Key Strengths of Colbertens Sc

- Colbertens has a stable linear supply chain function that integrates the aspect of stable pricing, optimal functionality, and reputable supply chain security.

- The company has strong in-bound supply contract for the independent, government, and other suppliers

- Stable pricing and well controlled inventory management channel

- Stable supply security and reputation for quality buying of raw materials and timely payments to suppliers.

- Excellent client relationship in the supply chain network, especially with the external suppliers

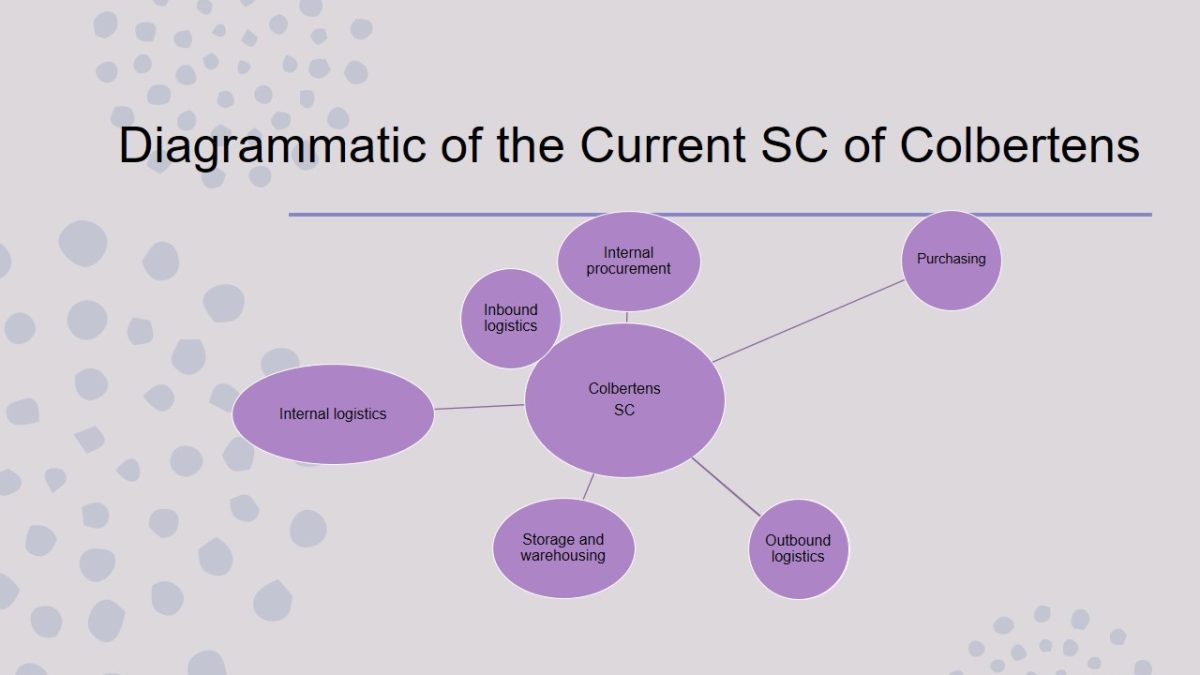

- Strategically developed external and internal supply chain communication network as summarized in the linear supply chain model below.

Production Equipment Purchase Strategy

In the event of expansion into 4 other countries, the production and specialist equipment purchase should be centralized because:

- To guarantee smooth transition in the supply chain management through minimizing risks associated with decentralized operations.

- To ensure that the flow in the supply chain is intact for the benefit of minimizing the costs as a result of introducing many subsidiary supply networks that can be effectively operated from a central point in line with MRO consideration.

- To guarantee ability to track all aspects of supply chain since a centralized system acts like the main circuit that systematically align different production functions to the centralized goal of efficiency in the supply chain management, especially when the targeted countries have unpredictable economic climate.

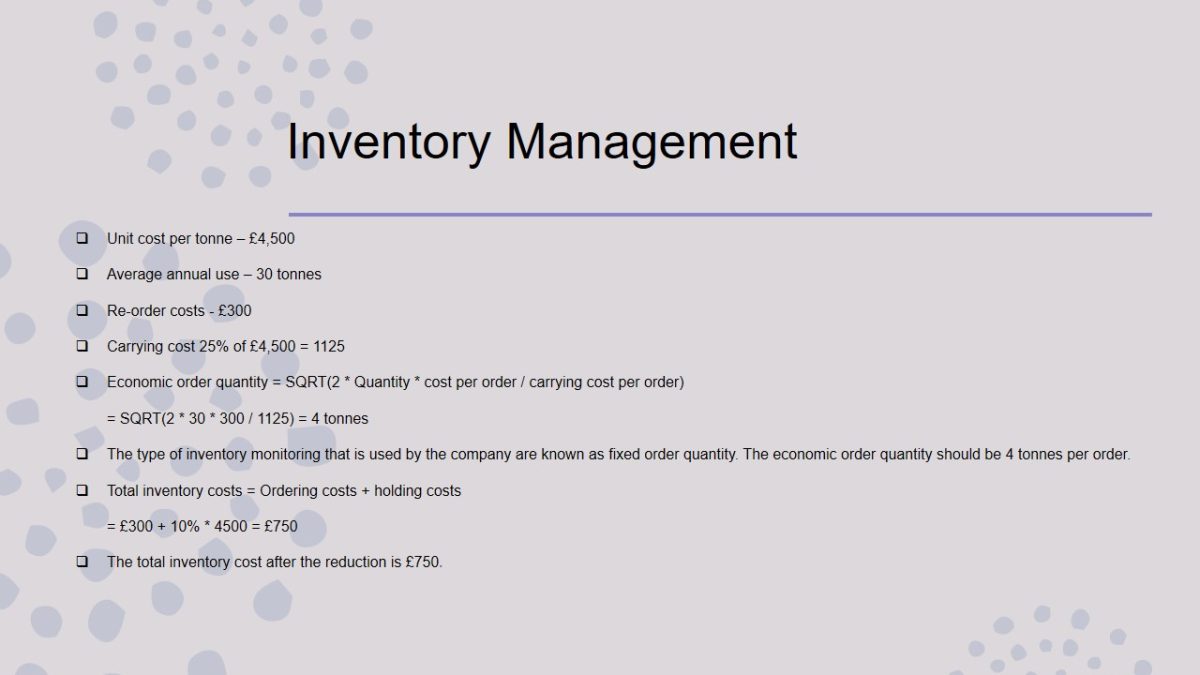

Inventory Management

- Unit cost per tonne – £4,500.

- Average annual use – 30 tonnes.

- Re-order costs – £300.

- Carrying cost 25% of £4,500 = 1125.

- Economic order quantity = SQRT(2 * Quantity * cost per order / carrying cost per order) = SQRT(2 * 30 * 300 / 1125) = 4 tonnes.

- The type of inventory monitoring that is used by the company are known as fixed order quantity. The economic order quantity should be 4 tonnes per order.

- Total inventory costs = Ordering costs + holding costs = £300 + 10% * 4500 = £750.

- The total inventory cost after the reduction is £750.

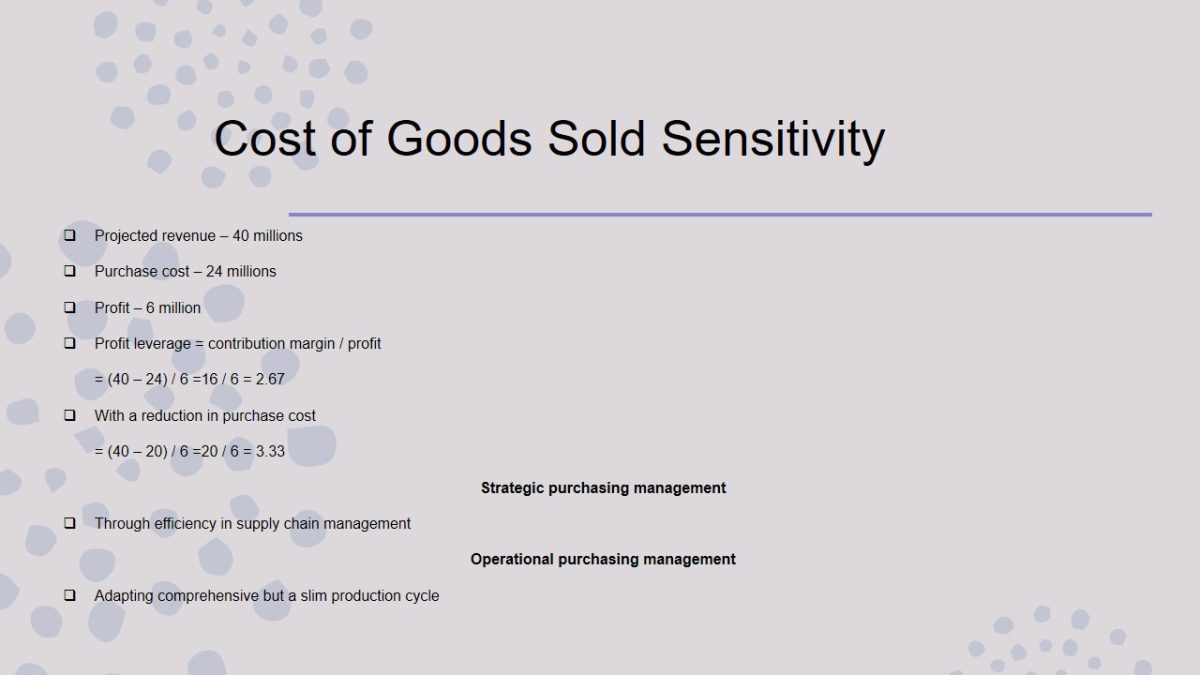

Cost of Goods Sold Sensitivity

- Projected revenue – 40 millions.

- Purchase cost – 24 millions.

- Profit – 6 million.

- Profit leverage = contribution margin / profit = (40 – 24) / 6 =16 / 6 = 2.67.

- With a reduction in purchase cost = (40 – 20) / 6 =20 / 6 = 3.33.

Strategic purchasing management

- Through efficiency in supply chain management.

Operational purchasing management

- Adapting comprehensive but a slim production cycle.

Colbertens Versus Colbertens – Myratech Strategic Comparisons

The difference in the overall strategy in the new Colbertens-Myratech partnership will be improved efficiency and expanded scope of operations.

Through the partnership, the new partnership will increase the scope of the supply chain management to almost double the current levels of reliable supply, quality products, and ideal manufacturing at the least possible cost (Pearce 45).

Therefore, the new partnership is expected to facilitate introduction of supply chain aspects such vertical integration, supplier relationship management, anf periodic system functionality review.

Shipping and Delivery of Sensitive Goods

- The delivery of sensitive would be contracted through the Free on Board term.

- This approach will protect the company from transferable risks since the contract of carriage is only valid upon delivery of the sensitive goods.

- Besides, the above term allows for division of costs to ensure that liability during transportation is handled by an independent party such as an insurance company (Lashinsky 39)

- The INCOTERMS to be requested in contract negotiation are risk transfer, licenses, and insurance.

- The licenses and proper documentation will make the whole process legal and binding in an event of contract breach.

- The insurance will take care of potential damage and loss during transportation.

- Risk transfer will allow the company to protect itself from potential challenges in the process of transportation.

Exposure to Forex Variation

In order to protect itself from forex fluctuations, Colbertens should consider the following strategies:

- The company can hedge all ifs foreign assets into the business portfolio. This means that the Colbertens will minimize losses as a result of local currency fluctuation. The company can achieve this through investing in currency-hedged or exchange-traded funds (Gelder 13).

- The company may also consider matching the currency that its uses often in selling and buying (Smithson 29). For instance, in the Nigeria market, the company’s sales revenues in naira should be balanced with raw materials bought in naira. This translate into protected profti margins since costs will stay comparative to end price. (Mallin and Finkle 45).

- The company should also strive to increase the understanding on the origin of costs within the supply chain to improve its agility. In the case of Colbertens, the company might forge proactive partnership with suppliers operating in different locations. The company might relocate production facility to regions with competitive costing (Lashinsky 15).

Customer Selection and Compliance

The Colbertsons would assess new suppliers by;

- The ability of the new supplier to deliver on time and at the most cost effective way.

- The existing network, work experiences, and past records on acceptable business practices.

- Ability to serve the interest of the company such as honoring contract to avoid conflict on interest by examining the business structure of the new supplier (Teece 53).

- The past critical projects that the supplier has achieved, especially in terms of life cycle cost to gauge the level of commitment.

Works Cited

Gelder, Van. Global brand strategy: Unlocking branding potential across countries cultures and markets, London: Kogan Page Publishers, 2005. Print.

Lashinsky, Adam. Inside Apple: How America’s Most Admired-and Most Secretive- Company Really Works, New York: Business Plus, 2012. Print.

Mallin, Michael and Todd Finkle. “Product Portfolio Analysis: The Case of Apple, Inc.” Journal of International Academy for Case Studies 17.7 (2011): 63-74. Print.

Pearce, John. Strategic Management: Formulation, Implementation, and Control, New York, NY: McGraw-Hill, 2009. Print.

Smithson, Samuel. “Analysing Information Systems Evaluation: Another Look at an Old Problem.” European Journal of Information Systems, 7.3 (2008): 158-174. Print.

Teece, David. “Business Models, Business Strategy, and Innovation.”Long Range Planning 43.1 (2010): 172-194. Print.