Introduction

National competitiveness is an important economic indicator which determines the ability to compete in international markets while maintaining or improving living standards over time. From a national viewpoint, the objective of international trade is to increase total national wealth and national living standards. A country is competitive if it trades in a reasonably free and open market environment, produces goods and services and trade, and, by implication, balances its accounts while simultaneously maintaining and expanding the real income of its citizens. The notion of competitiveness and the ability of a nation to compete on the global scale was analyzed and discussed by many economists. Classical economy and modern economic tradition try to determine the main factors and influences important for a nation-state to achieve a leading role in the global economy. Critics admit that to compete in the new world economy nations must adopt new production practices and trade policies.

Smith and Ricardo developed the main of national competitiveness explaining the main factors which helped a state to compete with other nations. Modern economists extend their assumptions and add the role of natural resources, foreign direct investments and national advantages. Michael Porter goes beyond traditional economic approach underlining the role of factor conditions, demand conditions, relating and supporting industries, strategy, structure, and rivalry between firms. Thus, these theories have some weaknesses and limitations in their frameworks. The aim of the paper is to analyze the beginning and development of national competitiveness theory, and discuss the main similarities and weaknesses of the theories. The paper consists of an introduction, four chapters and conclusion

Classical Economy

According to classical tradition, economy was understood as the management of the material affairs of the nation (polis). The “science” of classical economy consisted of the laws and principles that should guide statesmen in their capacity as administrators and legislators. A contribution by classical economists has been their search for an understanding of the varying linkages over time between nations and the ‘outside’ world. How and to what extent do intra-state and also inter-firm relationships provide efficiencies in the allocation of resources over borders and add to overall economic growth? Sometimes nations have not only responded to conditions within the world economy, but have had profound impact on the course of those circumstances.

Adam Smiths’ Theory

Classical economy theory began with publication of work of Adam Smith “The Wealth of Nations” in 1776, where he wrote that “invisible hand” leads all individuals in their motivation of self-interest to produce the greatest benefit for society and community. In contrast to previous knowledge, Smith narrowed the object of political economy, as implied by its etymology, from the general “material affairs of the nation” to the much more restrictive “nation’s wealth,” a restriction of meaning that was often alluded to by critics of Smith and his followers.

According to Smith, a society made up of self-interested men measures its well-being primarily in quantitative terms. Social prosperity from one year to the next, from one generation to the next, is dependent on the increase in the marketable value of economic goods men labor to produce and to trade. Second, society as a whole is a self-regulating mechanism. If one believes that in a free market competitive trade among individuals serves to prevent selfish passions from becoming destructive, it follows that man’s common social destination will take care of itself. Thus, the health of a capitalist society is not the result of a comprehensive rational design. It is found in the extent of that society’s ability to facilitate its members’ desires to satisfy their own separate material needs. Finally, politics has no positive moral value or purpose in a capitalist society.

Statesmen and legislators understand that their subjects do not pursue trade and profit for the conscious purpose of increasing the wealth and prestige of the state. Since the public good is founded on economic prosperity and growth, and not the proper activity of citizens, men with political power see that their primary responsibilities are legislative and administrative improvements that facilitate further increases in trade and profit. Smith states that production of income and strongly rejected governmental interference and restriction of any kind. In his view the ideal economy is a self-regulating market system that automatically satisfies the economic needs of the populace.

In terms of classical economy, Smith emphasized that commerce satisfied social passions as well as social needs. Profits that lead to luxury or comfort represent hollow satisfactions unless accompanied by social recognition. Money-making may not be virtuous activity strictly speaking, but it surely involves some “communicating of pleasures to others”. More important, it also explained the cosmopolitan nature of commercial civilization.

Free pursuit of profit required commercial men to cross all political and cultural boundaries. With the advance of commerce, local interconnectedness brought about by economic activity extended to the whole world. Commerce may have been divorced from virtue, but it was wedded to peace. Adam Smith thought that the case for economic freedom turned on an accurate appraisal of the relationship between men and their governments. The “Wealth of Nations” also was held together by a series of theoretical couplets including productive/unproductive labor, production/consumption, town/country, commerce/agriculture, East/West, ancient/ modern–designed to provide a multiplicity of perspectives, not all of them positive, on man’s pursuit of wealth. As a working analytical principle in Smith’s work, it meant that capitalists seek to employ their capitals in those lines of production that yield the greatest profits, that workers seek to sell their labor in the market in which it will fetch the highest wage, and that consumers seek to buy the objects of their desires in the cheapest markets.

It was also seen as “the master spring” of human industry and exertion. The principle of self-interest would probably not have been regarded as so fundamental had it not been so closely associated with the principle of liberty. That principle asserted that people, if left to pursue their own interests in their own ways, would, without intending it, promote the interest of the nation as a whole. In Smith’s words:

The most effectual plan for advancing a people to greatness is to maintain that order of things which nature pointed out; by allowing every man, as long as he observes the rules of justice, to pursue his own interest in his own way, and to bring both his industry and his capital into the freest competition with those of his fellow citizens.

Underlying this principle was the concept of the market as essentially self-regulating. The outcome of its self-regulation would be, it was believed, in modern parlance, the optimal allocation of the nation’s capital and an equitable distribution of income. The principle of liberty was the basis of the economists’ advocacy of free trade and laissez-faire, and was the fundamental tenet of the ideology of “liberalism.” Another of the most conspicuous of the economists’ principles was the quantity theory of money–that the exchangeable value of the currency is roughly proportional to the quantity of currency in circulation. Upon this principle were built most of the political economists’ analyses of the monetary system and, in particular, their diagnosis of the effects of the suspension of the gold standard that took place in 1797 and continued until 1821.

David Ricardo’s Theory

Another important theorist and economist who followed ideas by Adam Smith was David Ricardo. His work, “Principles of Political Economy and Taxation” (1817) is a running commentary on Smith’s views of the subject. Ricardo “Principles” was seen by many at the time to stand on its own merits as a classic of political economy, and Ricardo was seen by some as a “second founder of the science.” In spite of Ricardo’s influence and notoriety, Smith remained the preeminent master of the science, and those unpersuaded by Ricardo’s revisions continued to praise in as high terms as ever the authority and insight of Smith.

Ricardo’s contribution to the proceedings that did the most to raise his name to public attention and associate political economy with the bill that ultimately put a plan to resume into effect, came in the second half of the investigations by the committees. In his book, Ricardo developed a theory of comparative advantage and stated that a nation has a comparative advantage if it produces goods and services more efficiently than another nation. This theory became a basis for modern Heckscher-Ohlin model. It is significant that Ricardo’s challenge to Smith’s authority had a considerable impact, for it was Ricardo and his followers, through their efforts as political reformers, who did the most to bring political economy to the attention of the public and most actively to bring it to bear on issues of political relevance. Ricardo states: “The value of a commodity, or the quantity of any other commodity for which it will exchange, depends on the relative quantity of labor which is necessary for its production, and not on the greater or less compensation which is paid for that labor”. Ricardo emphasized especially the dampening effects upon capital accumulation that the restriction of imports would entail. Ricardo stated that countries could benefit from relative costs of production participating in international trade; it could lead states in production specialization acquiring as consequence comparative advantage.

Free Trade and Competitiveness in Classical Economy

One was that freedom of trade gives the most efficacious encouragement to the exercise of human effort and industry, which for Smith was the immediate source of the nation’s wealth. This followed directly, although perhaps somewhat naively, from Smith’s fundamental principle that there is in every man an inextinguishable “desire to better his condition.” Thus to inhibit the exercise of human industry by inhibiting the opportunities of individuals to employ their capital and labor as they see fit would be to cap the nation’s wealth at its source. Another argument was that commercial freedom would encourage improvements in the productive power of labor by giving the freest scope possible to the development of the division of labor.

The division of labor, the greatest single source of improvements in the productive power of labor according to Smith, was limited mainly by the extent of the market. It could not help but be facilitated by freeing the development of competitive markets or be inhibited by restricting the range allowed to market activity. The third argument was that it would naturally and necessarily lead to the employment of the nation’s capital and labor in those lines of production most beneficial to the nation as a whole. In “Wealth of Nations”, Smith wrote:

Every individual is continually exerting himself to find out the most advantageous employment for whatever capital he can command. It is his own advantage, indeed, and not that of society, which he has in view. The study of his own advantage naturally, or rather necessarily, leads him to prefer that employment which is most advantageous to society.

This is the fabled “invisible hand” argument. Implicitly it contains the notion of a market economy as essentially self-regulating, whose inner logic and laws of motion, so to speak, derive from man’s natural propensities and the nature of the production process. In short, the argument is that as a result of free competition, production comes naturally to be suited to the desires of the people at a minimum cost to the nation.

Under such a regime the prices of commodities, including labor, and the quantities of commodities brought to market are continually seeking their natural level as determined by competition. If the production of a good is less than this natural level, its market price will exceed its “natural” price. Profits to be derived from its production will exceed the natural rate of profit, and as a consequence capitalists seeking to better their condition will move their capital out of less profitable lines of production and into the production of the good yielding higher than normal profits. This will have the effect of increasing the supply of the commodity and reducing its price to its natural level, the one that will afford to capitalists the normal rate of profit. Moreover, in continually seeking to undersell their competitors and thereby garner a larger share of the market, capitalists will seek to employ those methods of production that entail the lowest costs. Hence an economy in which there is free trade will be continually and automatically adjusting production to match the desires of the community at the lowest cost.

Notably, the period 1815-1825 saw the introduction of two new and innovative arguments in favor of a free international trade. Ricardo was the man most responsible for their propagation if not their formulation, although he had a sizable hand in the latter as well. One was an argument for free trade in general. It has come down to us under the name of the “theory of comparative advantage,” which proposes that it is in the interest of a nation to import goods in exchange for exports that would cost the nation less than what the imported goods would cost if produced domestically.

Thus it would be in the nation’s interest if it could trade exports valued at, say, £100 for imports that, if produced domestically, would be valued at over £100. By such trade the nation could transfer the capital freed by the import of the previously domestically produced good to the further production of the exported good and end up as a result with more of both goods available for domestic consumption. Indeed, all of this would happen automatically, without the need for any governmental intervention. Ricardo showed that such trade was advantageous even if one country could produce both goods at a lower cost than the other.

What was necessary for trade to benefit both countries was that there be a comparative difference in the production costs of the traded commodities. The other innovation in the set of arguments in favor of a free international trade developed by Ricardo was the argument based on the celebrated theory of diminishing returns in agriculture. It was Ricardo, however, who in the same year made the most stunning use of it. The theory held that in well-settled countries additional applications of capital and labor to agriculture, either in improving lands already in cultivation or in extending production to previously untilled lands, would result in successively smaller additions to output.

On the basis of this “law,” Ricardo and others reasoned that an increasing population requiring increasing quantities of food for its support could be supplied only at increasingly higher costs. The effect would be to increase not only the costs of food but also the rent obtained from the better land already under cultivation. Hence profits would be squeezed, dampening accumulation in the nonagricultural sectors of the economy.

Although then the rise in the price of most of our own commodities, would for a time check exportation generally, and might permanently prevent the exportation of a few commodities, it could not materially interfere with foreign trade, and would not place us under any comparative disadvantage as far as regarded competition in foreign markets.

The effects of protecting domestic agriculture and keeping out low-cost foods that could be imported from the European continent would be to encourage the extension of agriculture to poor soils, raise the costs of food, engorge the incomes of the landed classes, and restrict the expansion of manufacturing.

A Contemporary Economic Theory

Contemporary economic theory takes its roots in classical tradition including Smith’s and Ricardo’s concepts. Contemporary economic theory defines a competitive nation as a nation with a growing economy that is creating jobs and lifting incomes without inflation, and that is getting the most from its natural and human resources. In short, a competitive nation is one that has what economists would call a healthy, vibrant economy. Most trade between developed countries is intra-industry trade, which means that at a high level of aggregation of products (e.g. electronics or automobiles), developed countries have similar macro-level location advantages. The key explanation of this phenomenon is product differentiation, combined with the presence of scale economies and therefore imperfect competition.

Competitiveness

That means that competitiveness is an issue of the standard of living: the state (nation) needs to balance its accounts while maintaining or expanding the standard of living of citizens. At bottom national competitiveness defined this way is a living-standard issue that boils down to a productivity issue, because improving a nation’s international competitiveness depends fundamentally on productivity growth rates. That does not mean just increasing productivity; in an integrated world economy, rates of productivity increase must compare favorably with those of major foreign competitors.

In order to achieve the strongest international competitive advantage, there must be cooperation between the public and business sectors. In other words, a nation will maximize its competitive advantage when both government and firms pool their competitive advantages together. Competitive advantage along with locationspecific advantages should be integrated in the design of a firm’s overall international strategy.

In modern economci theory, competitiveness, as seen by an individual firm is its view of its current and projected ability to sell and to profit in international markets or, at a minimum, to compete successfully with foreign firms in the market. Competitiveness would look very much the same from the standpoint of individual industries. In political economy, competitiveness is associated with “unit labor costs, from which it follows that many will move production abroad if they can find cheaper labor there. These propositions generate a particular model of the political dynamic inspired by globalization”.

That is an important point in the sense that the competitiveness of individual firms and industries can perhaps be enhanced by dollar depreciation, by wage cuts, by overseas sourcing of production, and even by U.S. import restrictions. If most of the firms in an industry are competitive in the sense of being able to make a profit and if they are not losing out to foreign competitors in foreign markets or their own market, they would consider themselves internationally competitive.

Absolute Advantage and Comparative Advantage

Absolute advantage refers to the ability of nations to produce more efficiently than other. It is presumed that nation has absolute advantage in relation to another when less inputs are required to produce same quantity of outputs. “Most of this literature, looks for the ingredients of absolute advantage, i.e. it identifies factors more of which will improve the performance of any economy”.

The other results tend to reinforce conventional views concerning the sources of comperetive advantage for the United States. Imports are significantly higher in industries which are either labor-intensive or rapidly expanding. Imports are lower for products which are protected by tariffs or produced by high-wage industries abroad. Exports are strongest in U.S. industries characterized by workers with high education levels and by high expenditures on research and development. There is also some evidence that imports are higher in energy-intensive sectors and that net imports are higher in sectors which are dependent on nonrenewable resources (excluding petroleum).

These results confirm that many industry characteristics, with the notable exception of unions, are important in determining U.S. trade flows. Also, it is possible to speak about comparative institutional advantge. “The basic idea is that the institutional structure of a particular political economy provides firms with advantages for engaging in specific types of activities there. Firms can perform some types of activities, which allow them to produce some kinds of goods, more efficiently than others because of the institutional support they receive for those activities in the political economy, and the institutions relevant to these activities are not distributed evenly across nations”.

Comparative advantage should affect the volume of activity in an industry for a given country; it is by no means manifest what the effects of the workings of comparative advantage on the size of the largest firms should be, unless the industry volume is below the optimum. It can also be argued that comparative advantage in the context of intra-industry trade and investment is hard to capture at this level of aggregation. Despite these caveats, these findings point to the importance of competition through technological and product differentiation in advanced industrial markets rather than through comparative advantage resulting in specialization.

Location Advantage

The standard Ricardian model concludes that comparative rather than absolute advantage of nations leads to trade and gains from trade. Even if the country possesses a superior technology that would make it the more efficient producer of any good, it will, subject to a number of conditions, specialize in only that product for which it is comparatively most efficient in terms of labour productivity. This also implies that the other country, with an inferior technology, will still have an implicit location advantage in producing the second product. The Heckscher-Ohlin model builds upon the availability of identical technologies in the two countries, but also the presence of two production factors (labour and capital) and concludes, again subject to several critical assumptions, that each country will specialize in the product that, in relative terms, requires the most intensive use of its most abundant production factor.

More specifically, the labour abundant and capital abundant country will export the labour intensive and capital intensive product respectively. Follow-up work, building upon the Heckscher-Ohlin thinking has led to a relaxation of most assumptions of the original model, allowing analyses to be performed that recognize the presence of many goods and many production factors. The two key conclusions usually continue to hold, however; first, an abundance of a particular production factor in one country gives this country a location advantage for the manufacturing of products that make an intensive use of the abundant production factor.

Second, an increase of a specific production factor will not lead to a homogeneous expansion of the country’s output. It will shift production and trade toward products that make the most intensive use of the expanding factor, hence strengthening the country’s apparent location advantage for that product. The explanation of trade based upon the comparative, macro-level advantage of countries in terms of the availability of technology or production factor abundance has undoubtedly proven useful to explain trade patterns between countries at very different levels of economic development.

Although the identification of location advantages clearly becomes much more complex when international production is involved, the predicted direction of the trade flows associated with natural, resource seeking FDI is largely consistent with conventional trade theory. The home country will export capital intensive products with a high knowledge content. The host country will primarily export resource based or labour intensive products with a low technology content. In addition to the four main motives for FDI, additional motives appear equally related to location factors.

First, escape investments, typically made to avoid home country restrictions (e.g. regulation of laboratory tests on animals, limitations on the range of services that can be provided in the financial services industry, etc.) obviously reflect the absence of government restrictions elsewhere. Second, trade supporting investments (e.g. to aid in purchasing of inputs, logistics activities, after sales service, the liaison with host governments, etc.) precisely aim to facilitate home country imports or exports through building on host country location advantages.

Productivity

Productivity refers to quantity of the goods and services produced per unit of input. Role of the productivity is to define living standard, where nations that can produce high level of goods and services can enjoy high living standard. Resources that determine productivity are physical capital, human capital, national resources and technological knowledge. Physical capital represents all nonhuman asset made by humans, tools and equipments, and infrastructure which are used to produce goods and services. Quality and advancement physical capital, or just capita, stipulates quality of products and services, thus nations with higher living standard tend to have sophisticated equipment which allows them to produce at higher volume requesting better price.

Gross Domestic Product

The gross domestic product (GDP) deflator can greatly help to explain the different levels of productivity in a relatively large number of countries. For instacne, popular impressions sometimes outrun the realities of the US situation, and an antidote needs to be injected. U.S. productivity and per capita income level are still the highest in the world based on purchasing power comparisons. In the latest data available, Japan ranks sixth among the twenty-four OECD countries in per capita GDP, approximately three-quarters of the U.S. level. Nevertheless, this could change in little more than a decade should recent trends persist. “GDP generally is defined as the market value of the goods and services produced by a country”.

Each of the leading national capital goods companies makes substantial capital expenditures to restructure plants and reduce manufacturing costs in order to become more competitive. Investment spending influences the technological level of a nation by creating the opportunity for introducing technical changes. Research and development spending is another form of investment in new technology, most of which is charged to current operations by businesses. A third form of spending, not often thought of as embodying some investment, is that involved to establish distribution outlets, service, finance, and other support facilities offering opportunities for change and improvement in the delivery of products and services.

Foreign Direct Investments

Foreign direct indestments (FDI) can be devided into three main catagories: FDI seeking natural resource, market seeking FDI and efficiency seeking FDI. These types of investments have a great impact on national and foreign economy and competitiveness of the nation. Natural resource seeking FDI occurs when firms identify specific host country locations as an attractive source of natural resources at the lowest real cost. However, even in this case, additional location advantages such as good transport infrastructure, an effective institutional and legal framework, etc. have been identified as critical.

In this case, FDI is usually associated with the exports of resource based products from the host country. However, this may in turn improve the location advantages of the home country both for the production and exports of goods which use the imported resources as a low cost or high quality input. As intra-firm trade replaces inter-firm trade, an unfavourable taxation regime in a specific country—whether the home or host nation—can even be overcome as a location

disadvantage by shifting profit, but not the production itself from the nation with the unfavourable regime. FDI should therefore not be viewed solely as an outcome of existing location advantages but it may be instrumental to the creation of new location advantages.

Market seeking FDI is more difficult to reconcile with conventional trade theory because it usually has an immediate import substitution effect (except if trade barriers made imports impossible in the first place), but often also leads to trade creation. This occurs, for example, when the newly established subsidiary uses intermediate outputs from the home country in its own production process, when it becomes a leveraging platform for additional exports in other product areas for the home country and finally, when its production is not used only to serve a host country market but also third country markets. Location advantages of specific countries may shift over time as exemplified by the international product cycle A net exporter of innovative products may switch to market seeking FDI and may later become a net importer of the same, but now standardized, product.

Efficiency seeking FDI leads to even higher complexity as regards the location advantages of the countries involved. First, this type of FDI is usually trade creating at the firm level, because it reflects a rationalization of the MNE’s operations and typically a specialization of the various affiliates in its internal network. This increases both intra-firm knowledge and goods flows, and the international exposure of the affiliates. An in-depth, fine grained analysis, of FSA and location advantage bundles at the affiliate level is then required to understand exactly how location matters to the firm. Here, it is important to understand the specific role given to or earned by affiliates in the company.

They may act as ‘globally rationalized’ subsidiaries performing a particular set of activities in the vertical chain or have a regional or world product mandate. In the case of a vertically integrated chain consisting of several, globally rationalized businesses, intra-firm trade is likely to increase, building upon the location advantages benefiting each subsidiary, thereby leading to an increase of both intermediate goods trade and international production.

Substantial intra-industry FDI can now be observed, reflecting the differential firm specific advantagesof rivals in an industry but also the similar location advantages of countries, as both the source nation and recipient of FDI. Even within a single MNE, complex intra-firm flows of knowledge and goods can often be observed, reflecting sophisticated bundles of location advantages and firm specific advantages, and resulting in complex network linkages among the various affiliates. Dunning (2000) in a survey of the field studies on FDI, already identified thirty location advantages viewed as determinants of especially market seeking FDI including host country market characteristics, trade barriers, cost factors, investment climate components, etc.

The third type of FDI, An interesting observation regarding internationally integrated production is, however, that the key location advantages do not appear to be related to low wages. MNEs export primarily from high labor cost countries with large markets, implying to some extent the presence of local scale economies. Even more importantly MNEs seek location advantages complementary to their own firm specific advantages, typically in the form of an appropriate infrastructure, technology development, and supporting institutions. Assets of foreign firms are secured by new plants and acquisitions or joint ventures, to create synergies with the existing pool of assets through common ownership performed in host countries rather than the home country which constitutes the key location advantage leading to FDI. To the extent that the acquired assets sourced from a host country are also linked to a localized innovation system, the MNE as a whole may get access to at least some spillovers from that innovation system. Conversely, the localized innovation system may benefit from being associated with the foreign MNE.

Innovation and Technology

In recent years there has been a steady expansion in the literature that relates the internationalization of production to the development and transfer of technology by multinational enterprises (MNEs). It is a literature that can be dated back at least to John Dunning’s (1958) seminal study of the impact of US MNEs upon UK technology and productivity, and Ray Vernon’s (1966) development of the product cycle model (PCM) as an explanation of the technological dynamism associated with the growth of US foreign direct investment (FDI) in Europe in the 1950s and 1960s.. However, what is new in subsequent research is the greater focus upon the firm as a unit of analysis, and upon the theory of the firm or a theory of business, in place of the earlier focus upon the level of the country or the product.

A crucial related theme in Dunning’s work was the association of FDI with technology gaps between countries, and how FDI may sometimes act (and sometimes not act) to narrow these gaps and permit ‘catching up’. It was when the local industry in a host European country had inherited a strong technological tradition from the past (such as in the case of the German chemical industry) that inward FDI precipitated an indigenous revival and a closing of the postwar technology gap with the US. Thus, technological change is a localized and context-specific process, and some models of international technology transfer have attempted to accommodate the implications of this insight.

It is not only the possibility of favourable spillovers from MNE affiliates to indigenous firms that depends upon the existent level of local capabilities, but also the feasibility of licensing the technological knowledge of MNEs to local partners as opposed to developing and exploiting technology entirely internally within the MNE. Indeed, locally technologically creative FDI and inter-firm licensing are generally complements rather than substitutes, on how MNE affiliates depend upon localized knowledge sources in their own local knowledge generation. Indeed, the realization that FDI is both easiest to attract and has the most favorable effects the greater is the innovativeness of indigenous companies, has led to an increasing interest in corporate capabilities and in the firm as a level of analysis alongside the country or the product levels.

Linked as well to the current understanding that Innovation and imitation or adaptation are complementary parts of a common process rather than alternatives, attention has shifted from the MNE simply as an agent of technology transfer and towards the MNE as a technology creator across national boundaries.

Natural Resources

Companies that own or access unique resources and capabilities—demonstrating unique core competencies in Hamel and Prahalad’s terms—find that international expansion gives them vast new opportunities to leverage these expensive and valuable skills. A variety of studies have shown that for American and British MNEs, international expansion leads to greater profitability, presumably because they can leverage such resources.

Competencies typically involve large investments in capital and managerial energy, incurring high fixed costs. Firms that can expand their operations widely can earn greater returns to these investments, while potentially improving the competencies through previously unconsidered applications. International markets offer many of the advantages of product proliferation while allowing the firm to remain in its primary line of business. MNEs can also access resources and build capabilities through international expansion. While many firms go abroad seeking new, more accessible markets, others (and even the same firms examined from a different perspective) go abroad to access resources that are in short supply in the home market.

Frms move abroad in search of less expensive labor in overpopulated developing countries, as has been seen historically for American firms locating plants in Mexico or South East Asia. Essentially, access to traditional sources of comparative advantage, cheap land, labor, or resources, is a key objective of many internationalization moves. Many such companies still see themselves as essentially domestic, but they are actually totally reliant on international sources of supply for their domestic markets. When the resources cannot move (or cannot move in sufficient quantity) to the producer, the producer must move to the resources.

Porter’s “Diamond Theory”

Definition

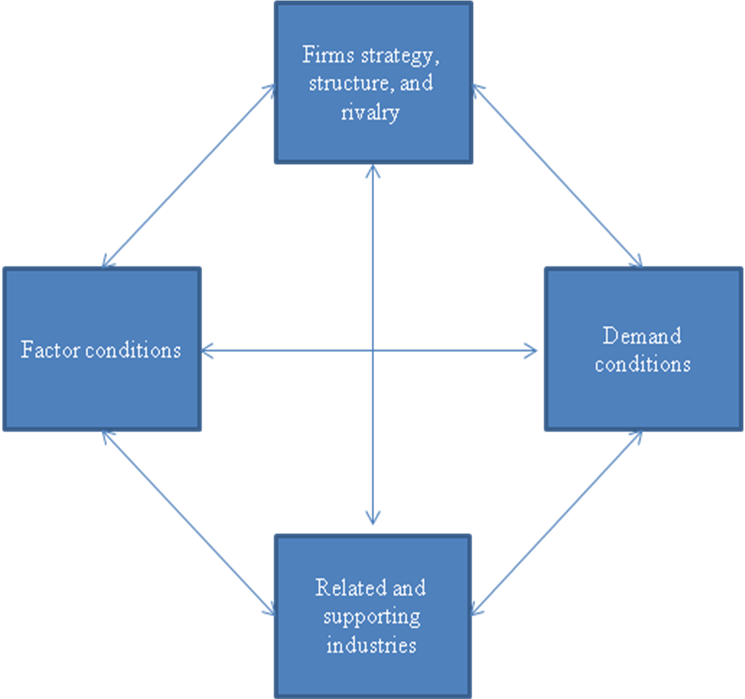

The most influential work on the impact of location on international competitiveness in the 1990s has undoubtedly been Porter’s study on the ‘diamond’ of competitive advantage (Porter 1990). “Diamond Theory” emerged as a consequence of the research done by Porter and his associates in 1990. During four years, they investigate the problem of the competitive advantage in particular industries in 10 states. Porter concluded that nation succeeds in a particular industry if it has a competitive advantage. Porter argues that four interrelated elements at the level of each industry within an individual nation determine international competitiveness. These determinants include factor conditions, demand conditions, related and supporting industries, and firm strategy, structure, and rivalry. Two other elements, namely government and chance are viewed by Porter as secondary determinants that may affect the strength of the primary elements. Porter foundation of competitiveness is based on productivity of national economy and it is underlying source of national prosperity. What defines national environment in which companies are born and learn how to compete are four attributes:

- Factor conditions. The situation in the country regarding production factors, such as skilful labor, infrastructure and all necessary for competition in domestic industry.

- Demand conditions. Describes the state of demand for products and services in a country.

- Relating and supporting industries. The existence or non-existence of internationally competitive supplying industries and supporting industries.

- Firm strategy, structure, and rivalry. The conditions in a country that determine how companies are established, coordinated, administrated and that determine the characteristics of domestic competition.

Porter goes well beyond classical economy on explaining what competitiveness is and what new possible sources of competitive advantages are.

The determinants, individually and as a system, create the context in which a nations born and compete: the availability of resources and skills necessary for competitive advantage in an industry; the information that shapes what opportunities are perceived and the directions in which resources and skills are deployed; the goals of the owners, managers, and the employees that are involved in or carry out competition; and most importantly the pressure on firms to invest and innovate.

If home environment is not dynamic and does not force companies to innovate and invest it cannot be expected that firms’ performance internationally be successful. Four determinants stimulate international firms to enter or stay away from market. Porter’s (1990) approach constitutes an important advance on conventional economics thinking on the sources of competitiveness at the industry level. His comments on the importance of

- created, advanced factor conditions as opposed to natural resource endowments;

- sophisticated rather than large scale demand;

- linkages with related and supporting firms; and

- intense domestic competition, have undoubtedly been useful to both managers and public policy makers.

Main Determinants

For each business, the firm relies on country specific advantages of a single nation as the key source of competitiveness. The firm then creates non-location bound country specific advantages building upon the home base country specific advantages, leading to exports and outward FDI (foreign direct investments). Porter describes the firms that consist of largely independent, country based business units.

They derive their competitive advantages primarily from location-bound firm specific advantages that allow them to be nationally responsive. Porter reflects the case whereby the firm (or its businesses) again relies on a single home base, but here it does not lead to the firm becoming a successful exporter or outward investor. Instead, the only way to achieve survival, profitability and growth is to develop specific domestic niches. “Other parts of the “diamond,” then, influence whether a nation’s firms innovate around selective factor disadvantages rather than take the easy but less desirable solution”.

Porter represents firms or individual businesses within the firm which function primarily through international network linkages. These units operate in a more integrated fashion, within a structure that may take the form of a ‘global web’. It is in this case that the management of both the intra-organizational and inter-organizational networks may become very complex. The question arises where firms should be positioned that work with subsidiary world product mandates. Here, it should be emphasized that if the ‘businesses’ within an MNE are defined sufficiently narrowly, it can usually be argued that individual ‘business units’ with world product mandates indeed all function with a single home base, thus requiring their positioning.

However, the single home base concept then becomes largely tautological (see below). It should be mentioned that Porter has refined his perspective on the importance of a single home base in more recent work, recognizing the importance of foreign locations to the overall competitiveness of MNEs. However, rather than acknowledging the existence in many cases of the importance of multiple home bases for MNEs, even for individual businesses, he has now chosen to define the concept of ‘business’ or ‘product line’ in such a narrow fashion that the prevalence of a single home base can indeed be defended in most cases of world product mandates. Porter’s (1998) analysis suggests that a high percentage of core assets, competencies, and strategic decision making power concentrated in one country would lead to the qualification of a firm as being a single home based company.

In contrast, the authors argue that there must be a ‘threshold percentage’ of core assets, competencies, and strategic decision making power concentration below which a firm would be viewed as functioning with several home bases, and when one or various foreign units have built up a substantial critical mass of, e.g., R&D knowledge and are able to substantially augment this knowledge base through virtuous interactions with location advantages in host countries, the firm would again be viewed as functioning with several home bases.

At the business unit level, Porter’s perspective suggests that any business unit can be defined sufficiently narrowly (typically as a product line) so as to allow the identification of a single home base. A business unit with several product lines using different home bases would then reflect the presence of a multiple home base structure. From a normative perspective, “The causes of cluster atrophy and decline can also be found in the elements of the diamond. They can be grouped into two broad categories: endogenous, or deriving from the location itself, and exogenous”.

Porter’s view is more problematic as he suggests that it is impossible at the firm or business unit level to have more than one home base. His approach therefore is not testable. In contrast, the economists view the presence of one or multiple home bases as an empirical question, whereby factual evidence suggests an increased use of multiple home bases. The main challenge facing MNEs today in the location area is to combine effective access to—and participation in—foreign knowledge clusters, with efficient firm-level leveraging of the resulting knowledge base. To meet this challenge may be fraught with difficulties, for two reasons.

First, the benefits from setting up a subsidiary in a foreign, local cluster may not be easy to assess at once, as these benefits may largely depend on the actual absorption of cluster know-how. The absorption effectiveness may be very difficult to predict, given that a substantial portion of these benefits consists of cluster spill-over effects. Subjective perceptions may be critical here. This also implies that existing participants in a cluster, as well as local/regional.

Porter’s “Diamond Model” goes beyond simple economic development in determining preferred locations for activities. MNEs can base key product lines in order to access local competencies or regional clusters and then can apply these skills to the benefit of the entire MNE. Even within general categories of national development, regional specialization is common to many industries.

Comparison and Weaknesses of the Theories

Weaknesses of the Theories

The notions of national and economic competitiveness and Porter’s “Diamond Theory” raise heated discussions among modern scholars. Both classical and Porter’s theory have some weaknesses and limitation in their analyses and explanations of the phenomenon. Porter’s (1990) perspective has been rightfully criticized by several international business scholars. Dunning (1993) has argued: “To suggest the competitive position of MNEs like IBM, Philips of Eindhoven, SKF, Nestle, BAT, rests only on their access to the diamond of competitive advantage of their home countries is ludicrous—however much their initial foray overseas may have been based on such advantages.”.

Porter did acknowledge the strategic option for firms to ‘shift’ the ‘home base’ for specific businesses from the home country to a host country, in function of their relative country specific advantages. However, firms and industries from small open economies largely rely on international linkages, especially through inward and outward FDI as sources of competitiveness. For example, in relatively small economic systems such as Belgium in the European Union (EU) context, or Canada in the context of the North American Free Trade Agreement (NAFTA), any analysis of the sources of domestic firms’ international competitiveness needs to take into account the issue of access to foreign diamond components. Hence, a ‘multiple diamond’ approach is clearly required, as demonstrated by several conceptual and empirical studies.

One of the key problems of Porter’s (1990) framework is his concentration on non-location bound firm specific advantages developed by companies in their home country prior to engaging in FDI. As a result, he largely neglects

- the systemic advantages of MNEs resulting precisely from the common governance of internationally dispersed value added activities, each building upon an idiosyncratic bundle of country specific advantages, and

- the benefits of strategic asset seeking FDI, accruing to the MNE, whereby these assets may largely have been created on the basis of host country specific advantages.

Dunning (1993) has empirically assessed the geographical sources of MNE competitiveness through a survey of 144 of the Fortune global 500 industrial firms. He found that the relative contribution of host nation country specific advantages to the MNE overall competitiveness is increasing. On average, between 40 and 50 per cent of the location advantages’ contribution to MNE competitiveness is viewed as being derived from host countries, particularly in the areas of natural resources, linkages with suppliers and rivals, and through foreign market size. In contrast, technological capabilities and skilled labour capital still appeared to be derived largely from the home country.

In The Competitive Advantage of Nations, Porter argues instead for participating in national markets with the strongest rivals and most demanding customers, in order to build international competitiveness. One difference between his two positions is explainable by the difference between a closed, domestic industry and an open, globalized industry. In a closed, domestic industry, a company accustomed to weak competitors and undemanding customers has little to fear—there is no source of new competitors who might grow strong in more demanding competitive arenas. In an open, globalized industry, such newly strong competitors abound. Porter, together with other international strategists, has also come to recognize the importance of learning in international environments in addition to simply exploiting old capabilities in new locations.

However, from an international business perspective, Porter’s (1990) framework is also associated with substantial weaknesses, especially when applying his perspective at the firm level. His framework assumes that for each business in a firm, a single home base exists which acts as the sole source of this firm’s key location advantages. These country specific advantages can then be absorbed within the firm, i.e. contribute to the development and exploitation of its firm specific advantages. Foreign nations’ diamonds can only be tapped into selectively, because a firm aiming to draw upon a foreign diamond’s strengths is viewed as always being at a disadvantage vis-à-vis firms ‘inside’ this foreign diamond system.

Given that Porter established his reputation by providing frameworks for mapping the strategic environment of businesses (the “Diamond” of national competitiveness in 1990), it is somewhat ironic that when he turned his attention to global competition, he eschewed the I-R grid in favor of his own model that mapped strategies on a two-dimensional grid made up not of environmental but of organizational variables (coordination and configuration, the latter being defined as a continuum between concentrated and dispersed).

Despite his insistence that the Integration-Responsiveness Grid didn’t capture the complexity of a firm’s international strategic choices, Porter shared the emerging unilinear view of international competition as entailing organizational convergence on a single model, which he characterized in terms of rising levels of both dispersion and of coordination. Although many found configuration and coordination useful concepts, the main contribution of Porter’s brief foray into the analysis of MNE organization was to reinforce the increasingly widespread perception of convergence on a single dominant model of the MNE.

Second, the international leveraging of know-how derived from participation in a cluster may also be difficult, when various MNE operations build upon diverging, specialized technological capabilities and when knowledge transfer costs are high. A complementary issue is related to the effect of MNEs on the local knowledge clusters themselves. Whether MNEs will consistently enhance the upgrading of local knowledge clusters, rather than eliminate domestic expertise and reduce long-run cluster stability in host countries is at present a much debated policy issue and an empirical question which requires substantial further research. However, on the positive side, two categories of potential benefits to clusters from MNE activity have so far been largely ignored in the literature.

First, high profile MNEs may through their presence in a cluster provide legitimacy to this cluster and alter the cluster’s attractiveness as perceived by other MNEs and domestic firms. In other words, a global signalling effect may arise, which may greatly contribute to the cluster’s visibility, as well as its expansion and sustainability.

The mainstream international business literature has traditionally viewed the MNE as an efficiency driven, transaction cost reducing, and welfare enhancing institution, as exemplified by J. Dunning.

In this work, the MNE is considered an appropriate vehicle for the transfer and exploitation of proprietary knowledge, as well as for knowledge development, and extension or acquisition across borders when alternative modes of operation are inefficient. As a result of FDI, the MNE benefits from foreign location advantages, whereas foreign locations may benefit from various beneficial MNE spill-over effects, such as the upgrading of the local supplier base, the productivity improvement of the local human resources pool, the increase in sophistication of local demand, and better customer service as an outcome of stronger competition. However, MNEs may also increasingly act as a link between sticky, localized innovation clusters. In such a case they are the unintended lubricant for international exchanges and spill-overs among these centers.

The main weaknesses of classical economi theories (Smith and Ricardo) are that they do not take into account GDP, productivity and countries investments. These are important elements of competitive advantage because international spread is generally associated with superior performance, as might be expected for firms applying their particular capabilities in a wider market. However, other studies have shown less apparent benefit, even for firms. Modern longitudinal studies of Japanese multinational firms suggest that increased international sales actually predict lower levels of accounting performance, although they are more likely to reflect faster sales growth.

The marginal costs of entering international market may well surpass the marginal benefits at some point, resulting in an eventual competitive disadvantage to ever-greater geographical spread. In today’s knowledge-intensive business world, asset-seeking investment is moving away from traditional natural resource endowments. More firms go abroad to access constructed, or man-made assets. Porter (1990) focuses on the role of social institutions in developing home country advantages that can be exploited in foreign markets, but it is equally the case that international expansion can access location-bound competencies that have developed in other countries.

Asset-seeking expansion may be looking for skilled labor educated and conditioned in foreign systems (often a driver of investment from less developed countries (LDCs) into the United States or Europe), technologies that have arisen in foreign industrial clusters, or business processes that are embedded in a foreign location. Companies may also seek institutional conditions more friendly to their activities, moving their financing arms to financial centers, production to areas with less restrictive labor laws, or research to countries with strong intellectual property rights enforcement. The definition of location-based assets has changed, but the objectives of asset-seeking international expansion have not, at least, not in any real sense.

The main weaknesses and limitations of both theories are that they neglect the role of government in competitive advantage of the nation. Despite all the negative publicity concerning government’s economic actions, nobody yet categorically denies that government historically played a critical role in modern economic development. Everybody accepts the importance of public institutions that ensure property rights and effective markets.

There is little question concerning the positive effects of public spending on infrastructure such as basic education and transportation. Public investment in technology has been universally encouraged. Above all, sound macroeconomic policies, accountable public finance, and monetary stability are accepted as necessary conditions for continuous economic growth. For the past generation, economic thinking on the appropriate role of the government has shifted drastically. Up to the early 1970s a main focus of economic policy, at least in advanced industrial economies, was demand-side, macroeconomic management in the Keynesian tradition, which aimed to increase demand, often with extensive government spending, to boost economic expansion.

Within this macroeconomic framework, however, microeconomic interventions to tamper with the price mechanism remained an important undercurrent. Across nations, economic concerns and political realities propelled individual governments to adopt different mixes of microeconomic policies such as industrial policies, antitrust measures, and price-regulatory regimes in order to ensure the maximum economic output of individual industries and enterprises.

As conventional demand management became problematic in many industrialized nations due mainly to hyper-inflation, unemployment, and overall poor economic performance, the focal point of economic policies shifted towards the supply-side, emphasizing production and efficiency. Supply-oriented policies actually went in two conflicting directions: first, microeconomic, particularly industrial policies, which aimed to increase output and productivity through government guidance of individual industries; and, macroeconomic, particularly financial policies, which attempted to maximize economic welfare by encouraging saving and investment.

Many modern policy-makers in many industrial as well as industrializing nations became acutely interested in supply-side microeconomic policies, particularly sector-specific industrial development policies, thanks mostly to the powerful impression of rapid economic growth achieved in Japan and, later, in other East Asian countries. The European Union actively sought to establish a systematic ‘European Industrial Policy’ following its formation in 1992, based on elements of the industrial policies of different members from the end of the Second World War, or earlier.

In 1993 even the World Bank endorsed the ‘marketfriendly’ approach to economic policy management which recognized de facto the positive effects of industrial policy in East Asia. By the 1990s, however, the tide of public policy worldwide had again shifted, as market forces revived themselves as the major administrative mechanism for economic growth and efficiency. These policies encourage private saving and investment in order to increase the capacity and capability of the economy to produce more goods at a lower cost.

Comparison of the Theories

The main similarity between classical economic tradition and Porter’s Diamond theory is that they accept a need of high national saving rates to fund strong capital formation rates, expanding research and development, and continuing human resources development–which means, of course, continuing improvement of the labor force. Some economists suggest that a country needs effective trade policies to become competitive. Probably trade policies get more attention than the other elements, those that take a long time to improve. A country makes an input today and gets an output maybe several years downstream. A country can balance its accounts without good performance in savings rates, capital formation rates, R&D, and labor force improvement, but it cannot be internationally competitive i without consistently strong performance in these elements.

In dealing with U.S. international competitiveness, the important items are laws, rules, and regulations that affect human and physical capital formation and technology development and national trade policies. But common to both would be policies that affect saving, consumption, and investment rates. What lies ahead? The trade deficits will decline. U.S. manufacturing will certainly survive. But the debt is going to grow. The competitiveness challenge is going to intensify. International competition in manufacturing trade is going to get even more intensive than it is now. Part of the solution to problem will be the movement of foreign firms to the United States to produce here rather than abroad. Adjustment is going to come; there will be major adjustment problems in the United States and abroad. National deficits will be shrinking, and foreign surpluses will be shrinking.

The analysis of intra-industry trade has pushed international economics scholars to largely shift their focus from analysing the comparative advantage of nations merely at the macro-level toward the joint analysis of country level, industry level, and even firm level location advantages. The modern trade theory literature has thereby systematically shifted from merely covering national advantages. In this context is Cox and Harris’ (1985) study on the likely impact of free trade between Canada and the United States.

The study not only concludes that both countries may actually benefit from gains of trade at the macro-level but also that the higher potential to obtain scale economies and lower prices will lead to an exit of small, inefficient producers. Although freer trade with the United States will lead to a stronger location advantage for Canadian exporters at the macro and industry level, it simultaneously implies the elimination of the main location advantages, i.e. trade barrier protection, benefiting small, but previously economically viable firms.

Classical economic theory does not involve the impact on knowledge on economic performance of a nation an its competitiveness. The tendency is now to think of technology in broader terms, as encompassing the corporate capability to operationalize and effectively use in production this knowledge. While innovation can be defined as the introduction of new products and processes, technology is the capability to efficiently sustain these processes that generate quality products. Indeed, the creation of technology in this broader sense relies upon the corporate capacity to absorb new knowledge as an input into further learning in production, and hence in the generation of new capabilities. From this perspective technology transfer is a misnomer. While codified knowledge and blueprints can be transferred, corporate technological capabilities cannot be transferred through market-like exchange.

Conclusion

National competitiveness is a complex notion which involves different factors and determinants. There is not a single approach to factors and determinants which lead to success on the global scale. Both classical and Porter’s theories promote regional solutions as balanced compromises to meet both the challenges of globally efficient integration and local organizational responsiveness. These authors suggest that benefits from globalization and localization challenges could indeed be exploited simultaneously and therefore express skepticism whether global strategies always represent the right choice for national companies.

National competitiveness is closely connected with particulate industries and their development. Firms that plan to excel in a particular industry must be present in such clusters or industrial districts, but without the ability to move the products of such location-based advantage efficiently and to combine them with other capabilities, advantage is localized and benefits are severely limited. This is a key point that distinguishes local adaptation strategies from globally integrated strategies. The ultimate determinant of which type or types of global strategies a nation should use depends on performance.

Classical and modern theories of competitiveness show a strong positive relationship between the use of global strategy and superior performance in terms of relative market share and relative profitability. In global industries, nations with strong comparative advantage best perform on measures of return on assets and return on investment. It is not the case that integration into a global system is always best for a nation, or that an overall integrated strategy is the preferred international solution to world markets for all firms in all industries. Most of the theories continue to look at change over time in the organization of national factors and advantages, and in doing so many researchers attempted to integrate the internal and the external drivers of global change, and to move away from simple unilinear models of evolution.

Issues of innovation and knowledge transfers became increasingly central to all streams of work on national competitiveness. Research on competitiveness is quite likely to have an evolutionary framing, either explicitly or implicitly, for the foreseeable future, as the development of border-crossing capabilities, learning across units in different contexts, and the adjustments of organizational patterns to changing intra-state networks and changing external contexts continue to be the focus of work on MNE strategy and organization.

Evolutionary framing can draw on increasingly sophisticated theorizing in the social sciences, as the recognition of the importance of a variety of selection forces (both internal and external), multiple evolutionary paths, strategic choice, and the complexities of the co-evolution of organizations and environments have reshaped evolutionary thinking.

References

- Becker, G. (2007). Economic Theory. Transaction Publishers; 2Enlarged Ed edition.

- Caves, R. (1996). Multinational Firms and Economic Analysis. Cambridge: Cambridge University Press.

- Chang, Lieh-Ching and Lin, Cheng-Ted. (2005). The Exploratory Study of Competitive Advantages of Hsin-Chu City Government b…, The Business Review; 3,2; ABI/INFORM Global. ProQuest ed.

- Cho, Dong-Sung, Moon, Hwy-Chang (2000). From Adam Smith to Michael Porter. Evolution of Competitiveness Theory. World Scientific Pub Co Inc.

- Dasgupta, P.S., Heal, G.M. (1990). Economic Theory and Exhaustible Resources (Cambridge Economic Handbooks). Cambridge University Press; New Ed edition.

- Dicken, P. (1998). Global Shift: Transforming the World Economy. London: Paul Chapman Publishing Ltd.

- Dunning, J. H. (1973). ‘The Determinants of International Production’, Oxford Economic Papers, 25, 289-336.

- Dunning, J. H. (1992). Multinational Enterprises and the Global Economy. Wokingham: Addison-Wesley.

- Dunning, J. H. (1993). The Globalization of Business. London: Routledge.

- Dunning, J. H. (2000). ‘The Eclectic Paradigm as an Envelope for Economic and Business Theories of MNE Activity’, International Business Review, 9, 163-90.

- Gross Domestic Product (2007). MBA. Web.

- Hamalainen, T.J., Dunning, J. (2003). National Competitiveness and Economic Growth. Edward Elgar Pub.

- Krugman, P. R. (1991). Geography and Trade. Cambridge, Mass.: MIT Press.

- Mankiw, N.G., Mankiw, G. (2004). Principles of Economics. Harcourt.

- Moon, H. C., Rugman, A. M., and Verbeke, A. (1995). ‘The Generalized Double Diamond Approach to International Competitiveness’, in A. M. Rugman, J. Van den Broeck, and A. Verbeke (eds.), Research in Global Strategic Management, Vol. 5: Beyond the Diamond. Greenwich, Conn.: JAI Press, 97-114.

- Moon, H. C., Rugman, A. M., and Verbeke, A. (1998). ‘A Generalized Double Diamond Approach to the Global Competitiveness of Korea and Singapore’, International Business Review, 7, 135-50.

- Niehans, J. A. (1994). History of Economic Theory: Classic Contributions, 1720-1980. The Johns Hopkins University Press; New Ed edition.

- Ricardo, D. (2004). The Principles of Political Economy and Taxation (Dover Value Editions). Dover Publications.

- Robbins, L., Medema, S.G., Samuels, W.J., Baumol, W.J. A (2000). History of Economic Thought. Princeton University Press; New Ed edition.

- Porter, M. E. (ed.) (1986). Competition in Global Industries. Boston: Harvard Business School Press.

- Porter, M. E. (1990). The Competitive Advantage of Nations. New York: Free Press.

- Porter, M. E. (1998). On Competition. Boston: Harvard Business School Press.

- Porter, M. (2004). Competitive Strategy: Techniques for snslyzing industries and competitors Free Press.

- Rugman, A. M. (1981). Inside the Multinationals: The Economics of Internal Markets. New York: Columbia University Press.

- Rugman, A. M. (2000). The End of Globalization. London: Random House Business Books.

- Rugman, A. M. and Verbeke, A. (1990). Global Corporate Strategy and Trade Policy. London: Routledge.

- Smith, A. (1991). Wealth of Nations. Prometheus Books; New edition.

- Walras, L. (1954). Elements of Pure Economics (Reprints of Economic Classics). Harvard University Press.

- Welch, P. J., Welch, G. F. (2006). Economics: Theory and Practice. Wiley; 8 edition.

- Varieties of Capitalism: The Institutional Foundations of Comparative Advantage. (eds) P.A. Hall, Soskice, D. (2001). Oxford University Press.