Introduction

This paper presents an analysis of the design of controls for a company’s sales process. The paper also shows the relationships between the company’s internal controls and substantive procedures.

Memo

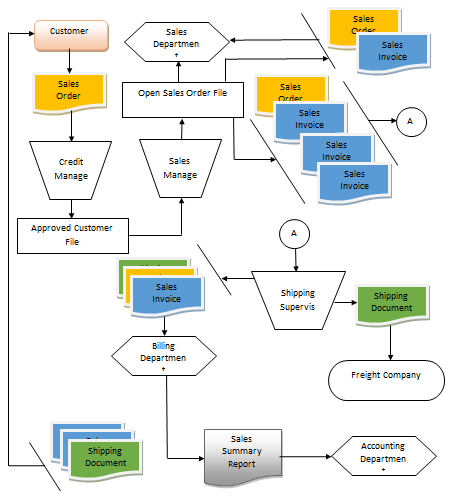

The staff auditor at Ross Arthur, LLP conducted an audit procedure of testing controls for the sales process of Parts and Supplies, Inc. (PSI) in order to prevent the occurrence of material misstatements. During the engagement, the inherent risk associated with the entity’s sales cycle was assessed. The auditor inspected the interrelated set of business transactions in which the company examines its customers for creditworthiness, provides them with products, issues invoices, and receives revenue. A flowchart documenting the structure of the control environment of the organization and how it maps on the physical areas of the company’s activities during its sales process was prepared by the auditor. The flowchart depicts the company’s internal controls relevant to the auditor’s opinion. The general ledger function and processes such as cash receipts transactions were not documented during the audit engagement.

The review of internal controls was made on the assumption that they “generally operate as described and that they function effectively throughout the period of intended reliance” (AICPA 71). Therefore, the following objectives of internal controls were considered during the preliminary assessment: transactions are conducted in accordance with the specific authorization, and all transactions are recorded within a framework of recognized accounting practices and in the correct amount (Hermanson et al. 33; Knechel and Salterio 24). Given that the preliminary evaluation focused on sales transactions, the controls associated with trade accounts receivable, sales, bad-debt expense, and allowance for uncollectible accounts were assessed.

The controls associated with the following types of documents were evaluated: customer sales order, credit approval form, new open-order report, shipping document, sales invoice, sales journal, and customer statement. In order to ensure that the unauthorized disposition of PSI’s goods did not occur and that all transactions were conducted in accordance with the company’s management authorization, the major functions of the sales cycle were assessed. These functions include order entry, credit authorization, shipping, and billing. In order to make a proper assessment of the control risks for the sales cycle, the following audit procedures were performed: inquiry of the company’s personnel and inspection of documents and records.

For the purpose of documenting the client’s elements of internal control, the auditor developed a flowchart representing the sequence of activities in PSI’s sales process. The graphical representation of the sales cycle assisted the auditor in analyzing the strengths and weaknesses of the company’s control activities. The following assertions about classes of transactions were evaluated: occurrence, completeness, authorization, accuracy, classification, and cutoff (AICPA 76). The auditor’s main focus was on two types of material misstatements: “sales to fictitious customers and recording of revenue when goods have not been shipped, or services have not been performed” (Messier et al. 354).

The engagement showed that the company’s controls aimed at the prevention of fictitious sales occurrence were efficient. Segregation of duties between different functions helped to prevent unauthorized shipments. Furthermore, all revenue transactions were properly recorded. However, control activities associated with the completeness of revenue transactions were inefficient because an open-order file was not reviewed and reconciled with the daily sales report.

The auditor did not spot a weakness in the authorization of revenue transactions. Controls for the accuracy of revenue transactions were deficient because PSI did not have terms of trade, which increased the risk of inaccuracies. There were no weaknesses in the cutoff of sales transactions. The company did not use proper codes for their transactions, which is a major weakness in the classification of revenue transactions.

The auditor came to the conclusion that despite some deficiencies in control activities, the company’s internal controls over its revenue cycle were effective and provided reasonable assurance that their objectives were achieved.

Analysis of Internal Controls over Sales Transactions

The occurrence of Sales Transactions

Strengths

Segregation of duties helps to ensure that the occurrence assertions are met. Furthermore, “sales recorded only with an approved customer order and shipping document” (Messier et al. 356).

Weaknesses

N/A

Conclusion

The auditor assessed the segregation of duties and other controls and came to the conclusion that they are effective in ensuring that the company’s revenue transactions are valid, and it does not incur bad debts.

Completeness of Sales Transactions

Strengths

Numerical orders of the company’s sales invoices and sales orders prevent the occurrence of major misstatements. The company’s billing department matches shipping documents with sales invoices and accounts for their numerical sequences (Case Study).

Weaknesses

There is no revision and reconciliation of the open-order file with orders that are “older than some predetermined date” (Messier et al. 357).

Conclusion

The sales department has to regularly review the open-order file and investigate why the transactions have not occurred.

Authorization of Sales Transactions

Strengths

Credit checking helps to ensure that the company’s credit policies are applied to each potential customer. Credit decisions fall within the purview of PSI’s credit manager, who ensures that a transaction does not occur until the credit is approved. Sales managers report all price reductions at regular sales meetings.

Weaknesses

N/A

Conclusion

Even though sales managers have access to an authorized price list and could introduce changes in it, they are obliged to regularly report all special price reductions, which is a strength of the process. Other authorization procedures also help to ensure that sales occur only at authorized prices and that customers do not have bad credit risks.

Accuracy of Sales Transactions

Strengths

The company has the authorized price list that helps to ensure that the accuracy of revenue transactions assertion is met. Personnel initials on shipping documents help to verify the accuracy of sales transactions. Also, sales invoices are tied with shipping documents and reconciled with daily reports.

Weaknesses

The weakness of an otherwise properly designed sales cycle is the lack of specified terms of trade. There should be controls for the elimination of discrepancies between prices of goods stated in sales invoices and those specified in PSI’s authorized price list.

Conclusion

The company should improve its control of the accuracy of revenue transactions.

Cutoff of Sales Transactions

Strengths

The company’s billing function receives sales invoices daily. A sales transaction is complete only after shipping documents are checked and recorded by a billing clerk.

Weaknesses

N/A

Conclusion

All sales are billed and recorded in a proper and timely manner.

Classification of Sales Transactions

Strengths

N/A

Weaknesses

PSI does not use proper codes for classifying its revenue transactions.

Conclusion

It can be argued that “the use of a chart of accounts and proper codes” (Messier et al. 358) will help to meet this assertion.

Flowchart

Figure 1 demonstrates the company’s sales process.

Conclusion

The paper presented the flowchart of PSI’s sales process, which helped to evaluate the strengths and weaknesses of its internal controls.

Works Cited

AICPA. Audit Guide: Government Auditing Standards and Single Audits. John Wiley & Sons, 2017.

Case Study

Hermanson, Dana, Jason Smith, and Nathaniel Stephens. “How Effective are Organizations’ Internal Controls? Insights into Specific Internal Control Elements.” American Accounting Association, vol. 6, no. 1, 2012, pp. 31-50.

Knechel, Robert and Steven Salterio. Auditing: Assurance and Risk. Routledge, 2016.

Messier, William, Steven Glover, and Douglas Prawitt. Auditing & Assurance Services: A Systematic Approach. 9th ed. McGraw-Hill, 2013.