Introduction

The performance of the housing industry has fallen after the recession. It is a fact that the recent economic recession was started by the mortgage industry. The federal government had deregulated the mortgage industry. This allowed banks to give loans to subprime borrowers. This caused a boom because many subprime borrowers obtained loans from the banks to purchase the mortgages. The housing boom reached its climax in 2007. With the increasing inflation in the country, many subprime borrowers were unable to service their loans. This was worsened by an increase in food prices, oil prices and failure in most industries. This caused mass default of the subprime loans because the borrowers were unable to repay their debts. The mass default caused failure in the banking industry, and this caused most banks to collapse. The failure in banking industry caused spill over effects to other industries. Therefore, the recession spread over to other industries and with no time other countries started to suffer from the recession. International trade caused the recession to spread to other countries trading with the US. In 2010 some countries started to recover from the recession while others were seriously affected. Some countries have completely recovered economic stability today but others continue to be affected by the failure in most industries in their economies. In the United States, most industries have recovered, but the housing industry is yet to recover from the recession (Warren, 2011).

Impacts of the recession to the real estate industry

The federal government has amended the laws concerning the housing industry to protect the economy against a similar turmoil. The banking industry has been restricted against issuing loans to subprime borrowers. This law was enacted to prevent the banking industry from issuing loans to the subprime borrowers because they have a high likelihood of defaulting loans. This has been done by increasing interest rates to subprime borrowing, hence restricting subprime borrowers from accessing mortgage loans. The government announced bailout program to all subprime borrowers who failed to repay mortgage debts (Organization for Economic Co-operation and Development, 2010).

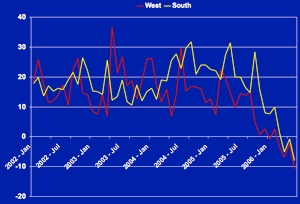

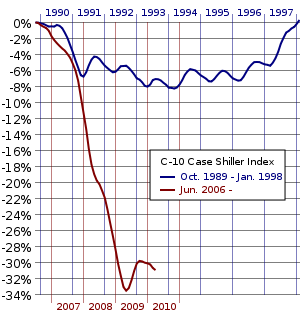

House prices continue to fall even though the country has recovered from the recession. House prices have dropped by almost 50 percent since the recession started, and this shows that the industry is suffering huge losses. This is the worst experience that the industry has undergone. The graph below shows a drop in the house prices in South and West regions of the United States. It indicates that house prices had been increasing up to 2006 when the prices started to drop. The decline in prices was so serious such that it was predicted to be negative in 2007 and 2008 (Warren, 2011).

It is evident that house prices continued to drop after the recession. From 2007 to 2011 house prices have been at the lowest level ever experienced in the history of the US.

The housing industry has been affected such that constructing of new houses has become a major challenge. Home builders report a drop in business, and constructing new homes has dropped after the recession. Some of the home building companies are Pulte, Lennar, D. R. Horton and others. These companies reported the highest profits and prices in 2005 and 2006. D. R. Horton had the highest stock prices of $42.82 in 2005. Pulte had revenues of $14.69 billion in 2005 (Gittelsohn & Willis, 2010). These companies have reported reducing performance since the recession started, and there is little hope of the companies recovering in the near future (Standard & Poor’s Corporation, 2006).

Mass movement of residents has been experienced because people are avoiding the expensive residents. The rising house prices have forced people to move to cheaper houses. Expensive residential estates have lost demand because most house owners cannot afford the expensive prices attached to the products. Some residential regions such as Riverside County in California have experienced high population growth because many people have moved to the region. In 1990 the region had a population of 1,170,413 while in 2007 the population increased to 2,026,803 (Gorenstein, 2011). This is a double increase in population, and it is an indication that people prefer to reside in the area. Riverside County has been preferred because it is near San Diego as well as Los Angeles. The Loudoun County has experienced triple growth in population in 2006 (Rashkin, 2012).

Regional land prices have differed a lot after the housing boom was experienced in the US. Land prices have increased within a short time and it is becoming hard for people to purchase land for construction. Regions such as Atlanta, GA and others had experienced faster growth before the recession because land values were low. However, the growth rates have reduced after the recession affected the country (Rashkin, 2012).

Building costs have increased, and most building companies find it costly to build new houses. This has reduced the number of real estates being constructed in the country today. The recession was accompanied by inflation, and this caused the prices of most building materials to escalate. Suppliers of building materials find it uneconomical to lower the prices even after the recession. This is attributed by the high cost incurred when purchasing the materials. This has caused the cost of construction to be high. However, the low demand for real estates has caused the prices to go down. The differences in cost and demand have caused most investors to incur losses. This has caused reduction in the number of houses being constructed (Ayers, Gould, Oshinsky & Soderlund, 2011).

The GDP of the US has been adversely affected by the drop in housing industry. The industry was one of the sources of revenues to the country. The government collected a lot of revenues in terms of taxes and other revenues from the industry. However, after the recession affected the industry, the income generated from the industry has been too low (Ayers, Gould, Oshinsky & Soderlund, 2011).

Investor confidence in the real estate industry has dropped. Many investors are not willing to invest in the industry because they fear experiencing losses due to similar ion happening in future. Domestic and foreign investors have lost their confidence in the industry, and few incomes are being generated. This has created mass unemployment because people who had been employed in the industry cannot be sustained by the companies due to poor performance. Companies are making losses and it becomes difficult to pay employees with such conditions. In addition, consumer confidence has dropped, and this is the cause of the low demand in real estate products. The low demand for houses in the US has caused low prices to prevail in the market. Most households in the country opt to repay debts and to make savings rather than purchase new houses. This has caused the housing industry to drop in performance, and this has resulted in bad economic benefits being derived from the industry (Whalen, 2011).

The lending habits of financial institutions have changed, because there is fear of making losses in case a similar recession is experienced in the economy. This has caused financial institutions to raise their lending interest rates, and this has made it impossible for people to borrow cash to purchase real estates. The Fed has taken monetary and fiscal measures to protect the economy against similar recession. This has been applied by regulating money supply in the economy. In addition, the interest rates have been used as tools of controlling the real estate industry by the Fed (Saft, 2011).

Conclusion

The economic recession that affected almost every country in the world was caused by subprime mortgage industry. The housing industry reached its boom in 2007, and this resulted to massive defaults of subprime debts. The banking industry was the worst hit, and this caused other industries to reduce their performance. The housing industry has dropped in performance since then, and the effects of the recession continue to be experienced in the industry. The prices of real estates continue to drop because the demand for houses has declined while the cost of building houses continues to increase. The government has taken stringent measures to protect stakeholders in the industry against the side effects of failure in the housing industry. Some of the measures include bailouts to subprime borrowers, imposing more regulations to the industry and other measures.

References

Ayers, E. L., Gould, L. L., Oshinsky, D. M., & Soderlund, J.R. (2011). American Passages: A History of the United States. Wadsworth Pub Co.

Gittelsohn, J. & Willis, B. (2010). Housing Slide in U.S. Threatens to Drag Economy Into Recession. Web.

Gorenstein, P. (2011). 20% Drop in Housing to Cause Recession in 2012, Says Gary Shilling. Daily Ticker.

Organization for Economic Co-operation and Development, (2010). Norway. Washington: Organization for Economic Cooperation & Development.

Rashkin, S. (2012). Retooling the U.S. housing industry: How it got here, why it’s broken, and how to fix it. Clifton Park, NY: Delmar.

Saft, J. (2011). Housing raises US recession alert. Reuters.

Standard & Poor’s Corporation. (2006). Standard & Poor’s 500 guide: 2006. New York: McGraw-Hill.

Warren, A. (2011). Global Real Estate Trends. Global Economic Research: 866-4315.

Weiss, M. D., & Weiss, M. D. (2011). The ultimate money guide for bubbles, busts, recession, and depression. Hoboken, N.J: Wiley.

Whalen, C. J. (2011). Financial instability and economic security after the great recession. Cheltenham: Edward Elgar.