Introduction

Corporate reporting has increasingly become an important element in the operation of firms in different economic sectors. Everingham & Kana (2008, p.1) define corporate reporting as the process through which firms’ management teams provide information regarding the performance of their organization to various stakeholders.

It is a statutory requirement for organizations to engage in corporate reporting. Everingham and Kana (2008, p.1) assert that there is a gap between the stakeholders’ need for information and the information provided by organization.

One of the categories of information that organizations are required to provide relate to their organization’s financial performance. Additionally, corporate reporting should also include non-financial issues. This makes corporate reporting to be a vital ingredient in firms’ effort to motivate their stakeholders.

In addition to ensuring effective corporate reporting practices, managers are also charged with the responsibility of maximizing the shareholders’ wealth. To attain this, various techniques such as earnings management are incorporated.

This paper entails an analysis of two main issues which include the importance of reported earnings to users of accounting information and the concept of earnings management.

Importance of reported earnings to users of accounting information

Organizations are charged with the responsibility of communicating their financial information to various stakeholders for example by publishing their annual report. The annual report is composed of 3 main financial statements which include the income statement, the balance sheet and the cash flow statement (Nikolai, Bazley & Jones, 2010, p. 8).

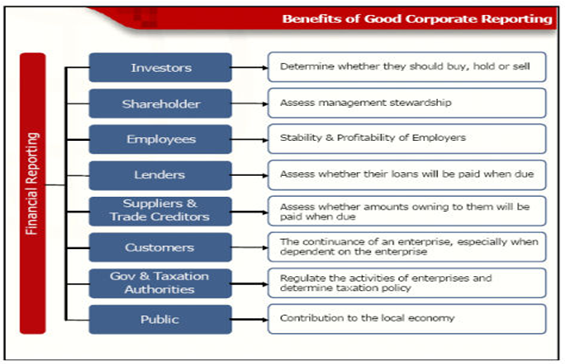

Accounting information is important to different users as discussed below. Some of the main users include lenders, investors, employees, suppliers, trade unions, creditors, financial analysts, customers, regulatory agencies and the general public (Narayanaswamy,n.d, p.9).

Investors and shareholders

Accounting information is beneficial to individual and institutional investors. Shareholders are mainly concerned with two main issues regarding their investment.

These include the risk and return associated with their investment. Accounting information is also important to investors in the process of making decision regarding the investments to purchase, retain or dispose (Narayanswamy, n.d, p. 9).

Additionally, accounting information is also important to investors when evaluating the probability of a particular investment paying dividends.

Despite the fact that investors have a legal right to access accounting information periodically from the institutions in which they have invested in, potential investors are also interested in accounting information.

Financial analysts

When making financial decisions, investors and creditors usually seek assistance from financial specialists such as stock brokers in order to make effective decisions. Financial analysts provide these parties with specialized analysis and interpretation of various financial reports.

One of the main concerns of financial analysts relates to the return associated with a certain security. In order to offer useful advice, financial analysts usually collect accounting information from different organizations either directly or indirectly.

Managers

Managers make different decisions in the process of executing their duties. As a result, they have to access information from different sources. The accounting system is one of the major sources of information that managers use when making decisions related to investment projects.

In order to be effective, managers are required to continuously monitor their organization’s key financial indicators that are provided in the financial reports. Additionally, managers also use accounting information to compare the performance of their organization with that of their competitors.

Additionally, when faced with challenging situations such as hostile takeover, managers usually communicate additional financial information associated with the organization so as to improve the firm’s stock price (Narayanaswamy, n.d, p.12).

Customers

Customers require organization accounting information when making a decision on whether and the extent to which they will be involved with a particular organization. For example, customers would like to know the financial information of their suppliers in order to determine whether they can rely on them for their purchases and after-sales support.

In their operation, suppliers usually make large profit margins. To determine whether they are being overcharged, customers usually evaluate the firm’s profit margins (Narayanaswamy, n.d, p.12).

Suppliers and trade financiers

Organizational suppliers use firms’ accounting information to determine the likelihood of the organization continuing to be their customer.

Accounting information gives suppliers a clue regarding the organization’s financial strength. For example, the suppliers are able to determine whether their organizational customers will go bankrupt. Bankruptcy of a particular organizational customer can affect the future performance of its suppliers.

Trade financiers provide organizations with short term credit. When extending their credit services, suppliers and trade financiers are mainly concerned with whether the ability of their customers to make payment in the short term.

The government and regulatory agencies

In its operation, governments mainly rely on tax as the main source of revenue. When formulating taxation policies and other business regulatory practices, various governments usually depend on accounting information. As a result, organizations are required by law to submit their financial information to the relevant authorities.

For example, when computing the tax that an organization should pay, tax authorities usually evaluate different accounting information. According to Needles, Powers and Crosson (2010, p.12), organizations are required to report periodically to various regulatory agencies. For example, public limited companies in the United States are required to report regularly to the Securities and Exchange Commission (SEC).

Labor and trade unions

Trade and labor unions usually use organizational accounting information when negotiating wage and salary increment with their employers.

The accounting information provided in financial statements such as the income statements enable trade unions and employees to determine the probability of receiving salary and wage increment. Additionally, the employees are able to determine the ability of their employer meeting future financial obligations such as pension and other related post-retirement benefits (Elliot& Elliot, 2008, p.259).

The public

Organizations affect the society within which they operate in a number of ways. For example, the offer employment opportunity to local community in addition to creating job for local suppliers. Through the financial statements, the public is able to understand the organization’s trend.

Incentives for management to meet or exceed the consensus analyst forecasts

Mulford and Comiskey (2002, p.38) assert that firms manage their earnings in such a way that they meet or exceed the consensus analyst forecast.

One of the ways through which they achieve this is by integrating accrual-based earning management technique (Elliot & Elliot, 2008, p.22). Li, McDowell and Moore (n.d, p.3) are of the opinion that there are various incentives that motivate managers to report financial earnings that either meet or exceed forecasts by financial analysts.

Managers are usually concerned with improving the stock prices of their organizations. As a result, managers who attain or exceed the earnings expectations are usually rewarded by investors through large bonuses.

This is one of the incentives that motivate managers to meet or exceed their forecast. Lee and Yu (2007, p. 2) are of the opinion that if organizational earnings fall short of the analyst’s consensus, managers incur a significant reduction in their annual cash bonuses.

The second incentive that motivates managers in executing their agency duties relate to the need to improve their reputation and hence their competitiveness within the managerial labor market. The resultant effect is that their probability of attaining their career objectives is enhanced.

Findings of a study conducted by three scholars Dr. Sherry Fang Li, Dr. Evelyn McDowell and Erin Moore revealed that attaining the earnings target is one of the main concerns by managers in an effort to improve their reputation.

Another incentive relates to the need to improve the reputation of their organization amongst the external stakeholders such as the creditors, customers, suppliers and the government.

Earnings management

Mulford and Comiskey (2002, p.23) defines earnings management as a reasonable and legal reporting process that is aimed at attaining steady and predictable financial results. Organizations attain earnings management by integrating various accounting actions such as accelerating or deferring revenue and expense transactions and recognizing one-time non-recurring items.

Costs and benefits associated with earnings management

Mulford and Comiskey (2002, p.82) assert that earnings management is beneficial to an organization in that it enhances the probability of managers meeting the consensus forecast. The resultant effect is that the organization’s market value is safeguarded from declining.

Earning management also make it possible for organizations to avoid consequences that may arise from financial covenant violations. This arises from the fact that an organization is able to integrate effective credit management (Mulford & Comiskey, 2002, p. 84).

Through earnings management, an organization is able to reduce its earnings volatility. This is achieved by integrating effective earnings management techniques such as income smoothing.

An organization that has a smooth earning stream is considered to have a high market value. An organization is also able to maximize proceeds from initial public offers through integration of earnings management.

Despite these benefits, there are a number of costs associated with earnings management. For example, the technique may increase an organization’s operating difficulties which may negatively affect the shareholders.

Additionally, earnings management alters an organizations accounting information. The resultant effect is that the reliability of an organization’s financial information is reduced.

Earnings management techniques and their impact

Cookie-Jar reserve technique – This technique entails estimating an organizations future expense on the basis of its current financial year. When using this technique, firm’s management team usually overestimate future expenses. Overestimating expenses enables the management team to recorded less expense in the future. Using this technique leads into creation of a form of a financial reserve.

Through this technique, an organization can be able to tap into the reserve in the future in order to boost its earnings. However, if the future expenses incurred by the organization are more, the reserve is depleted which means that its earnings are not boosted. However, this technique suffers from a limitation that arises from the fact that it is not possible to determine future expenses with certainty.

The big-bath technique

This technique is not usually applied by organizations. However, in an effort to remain competitive, firms’ management teams may decide to undertake organizational restructuring by eliminating some of its operations or even closing down some of its subsidiaries.

Through this technique, an organization records the cost of implementing the change as a non-recurring cost. As a result, the cost is not reported amongst the ordinary operating earnings.

Big bet on the future

Organizations undertaking acquisitions are considered to have ‘a big bet on the future’. This is due to the fact that there is a high probability of these firms increasing their reported earnings. However, when undertaking acquisitions, organizations usually incur significant costs since the cost of acquisition is usually are considered as a purchase.

Policy implications of the earnings management technique

The cookie jar reserve technique increases the probability of an organization attaining its earnings forecast. This arises from the fact that the reserve created is used to boost the firm’s earnings.

By charging a large amount of loss against its current earnings, the prevailing market price of the firm’s share is negatively affected. As a result, investors usually associate implementation of big-bath technique by organizations with lack of competitiveness.

By integrating the big bet on the future technique, an organization may either write off the research and development cost of the firm being acquired. Therefore, if the organization incurs these costs in the future, it will not be a must that it reports them. The resultant effect is that its future earnings will be boosted.

Conclusion

The analysis has illustrated the importance of integrating effective corporate reporting especially with regard to accounting information. This has been achieved by analyzing the importance of accounting information to various stakeholders.

Additionally, the paper has also analyzed earnings management as one of the financial management efforts aimed at ensuring that a firm is competitive in the market. This has been attained by evaluating a number of earnings management techniques and their policy implications.

Reference List

Elliot, B. & Elliot, J., 2008. Financial accounting and reporting. London: FT Prentice Hall.

Everingham, G., & Kana, S., 2008. Corporate reporting. Sunninghill: PriceWaterhouseCoopers.

Lee, Y., & Yu, T., 2007. Do corporations manipulate earnings to meet or beat analysts’ forecasts? Evidence from pension plan assumption changes. Kingston: University of Rhode Island.

Li, S., McDowell, E., & Moore, E., n.d. Accrual based earnings management: Real transactions manipulation and expectations management: U.S and international evidence. Chicago: Westfield State College.

Mulford, C., & Comiskey, E., 2002. The financial numbers game: Detecting creative accounting practices. New York: Wiley.

Narayanaswamy. n.d. Financial accounting: A managerial perspective . New York: PHI Learning PVT.

Needles, B., Powers, M., & Crosson, S., 2010. Principles of accounting. New York: Cengage Learning.

Nikolai, L., Bazley, J., & Jones, J., 2010. Intermediate accounting. Mason, OH: South-Western Learning.