Executive Summary

Organizations are incorporated with the primary objective of increasing shareholders’ value by making profits. Consequently, corporations channel their resources into activities that generate profits, keeping the business afloat in the industry. Commonwealth Bank of Australia (CBA) is one of the largest financial providers in Australia and the world at large.

Although the bank started as a public entity, it was fully privatized, paving the way for the need for more profits. CBA has been competitive in the Australian and global markets due to the integration of financial technology. However, its financial analysis indicates that it largely depends on equity investments and not assets. The bank’s returns on assets (ROA) indicate that it reaps lesser profits from commercial operations. Therefore, a strategy that reduces over-dependence on equity investment and increases ROA will help CBA remain competitive while meeting shareholders’ expectations.

Focal Organization

Organization Description

CBA is one of the most active financial service providers in Australia. The bank provides services such as retail financing, personal and commercial banking, and asset management, among other services (Bandara et al., 2021). CBA was founded in 1911 by the Australian government but was fully privatized in 1996 to improve its performance (Wang-Ly and Newell, 2022). The organization was involved in various financial scandals such as money laundering, bank bill swap rate, and the 2016 $76m Ponzi scheme (Li and McMurray, 2022). Consequently, the bank adopted various strategies to maintain its reputation and attract more investors.

Strategic Direction and Stakeholders’ Interests

The recent financial reports show that CBA has remained profitable in the business. In the year 2021, the bank made a Cash Net Profit After Tax of $8.65 billion (Common Wealth Bank of Australia, 2022). The profit projected an increase of 19.8% from the 2020 financial statement. Meanwhile, the company’s dividend was $ 2.00 per share, taking the full-year dividend to $3.50 per share when fully ranked, satisfying stakeholders’ interests (CBA, n.d.). The strategy focuses on addressing financial abuse, ethical business practices, and contributing to the community.

Organizational Challenge

Problem Statement

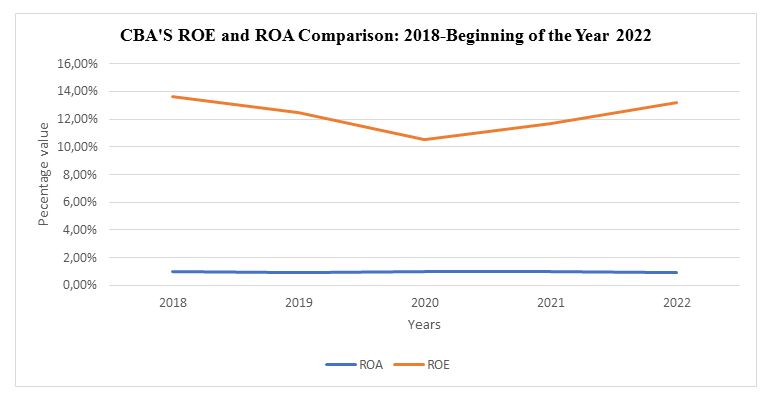

Over the past years, CBA has remained profitable and competitive in the Australian and global financial markets. However, the organization largely depends on equity investment as compared to assets. As of January 2022, the ROE was at 13.17% while the ROA was at 0.9% (Common Wealth Bank of Australia, 2022). The company’s ROE shows an inconsistent trend, risking its survival in the financial market (Figure 1.0). The smaller ROA than ROE shows that CBA is less profitable in its commercial operations.

Targeted Shortcomings and Opportunity in Addressing the Problem

The inconsistent ROA value presents various shortcomings to CBA that are detrimental to its growth and strategic directions. The smaller ROA indicates the risk of the bank depending on debt to balance its financial statements (Priyadi et al., 2021). Increased debt can lead to insolvency, and the possibility of acquisition by creditors (Giambona, Lopez-de-Silanes, and Matta, 2022). Expanding its consumer base, restructuring the organization, and new business ventures could help relieve the problem (AlTaweel and Al-Hawary, 2021). Therefore, addressing the challenge will lead to increased profitability for the shareholders and the business at large.

Alternative Analysis

CBA can adopt various measures to address the overarching challenge of decreased profitability in commercial operations. The bank is focused on basic financial services such as checking and saving accounts, loans and mortgages, and asset management (CBA, n.d.). The corporation competes with other banks to provide the services. The bank’s key stakeholders are the clients and shareholders. The new business venture and consumer base expansion will meet clients’ requirements for readily available financial services. Meanwhile, restructuring the organization and consequent profits from business expansion and new ventures will meet the shareholder’s requirements of high return on investment.

New Business Venture

The financial sector is multifaceted with many opportunities that can be exploited for profitability. Since CBA has focused on basic banking services, venturing into other business options can lead to increased profitability (Kraus et al., 2021). Some of the new business ventures available for the bank are offering professional financial counseling. The service is beneficial to the customers since they will make informed financial choices. Meanwhile, the bank will benefit from the fees charged. Venturing into financial counseling will present CBA with an opportunity to well understand its clients while making profits.

Expanding Consumer Base

CBA is operational in Europe, Asia, and the U.S. ignoring African countries. Although many opportunities exist in developed countries, developing countries need quality financial services. Therefore, CBA can expand its operations to African countries where agricultural and mining activities present opportunities to the bank. CBA can offer loans and expert financial counseling to small businesses and farmers in Africa. The developmental activities in the majority of African countries provide an opportunity for financial services companies that are contracted to build roads among other structures. Extending its operations to African countries offers CBA an opportunity for growth and expansion.

Organizational Restructure

Leaders play a significant role in executing organizational objectives and achieving set goals. CBA has historically depended on equity investment as the major income source. The current management is aware of the situation but took no action to increase the income of commercial operations. Therefore, the bank needs management that is proactive and solution-oriented. Proactive leaders are significant in identifying and solving organizational problems (Smithikrai, 2022). Moreover, proactive management can develop strategies that are beneficial to the shareholders and the business. Restructuring CBA management will help get rid of inactive leaders who are not problem solvers. Therefore, it is recommended that CBA expand its consumer base through new business ventures and restructure its leadership to overcome the identified challenge.

Recommendation Feasibility and Viability

Recommendations’ Benefit

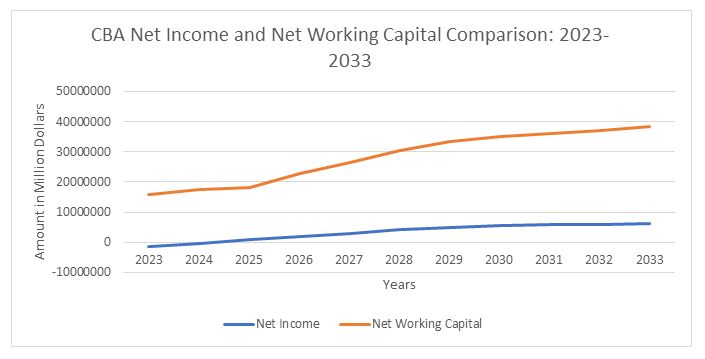

The suggested recommendations are beneficial to CBA in various ways. New business venturing involves the identification of new business opportunities and their consequent exploitations. The organization will have a competitive edge over other banks. Unlike other banks, CBA will have an expanded service category, with increased sources of income. Additionally, the new business venture offers an opportunity to develop further products that are beneficial to the consumers (Roberts, Palmer, and Hughes, 2021). For instance, as the bank engages with its clients in professional financial counseling, it may identify other niche areas. , the new business venture builds trust between the clients and the business since the customers feel that their problems have been solved (Zhao et al., 2021). Therefore, new business venturing has a mutual benefit to the organization and its stakeholders. Figure 2.0 shows a forecast comparative analysis of the net income and net working capital in the next 10 years, showing lower net income than the amount of invested capital. The ROE decreases slowly to the cost of net capital investment (Sue et al., 2014).

Meanwhile, expanding its consumer base allows CBA to increase its profits. The newly recruited consumers are significant in identifying market gaps and solutions to existing business problems (Zhao et al., 2021). Additionally, an expanded consumer base is crucial for business survival since there is always a ready market for newly developed products (Nikbin et al., 2022). Restructuring the organization would lead to new business management that would focus on its performance. A new business culture will be developed to enhance profitability and optimal performance (Zhao et al., 2021). Expanding its consumer base through new business venturing and restructuring its management will be beneficial to CBA since it increases profitability and reduces over-dependence on equity investment.

Resources Required

New business venturing through consumer base expansion and management restructuring requires various essential resources. First, CBA will need a strategic team that will explore the available business expansion framework. The team will include financial experts who can estimate the entire costs of the new business venture identification process and consequent business expansion. Moreover, the experts will explore the economic and other external business environments of various African countries, and choose the ones that are worth business expansion and new venture. Second, the organization will have a technical framework that will ease the process of business expansion and new business ventures. For instance, a computer software program that collects and analyzes collected data will help in forecasting the project’s viability.

Third, finances will be crucial in executing the new business identification and expansion activities. The experts’ labor costs, and forecasting system development, among other activities, will need to be financed by the organization. The bank will need a preliminary budget that will estimate the cost of marketing newly expanded business activities and the total costs of business transition. Fourth, CBA will need product resources to expand its business activities in the African continent. The resources will include specific financial services and products that will be offered to the newly identified African market. Last, the organization will need human resources which include new managers who will steer the proposed changes. The business leaders will be recruited based on competency in solving business problems.

Planning

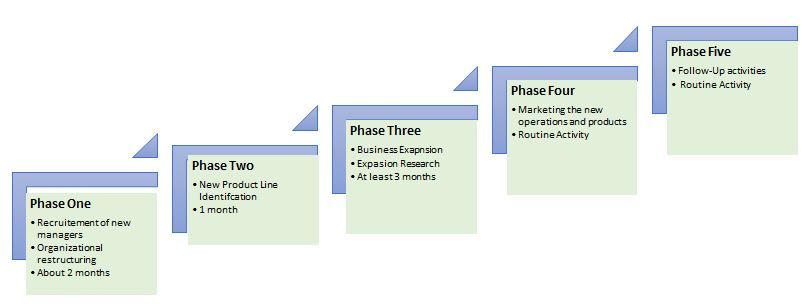

Strategic planning involves business processes of identifying specific objectives and allocating resources necessary resources for business success. Solving CBA’s problem involves various activities that need management and stakeholders’ intervention. Planning will provide the organization with structure and foresight for the execution stage (Castillo-Camarena and López-Ortega, 2021). Consequently, CBA will avoid wasting resources through the elimination of unnecessary activities and patterns. Furthermore, proper planning will allow the organization to make changes within the set deadlines and budget (Malabagi et al., 2021). A well-outlined project plan will offer an opportunity to reflect on the made changes and possible improvements (Malabagi et al., 2021). CBA will adopt a five-phased plan for business improvement to increase its profitability on commercial operations: recruitment and restructuring of management, identification of a new product line, expanding the business, marketing new operations, and reflecting on the new changes.

The first phase of the plan will be an explicit internal business process. The team of experts will involve the business stakeholders in replacing inactive leaders and restructuring the current management. The process will include the identification of the problem with existing management and possible remedies. The first phase is estimated to take place for about two months. After that, the second phase will set in whereby the organization will identify and define its new product line, professional financial counseling. During this phase, the bank will develop a specific department that will offer the service to its client. The phase will determine the counseling service department’s scope and its internal leadership and will take one month.

The third phase will take at least three months due to the intense research on the most profitable African countries. Experts will be involved in acquiring necessary data that helps in projecting the financial feasibility of the new market. The fourth phase will involve intense marketing activities to promote the newly developed product and advertise the new operations. The marketing content will be customed for a specific market: the U.S., Europe, and Africa. The marketing phase is a continuous process that will actively involve the marketing department. Last, the organization will conduct a follow-up activity to determine the impact of the business changes on profitability and overall business performance. Figure 2.0 summarizes the plan for adopting and implementing the new changes.

Accounting Assumptions and Risk

The proposed initiative is based on various assumptions that may be risky to the organization. Firstly, it is assumed that the allocated timeframes for the planning are sufficient to conduct the activities at each phase of the implementation process. The assumption is risky since some activities may take more time than planned. Taking the extra time that is out of a project’s plan can lead to extra expenditure that will affect the proposed budget (Hasan, Chowdhury, and Akter, 2021). Therefore, every stakeholder must work to their level best to ensure that activities are executed within the suggested timeframes.

Secondly, the proposed initiative assumes that the African continent is easily accessible for new business ventures. However, the differing economic and political circumstances can lead to the need for extra budget to fully exploit the continent (Iddawela, Lee, and Rodríguez-Pose, 2021). Consequently, the organization may experience lesser ROA than expected, increasing debt risks (KPMG, 2019). The organization should deploy experts who are conversant with the conversant with African economy and politics to avoid expenditure in identifying the new market.

Lastly, the initiative’s success assumes the economic and political conditions will remain constant, with maybe slight changes. The assumption is risky since the global economy is dynamic due to the emergence of natural disasters and pandemics. Setting aside an extra budget for emergency control will help avoid the downfalls that come with natural disasters (Jiang, Ritchie, and Verreynne, 2021). While the proposed initiative is based on various assumptions that are risky to CBA operations, the long-term results are beneficial.

Conclusion

CBA is one of the most popular and active financial providers operating in European countries, Asia, and the U.S. The bank was initially founded as a public corporation but was fully privatized to improve its operations. Unlike, many financial providers in Western countries, CBA has been involved in various financial scandals that soiled its reputation. Consequently, the bank has been failing to achieve its maximum profit potential. Although the organization has been profitable for the past five years, it largely depends on equity investments. Therefore, CBA’s ROE has always been more significant than its ROA. Low ROA values mean that the bank is at risk of depending on loans for survival. Business expansion through new market venturing and management restructuring will allow the organization to overcome its challenges. A well-structured and strategic plan will enable the organization to implement and adopt the proposed initiative. Although the proposal is based on various financial and logistical assumptions, CBA will reap big by implementing the changes.

References

AlTaweel, I.R., and Al-Hawary, S.I. (2021) ‘The mediating role of innovation capability on the relationship between strategic agility and organizational performance’, Sustainability, 13(14), pp.7564. Web.

Bandara, W., Merideth, J.C., Techatassanasoontorn, A.A., Mathiesen, P. and O’Neill, D. (2021) ‘Successful BPM governance: insights from Commonwealth Bank of Australia’, Business Process Management Cases Vol. 2, pp.195–206. Web.

Castillo-Camarena, N. and López-Ortega, E. (2021) ‘Technological foresight as support for the planning of research and development centers: the case of EI-UNAM’, Foresight, 23(4), pp.457–476. Web.

CBA. (n.d.). Half-year 2022 financial results – CommBank. Web.

Common Wealth Bank of Australia (2022). Profit Announcement. CBA. Web.

Finbox. (n.d.). Return on Assets for Commonwealth Bank of Australia. Web.

Giambona, E., Lopez-de-Silanes, F. and Matta, R. (2022) ‘Stiffing the creditor: Asset verifiability and bankruptcy’, Journal of Financial Intermediation, p.100962. Web.

Hasan, R., Chowdhury, S.A. and Akter, J. (2021) ‘Construction project monitoring: The cost and schedule control by earned value method (EVM)’, Journal of Technology Management and Business, 8(1), pp.1–9. Web.

Iddawela, Y., Lee, N. and Rodríguez-Pose, A. (2021), ‘Quality of sub-national government and regional development in Africa’, The Journal of Development Studies, pp.1–21. Web.

Jiang, Y., Ritchie, B.W. and Verreynne, M.-L. (2021) ‘Developing disaster resilience: A processual and reflective approach’, Tourism Management, 87, p.104374. Web.

KPMG (2019) ‘What’s it worth? Determining value in the continuing low-interest-rate environment: KPMG Valuation Practices Survey 2019’, KPMG. Web.

Kraus, S., McDowell, W., Ribeiro-Soriano, D.E. and Rodríguez-García, M. (2021) ‘The role of innovation and knowledge for entrepreneurship and regional development’, Entrepreneurship & Regional Development, 33(3-4), pp.175–184. Web.

Li, L. and McMurray, A. (2022) ‘What is corporate fraud?’, Corporate Fraud Across the Globe, pp.3–22. Web.

Malabagi, S., Kulkarni, V.N., Gaitonde, V.N., Satish, G.J. and Kotturshettar, B.B. (2021) ‘Product lifecycle management (PLM): A decision-making tool for project management’, Seventh International Symposium on Negative Ions, Beams and Sources (NIBS 2020). Web.

Nikbin, D., Aramo, T., Iranmanesh, M. and Ghobakhloo, M. (2022) ‘Impact of brands’ Facebook page characteristics and followers’ comments on trust building and purchase intention: Alternative attractiveness as a moderator’, Journal of Consumer Behaviour. Web.

Priyadi, U., Utami, K.D.S., Muhammad, R. and Nugraheni, P. (2021) ‘Determinants of the credit risk of Indonesian Sharīʿah rural banks’, ISRA International Journal of Islamic Finance, 13(3), pp.284–301. Web.

Roberts, Deborah.L., Palmer, R., and Hughes, M. (2021) ‘Innovating the product innovation process to enable co‐creation’, R&D Management. Web.

Smithikrai, C. (2022) ‘Antecedents and consequences of proactive work behavior among Thai employees’, The Journal of Behavioral Science, 17(1), pp.43–57. Web.

Sue, Wright, et al. (2014) ‘Business Analysis and Valuation: Using Financial Statements’, Text and Cases Asia Pacific Edition, Cengage Learning Australia, pp. 236-250.

Wang-Ly, N. and Newell, B.R. (2022) ‘Allowing early access to retirement savings: Lessons from Australia’, Economic Analysis and Policy, 75, pp.716–733. Web.

Zhao, J., Xue, F., Khan, S. and Khatib, S.F.A. (2021) ‘Consumer behavior analysis for business development’, Aggression and Violent Behavior, p.101591. Web.