The process of good management in an organization is called corporate governance. Corporate governance is the live wire of an organization (Acemoglu 1995). With the growing pressure on a firm’s competence, the director’s quest for the right approach to governance involves transparency, organizational culture and an effective governance scheme.

To balance investment strategies, with the aspirations of the entire stakeholder’s of the organization, the rules, procedures and processes must be managed and controlled. The management of these processes and controls are called corporate governance.

Previous literatures examined the processes of business organizations and their objectiveness in running daily transactions. This report will focus on variables that enhance performance in the organization. The fundamental variables are the owners and managers. Owners of industries hire capable managers to conduct the affairs on their behalf.

Each theoretical framework of corporate governance provides a platform for measurement. The cost of management increases when the owners employ quality hands to manage their investments. Sometimes, a clash of interests reduces the growth of the organization (Adams 2002). When managers tailor a firm’s investment strategy to his or her interest, it will encourage friction between the owners and the managers.

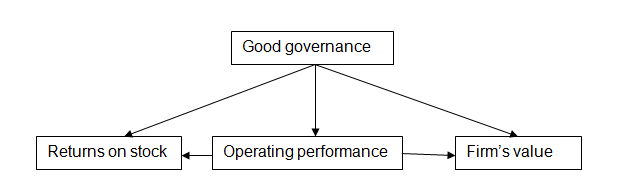

However, corporate governance can reduce the friction in corporate organizations thus, monitoring the performance of the organization (Roche 2005). This report x-rays the relationship between corporate governance characteristics and the firm’s performance. The relationship can be shown with a diagram:

Table 1

This report correlates the impact of good governance on the firm’s stock value and the cost of auditing and management. The sample size was reduced to 20 UK firms thus, removing firms not documented in UK, firms without valid annual reports and financial firms in the UK. 20 firms were selected from the FSTE100 between 2004 and 2008. The variables of analysis were divided into dependent and independent variables.

The dependent variables include: Return of Equity (ROE), return on assets and the profit margin of the listed firms (Agrawal & Knoeber, 1996, p. 387). The independent variable include: the board size, board composition, the composition of the audit committee, the status and composition of the Chief executive to mention a few.

Descriptive analysis

Table 2: Descriptive statistics of Corporate Governance in 20 UK Firms

The report analysis reveals that the score is not significant across firms with high mean (Vafeas, 1999, 116).The sample size is comprised of manufacturing firms, transport, communication, electric plants, gas plants and sewage and sanitary firms. The composition in percentage include 42%, 18%, 12%, 16%, 5% and 7% respectively.

Table 3

The descriptive statistics in table 3 reveals the earnings per share of listed firms in the UK. The analysis represents the total sample size of the report. The number of board executives reveals the significance of control in an organization. Public companies have a greater number of directors in management. The size of the boards of directors suggests its significance on the performance of the firm (Healy, 1985, p. 98).

Although the employee’s log did not show any significant difference in performance, the earnings per share significantly influenced the performance of the firm (Vafeas & Theodorou, 1998, p. 402). Good governance can be correlated with the performance of the firm as suggested by the analysis in table 3. The variables were analyzed using Pearson correlation analysis to determine the degree of significance.

The regression results showed 15% significance in the board size. By implication, the significance between the companies with separate management and Chief executive Duality is high (Adams et al. 2002). The existence of nonexecutive members did not play an important role in the performance of the firm.

The percentage of coefficient implies that being independent does not mean having control of the organization. However, the coefficient for the board of directors is not significant.

Conclusion

The report x-rays the significance of corporate governance in an organization. The relationship between the dependent and independent variables was revealed. Director’s duality showed negative influence on the performance of the firm.

The variable reduces the efficiency of the board members. Finally, the significance of the return of assets and the return of equity improved the performance of the firm. Thus, board variable, firm’s performance and the firm’s size are independent variables.

References

Acemoglu, D 1995, Corporate control and balance of powers, Working paper, Massachusetts Institute of Technology.

Adams, R, Almeida, H, & Ferreira, D 2002, Powerful CEOs and their impact on corporate performance, Working paper.

Adams, R 2002, The dual role of corporate boards as advisors and monitors of management: Theory and evidence, Working paper, University of Chicago.

Agrawal, A & Knoeber, C 1996, Firm performance and mechanisms to control agency problems between managers and shareholders, The Journal of Financial and Quantitative Analysis, Vol. 31, No. 3, 377-397.

Healy, P 1985, The effect of bonus schemes on accounting decisions, Journal of Accounting and Economics, Vol. 7, 85-108.

Roche, J 2005, Corporate Governance in Asia, Routledge, Oxon.

Vafeas, N 1999, Board meeting frequency and firm performance, Journal of Financial Economics, Vol. 53, 113-142.

Vafeas, N & Theodorou, E 1998, The relationship between board structure and firm performance in the UK, British Accounting Review, Vol. 30, 383-407.