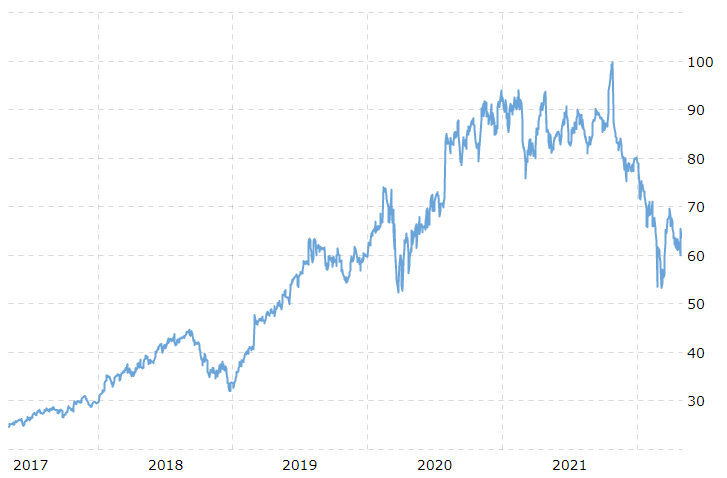

CoStar Group is a public company that provides information, analytical reports, and promotion services to individuals and organizations that are interested in buying or selling commercial real estate. As of May 2, 2022, the market price of the company share is equal to $64.42 per share (Yahoo Finance, n.d.). This number is 24.6% less than the results on the same day last year when the stock value was equal to $85.4 (Yahoo Finance, n.d.). Such a drop in CoStar Group’s share price may signify the difficulties that the business currently encounters. On the other hand, the reduction in the stock value may provide compelling opportunities for potential investors. Therefore, in order to understand whether one should purchase CoStar Group’s shares, a thorough industry and company analysis are needed.

The important factor to consider concerning the attractiveness of CoStar Group for investors is how the business’s performance is different compared to its closest competitors. The latter include Apto, BoomTown, CBRE Group, Hightower, RealtyMogul, Redfin Corporation, and Reis, to name a few most important companies (Comparably, n.d.; Global Data, n.d.; Yahoo, n.d.). However, since only CBRE Group and Redfin Corporation are public organizations, they are the most suitable benchmarks against which CoStar Group’s performance can be compared.

The analysis revealed that CoStar Group generally is a better investment choice than CBRE Group and Redfin Corporation from the perspective of potential development. To assess it, the enterprise value was compared against the market capitalization of the companies. While for CoStar Group, the ratio is equal to $22.4B/$22.21B=0.89 for CBRE Group and Redfin Corporation, it is equal to $29.22B/$27.46B=1.06and $2.1B/$1.19B=1.76 accordingly (Yahoo, n.d.). It implies that CoStar Group has more available cash than the debt, which the organization can use to invest in development. In contrast, CBRE Group and Redfin Corporation have more debt than the cash available, but for the former, this number is not critical. Thus, this information can be interpreted by the investors that CoStar Group can increase its performance in the near future, which, in turn, can significantly and positively affect the market price of CoStar Group’s shares.

Additionally, the comparison of the companies’ returns on assets (ROA) and returns on equity (ROE) show that CBRE Group outperforms its competitors. As for the former, the historical data for the past five years is presented in Figure 1 (The data for Redfin Corporation is not included as it has negative values). This ratio was chosen for the current analysis because it allows an understanding of how efficiently the business uses its assets. The results reveal that for the last five years, CBRE Group outperformed the CoStar Group. As of the 4th quarter 2021, the former company’s ROA was more than twice better than the latter’s index. In a similar vein, CBRE Group’s ROE was more than four times more than that of CoStar Group, being equal to 21.84% and 5.28%, respectively, during the last 12 months (Yahoo, n.d.). Yet, both organizations greatly outperformed Redfin Corporation, whose ROE equals -22.37% (Yahoo, n.d.). Thus, from the investor’s perspective purchasing the shares of CoStar Group may not be the best decision based solely on ROA and ROE; rather, it is suggested to consider CBRE Group.

Such a difference between the two companies’ ROA has a significant impact on the share prices of CoStar Group. Indeed, Figure 2 shows the sharp drop in the business’s stock value after the 4th quarter of 2021. Partly, it is the result of comparisons that potential investors make between CoStar Group’s and its main competitors’ ROA. In this regard, the marked contrast between CoStar Group’s and CBRE Group’s performance suggests that the reviewed company may lose its position in the market in the future. Then, simply put, investment in CBRE Group is less risky and more attractive in terms of returns.

Other factors that influence the stock price do not depend on the competitors’ performance. They include management profile, bank rates, investors’ expectations concerning the economy, and the trade cycle, to name a few factors. For instance, it is generally considered that having more experienced top managers is associated with better performance (Almashaqbeh et al., 2021). Andrew C. Florance founded CoStar Group in 1986 and has since been the company’s CEO (CoStar Group, n.d.). On the one hand, he has a great experience which means that the company should be functioning successfully. On the other hand, based on the ROA and ROE information, for instance, investors may think that the company necessitates a new leader who can bring fresh ideas which will help to increase productivity. Nevertheless, the recent drop in the stock price signifies that investors generally lack faith in CEO’s abilities to address the current issues that the business encounters.

Overall, the current essay presented the factors that affect CoStar Group’s share price. First, the company’s performance was evaluated using the enterprise value against market capital ratio, ROA, and ROE. It was shown that the company has more available cash and less debt compared to its competitors, namely CBRE Group and Redfin Corporation. However, the company’s performance is substantially worse than that of CBRE Group. Such a situation may signal to the investors that although the company has available cash to invest in development, the use of money may not be quite efficient. Next, the factors that affect the business’s value directly – without the need to compare with competitors – were presented, and it was analyzed how CoStar Group CEO’s image can impact the share price.

Reference

Almashaqbeh, M., Islam, M. A., & Bakar, R. (2021). Factors affecting share prices: A literature revisit. In S. Z. A. Rahim et al. (Eds.), AIP Conference Proceedings, 2339(1, p. 020143). AIP Publishing LLC. Web.

Comparably. (n.d.). CoStar Group competitors. Web.

CoStar Group. (n.d.). Andrew C. Florance. Web.

Global Data. (n.d.). CoStar Group Inc: Competitors. Web.

Macrotrends. (n.d.). CoStar – 24 year stock price history | CSGP. Web.

Yahoo Finance. (n.d.). CoStar Group, Inc. (CSGP). Web.