Business can be typically grouped based on the entity type. Some examples of business entities include a sole proprietorship owned and operated by an individual; partnerships, owned and run by group of partners and corporations owned by share holders and run by directors.

However, for the purpose of this report the discussion will focus mainly on limited liability corporations as this appears the most suitable for BGP technologies. A corporation is set up by selecting a company name, paying required fees, preparing articles of incorporation, holding an organizational meeting and adoption of the various bylaws (Gitman & McDaniel, 2008).

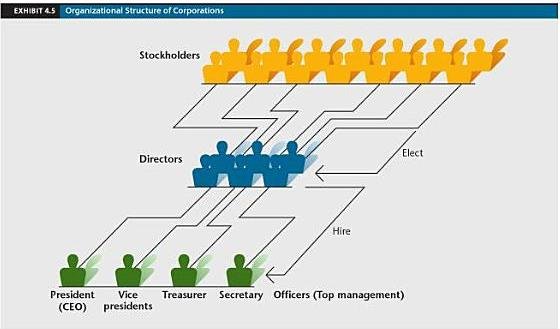

Given that a partnership or a sole proprietorship is owned by small groups it becomes a major hurdle when BGP Technology intends to expand and access financial resources. For this reason business operations that require huge sums of money to run are better suited to be formed as a corporation. The BGP Technology Corporation is owned by the shareholders who own varying degrees of the company stock. This position gives the shareholders rights such as the right to elect the directors (See fig. I).

The directors then hire other office bearers such as the CEO and other company executives (Gitman & McDaniel, 2008). The corporation provides greater flexibility in terms of access to funds and is therefore more suited for operations that require large capital investment.

Another reason why specific business operations are better suited to certain business entities is the question of flexibility in operations. Take the case of a large BGP Technology but consider that it is run by two individuals. In the course of business one partner feels the need to withdraw their investment from the venture. This will put a lot of pressure on the other partner to raise the amount or locate an alternative partner with that amount to invest (Gitman & McDaniel, 2008). However, if the company were registered as a corporation this process of transferring ownership rights would be as easy as putting up one partners shares for sale in the market.

The last reason highlighting why certain entity types are suited for specific business operations can be traced to finance and taxation. When running a large company with huge turnover and resources such as BGP Technology all available means to save are crucial. Take for example a taxation regime that charges 7.5% and one charging 10%. For revenues in the range of 100 million that amounts to 7.5 and 10 million respectively. Given that corporations are allowed tax deductions it is common for business to be registered as a corporation to enjoy this benefit (Gitman & McDaniel, 2008).

In addition to this, corporations offer a major incentive in the ease they give the company when it comes to accessing funds. At any given time BGP Technology can decide to reduce share value and increase number of shareholders. This alone ensures corporations resources that can see them expand to heights that are unreachable in sole proprietorships and partnerships (Gitman & McDaniel, 2008).

The various business entity types also pose a variety of problems for the owners whether they are partners or shareholders. According to the law in most states shareholders by virtue of an ownership interest are entitled to certain rights. The main rights include the right to vote and the right to inspect the corporation records.

Though the share holders have these rights it should be noted that in cases when they want to inspect the records and the corporation by laws does not allow this it is impossible to allow the action (Walston-Dunham, 2008). To avoid the possibility of litigation in BGP Technology between the directors and the share holders it is therefore crucial that the by laws are prepared in a transparent and clear manner that ensures all the members rights are satisfied.

In relation to the above point, another area that is likely to cause litigation is the issue of member rights violation. This is because in a manager operated LLC the managers are elected after a specified term. The members have the right to elect the managers in an election as specified in the operating agreement or by laws. Therefore based on this it is assumed a member getting 50% voting rights will have contributed an equal amount in capital (Mancuso, 2009).

In light of a dispute, other members may begin litigation with the party with greater rights if the position regarding ownership and voting rights is not clarified. In a similar fashion the elected managers also have rights that are proportional to the guidelines stated in the operating agreement (Mancuso, 2009). Thus suggesting that the BGP Technology should make efforts to clarify such issues that may result in litigation problems.

With regard to partnerships it is possible for partners to disagree and end up in court in attempts to resolve disputes. In order to avoid such instances one can ensure that prior to engaging in business in partnership the members clearly outline the roles to be played and any compensation that is to be received.

This arises in instances where one partner may be overly engaged in the business activities and yet entitled to an equal share in the profits (Walston-Dunham, 2008). To resolve such disputes it is possible for partners to end up in court. However, a more reasonable approach will involve the partners agreeing on any compensation for their participation and the amount of profit each partner is entitled to prior to doing business.

In addition to this, other litigation may arise from losses incurred leading to the loss of assets or investment. In such a case it is probably better for the partners to register the partnership as a limited liability partnership. In such an arrangement each partner is only entitled to losses that are equal to their contribution into the partnership (Walston-Dunham, 2008). In this instance it is therefore impossible for a partner to make losses greater than their investment. These suggestions are just some of the many means to avoid risk in limited liability companies and partnerships.

References

Gitman, L. J., & McDaniel, C. (2008). The Future of Business: The Essentials. Mason, OH: South Western Cengage Learning.

Mancuso, A. (2009). Nolo’s Quick LLC: All you need to know About Limited Liability Companies. Berkeley, CA: Delta Printing Solutions.

Walston-Dunham, B. (2008). Introduction to Law. New York: Delmar Cengage Learning.