Bank of America has developed products and services that meet needs of customers across various stages of life. In fact, it has created a business model of ‘One Stop Shop’ with various banking units, including transactional banking, investment banking, and wealth and asset management banking (Kendall 12). All these banking units have unique products designed to meet diverse needs of consumers. Bank of America utilizes its product development expertise to create competitive edge in a highly competitive banking industry. As such, it is among the most powerful financial institutions in the world (Hanson 1).

It was observed that after the period of consolidation, the banking industry embarked on enhanced product and service development. In this case, the R&D department initiated several formal processes to develop new service solutions for the retail segment (Thomke 1). The Bank created a form of laboratory branches to determine customer needs, measure results, get real time feedback, and develop innovative solutions.

Large Resource Base

Currently, Bank of America has a capital base of $2.14 trillion alongside a workforce of 200,000 people. In the recent past, the Bank acquired Merry Lynch and Countrywide Finance. These acquisitions have increased the Bank’s asset base. The Bank will exploit these massive resources for its growth. In addition, Bank of America boasts of 5,000 million branches, 16,000 ATMs and millions of customers using its Internet and online banking platforms.

Weaknesses

Mortgage Troubles

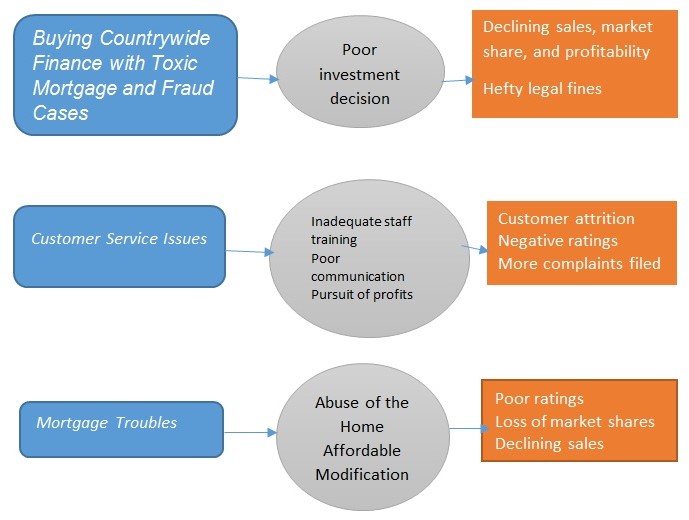

One current major weakness negatively impacting the Bank’s earning is the mortgage trouble. It has been observed that the Bank is losing market share to its major rivals. Mortgage refinancing has been particularly poor (Raymond 1). Besides, the Bank was found liable for mortgage fraud and shoddy business practices. Mortgage business has declined as other players continue to gain market share. Interestingly, even non-banking institutions such as Quicken Loans and Leader Bank have started to claim a share of the market held by Bank of America.

The root cause of the Bank’s mortgage troubles emanated from poor customer service. For instance, Bank of America ranks poorly among its mortgage customers and noncustomers surveyed on satisfaction. It is considered the worst performing bank in terms of customer satisfaction. It is also claimed that Bank of America has the “worst reputation” among individuals surveyed, including noncustomers (Maxfield 1). The Bank’s mortgage troubles originated from several claims related to mismanagement of the Home Affordable Modification Program of 2009.

It would not be simple for Bank of America to overcome its mortgage troubles. Nevertheless, here are some solutions Bank of America should explore to control the mortgage troubles. First, the Bank should consider lowering the principal or changing repayment on some mortgages. Such arrangements should target customers worst affected by the crisis. Second, the Bank should consider low and moderate lending for low-income homeowners, individuals who lost their homes in foreclosures and first time home customers. The Bank should consider extending credit to these customers if they have favorable credit scores. Third, the Bank should consider funding the construction of low-cost rental housing for low-income households. It should also consider rehabilitation and remodeling of existing homes to cater for critical households in need of housing. Finally, the Bank should work on new products to avoid possible foreclosures. In fact, it should work with locals to support home initiatives.

Customer Service Issues

Bank of America customer service is simply described as horrid (Jaffe 1). The root cause of this weakness is noted in insufficient training among customer service employees. At the same time, the Bank is focused on shareholders’ returns at the expense of its customers. This leads to selling of wrong products to customers. Poor communication between executives and employees is also responsible for customer service issues.

The Bank can overcome this challenge through effective employee training, improved communication and a less focus on shareholders’ returns at the expense of the customer. It noted that the Bank’s inability to solve even minor customers’ issues have led to its poor rating. Once these efforts are initiated, Bank of America can experience change in terms of customer perception.

Buying Countrywide Finance with Toxic Mortgage and Fraud Cases

Bank of America did not make the best business decision when it purchased Countrywide Finance. Although Bank of America intended to use Countrywide Finance to attract a large share of the mortgage market, recent events, including customer attrition, liability for mortgage fraud, lawsuits, and fines have proved extremely expensive. Consequently, the Bank continues to pay hefty fines and issue profit warnings because of legal costs.

The main root cause of this problem is poor investment decision on an institution before effective evaluation was done.

It is currently difficult for the Bank to fix the problem. Nevertheless, it can seek for an out-of-court settlement with the Justice Department with the aim of curtailing massive fines.

Works Cited

Hanson, David. “Bank of America’s Simple and Ingenious Business Model.” The Motley Fool. 2013. Web.

Jaffe, Sarah. “Bank of America’s horrid “customer service” scandal.” Salon. 2014. Web.

Kendall, Gerald I. Viable Vision: Transforming Total Sales into Net Profits. Plantation, FL: J. Ross Publishing, 2004. Print.

Maxfield, John. Here’s Why People Hate Bank of America. 2013. Web.

Raymond, Nate. Bank of America loses fraud trial over shoddy mortgages. 2013. Web.

Thomke, Stefan. “R&D Comes to Services: Bank of America’s Pathbreaking Experiments.” Harvard Business Review. 2003. Web.