and to avoid the high risks associated with unstable economy in the country.