Company Overview

United Arab Emirates (UAE) is a Gulf nation that has natural resources such as oil and gas in abundance. If we talk about the financial performance of the UAE, its GDP is the highest among all the Asian nations. The credit goes to the finding of the natural resources way back in 1960. Gas is one of the natural resources that play a crucial role in the development of the human race. Natural gas provides various opportunities for the research and development of science.

Due to its worldwide necessity and importance, I thought it feasible to shortlist DANA Gas to research and write about. “DANA Gas is the Middle East’s leading private sector natural gas company producing some 65,000 barrels of oil equivalent per day of oil, gas and natural gas liquids from its operations in Egypt and the Kurdistan Region of Iraq” (DANA Gas, 2013a, p. 1). DANA Gas started its operations in the year 2005 and has more than 300 well known “founder shareholders from across the Gulf Cooperation Council (GCC) region” (DANA Gas, 2013a, p. 1).

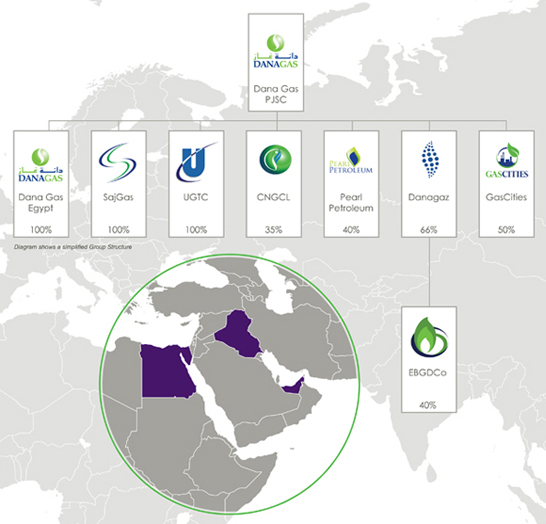

The organization has its head office in Sharjah, UAE, with branches all over the “Kurdistan Region of Iraq and Egypt” (DANA Gas, 2013a, p. 1). The DANA group consists of several companies where DANA Gas PJSC is either the sole owner or has a significant share. Following are the sister concerns of the group (DANA Gas, 2013d, p. 1):

- Dana Gas Egypt (100% ownership).

- SajGas, UGTC, and CNGCL, which collectively comprise the UAE Gas Project.

- Sajaa Gas Private Limited Company – SajGas (100% ownership).

- United Gas Transmissions Company Ltd – UGTC (100% ownership).

- Crescent Natural Gas Corporation Ltd – CNGCL (35% ownership).

- Pearl Petroleum Company Ltd (40% ownership).

- Danagaz Bahrain (66% ownership).

- Danagaz owns 40% of EBGDCo.

- GasCities (50% ownership).

The following chart depicts the group structure:

Strategic Posture

The following are the major shareholders of DANA Gas (DANA Gas, 2013f, p. 1):

- Crescent Petroleum – 20.12 %.

- Bank of Sharjah – 3.06 %.

- Khalid Abdul Rahman Saleh Al-Rajhi – 2.26 %.

- Government of Sharjah – 2.17 %.

- National Industrial Group – 2.16 %.

Vision and Mission

The vision of DANA Gas is, “To be the leading private sector natural gas company in the Middle East, North Africa, and South Asia (MENASA) region generating value for our stakeholders” (DANA Gas, 2013b, p. 1). The Chief Executive of DANA Gas states that “We explore and produce gas, but we are equally interested in building an integrated gas infrastructure throughout the midstream and downstream. I think that is exactly what countries in this region want – to develop their wider economics” (Al-Arbeed, 2010, p. 20).

According to Mr. Hamid Jafar, Executive Chairman of DANA Gas, the mission of the organization is, “to provide clean energy for our region’s tomorrow” (DANA Gas, 2013c, p. 1). The organization’s mission is at par with the aims and objectives of the World Economic Forum.

The statement of the Chief Executive of DANA Gas shows that the organization has a distinctive mission and vision. Stakeholders are the key participants of any organization’s growth. The stress of the organization on the overall economic growth shows that it is concerned about the benefit of its stakeholders as well. The vision and mission of the organization are clearly stated and it strives to fulfill the same. In pursuance of its mission and vision, DANA Gas is dedicated to the welfare of the world society and economic developments.

Objectives

DANA Gas has clearly “stated objectives to adopt and implement sustainable policies for best practice in the following areas: corporate governance, health, safety & environmental management, and corporate social responsibility” (JPMorgan, 2007, p. 141).

The objectives of DANA Gas are not consistent with its vision and mission because the objective of the organization is to fulfill its corporate social responsibility whereas the vision and mission statements of the organization include economic growth only. But it doesn’t mean that the organization doesn’t fulfill its corporate social responsibility. We are just relating the objectives of the organization to its vision and mission.

In my opinion, DANA Gas, in pursuing its objectives, is taking care of its external environment (the threats and the opportunities) perfectly. The organization is striving to become the world leader in gas production. In the process, the organization has to face several threats like competition from other major gas-producing companies in the world.

The organization also grabs any available opportunity that might help it in achieving its objective of becoming the world leader in gas production. Unfortunately, the objectives of the organization don’t have any mention of its taking care of the internal environment (the strengths and weaknesses).

Strategy

DANA Gas also has a distinctive strategy that has been laid out. The organization’s strategy requires it to “Focus on sustainable growth in the MENASA region across the natural gas value chain, leverage strategic relationships to maintain competitive advantage, and continuously enhance our technical skills to develop and operate assets safely and efficiently” (DANA Gas, 2013b, p. 1).

The strategy of DANA Gas also concentrates mainly on the economic growth of the organization. So the strategy of the organization is also not consistent with its vision and mission. The strategy indeed takes care of the external environments but there is no reference to the internal environments.

Values

The organization follows a moral code of conduct, in pursuance of which it devises its strategies that fulfill its social responsibilities as well. The organization’s official website states that “We set and apply the highest standards of conduct and accountability. We respect and value everyone and embrace all kinds of diversity. We strive to devise and implement ways to improve our business and fulfill our commitments” (DANA Gas, 2013b, p. 1). The organization also aims at making available a friendly working atmosphere for its employees. The organization also ensures that none of its activities proves to be harmful to society in any manner. The main criterion is to save the environment from being polluted.

Considering all the aforementioned points, it is clear that DANA Gas has a clearly defined vision, mission, objectives, strategies, and values. But it is also evident that the vision and mission of the organization are not in line with its objectives and strategies. On the other hand, the values of the organization articulate its intentions of taking care of the internal environments as well.

Board of Directors

The Board of Directors of DANA Gas comprises 18 members. Most of these members are prominent business people from the Gulf Cooperation Council countries. They have ample knowledge and experience of the oil and gas sector, a positive factor that helps in formulating future strategies.

Table 1. Board of Directors of DANA Gas.

Top Management

The top management at DANA Gas is responsible for the smooth flow of day to day business. Specific responsibilities of the top management include timely and secure deliveries, adhering to the annual budget, efficiently handling of the risk evaluation and management programs, and mitigations.

Table 2. Top management of DANA Gas.

Mr. Rashid Saif Al Jarwan “is the Executive Director and acting CEO of DANA Gas. He serves on the board of the Emirates General Petroleum Corporation (Emarat), Oman Insurance Company, and DIFC Investments (DIFCI)” (DANA Gas, 2013e, p. 1). He has vast experience of 35 years in the oil and gas field. He “holds a Bachelors Degree in Petroleum & Natural Gas Engineering from Pennsylvania State University, the USA” (DANA Gas, 2013e, p. 1).

Dr. Mohammed Nour El-Din El Taher has over 30 years of experience in the law field. He was previously General Counsel and Corporate Secretary at Arab Petroleum Investments Corporation (APICORP). He has also served as, “Associate Professor – Faculty of Law in University of Khartoum. LLB – University of Khartoum, LLM and Ph.D.- Cambridge University, the United Kingdom” (Estefane, 2011, p. 11).

Robinder Singh, “has over 20 years of international experience in investor relations, marketing, and corporate communications, product management and business development with Reliance Industries, HSBC, Bank of America and Lowe Lintas” (Trade Arabia, 2013, p. 1). Owing to his vast experience and working with major international organizations, Mr. Singh has the required competence to steer DANA Gas to new heights. His main concentration is in the investment sector.

Ranga Kishore is a certified Chartered Accountant from the Indian Institute of Chartered Accountants of India. He has also done his management from the Institute of Management Accountants. He has previously served as Manager – Sp. Projects at Aabar Petroleum PJSC, Finance Manager – E & P at Oman Oil SAOG, Finance Manager at Petrogas E & P LLC, Head of Accounts at Al Mansoori Sp. Engineering (Oil Field Services), and Senior Executive – Accounting at Chemplast Sanmar Limited. Ranga Kishore is serving as Head of Financing at DANA Gas since February 2008.

External Environment: Opportunities and Threats

Various factors have an impact on the performance of an organization. DANA Gas is no exception and as such, it is also prone to external and internal environments. We shall discuss the political, technological, financial, and socio-cultural aspects in detail in the ensuing paragraphs. But first, let us understand the other general factors that might have an impact on the performance of DANA Gas.

A rise in the cost of living will hurt the organization. The rise in the cost of living might lead to economic instability and as a result, DANA Gas might find it difficult to get its payments on time. The intervention of governments where DANA Gas has its businesses might pose a problem.

Various regulations, taxations, etc. might delay things and might increase the costs of production. Impediments in the issuance of new permits or renewals of existing permits might increase the costs. Some other factors might be a shortage of the required infrastructure, expropriation of assets by the governments, etc.

Political

“The success of DANA Gas depends in part upon understanding and managing the political, economic and market conditions in the many diverse economies around the MENASA region in which it does business” (DANA Gas, 2013g, p. 1). Moreover, since there are a lot of stakeholders who are interested in the performance of the organizations, it becomes all the more important for it to perform in a better way. Since there are various health hazards associated with the operations of the organization, the organization follows a strict risk management process.

The turmoil in Egypt has had a great negative impact on the stock prices of DANA Gas. The production of gas in this region experienced all-time low outcomes. Payments for DANA have been stopped and as a result, the organization is facing severe difficulties in clearing payments of its debtors.

History is witness that a majority of the wars that were fought between groups, tribes, or nations had a single motive – either to usurp fertile land or to acquire wealth. The present world has the same motives for war. Because the Gulf region is rich in oil and gas – and since oil and gas are essential sources of power and energy – the area is prone to the risks of war. Even though it cannot be predicted that a war or a similar event will take place, organizations have to be prepared if in case such incidents occur.

Consequently, it cannot be assured that DANA Gas will be able to sustain the impact of a war in the region. War means lots of chaos and in such circumstances, governments of the warring countries might not be interested or might not be in a position to clear the debts of DANA Gas. Such circumstances will not be in favor of DANA Gas and as such the organization has to be ready with some backup plan.

Legal

There are some developing countries where the laws about foreign investments are still in the process of being finalized. Such countries experience frequent changes in the laws and legalities required for doing business. So if DANA Gas wants to do business in such countries, it has to accept the fact documentations and other requirements might be delayed and as such, the costs may rise. There is no fixed economy in such countries.

Technological

Since the business of DANA Gas is dependent on underground products, it is very uncertain to predict the future of the organization. The organization must keep on exploring new oil fields so that future projects may be ascertained. Another important factor concerning future projects is that since exploration is done under the earth’s surface, it cannot be ensured as to how much expenditure will be incurred. So a fixed budget allocation doesn’t help. Time is yet another factor that is not certain. More than the expected time might be consumed in underground operations.

Another threat for the organization is that since the “business activities conducted by the Group are often conducted with joint venture partners; some assets are under the day-to-day management of these partners and may therefore be subject to risks that are outside the control of the Group” (DANA Gas, 2013g, p. 1).

Yet another threat is the health and safety issue of the workers. During the process of drilling and exploration, various hydrocarbons are transmitted which may lead to HSSE hazards. Such incidents might pose danger to the environment as well.

The potential for gas is highly dependent on technological developments. There are some areas (within the production process) where there is a need for improvement in the technology. New technology is required to contain some hazards that are still beyond control.

DANA Gas has to bear a lot of transportation costs (about the transportation of gas) at present. The new technology that might reduce the transportation cost will be a plus point and will increase the profit margins of the organization.

Financial

DANA Gas has experienced a lot of ups and downs during its existence. There was a time when people used to wait anxiously for an IPO of DANA Gas. People used to come from the surrounding nations to participate in the upcoming IPO. It was a time when DANA Gas had plans to import gas from Iran to fulfill the United Nations of Emirates’ demand for gas.

DANA Gas was considered to be a gold mine for investments and was seen at par with the Saudi Basic Industries Corporation of Saudi Arabia. But unfortunately, today’s scenario is different. Despite the oil prices touching the sky, DANA Gas’s share prices have tumbled down to as low as 40 fils – i.e. about 1/12th of the initial price.

The exploration of oil and gas needs time. The international market rates of currency and commodity keep on fluctuating. As such, the Group also faces financial risks such as “liquidity risk, exchange rate risk, credit risk, and commodity price risk” (DANA Gas, 2013g, p. 1).

The nonpayment of overdue amounts by the customers led to great financial constraints for DANA Gas. Billions of dollars became overdue and the organization faced a financial crunch. For example, the Egyptian government still owes about the US $230 million to the organization for the purchases made during the Egyptian turmoil.

One of the main concerns of DANA Gas, as far as the financial performance is concerned, is that given the financial crisis being faced by the organization, the Sharjah government is seriously contemplating to withdraw the gas subsidy unless the organization starts developing the gas field in the region (Yee, 2012, p. 1).

A greater problem for the organization is the non-compliance of an agreement by Iran. Under this agreement, Iran was supposed to supply gas to Dubai and the Northern Emirates. DANA Gas had promoted this idea as a revenue generator to attract investors in the IPO. But the idea flopped completely.

As far as the investors are concerned, they must consider the risks of war or similar incidents on their investments. Wars are not fought often but the risk is always there. So, keeping into consideration the risks of war, the investors have to decide whether their investments will be safe or not. Due to this very reason, some good investors desist from investing in the IPOs of DANA Gas. This proves to be a drawback for the organization.

Another issue that poses a challenge for the financial performance of DANA Gas is the UAE bankruptcy law. “In the event of DANA Gas insolvency, UAE bankruptcy law may adversely affect DANA Gas’s ability to perform under the Purchase Undertaking and therefore the Issuer’s ability to make payments to Certificate holders” (JPMorgan, 2007, p. 38).

The certificate holders of DANA Gas have to accept the risk of instability in the share prices. Since the price of Certificates depends on the prices of the shares, the Certificate prices are influenced by the share prices. Moreover, the rise or fall in share prices cannot be envisaged. A downfall in the share prices might have an unfavorable impact on the certificate holders.

Socio-cultural

While doing its business and in pursuance of its vision and mission, DANA Gas is committed to the welfare of the stakeholders as well. The society is one of the major stakeholders of DANA Gas. Society may be affected in various ways by the actions of the organizations. The most important is environmental pollution. As discussed earlier, the transmission of hydrocarbons during the production process poses a great health hazard for the society and the workers (also stakeholders). The organization follows strict measures to contain the pollution to the minimum.

To contribute towards the development of the community the organization works in, it contributes towards the communities’ development. The organization ensures that during the workings of the organization, the interests of the people of the community are not hampered in any manner. The organization, to fulfill its corporate social responsibility, conducts several socio beneficial programs.

The organization, despite the recent financial crunches and other problems, has not stepped back from the socio-cultural causes. The organization is committed to providing the stakeholders with a long time value.

DANA Gas is committed to its corporate social responsibility. It is this commitment that has inspired the organization to sponsor the ‘DANA Gas Chemical Engineer Chair’ at AUS. The organization has plans to continue the sponsorship till the year 2015. The organization also gives the ‘DANA Gas Excellence Awards’ to meritorious students each year. The organization also helps the children of poor communities to acquire proper education.

Opportunities

As far as the opportunities for DANA Gas are concerned, since the modern world is dependent on gas, to a great extent, there is a lot of scope for the organization in the future. There can never be a shortage of demand from across the globe. DANA Gas, being a major player in the gas sector, controls a major share of the gas supply market.

It is expected that the rise in oil prices will continue for the coming years. This is a good sign for DANA Gas. Gas energy is gradually, but firmly, becoming an energy source that can not be compromised with. The requirement for gas is increasing day by day and as such, the organizations engaged in the production of gas need to invest more funds in this field.

Conclusion

If we take the vision and mission of the organization, the socio-cultural sector is the most important one. On the contrary, if we consider the objectives and the strategies of the organization, the main sector seems to be the economic one.

So, generally, the financial sector and the socio-cultural sector seem to be the two most important sectors for the organization. It seems that the organization will never compromise on these two sectors. Society, being one of the most important stakeholders, is very crucial for the organization to ascertain future growth.

In this paper, we have discussed the importance of finance and the problems being faced due to the lack of the same. The organization is devising new strategies to tackle the current financial turmoil in a befitting manner.

According to me, the least important sector is the legal one. Even though it should not be misunderstood, the legal problems are not that intricate. There are well qualified and experienced people to look after such issues. The greatest challenge is being posed by the financial sector. The nonpayment of over dues by the customers has posed a great danger before the organization.

References

Al-Arbeed, A. (2010). Private Power. Web.

DANA Gas. (2013a). Overview. Web.

DANA Gas. (2013b). Vision, strategy and values. Web.

DANA Gas, (2013c). Dana Gas joins world economic forum community of global growth companies. Web.

DANA Gas. (2013d). Group Structure. Web.

DANA Gas. (2013e). Board of Directors. Web.

DANA Gas. (2013f). Governance. Web.

DANA Gas. (2013g). Risk Management. Web.

Estefane, J. (2011). Dana Gas. Web.

JPMorgan. (2007). Dana Gas Sukuk Limited. Web.

Trade Arabia. (2013).Dana Gas appoints new investor relations director. Web.

Yee, A. (2012). Where it all went wrong for Dana. Web.