Abstract

Economics is a complicated subject and the significant issues that make it such a phenomenon are connected to the ambiguity of the economy’s notions. This paper considers two ambiguous notions without which a person risks losing considerable money by taking loans.

Compound interests and title loans are interconnected terms of the same area – money loans. Compound interest is the process of interest accumulation through the period of loan repayment (NCSU, 2009). Having agreed to a compound interest model, a person is at risk of paying 250% over the actual value of the loan. The interest rates are compounded and accumulated to form the highest interest rate at the last payment for the loan (Teacherschoice, 2009). Indeed, title loan companies do not check credit: this is one reason the interest rate is higher than a conventional loan. Title loan companies fix lending operations within 15 minutes. Title Max is one of the companies specializing in title loans using the compound interest model.

Title Max Loans

The essence of the compound interest model can be formulated in the statement that the simple interest is calculated according to the principal amount, while compound one combines the principal and previously accrued interest. The formula for the compound interest calculation is as follows:

A = P (1 + i)n, where A denotes the total amount owed by the borrower to the lender, P indicates the principal amount of money borrowed by a person without any interests, while i is used to refer to the interest rate established for the loan per compounding period. Finally, n indicates the number of payments for the loan and actually determines the level of the compound interest rate.

To exemplify the formula operation, the Title Max example can be used. According to Complaints Board (2009), a loan of $1050 made a person pay over 121.56% of interest rate and left this person owing over $2000 to the company when only two months of payment remained (Complaints Board, 2009). Applying the inverted above formula, we can calculate the actual interest rate per period for the considered loan and then see the sum of the compound interest.

Thus, if A = P (1 + i) n, then to calculate i we have to use the formula according to which i =

Accordingly, the actual interest rate established for the payments per period, if assumed that the loan period is 12 months equals: i =

– 1 = 0,103

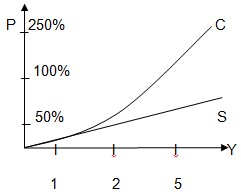

Thus, the total amount of the money paid for the loan will be calculated by the formula A = P (1 + i) n. Accordingly, A = 1050 (1 + 0,103)12 = 1050 x 2,215 = 2326. Based on this formula, we can see that the compound interest rate for the title loan from the Title Max amounts to 121.56% that the borrower had to pay to the company. Having taken $1050, this borrower had to repay $2326 (Title Max, 2009). On the whole, the dynamics of interest rates growth in the comparison of common and compound interest rates can be illustrated by the following graph (Graph 1), in which P denotes the principle sum of money borrowed, Y refers to the years the loan is taken for, the curve S reflects the simple interest progression, and the curve C shows the compound interest development:

Reference List

Complaints Board. 2009. Outrageous Interest, No Truth, in Lending Disclosure. Title Max Title Loans Complaints.

NCSU. 2009. Compound Interest Problems. NCSU. edu. Web.

Teacherschoice. 2009. Compound Interest. Mathematics ‘How To’ Library. Web.

Title Max. 2009. What We Do. Title Max, Springfield. Web.