Abstract

The concept of corporate governance is becoming increasingly important in the modern business environment. The ability to meet interests of different stakeholders within a business environment, especially the shareholders, clients, suppliers, employees, and the government are met defines capacity to achieve success in the market. This paper focused on determining the impact of corporate governance on a firm’s performance. It was established that corporate governance significantly affects financial performance of a company. Although the sometimes stakeholders’ interests may be conflicting, the management should find a way of meeting them in the best way possible to ensure that everyone feels taken care of within the firm.

Introduction

Background of the Study

Managing large companies in the modern competitive business environment poses several challenges. According to Patra and De (2014), the top management unit has to understand the fact that the presence of the firm in a given market affects various entities. Some of these stakeholders may have varying interests that must be met in some way to ensure that the firm remains sustainable. Customers expect the firm to deliver quality products at reasonable prices in a regular manner. Suppliers have their interests that must be met to ensure that they continue to avail raw materials or products needed for the normal function of the company.

The shareholders expect a consistent increase in the value of their investment in every financial year. Employees expect the firm to provide a good workplace environment and competitive salaries. The government must be paid the necessary tax as regularly as possible. Then there is the community within which the firm operates that expects a clean environment and support from the firm. Some of these firms employ a huge number of people and it is in the interest of the government and the community that it remains operational despite the challenges it may face. The need to meet these conflicting interests led to the emergence of the concept of corporate governance.

Corporate governance, according to Badu and Appiah (2017), are practices, processes, and rules of managing a corporation at the highest level to achieve the set vision. It involves a delicate balancing of the interest of all stakeholders, however much these interests may be conflicting from one another, to ensure that there is a smooth operation of the company. Kumar and Bhaskar (2014) argue that the ability of a firm to achieve success in the current competitive business environment depends on its ability to embrace appropriate management principles.

While employees desire to have higher, salaries may be in conflict with the need to increase the value of shareholders’ investment, one must understand that high salaries may improve the output of the workers. It means that by paying employees high salaries to improve their performance, the firm will also be meeting the interest of the shareholders. Success of a firm lies in such unique ability to understand how to tie together these interests and move forward towards realising the needed goal for the firm. In this dissertation, the focus is to investigate the impact of corporate governance on a firm’s performance.

Problem Statement

The 2008 global economic recession clearly demonstrated the significance of large corporations in a given economy. When large firms started suffering financial losses or stagnation, some of them considered laying-off employees while others such as the Lehman Brothers were forced out of the market (Panda, Chaudhury, & Das, 2014). The economy of many countries suffered, as many firms were unable to pay their taxes while others had to rely on government’s financial support to remain operational.

Unemployment and underemployment in many developed countries increased to unprecedented rates (Ahmed & Rab, 2014). It was a clear indication that governments could no longer afford to let firms operate without proper guidelines that can protect interests of different stakeholders. It emerged that these firms needed to be protected from management principles that may have negative impact on investors and other stakeholders.

Organisation for Economic Cooperation and Development (OECD) was the first intergovernmental entity to set regulatory principles meant to define principles of corporate governance that a firm should embrace. China Securities Regulatory Commission (CSRC) and State Economic and Trade Commission also set regulations that Chinese firms had to observe in their operations as a way of protecting large corporations (Kamila & Bhattacharjee, 2014).

The decision to have government directly involved in the corporate governance of large companies is an indication of the desire to protect different stakeholders. However, meeting the interest of all stakeholders may not be the same as enhancing a firm’s performance in the market. A company may make good profits in the market, but if the income is not reinvested to help the firm expand, then its sustainability may be in question. As such, it is necessary to investigate the effect that corporate governance has on the performance of a given company. This investigation will have practical benefits to the corporate managers by defining what they need to do to achieve organisational goals and objectives.

Importance of the Study

Conducting research is a time-consuming process that also involves using financial resources. As such, Dadhich (2014) argues that it is necessary to define the importance of a study to justify why it is necessary to conduct it. Investigating the impact of corporate governance on a firm’s performance is important because it is one of the ways of protecting large corporations in the country. The economy of a country is defined by the productivity of the local companies (Choi, Jeong, & Lee, 2014).

Successful firms provide employment to the locals, tax to the government, income to investors, and foreign exchange to the country if they export their products to other countries. As such, their survival benefits several stakeholders.

However, Hassan, Marimuthu, and Johl (2015) note that it is not easy to ensure that a large corporation maintains a consistent growth. Challenges such as stiff market competition, unfavourable policies in foreign countries, increasing cost of operation, and many other issues in the market may affect growth and sustainability of a corporation. This paper will identify ways in which competitiveness of a firm can be enhanced despite these existing challenges. Protecting these companies benefits all stakeholders.

Aim and Objectives

When conducting research, it is often important to define aims and objectives. Defining the aim makes it easy to understand what should be achieved by the end of the study. Setting out objectives helps in determining specific goals that need to be met in the study. The aim of this research is to determine the impact of corporate governance on a firm’s performance. The study will outline how different principles of management affect the performance of a company in different ways. It will also identify dangerous practices that corporate managers should avoid to ensure that the needed long-term success is realised. The following are the specific objectives that should be realised by the end of this study:

- To collect and critically review the literature about the relationship between corporate governance and financial performance;

- To deeply explore the role of corporate governance in promoting financial performance;

- To apply the framework to analyse corporate governance and financial performance of Chinese listed companies;

- To provide practical recommendations as to the improvement of corporate governance.

Data collected from both primary and secondary sources will help realise the aim and objectives set above.

Key Questions and Hypotheses

When the aim and objectives have been defined, the next step is to develop questions that would help in answering the questions. McNabb (2015) explains that research questions guides the process of data collection. It ensures that relevant information is obtained from relevant sources. The following are the fundamental questions that the study will answer:

- What is the relationship between corporate governance and financial performance?

- What is the role of corporate governance in promoting financial performance?

- How do members’ interests affect a firm performance?

It was also necessary to develop hypotheses that had to be confirmed or rejected based on data collected from primary sources. As Walliman (2016) notes, hypotheses are often developed based on the information obtained from the preliminary review of literature. The following are the hypotheses that the researcher seeks to confirm or reject based on the information that will be collected from primary sources:

- H1. There is a negative correlation between the size of board of directors and a company’s value.

- H2. The CEO duality (where the CEO doubles up as the chairperson) improves a firm’s performance.

- H3. The independence of the directors is directly correlated to the financial performance of a company.

The qualitative and quantitative data analysis that was conducted focused on determining if the statements above are upheld or challenged.

Overall Research Approach and Potential Limitations

The study will involve mixed method (both qualitative and quantitative) research approach to achieve the set goals and objectives. The appropriateness of this method and the manner in which it helped realise the aim of the research is discussed in chapter 3 of this paper. Potential limitations such as time and geographical barrier encountered during the process of collecting primary data are also discussed in that chapter.

Sampling Approach

Data needed for this study could be collected from numerous people who have been involved in corporate governance. However, the limited time meant that information could only be obtained from a manageable sample. Using purposeful and simple random sampling methods, the researcher collected data from 100 participants as discussed in chapter 3.

Dissertation Structure

The dissertation has six chapters. The first chapter is the introduction to the paper. It provides a detail background of the study, importance of conducting this research, and a problem statement. The second chapter is a detailed review of literature. Chapter 3 explains the method used to collect and analyse primary data. Chapter 4 focuses on data description. It discusses the response rate and demographics of the respondents interviewed. The firth chapter entails the actual analysis of the primary data collected from the respondents. The last chapter provides conclusion and recommendations.

Research Methods

The previous chapter focused on providing a detailed review of secondary data. The chapter provided background information on this topic by reviewing what other scholars have found out and identifying research gaps that need to be addressed. In this chapter, the focus is to provide a description of how primary data was collected, analysed, and presented. The chapter makes it possible for the reader to determine the reliability of the study by explaining the steps taken to gather facts and make conclusions and recommendations. It will help to explain the impact of corporate governance on a firm’s performance based on primary data collected from the respondents.

This chapter has several sections. It starts by explaining the research questions, hypothesis, and philosophy that was embraced in the study before explaining the appropriate research approach that is in line with the chosen philosophy. The chapter then explains the strategy used in data collection. Sampling and sample size, instrument used in data collection, and data analysis method used in the project is explained in the chapter. It ends with the discussion of ethical considerations and limitations that the researcher faced when undertaking this academic project.

Key Questions and Hypotheses

The research questions developed when developed during the literature review stage will help in defining the nature of data that should be collected from participants. In this chapter, it is necessary to restate these questions before explain methods used to answer them.

- What is the relationship between corporate governance and financial performance?

- What is the role of corporate governance in promoting financial performance?

- How do members’ interests affect a firm performance?

The researcher also developed hypotheses based on the secondary data collected from books and journal articles. The following hypotheses had to be confirmed or rejected based on the information obtained from secondary sources:

- H1. There is a negative correlation between the size of board of directors and a company’s value.

- H2. The CEO duality (where the CEO doubles up as the chairperson) improves a firm’s performance.

- H3. The independence of the directors is directly correlated to the financial performance of a company.

Research Philosophy

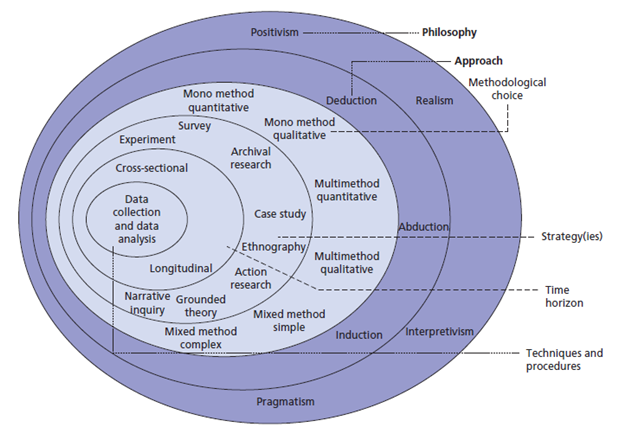

One of the first steps that should be taken before starting the process of data collection is to determine the appropriate research philosophy that one should embrace. It entails the source of information used in the study, the nature, and approach of developing knowledge. According to Abbaszadegana and Grau (2015), research philosophy defines beliefs embraced about appropriate ways in which data should be collected and analysed to explain a given phenomenon. It defines the basis upon which assumptions will be made in a given study. As shown in the research onion below (figure 1), a researcher can opt to use positivism, realism, interpretivism, or pragmatism depending on the nature of the study. It is important to discuss each of these philosophies before explaining why one of them was chosen.

Positivism

Positivism is one of the commonly used philosophies in social science studies. It holds the view that knowledge can only be considered factual and trustworthy if it is gained through senses and measurements (Information Resources Management Association, 2017). In this philosophy, a researcher is expected to be objective and with a limited role of collecting and interpreting data. He or she is not expected to influence subjects in any way and personal opinion is not expected to define conclusion and recommendations made at the end of the study.

The philosophy emphasises the need to base conclusion on quantifiable observation (McNabb, 2015). As such, a researcher is expected to conduct a statistical analysis of the primary data to make conclusion. This philosophy would be appropriate for the study but was not used because of its emphasis on quantitative data analysis. Some aspects of the analysis would require qualitative analysis as well.

Realism

Realism is another philosophy that a researcher may opt to use depending on the nature of the study. It holds the view that reality is independent of human mind. According to Prescott (2016), people are often blinded with stereotypes and beliefs that make them unable to face accept reality. In many cases, they try to look for facts that would justify what they already believe in when investigating an issue. Such a subjective approach of conducting a research minimises the ability to gather accurate facts that explains a given phenomenon.

As such, it holds that one should embrace scientific methods when conducting research. Scientific investigation is based on information that is devoid of what an individual wants to believe. This philosophy is common among those conducting pure science researches where experiments have to be done to ascertain a given issue. In this social science research, this philosophy was considered inappropriate.

Interpretivism

Interpretivism as research philosophy holds the view that access to reality is only through social constructions (Pruzan, 2016). Unlike positivism that requires a researcher to avoid interaction with the subject in a way that may influence their response, interpretivism encourages a researcher to engage the respondents. It holds the belief that it is not possible to understand why a certain group of people behaves in a given way unless a researcher becomes part of the group. Being part of the group gives a researcher a unique ability to understand why certain things happen the way they do based on the view of the individuals responsible.

In this study, it would require the researcher to be part of corporate governance unit to understand why top managers often make specific decisions, which would have direct impact on the performance of the firm. It encourages the use of qualitative methods to analyse a given phenomenon. The philosophy was considered inappropriate because it requires a lot of time to engage with the corporate leaders. Given that this study had some elements of quantitative analysis, it was not advisable to embrace this philosophy.

Pragmatism

Pragmatism is another popular philosophy in social science research. According to this philosophy, a concept can only be considered relevant and trustworthy if it supports action (Ratten, Braga, & Marques, 2017). It holds that there are different ways of interpreting the world, and that it is not prudent to have a fixed view that a phenomenon can only be interpreted in a given way. Instead, a researcher should be allowed to use different approaches based on acceptable standards to arrive at a given conclusion. Walliman (2016) explains that sometimes it is possible to have multiple realities when analysing a given phenomenon.

For instance, employees would want a situation where corporate governance involves improving the workplace environment and ensuring that salaries are competitive. On the other hand, shareholders would want corporate governance to involve promoting lean production and increasing the value for shareholders. These two realities may differ but accurately define what top management should be concerned about in their corporate governance. It accepts the use of both qualitative and quantitative methods of data analysis. The philosophy was considered most appropriate for the study.

Research Approach

When the appropriate research philosophy has been selected, the next step would be to determine the research approach that should be used. Walliman (2016) explains that research approach involves explaining the appropriate steps that should be taken when developing knowledge in a given study. The selected approach should be in line with the chosen strategy. A researcher can either use deductive or inductive reasoning approach. It is necessary to discuss both to understand why one was considered more appropriate than the other was.

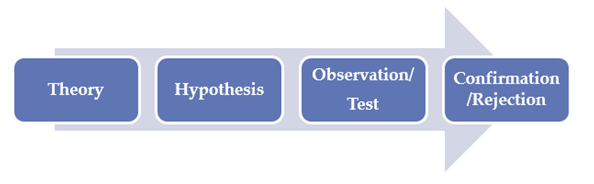

Deductive Reasoning

Deducting reasoning is a common research approach where a researcher is expected to start by defining a theory upon which the study will be based. After identifying the theory, a researcher is expected to develop hypothesis or hypotheses based on the theory selected. The next step is to conduct an observation, which involves collection of primary data from various sources. The data will then be used to accept or reject the hypotheses developed.

Acceptance of the set hypotheses will confirm the validity of the theory or a popularly held belief. However, when the hypotheses are rejected, it will be a confirmation that the theory is not valid and that there is need to redefine it based on the gathered facts.

In most of the cases, this reasoning approach emphasises the need to conduct statistical analysis of data to accept or reject the hypotheses (Card, 2016). However, it may also support some aspects of qualitative analysis. Given that the researcher selected pragmatism as an appropriate research philosophy, deductive approach was an appropriate reasoning pattern that would be embraced in the study. Figure 2 below shows the pattern of deductive approach of developing knowledge.

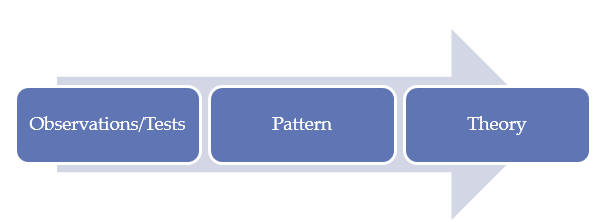

Inductive Reasoning

This approach takes a completely opposite pattern of developing knowledge as deductive approach. Instead of starting with a theory, it starts with a research question that stems directly from the topic of investigation. A researcher is then expected to conduct observations or tests to answer the set question. In this case, the question would be to determine the impact of corporate governance on a firm’s performance. Data collected should be used to develop a pattern.

The researcher should explain specific factors that have impact on the performance of a company. Once a pattern is developed, the final step is to develop a theory or a new concept that explains a given phenomenon, as shown in figure 3 below. The study should develop new knowledge about how corporate governance affects a company’s performance. However, it was considered an inappropriate approach that is in line with the selected philosophy.

Research Strategy

Research strategy, as Card (2016) defines it, refers to a systematic plan of actions on how data will be collected to help inform a given study. The research philosophy defines the beliefs and assumptions that were embraced while the approach defines the pattern of developing the knowledge. On the other hand, research strategy defines the specific steps that must be taken to obtain information needed to build the knowledge. In this study, the researcher used three main strategies to collect the needed data for the study.

Desk Research

Desk research involves collecting data from secondary sources. According to McNabb (2015), before collecting primary data, it is often advisable for a researcher to review existing literature. The information obtained from these sources not only helps in forming the background of the study but also enables a researcher to identify knowledge gaps in a given field. It eliminates cases where a study duplicates information that already exists. Chapter 2 was dedicated to the review of literature. Data for this chapter was collected from books, journal articles, and reliable online sources. Desk research enabled the researcher to understand the current state of knowledge in this field and specific issues that needed further investigations.

Case Studies

Case study was another important strategy of collecting data. When investigating a phenomenon, sometimes it is important to look at a similar case that happened to have an understanding of the issue being investigated. Prescott (2016) explains that case studies are often effective when conducting a qualitative or quantitative research by providing a real-life case of an event that happened, factors that made it happened, and the consequences that it had. In this case, looking at corporate governance practices of some of the local and international firms and their impact on their overall performance will provide insight into the issue under investigation. The information from the case study may help justify findings made from both primary and secondary data sources.

Survey

Survey was the other method of data collection considered critical in this investigation. The only way of addressing knowledge gaps identified during literature review is to collect primary data. McNabb (2015) argues that survey is one of the effective methods of collecting data from respondents to help in gathering information relevant to a given study. The researcher considered an online survey as the most appropriate method of gathering the needed information from participants without being affected by the geographic barrier.

For the researcher to understand corporate governance among Chinese listed companies, it was necessary to collect data from corporate officers and experts in corporate governance in China. Conducting an online survey meant that the researcher did not necessarily have to travel to China to collect the needed data. The participants could be identified in the online platform and questionnaires delivered to them electronically. The approach proved effective in collecting the information needed. It took five weeks to collect primary data online from the sampled respondents.

Sampling and Sample Size

Information about corporate governance can be collected from chief executive officers, directors, and senior employees who understand how a given company is run at the top level of management. China has numerous firms listed in their local stock exchange and it would not be easy to collect information from the entire population. As Prescott (2016) advises, it is always prudent to identify a manageable sample size when planning to collect data. The sample should be a representation of the entire population. The researcher used purposeful and simple random sampling methods to identify the needed participants in the study. Purposeful sampling was used to set the inclusion criteria.

In this context, the participants had to fall in any of the three categories (top executives, a major shareholder, or a senior employee) to be considered to participate in the study. Purposeful sampling method is always appropriate in ensuring that individuals selected to participate in the study have the needed information based on their level of education and experience in a given field of interest. After placing them into the three categories, the researcher used simple random sampling to select the needed participants in those categories.

Simple random sampling is effective in ensuring that personal bias is eliminated when selecting participants (Walliman, 2016). It eliminates cases where a researcher only selects individuals who will be inclined to answer specific questions in a given biased manner. A sample size of 100 participants was considered appropriate for the study.

Instrument of Data Collection

A questionnaire was used to gather information from the participants. Questionnaire was considered an appropriate tool in collecting data in a standard format to address research objectives (Wang & Ahmed, 2016). It was also easy to administer it online given that it was not possible for the researcher to contact the respondents physically. The instrument had two main sections. The first section focused on basic demographical facts about the respondents. It captured the age, gender, occupation, and experience of the participants. According to Card (2016), personal information such as age helps in identifying gender-related bias in a response provided by a participant.

On the other hand, the level of education and experience of a respondent helps to determine the trustworthiness of the information they provide (Walliman, 2016). A top manager with a doctorate degree who has been working in a company for twenty years is more likely to provide credible information about corporate governance of the firm than a new graduate who has just been hired. The second section of the questionnaire focused on specific questions about corporate governance and its impact on a firm’s performance.

Data Analysis

When the needed data has been collected from the sampled participants, the next step was to conduct analysis. As explained above, it was necessary to conduct both qualitative and quantitative data analysis to have a comprehensive response to the research question. Qualitative analysis was necessary to explain why specific factors affect related to corporate governance affect a firm’s performance in a given way. In corporate governance, there is always the need to meet needs of various stakeholders and sometimes these needs may be contradictory.

For instance, employees may need high salaries, but meeting this need will reduce a firm’s profitability, which in turn will have negative impact on shareholders’ interest. When using qualitative analysis, it is possible to explain how good corporate governance can help in balancing the interest of these stakeholders to achieve growth and financial success. On the other hand, quantitative analysis helped in determining the magnitude of the relationship of different variables.

The researcher considered it appropriate to use Tobon’s Q ratio to determine how corporate governance affect a firm’s performance in the market. This tool is often used to measure the assets of a company in relation to its market value (McNabb, 2015). Using the formula, Tobin’s Q = (Total Market Value of Firm / Total Asset Value of Firm) it is possible to determine whether a firm’s market value is greater than its recorded asset or not.

It the value is 1, it shows that the company’s value in the market is greater than its recorded asset. Factors such as a firm’s brand value and its reputation may make its overall value greater than its asset. On the other hand, if the image of the firm is poor and it has lost favour among customers, shareholders, and public, it is possible that its assets will be greater than its market value (Moreno-Gómez, Lagos, & Gómez-Betancourt, 2017). Such problems are common among new firms with weak brands, which are yet to gain popularity in the market. Such cases show that the firm suffers from poor corporate governance.

Ethical Consideration

When conducting research, Card (2016) emphasises the need to observe ethics at every stage of the project. In this study, the researcher was keen on taking into consideration various ethical issues. First, it was necessary to explain to the participants the primary goal why this study was important. They also had to understand the role they needed to play in the study. The information was provided in the questionnaire.

The researcher ensured that the identity of the respondents remained anonymous. Card (2016) explains that protecting the identity of respondents is critical in ensuring that individuals who have contrary opinion do not subject them to any form of criticism or unfair treatment. McNabb (2015) notes that an academic researcher must avoid any form of malpractices when writing a research. The researcher avoided any form of plagiarism in the study. Information obtained from secondary sources was properly referenced using American Psychological Association (APA) citation style. The study was also completed within the time provided by the school.

Limitations

The study faced some limitations, which are worth discussing in this chapter. The study used both qualitative and quantitative methods of data analysis, which consumes more time than when an individual decides to use either of the two. Primary data had to be collected from individuals who were widely distributed in terms of their geographical location. Prescott (2016) explains that one of the best ways of collecting primary data is to conduct face-to-face interview.

It allows a researcher to gather non-verbal cues such as body language and facial expressions that would help to determine the truthfulness of the respondent. Unfortunately, the geographical barrier and the limited time within which the study had to be completed made it impossible to conduct face-to-face interviews. It was also noted that some respondents failed to answer the questions provided in the questionnaire within the right time.

As McNabb (2015) explains, it is not possible to predict the rate of response among online participants. Some of them would promise to provide answers within the stipulated time only for them to fail when they are expected to deliver. To overcome this challenge, the researcher had to use a relatively large sample size just to ensure that those who failed to respond within the right time were replaced.

Validity, Reliability, and Generalizability

When collecting and analysing primary data, it is always important to ensure that validity and reliability is assured. In order to ensure that the assessment tool used produces stable and consistent results, it was necessary to conduct test-retest as a measure of reliability. This approach helped in ensuring that there was internal consistency. It was also necessary to ensure the validity of the study just to ensure that it represented what it was expected to in an accurate manner.

The researcher ensured that individuals interviewed had the right knowledge and experience in this field. Purposeful sampling was meant to ensure that information provided by the participants was trustworthy. Having a considerably large number of participants also helped in ensuring that there was an adequate representation of the general population. Given the fact that data was collected from top corporate managers, experts in this field, and employees who have worked with specific firms for a long period, it enhanced generalizability of data. The information could be generalised to different companies operating in the same business environment.

How the Information Will Help to Address Each of the Research Objectives

It is important to ensure that the analysed information helps to address each of the research objectives set in this paper. As explained above, there were six objectives set in this project. Each of the objectives was meant to ensure that the aim of the study is achieved. The analysis focused on addressing each of the objectives. The analysis was conducted in chapter five of this chapter.

Data Description

Chapter 3 provided a detailed explanation of the methods used to collect and analyse data from respondents. This chapter focuses on the description of the data used in this paper. The researcher used both primary and secondary sources of data. Secondary data was obtained from books, journal articles, and reliable online sources. Chapter 2 was dedicated to a review of the literature obtained from these sources.

The researcher ensured that secondary sources used were reliable. Primary data was obtained from a sample of respondents as explained in the previous chapter. This chapter explains the response rate to the surveys, a breakdown of the demographic information of the participants, a determination of whether the information collected allowed the researcher to meet the sample characteristics required. The chapter helps to explain the validity and reliability of the information in this study.

Response Rate to Surveys

The researcher was not able to get 100% response rate from those who were expected to answer the questionnaires. As such, it was necessary to contact more respondents to have the desired number of participants. The researcher contacted 140 individuals and 100 managed to answer the questions within the stipulated time, which means that there was a 71.42% response rate as shown in figure 4 below.

A Breakdown of Demographic Information

It was also necessary to break down the demographic information of the respondents. Issues such as age, level of education, and gender may help to identify any possible bias among the participants. Table 1 below classifies the participants in terms of their age groups. It is evident that majority of the participants were over 45 years.

Table 1: Age of Participants.

Gender is another factor that may define bias of an individual’s response to a given question. There was an attempt to ensure that at least one third of either gender was represented in the research. The majority of the participants (62%) were men while 38% were women. The demographic representation of the participants is shown in the figure below:

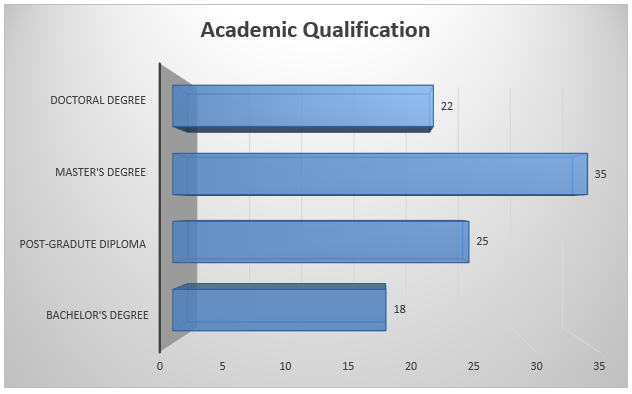

The level of education defined the trustworthiness of the information obtained from the participants. Highly educated individuals are often believed to have expert opinion over an issue, and as such, their views are considered credible (Ahmed & Hamdan, 2015). Figure 6 below shows that a significant majority of the participants have master’s degree, followed by those with post-graduate diploma and then doctoral degrees. The minority group was those with undergraduate degree.

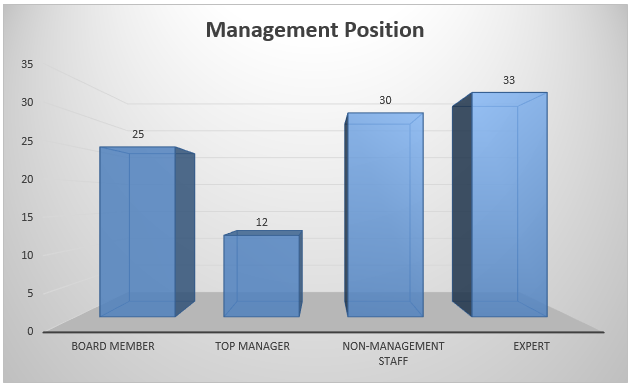

The nature of this study required information from individuals in management positions, experts in this field, and non-management staff who have worked in a given company long enough to have the needed experience that can help provide the required facts (Qasim, 2014). Majority of the respondents were experts. The management position of these respondents is shown in figure 7 below.

Meeting Sample Characteristics Required

The above information has allowed the researcher to meet the sample characteristics required for the study. There was a good representation of both genders. The academic qualification of the respondents, their age, and management position shows that they had the capacity to provide credible information regarding the impact of corporate governance on firm’s performance.

Data Analysis

In this chapter, the focus will be to conduct analysis to respond to the research objectives and hypotheses that were developed in the previous chapters. The researcher conducted both qualitative and quantitative analysis. There was also a case study conducted about Apple Inc. to determine the impact of corporate governance on a firm’s value.

Research Objectives

To determine the relationship between corporate governance and financial performance.

The first objective was to establish the relationship between corporate governance and financial performance of a given firm. Respondents were requested to state whether they believe there is a co-linier relationship between the two variables. Figure 8 below shows that corporate governance is directly proportional to financial performance. The findings confirm the information obtained through literature review. Hussain, Rigoni, and Orij (2018) stated that effective corporate governance is beneficial to a firm’s performance.

To explore the role of corporate governance in promoting financial performance.

The second objective focused on determining the role of corporate governance in promoting financial performance of a company. The respondents were requested to explain their views on this issue. It was evident that the participants felt that corporate governance has a major role to play in promoting financial performance of a corporate entity.

Respondent 11 said, “I believe a firm’s financial performance is highly dependent on its corporate governance. The ability of a firm’s top management unit to balance the varying interests of all stakeholders defines its financial performance.”

Respondent 16 said, “Firms that register impressive financial performance have effective corporate governance strategies. Managers at such entities know how to coordinate different activities to ensure that specific goals are realised within a given period.”

To study how the members’ interests affect the firm performance.

This objective focused on determining how interests of different stakeholders may affect the performance of a firm. In the literature review, it was established that sometimes interests of different stakeholders might have negative effect on a firm’s performance. Information obtained from participants confirmed this argument and provided more insight.

Respondent 4 said, “Shareholders may want more dividends every year, while employees would want frequent salary increments. Such interests might deny a firm resources needed for research and development.”

Respondent 7 said, “It is important to balance the interest of different stakeholders in corporate governance to ensure that the firm is protected from unnecessary expenditure.”

To apply the framework to analyse corporate governance and financial performance of Chinese listed companies.

In this objective, it was necessary to analyse corporate governance and financial performance of Chinese listed companies to determine the relationship between the two variables. Air China and Aluminium Corporation of China Limited are some of the large Chinese companies listed in Shanghai. It is possible to get financial statements of these companies. However, their market value is not easy to establish. As such, it was not easy to use Tobin’s Q framework in determining the company’s value in relation to its assets. As such, Apple Inc. was used as an appropriate case study because of ease with which its data can be found and the fact that it operates in China.

Apple Inc.’s Case Study

Apple Inc. is one of the firms that have registered impressive performance in the global market over the past decades. The company designs its products in the United States but the production is done in China (Vo & Nguyen, 2014). The company’s share price has been on the rise consistently because of the effective management strategies employed by the management. Using Tobin’s Q, the researcher was able to determine how the value of the firm has been increasing with every increase in the asset value over the years.

It was also necessary to establish the company’s market value over the same period. It was possible to find Apple’s market value within the same period as shown in the first column of table 2 below. Using the formula Tobin’s Q = {(Total Market Value of a Firm/Total Asset of a Firm)}, it was possible to calculate the value for the last four years, from 2015 to 2018.

Table 2. Tobin’s Q Value.

It is evident that Apple’s market value, in relation to its assets, has been on a consistent rise over the period under analysis. Within that period, the value was greater than 1, which is an indication that the firm’s financial performance is impressive. Although there was a slight drop in the value from 2015 to 2016, since then it has registered a consistent increase as shown in figure 9 below.

To conclude whether financial performance is correlated with corporate governance.

The objective focused on determining whether a firm’s financial performance is related to its corporate governance. When reviewing literature, it was established that financial performance of a firm is closely related to its financial performance (Qasim, 2014).

An overwhelming majority of individuals who participated in this study supported the same argument. As shown in Figure 10 below, 98% of the respondents believe that corporate governance affects a firm’s financial performance. The data makes it possible to conclude that a firm with proper corporate management system can easily achieve financial success. The ability of the management to know when and how to meet the needs of investors, employees, suppliers, the government, and all other relevant entities helps in boosting a firm’s performance in the market.

To provide practical recommendations as to the improvement of corporate governance.

The last objective focused on providing practical recommendations as to the ways in which corporate governance can be improved. After determining the importance of corporate governance on a firm’s overall performance, it was necessary to provide suggestions on how a firm can improve its performance based on the facts collected from both primary and secondary sources. The recommendations would inform future management practices of corporate entities in China and other parts of the world. The recommendations are provided in the last chapter of this paper.

Research Hypotheses

After conducting analysis based on the set research question, the next focus was to analyse the set hypotheses. As was explained above, the hypotheses were set based on the information collected from primary data. A confirmation of the three hypotheses would be an indication that there is an agreement between information collected from both sources.

H1. There is a negative correlation between the size of board of directors and a company’s value.

The first hypothesis stated that there is a negative correlation between the size of the board of directors and a company’s value. It holds that the larger the size of the board, the lower the value of the company would be. It was necessary to determine if this argument is true based on information collected from participants. They were asked to explain their view about the relationship between the two variables. Figure 11 below shows their view towards this issue.

The findings show that there is a close relationship between the two variables. Having a significantly small number of board members, especially when only one or two individuals have the capacity to make critical corporate decisions about the firm is detrimental to the value of the firm. It creates an environment where there is minimal consultation because views of the few would have profound impact on the path that a firm takes to undertake various activities.

Respondent 1 said, “A firm that has one or two individuals at the top level of decision-making processes may suffer because of lack of inclusivity. The top managers can easily be influenced by external forces to act in a way that may have negative consequences on the firm.”

As such, it is not advisable to have such a small number of individuals making critical corporate decision for a firm. The graph above shows that as the number of board members increases, the value will increase in tandem up to the level where the firm has nine board members. A company that has nine board members has the highest value. The number is high enough to facilitate adequate consultation and discussion of different views while at the same time small enough to ensure that decisions can be made within a reasonable time. As the number of board members increases beyond nine members, the value will start to decrease.

The larger the size of the board beyond the optimal level, the lower the value of the firm. Respondents noted that large board members find it difficult to reach consensus, even in cases where an urgent decision is needed. It is evident that the primary findings confirm the hypotheses above. It is held that there is a negative correlation between the size of board of directors beyond the optimal point and a company’s value.

H2. The CEO duality (where the CEO doubles up as the chairperson) improves a firm’s performance.

The second hypothesis focused on determining the impact of a CEO’s duality on a firm’s performance. It was necessary to establish if having a chief executive officer who doubles up as a firm’s chairperson is beneficial to its performance. The researcher asked participants their view about the issue. Figure 12 below shows their response. It is evident that an overwhelming majority (88%) believe that CEO duality improves a firm’s performance.

They noted that having the CEO being the chairperson gives this office enough power to make critical decision that would propel it to success in cases of emergency. The CEO would then inform the board about such decisions and reasons that made them necessary. Those who were opposed to this arrangement argued that it gives the CEO too much power that can be abused for personal gains. The hypothesis was confirmed.

H3. The independence of the directors is directly correlated to the financial performance of a company.

The third hypothesis focused on determining the independence of the directors and its relationship with financial performance of a company. In the literature review, it was established that having an independent board of directors helps in promoting checks and balances within the firm. It also allows the management team to make operational decisions without having to receive constant directives from the board.

Respondent 4 said, “An independent board of directors is critical in enhancing a firm’s performance. The board members can make impartial decisions that would enhance the progress of the firm.”

The majority of the respondents hold the same opinion. They believe that the board is the only unit that can monitor activities of top managers and provide guidance in a way that would benefit shareholders. When board members are deeply entrenched in the daily management activities of the firm, the firm will lack an oversight authority. The board members may end up making mistakes that should be made by the mangers. Given the fact that there will be no other authority to check the activities of the board on a regular basis, the firm may suffer financial losses.

It is evident that there is an agreement between the information collected from primary sources and data from secondary sources. Corporate governance has a direct impact on the performance of a firm.

Conclusions and Recommendations

The aim of this study was to investigate the impact of corporate governance on a firm’s performance. The main objective was to establish how decisions that top managers at a corporate level affect the financial position of a given company and what could be done to ensure that such corporate entities protect their interests in a competitive business environment. The study was important because it would provide guidance to management practices embraced by board of directors. The researcher considered mixed-method research as the most appropriate approach of achieving the aim and objectives of the study. Agency and stewardship theories were used to help guide this study.

The results of this study show that there is a close relationship between corporate governance and the performance of a firm in a given industry. The decisions that corporate managers make define how interests of a firm, its shareholders, employees, suppliers, customers, and the government are met even if they appear to be in conflict. The study shows that board of directors should always be committed to achieving a firm’s vision.

It means that none of the main stakeholders should be ignored when developing strategies and principles that guide a firm’s operation. The practical implication of this study is clearly identified in the analysis of the primary data. Corporate entities must understand the role of board of directors in steering the organisation towards a path defined in its vision. The study was able fully meet each of the six objectives, as discussed in the previous chapter. The findings of this study affirmed the information available in other secondary sources. Just like in the literature reviewed in chapter two, the findings show that corporate governance is closely related with a firm’s performance.

The study had some limitations discussed in chapter 3 of the paper, time available for the study, geographical barrier, and inability of some sampled individuals to respond to the questions provided within the right time were the main limitations. The validity, reliability, and generalizability of the study are also explained. The need to collect data from those in corporate governance was driven by the desire to ensure that validity of the study was enhanced.

The findings of the study can be used by businesses with similar business structures and individual researchers who may want to conduct research in this field. The case study used is transferable to other organisations with similar business models. It means that any business entity that uses a business model similar to that of Apple Inc. can apply these principles. It is evident from the information gathered from both primary and secondary sources that corporate governance affects the performance of a firm. The management of any major corporation should consider the following recommendations:

- It is important to differentiate corporate governance from daily management activities of a given firm. Defining the two roles helps in identifying activities that should be conducted at each stage.

- The board of directors should be exclusively responsible for corporate governance of an entity instead of getting involved in daily management plans.

- There should be a regular and open communication between the board of directors and individuals assigned the role of daily operations of a firm.

- Board of directors should be granted independence to conduct their oversight duties in a given corporation.

References

Abbaszadegana, A., & Grau, D. (2015). Assessing the influence of automated data analytics on cost and schedule performance. Procedia Engineering, 123(1), 3-6.

Ahmed, B., & Rab, K. (2014). Foreign direct investment and economic growth in India: A study. International Journal of Research in Management & Social Science, 2(3), 1-5.

Ahmed, E., & Hamdan, A. (2015). The impact of corporate governance on firm performance: Evidence from Bahrain stock exchange. European Journal of Business and Innovation Research, 3(5), 25-48.

Badu, E. A., & Appiah, K. O. (2017). The impact of corporate board size on firm performance: Evidence from Ghana and Nigeria. Research in Business and Management, 4(2), 1-12. Web.

Card, A. (2016). Applied meta-analysis for social science research (2nd ed.). New York, NY: The Guilford Press.

Choi, B. P., Jeong, J. G., & Lee, Y. (2014). Diversity and firm performance: An analysis of different levels of management composition. International Journal of Business Research, 13(1), 87-94.

Dadhich, M. A. (2014). Economic performance & global governance: Evidence from developing India. International Journal of Research in Management & Social Science, 2(3), 102-109.

Hassan, R., Marimuthu, M., & Johl, S. K. (2015). Diversity, corporate governance and implication on firm financial performance. Global Business and Management Research: An International Journal, 7(2), 28-36.

Hussain, N., Rigoni, U., & Orij, R. (2018). Corporate governance and sustainability performance: Analysis of triple bottom line performance. Journal of Business Ethics, 149(2), 411-432.

Information Resources Management Association. (2017). Organizational culture and behaviour: Concepts, methodologies, tools, and applications. Hershey, PA: Information Science Reference.

Kamila, K., & Bhattacharjee, S. (2014). Knowledge management and knowledge society. International Journal of Research in Management & Social Science, 2(3), 126-134.

Kumar, S., & Bhaskar, P. K. (2014). Social media branding and brand image development: Concepts and cases. International Journal of Research in Management & Social Science, 2(3), 68-72.

McNabb, D. (2015). Research methods for political science: Quantitative and qualitative methods (2nd ed.). New York, NY: M.E. Sharpe.

Moreno-Gómez, J., Lagos, D., & Gómez-Betancourt, G. (2017). Effect of the board of directors on firm performance. International Journal of Economic Research, 14(6), 349-361.

Panda, M. K., Chaudhury, S. K., & Das, S. K. (2014). Correlation between FDI and Indian stock market: A study. International Journal of Research in Management & Social Science, 2(3), 95-101.

Patra, R., & De, K. (2014). Corporate social responsibility in India: A comparative study of leading banks. International Journal of Research in Management & Social Science, 2(3), 6-12.

Prescott, J. (2016). Handbook of research on race, gender, and the fight for equality. Hershey, PA: Information Science Reference.

Pruzan, P. (2016). Research methodology: The aims, practices and ethics of science. London, UK: Cengage.

Qasim, A. M. (2014). The impact of corporate governance on firm performance: Evidence from the UAE. European Journal of Business and Management, 6(22), 118-122.

Ratten, V., Braga, V., & Marques, C. (Eds.). (2017). Knowledge, learning, and innovation: Research insights on cross-sector collaborations. New York, NY: Cengage.

Vo, D., & Nguyen, T. M. (2014). The impact of corporate governance on firm performance: Empirical study in Vietnam. International Journal of Economics and Finance, 6(6), 1-13. Web.

Walliman, N. (2016). Social research methods: The essentials (2nd ed.). London, UK: Sage Publications.

Wang, C., & Ahmed, P. (2016). The development and validation of the organizational innovativeness construct using confirmatory factor analysis. European Journal of Innovation Management, 7(4), 303-313.

Yahoo Finance. (2018). Balance sheet. Web.

Yahoo Finance. (2019). Apple Inc. market cap. Web.