Executive Summary

The objective of this paper is to make a strategic analysis of the functioning of Dollar Tree Inc, a discount variety merchandise retailer operating in the United States. The company is regarded as one of the top ranking player in the industry closely competed by firms like Family Dollar, Dollar General and 99 Cent Only. The analysis is designed to cover external analysis of the industry in which Dollar Tree is operating, internal analysis of the firm and strategic formulation for Dollar Tree Inc.

An analysis of the macroeconomic environment of United States, the discount variety retail industry and the operations of the major competitors of Dollar Tree is presented under external analysis segment. The macroeconomic analysis identifies three distinct changes during the period of last five years; rapid industrialization of China and the expansion in the service industry of India and the resultant growth in these emerging economies have a significant impact on the economic conditions of United States, Secondly the growth of baby boomer population while provides enhanced sales growth opportunities for the retailers also makes a serious impact on the economy by increased government spending on social security costs. The third change in the form of phenomenal growth in the users of internet has proved to be an opportunity for growth of online marketing and advertising.

Industry analysis was conducted based on the Five Forces Model advocated by Porter. This analysis suggests low barriers to entry, poor bargaining power of suppliers, high impact of customer power, moderate threat from substitute products and stiff competition from the rivals.

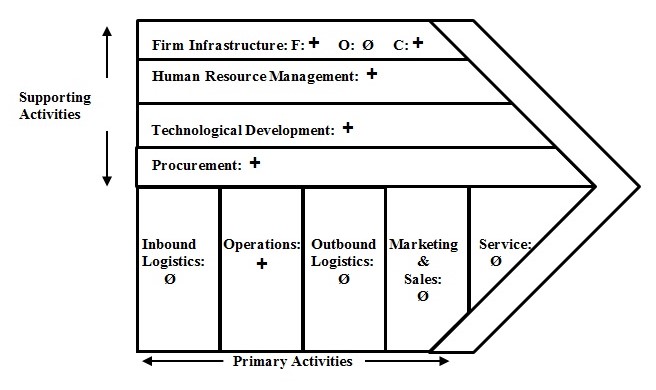

Analysis of financial results of the company, value chain analysis and VIRO analysis formed the internal analysis of the firm. The value chain analysis made a comparison of the values of Dollar Tree and Family Dollar for commenting on the relative position of Dollar Tree. The analysis suggests an improved performance of Dollar Trees in the areas of operating performance.

The company appears to be better placed in the areas of human resources management, technological development and efficiency of marketing and sales functions as compared to Family Dollar. Resources of Dollar Tree are its established presence in more number of locations and an efficient supply chain.

Metrics and histories for the company have been measured by turnover figures, net income, Return on Assets (ROA), Return on Equity (ROE) and sales per square footage for the past three year period. The metrics indicate a progressive growth of the company during the period reviewed.

Sales of the company Dollar city will be impacted by population growth and changes in consumer habits are the major factors that influence the demand for the products being offered by Dollar Tree. The recessionary trends in the economy and seasonal factors also influence the demand for the products of Dollar Tree.

Store expansion and new store opening are the business strategies being adopted by Dollar Tree for the growth of its business. Offering added value to the customers through the variety of products offering is also adopted as one of the business strategies by the company.

The low cost strategic options of improving the supply chain efficiency, internet marketing and sales promotion and expanding the private label merchandise have been recommended for achieving future sales growth by the company. Improving efficiency of the supply chain by focusing on the key sustainability aspects has also been recommended.

Introduction

Company Profile

Founded in the year 1986 as Dollar Tree Stores the company restructured and started operating with the name of Dollar Tree Incorporation effective March 2008 (AOLMoney&Finance, 2008) is one of the leading deep discount stores. The company operating through its 3,572 stores (as of November 1 2008) is offering wide assortment of general merchandise at a fixed price of $ 1.00 in most cases. The company offers variety of merchandise including consumables like candy and food, health and beauty care and household items, seasonal goods and variety merchandise like toys, durable house-wares, gifts, hardware and numerous other items. About 3,400 stores operating under the name of Dollar Tree and Dollar Bills sells substantial merchandise at $ 1.00 or less. The other stores operating under the name of Deal $ offers most of the merchandise at $ 1.00 or less; some of the items are sold for more than $ 1.00 (Standard&Poor’s, 2008).

The motto of the company is to surpass the customer expectations on the range and quality of merchandise that they can buy for $ 1.00. Buying of about 55% to 60% of the goods being dealt with by the company are sourced domestically with the balance being imported mainly from China. The company maintains direct relationships with the manufacturers that help the company to enjoy the advantage of a large selection of products and customized packaging. The company because of this relationship is able to manage the suppliers delivering large sizes and higher packaged quantities (Standard&Poor’s, 2008). These stores are being operated under various names that include “Dollar Tree, Dollar Bills, Dollar Express, Only One Dollar and Only $One” (Corporate Information, 2008)

Business Model

The company functions under the deep discounter retailing in which the inventory is comprised largely of frequently changing selection of brands and merchandise picked up at well below the original wholesale costs from closeouts and manufacturer overruns. The other portion of the merchandise is procured on a wholesale basis from selected supply sources regularly (Standard&Poor’s, November 2008). The stores are located in high-traffic strip centers anchored by mass merchandisers and supermarkets, malls, and in small towns. (AOLMoney&Finance, 2008) The business model of deep discount retailing works with the policy of transferring the benefits of lower costs to the consumers.

Corporate Strategy

The primary growth strategy of Dollar Stores Inc is to enlarge the operations by expanding through new store openings in the locations which remain un-served by it. In order to increase the customer base and repeat customer traffic the company quite often changes the product mix by introducing more consumables and changed its policy in receiving payments through cash to receiving payments through credit cards also. The company believes that the mix of imported and domestic products being offered by the company enhances the flexibility of the buyers and thereby enables the company to exceed the expectation of the buyers. Dollar Tree Inc also believes in an optimal store size of between 10,000 and 12,500 square feet. According to this policy the company has made changes the floor size of the stores. As of February 2008 only 14% of the stores (40% of the stores as of 31st January 2004) were having less than 6000 square feet. The company has increased the selling square footage from 16.9 million square feet in January 2004 to 28.4 million square feet in February 2008 (Family Dollar Stores Inc Form 10-K, 2008).

The company has reported a turnover of $ 4.24 billion for the fiscal year 2007 ($ 3.97 billion for fiscal year 2006) and a net earning of $201.3 for fiscal year 2007 ($ 192.0 million for fiscal year 2006) (AOLMoney&Finance, 2008).

External Analysis

An integrated understanding of the external and internal environments is essential for the firms to understand the present and predict the future and to accordingly formulate their strategies. The external analysis generally comprises of macro environment analysis, industry analysis and competitor analysis.

Macro Environment Analysis

Changes in the macro environment influence organizations in an industry, a market or yet, all organizations in an economy. (Chapter 6) General merchandise stores as Dollar Tree are classified as mature and cyclical industry with aggregate sales depending largely on the real GDP growth of the economy. A macro environment analysis is usually carried out by studying changes in economic, political, technological, legal, socio-cultural and demographic trends. In the recent past the US economy has been affected at the macro level with three significant factors:

- development of the emerging economies of China and India,

- rapid improvements in information technology – resulting in enlargement in the utilization of internet and ecommerce;

- significant changes in the demographic conditions of the United States with the growth in the number of baby boomers and Hispanics.

Role of Chinese and Indian Economies

The rapid economic progress in the emerging economies of China and India has had its impact on the retail industry in the US. The Chinese economy is more integrated with the world economy through enhanced international trade and investment which had helped its strong growth of its Gross Domestic Product (GDP) over the past three decades. Similarly India has emerged as another country with a rapid growth in the GDP. While China depends on industry for its economic development India relies on the service sector. (Deutsche Bank Research, 2005) The rapid growth of GDP of both countries compared with the global GDP growth is presented in the following graph.

According to the World Bank report China has the fastest acceleration in its economic growth in the past decade. (World Bank Report, 2008) Since the inception of economic reforms in 1979 the real GDP of China has increased at an average annual rate of 9.8% while the real GDP growth for the year 2007 was 11.4% which was the fastest since 1994. In 2007 exports from China was at $ 1,218 billion which was higher than the US exports of $1,162 billion. China emerged as the largest foreign exchange reserve holder at $ 1.5 trillion as at the end of 2007. (Morrison, 2008) While on one hand US consumers, exporters and investors have greatly been benefitted from the rapid economic growth of China, the surge in the Chinese exports to the US has put competitive pressure on major US Industries.

The increased activity in the service industry in India has attracted a number of US Companies to set up offshore subcontracting of their information system requirements from India. This has resulted in the reduction of employment opportunities in the US in the service industry. The large consumer base in these two countries and the ever increasing consumerism in these markets on which the growth of the economies of all advanced nations depend have had its impact on the functioning of other world economies including that of the United States (Sangani, 2008).

Growth in Internet Users

The next important factor that affects the macro environment is the rapid development of information technology which has resulted in enhanced usage of internet and ecommerce. Changes in information technology have led to major changes in internet usage and significant developments in mobile technology. With the increased use of the internet and other information technology developments, firms have found new ways of meeting the customer demands and communicating with the customers. Instant business decisions are made possible by communicating through the internet. The following table illustrates the growth of internet usage between the year 2000 and 2008 in respect of the top five countries in the world. The statistics is updated as of 30th June 2008.

It may be observed from the table, the United States ranks second next to China with the maximum numbers of internet users. With the increased number of internet users there is an all around increase in the online commercial activities. This has its impact on the retail market also as more people have started using the internet for their shopping of different products. The phenomenal growth in online spending may be observed from the fact that the volume of online spending has increased by 177.6%. The value of sales in the year 2000 was $ 63.2 billion which has increased to $ 217.9 billion in 2006. (Euromonitor, 2008).

Changes in Demographic Trends in the United States

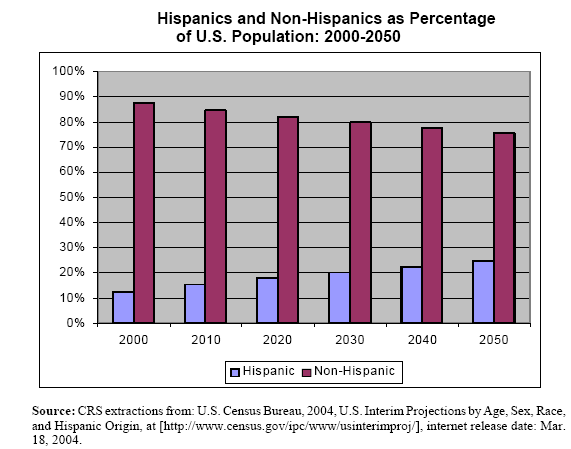

Demographic changes in the United States will have major implications on the economic development of the country. The declining birth rates and increasing number of pensioners may have an adverse impact on the economy with enlarged health care spending and social security costs. The statistics provided by the Centers for Disease Control and Prevention and the Administration on Aging has estimated the number of people older than 65 years will increase from the present 12.4% to almost 20% by the year 2030. This will have serious economic implications in the form of increased government spending and consequent pressure on the tax payers. The next demographic factor that affects the US economy is the increase in the ratio of Hispanic population to that of non-Hispanic. As shown in the graph the Hispanic population is progressively increasing and as per the CSR Report (2006) the Hispanic population is expected to increase from 12.6% in the year 2000 to 24.4% in 2050.

Both of these factors have an adverse impact on the US economy. The increase of Americans aged above 65 years has been estimated at 37.9 million people which accounts of 12.6% of the American population as of the year 2007. (Euromonitor, 2008a) The increase in this segment of the population has affected the US economy in terms of purchasing power as well as by the increase in the government expenditure. The increased Hispanic population has resulted in about 15% of the American population is constituted by Hispanic and in absoulte terms, 44.3 million people were Hispanic as of 2006. This has surely affected the structure of the labor force in the United States.

Industry Analysis

Discount variety retail industry has an annual turnover of $ 420 billion with approximately 40,000 stores operating all over the United States. (FirstResearchInc, October 2007) The industry is characterized by stiff competition in terms of prices, low barriers to entry, and absolutely no switching costs for the customers.

Porter’s Five Forces

Threat from New Entrants – Moderately Low

The capital cost of entry, the scale economies, product and price differentiation, switching costs, the expected retaliation from the existing player, legislative measures and access to the distribution channels is some of the factors that influence the ease of the new entrants. There are no established laws or regulations to govern the retail business model as that of Dollar Tree. Therefore the industry offers enough opportunities for new entrants. However, sourcing the products at lower prices to make adequate profits is really a tough proposition. Therefore there exists some amount of barriers to new entrants.

Bargaining Power of Buyers – Low

Any variation in the price or quality will induce the customers to look for an alternative source of supply, if there is no switching cost involved when the buyers change products. In fact, in the industry environment in which Dollar tree is operating there is no case of bargaining power of the buyers as all the products are sold at a price of around $ 1 per product. There is virtually no customer loyalty existing for the firms operating in the industry.

Bargaining Power of Suppliers – Low

The factors that determine the bargaining power of suppliers is the level of importance the buyer attaches to the supplier and the switching costs for the buyer to source from the alternative sources of supply. Normally the operators in the market source their products from China. Supply sources are abundant in China and therefore the suppliers do not possess any bargaining power over the market players. In general the firms acting in the industry enter in to agreements with the suppliers one year in advance (Need to add Reference). This gives the firms enough time to source from other sources if at all there is any price increase.

Threat from Substitute Products – Moderate

The price and quality of the products determine the shift in the consumer demand to the plenty of alternatives available in the retail industry. There is threat of substitution from branded products. However due to the recent economic situation firms in the industry is able to provide cheaper substitutes to those people who ‘trade down’. But when the economic conditions revive these customers may revert back to their original favorites of branded products. (InternationalBusinessTimes, 2008).

Extent of Competitive Rivalry – High

The industry is characterized by intensive competitive rivalry in the absence of customer loyalty. The competition is more pronounced in the current economic scenario. However one competitive edge for Dollar Tree is that the company has maintained the policy of selling its products at $1. This enables the company to overcome the competition from other similar players operating in the industry. (DollarTreeForm10K, 2008)

Competitor Analysis

Retail sales are directly related to consumer spending and therefore related to a large extent on the well-being of the economy. Recent changes in the economic environment actually act favorably to Dollar Tree and several other similar discount stores. Therefore, severe competition presently exists in the market. This analysis of the competitors of Dollar Tree discusses the relative position of three major competitors of Dollar Tree and presents their current strategies to sustain market share.

Dollar General

Dollar General is the market leader having the number one position in the General Merchandising Store market. The company operates about 8200 stores in about 35 states. The company has a marketing strategy of locating their stores in smaller towns where they are located far from other giant discount stores. The company does not incur any advertising costs because of their unique locations. In larger cities the stores of Dollar General are located in lower income areas. In the year 2007 stakes in Dollar General were acquired by affiliates of JJR and Goldman Sachs (Dollar General 10k 2007).

The competitiveness of the market will also be affected by factors like (i) the number of competitors present in the market and the degree of their concentration, (ii) rate at which the industry grows, (iii) the cost structure of the firms, (iv) the exit costs – when the exit costs are high the firms would like to stay back in the market by accepting lower margins.

Family Dollar

Founded in the year 1959 Family Dollar is the second largest dollar store in the US operating with more than 6500 stores in 44 states. Family Dollar sells food, health and beauty products, household products, clothing, shoes and linens. According to Neilson’s 2008 Homescan data approximately 44% of the customers of Family Dollar had annual gross income of less than $ 30,000 and approximately 26% of the customers had an annual gross income of less than $ 20,000. Approximately 33% of the customers of Family Dollar were African Americans or Hispanic and approximately 61% of the customers were under the age of 55. (Form 10-K, 2008) The products are priced between $1 and $ 10. The stores are located in places where low and middle income consumers are concentrated. Due to the increased competition from super stores like Wal-Mart Family dollar has to make strategic changes in the product pricing and with simultaneous increase of the number of brand items it deals with. Expansion is the growth strategy being followed by Family Dollar. The company made net sales of $ 6.98 billion for the year ended August 30, 2008. (Form 10-K, 2008).

99 Cent Only

The company sells its product at 99 cents or less. With about 265 store locations they are more concentrated in Southern California, Central California, Las Vegas, Phoenix and Texas. The company sells wide range of consumer goods and different first-quality closeout merchandise. The company operates two business segments namely retail operations and wholesale distribution. The company wants to expand its presence in other locations by selling select branded products like Colgate-Palmolive, Johnson & Johnson and Kellogg. Attractive merchandise and well-maintained stores are the unique selling points of 99 cent only store. The company has made a turnover of close to $ 1.2 billion for the year ended 29th March 2008 (99 ent Only Form 10-K, 2008).

Internal Analysis

Financial Analysis

The financial standing of Dollar Tree is compared with those of main competitors. The financial performance for the year 2007 for all the companies is compared on the basis of liquidity, profitability, debt management, and asset management.

Liquidity

With a current ratio of 1.94 Dollar Tree can be considered as a fairly liquid company and as compared to Family Dollar also the ratio appears to be significantly high. However the quick ratio is less than that of the Family Dollar. This is due to the reason that there was a drop in the cash which was caused by a share buyback without compensating by corresponding increase in the long-term debt. Though the current ratio of 99 Cent only is higher this firm is not comparable in volume with Dollar tree.

Profitability

The figures exhibited in the table are all self-explanatory with Dollar Tree being in a leading position in terms of operating margin, gross margin, profit margin and ROA. On an overall analysis Dollar Tree is a profitable company in comparison with the competitors.

Debt Management

The debt equity ratio as compared to that of Family Dollar is low which implies that the company is comfortably leveraged. However the interest coverage is not as good as Family Dollar.

Asset Management

The asset management of Dollar Tree as compared with that of the competitors cannot be said to be in a comfortable position as it appears from the figures for the year 2007 depicted above.

Value Chain Analysis

As a part of the internal analysis value chain analysis of Dollar Tree was undertaken comparing the primary and support activities of the company with Family Dollar General. Family Dollar is chosen for comparing the activities due to the reason that Family Dollar is the keen competitor to Dollar Tree with more or less identical product lines and pricing strategy. The comparison is made on the basis of the publicly available figures for both the companies for a comparable period.

Dollar Tree – Value Chain Chart

Primary Activities

Inbound Logistics – Neutral (Ø)

Dollar Tree and competitors are supplied from various sources of domestic and foreign suppliers mainly with term agreements and primarily at market-related prices. Suppliers are plentiful. More than 55% – 60% of the products are sourced from within the United States (DollarTreeForm10K). Although this gives the inbound logistics activity a positive indication there is a substatial proprotion of the merchandise is getting imported which are subject to the vulnearbiliies of natural calamities and political climates in the exporting country. This will have a significant impact on the inbound logistics of Dollar Tree. The company Family Dollar is also importing a significant amount of merchandise throuhg imports (FamilyDollarsInc.From10K). Therefore the activity of inbound logistics in Dollar Tree is comparable with that of Family Dollar and therefore the value of for this activiy is maintained as neutral.

Operations – Positive (+)

At January 31, 2004, Dollar Tree operated 2,513 stores in 47 states and as at 1st November, 2008, operated 3,572 stores in 48 states. (Standard&Poor’s, November 2008) Selling square footage increased from approximately 16.9 million square feet in January 2004 to 28.4 million square feet in February 2008. Store growth since 2003 has resulted from opening new stores and completing mergers and acquisitions. (Dollar Tree 10k, 2008) The growth in the number of stores was 5.96% in the fiscal year 2007 as compared to that of the year 2006. The sales per square foot for Dollar Tree are $ 161 as against $ 150.86 of Family Dollars. The comparative store sales growth is 2.70% for the fiscal year 2007 for Dollar Tree as compared to 0.90% of Family Dollar (Lou & Nguyen, 2008). The operating margin in the case of Dollar Tree for the fiscal year 2007 is higher at 7.79% than 5.50% achieved by Family Dollar. Therefore even though Family Dollar is operating more number of stores around 6500 (FamilyDollarsInc.From10K) the ‘operations’ activity of Dollar Tree is accorded a ‘positive’ value.

Outbound Logistics – Neutral (Ø)

Most of the companies in the discount variety merchandising follow more or less similar packaging methods and the customers take delivery of the merchandise at various store location of the firms operating. The firms in arrangement with their suppliers are able to get customized packaging (DollarTreeForm10K, 2008) and therefore there is nothing much for the stores to do on outbound logistics except inter-store transfers. Hence the value for outbound logistics for Dollar Tree is taken as neutral.

Marketing and Sales – Neutral (Ø)

Discount variety retail store like Family Dollar and Dollar Tree are competing for sales and store locations in different degrees of intensity with retail establishments operating on national, regional and local levels that includes “discount stores, department stores, variety stores, dollar stores, discount clothing stores, drug stores, grocery stores, convenience stores, outlet stores, warehouse stores, and other stores” (FamilyDollarsInc.From10K, 2008). In order to meet this highr level of competition almost all the companies in the market operate in similar fashion in terms of Marketing and sales which are low key compared to larger stores like Wal-Mart. The advertising and marketing strategies are also more or less similar for all the firms. Therefore the value is taken as ‘neutral’ for Dollar Stores. It can reasonably be assumed the same for Family Dollar also.

Services – Neutral (Ø)

The firms operating in the industry do not seem to have evolved any distinct policies on sales returns, guarantees or warranties on the products sold by them since the price of the products is too low to support any of these services. These companies are not in a position to offer any value added service to the customers with the kind of prices being offered by the stores. Therefore the value is taken as neutral for services.

Support Activities

Firm Infrastructure

Firm infrastructure is considered in three different parts: financial management, organizational infrastructure, and culture.

Financial Management – Positive (+)

The financial strength of the firms can be judged on the basis of liquidity position as well as the relative position of debts to equity of the firms. For Dollar Tree the current ratio is at 1.94 as against that of 1.36 of Family Dollar, while the industry standard is 1.48. The debt to equity ratio is also better for Dollar Tree at 0.81 where as it is 1.23 in the case of Family Dollar (Lou & Nguyen, 2008). In view of this strong financial position maintained by Dollar Tree as compared to Family Dollars the support activity of ‘financial management’ is given positive rating.

Organizational Structure – Neutral (Ø)

Dollar Tree is managed by a board constituted with directors having professional background. The company operates with the policy of encouraging teams which are cross-functional and multi-layered. There is no strict hierarchical structure. The managers are given the autonomy to merchandise the products that they feel will apply to specific customer segments. Dollar Tree in general is a type of flexible organization where the employees are allowed to deliver best results (DollarTree, 2008). Since Family Dollar is more or less following similar organizational structure and policies this report award a ‘neutral’ value to the organizational structure of Dollar Tree.

Culture – Positive (+)

Dollar Tree has built up a corporate culture that is embedded with the organizational core values of “honesty and integrity, doing the right thing for the right reason and treating people fairly and with respect” (AnnualReport). The management team has developed the practice of visiting the shops and stores to find out whether they are functioning effectively. The management of Dollar Tree claims that it has an open door policy for all the employees and encourage their ideas. In the case of Family Dollar no explicit information could be found on the organizational Culture. Therefore the support activity of ‘culture’ in Dollar Tree is given a ‘neutral’ value.

Human Resource Management – Positive (+)

42,000 employees working in Dollar Tree have contributed to the happening of 550 million transactions throughout the 3,411 stores during the fiscal year 2007 (AnnualReport).The company treats every person and job as important and the employees are treated with high respect. The company has realized that unless there is teamwork the growth of the company to this level could not have been accomplished. Dollar Tree employed 13,300 full time employee and 29,300 part-time employees as of 2nd August 2008 (DollarTreeForm10K, 2008). For the size and number of stores Family Dollar employed only 25,000 full time employees and 19,000 part time employees (FamilyDollarsInc.From10K, 2008) to manage the business in the 6,500 stores which appears to be a little lower side on the number of employees to store ratio as compared to that of Dollar Tree. Hence a ‘positive’ value is assigned to human resources activity of Dollar Tree.

Technological Development – Positive (+)

Point of sale (POS) technology adopted by Dollar Tree enabled the company to gather valuable sales information on the customer preferences. The information on inventory also enabled the company to manage their inventories efficiently. By the use of improved technology the inventory turnover of the company has increased approximately 25 basis points for the year 2007 as compared to 2006 and 45 basis points in the year 2006 with 2005 as the base year. (AnnualReport) Since comparable data and information cannot be gathered for Family Dollar it is assumed the technological development with respect to the systems in Dollar are assumed to be keeping with the requirements of time and the value is taken as positive.

Procurement- Positive (+)

Although no definite quantitative information should be gathered on the contracts or other arrangements with the domestic and overseas suppliers for procurement of different merchandise it is learnt that Dollar Tree makes agreements with Chinese suppliers at least one year in advance. This insulates the company from any probable price increase in the merchandise. Even if there is an increase in the prices the company will have sufficient time to try and find alternative sources. Therefore the procurement activity is given a positive value.

VRIO Analysis

Resource Based View Analysis (VRIO)

VRIO analysis indicates what strategically valuable resources are in a company. These resources are likely to support the company to build its core competencies and compete with its competitors.

Resource Based View of Dollar Tree

Inventory Management Systems

With discount retailers operating in low margins one of the best resources the companies have is to cut down their inventory carrying costs and the cost of bringing the merchandise to the shelf. The inventory management system should also take care of an economic distribution of merchandise among the number of stores spread in various states. In this respect Dollar Tree has an efficient inventory management system that enables the company to reduce the cost of the company by keeping the inventory at very optimal levels. Each of the distribution centers of the company has implemented “advanced material handling technologies including radio-frequency inventory tracking equipments and specialized information systems” (DollarTreeForm10K, 2008) The company could see tangible improvements in the inventory management system and this is evidenced by the fact that the company reporting an increase in the inventory turnover (AnnualReport). Therefore invenory management system is considered as one of the resources that is being used by the company to improve upon the profitability.

Pricing Strategy

As discussed elsewhere in this report Dollar Tree has a consistent pricing strategy of offering a variety of product mix at the $ 1 price point. This has attracted many customers to the shop especially in the recent economic trend. The impact of this resource can be seen from the following sales information.

Sales and Net Income Growth for Quarter 3 – Dollar Tree

Dollar Tree has reported total sales revenue of $ 1.093 billion for the third quarter 2008 which has registered an increase of 11.6% as compared to the corresponding period in the year 2007. There has been a growth of 15.3% in the net income for the same period. (DollarTree, 2008).

The significant growth in sales was due to increase in the store traffic and larger average transactions which is the direct impact of the consistent pricing strategy of Dollar Tree.

Store Locations

As part of the business strategy Dollar Stores always tries to locate their stores in smaller towns where they are situated away from other superstores and large supermarket chains. This can be seen as a distinct resource available to the company (Lou & Nguyen, 2008). This has enabled the company to improve upon the sales growth as well as in the customer traffic. The policy of the company to have a large retail store space also helps the company to have a large variety of merchandise in such locations.

SWOT Analysis

Strengths

- Dollar tree has the unique business policy of keeping the price stable for all their products a $1. Almost all other competitors have applied multiple level of pricing. This enhances the value of Dollar Tree among the customers as they are sure of what to buy in Dollar Tree.

- Since the company follows a fixed price policy to stand true to their image they have to run the company more efficiently and it is happening in reality. This enhances the company’s profitability.

- The company is financially very strong in comparison with the other players in the industry and with the industry average.

Weaknesses

- The company has somewhat poor day’s sale inventory as compared to their competitors. This would affect the sales growth of the company.

- Over the past years there has been a steady increase in the debt to equity ratio which implies that the financial risk of the company is increasing.

Opportunities

- With the present economic scenario, many of the customers would be looking for cheaper goods with more value. This places Dollar Tree in an advantageous position as they can increase their product offerings in basic consumables and enhance their economic benefits. This is a unique opportunity available to Dollar Tree and other general merchandise companies.

- The recent acquisition of Deal$ enables the company to offer newer products at reasonably higher prices without affecting the brand image of Dollar Tree.

- Performance of Deal$ is much higher than that of Dollar Tree as evidenced by the sales growth in the second quarter of 2008. Dollar Tree can use this company to its best advantage.

- The idea of the company to expand into refrigeration/freezer products will enhance the profits as the company can provide more varieties of products to the customer.

- Dollar Tree as a deviation from its policy has started accepting all major credit cards which is sure to add up its business.

Threats

- The company and many others in the industry imports majority of the products from China and with the development of Chinese economy there is greater currency exchange risk

- The company and the industry may have to take a beating as the chain stores and other super markets indulge in aggressive price reductions to maintain their market share. This may affect the sales and profits of Dollar Tree and others in the industry.

Metrics and Histories Analysis

Dollar Tree has reported total sales revenue of $ 4,243 billion for the fiscal year ended 31st January 2008 which has registered an increase of 6.90 % over the sales for the fiscal year 2007. There has been a growth of 4.69 % in the net income for the same period. (DollarTree, 2008)

The significant growth in sales was due to increase in the store traffic and larger average transactions. Sale of Halloween merchandise and essential merchandise that appeal to the customers in the current macroeconomic environment. (AOLMoney, 2008) The other metrics of Return on Assets (ROA) and Return on Equity (ROE) show an increasing trend over the past three years. However there has been a dip in the sales per selling square foot for the fiscal year 2007 as compared to the year 2006. However this has been made up in the year fiscal year ended 31st January 2008.

Strategy Formulation

Vision, Mission, Goals and Objectives

The mission statement of Dollar Tree stresses the important organizational objectives of customer-orientation and the price point. Empowerment of the associates and honest and considerate dealings with the third parties has also been stressed in the mission statement of the company. At the same time the company has included the ‘controlled profitability’ objective also in the mission (DollarTree, Mission & Values).

Market Demand

Population growth and changes in consumer tastes are the basic factors that determine demand for the industry. Since the profit margins are relatively low the firms in the industry can make profits only on higher volumes and efficient operations. It is possible for the large companies to have the advantages of offering wide range of choice to the customers and they can also enjoy economies in purchasing, distribution, marketing and finance.

Since core of the basic merchandise in the consumables tend to be the same, the retailers in the industry are bound to compete on the price points only. Increased sourcing out of close-out buys and direct souring have enabled Dollar Tree to offer low price and increase the sales volume. This has created a high value proposition for the customers. (Standard&Poor’s, November 2008).

Market demand in the discount variety retail industry cannot be said to be absolutely elastic or inelastic as the demand depends on population changes and change in consumer preferences. It also depends on the product offerings by the firms in the industry. Competition with superstores and chain stores selling branded products sometimes make the demand for the discount store products more price elastic. Consumers for these types of stores are highly price sensitive and therefore added value to the products mostly determines the demand. Therefore the market demand for the discount variety merchandise retail products can be said to be this industry is close to the unity demand curve

Generic Strategies

Business strategies of Dollar Tree include offering value merchandise to the customers and to have a proper mix of merchandise so that the firm can offer better choices to the customers. The business model of Dollar Tree strives to exceed the expectations of its customers over the scope and quality of the products that they can purchase for $ 1 by offering items that the management believes would cost the customers high anywhere else (DollarTreeForm10K, 2008). As growth strategy the company adopts the policy of enlarging the store openings and incrase in suare footage.The company believes that much of its future sales growth depends on the focus towards new store opening, store expansion and relocation programs. In line with this strategy the company has increased the number of stores form 2,513 in the year 2003 to 3,572 in 2008 (DollarTreeForm10K, 2008). This represents a compounded annual growth rate of 8%.The company has also made it a point to enlarge the average Selling Square Footage per store.

Enhancing the competittve strength through mergers and acquisitions is another distinct growth strategy being adopted by the company over the period. In the fiscal year 2007 the company made the acquisition of 138 store of Deal$-Nothing Over a Dollar chain that operates in 16 states.

Competitive Dynamic

Firms in the discount variety retail industry face a stiff competition with each other mainly because the core of the consumable products are more or less similar or procured from identical sources. Apart from the price factor the number of choices of the products and the quality of them determine the customer traffic. Those firms entered the industry early enjoy the first mover advantages and compete strongly with the other firms recently entered the industry. However there are other strategic actions taken by the firms to attract the customers like discount offers and freebies. Promotional activities and loyalty coupons sometimes make the way for increased customer traffic. Firms also invest large sums in information technological improvements in the supply chain to get the products to the shelves cheaper. New store openings in un-served locations are another strategic option being followed by the firms to avoid competition. Increase in the private label merchandise not only brings cost advantage to the firms but also enables them to offer better quality merchandise to them.

Business Strategies

Strategic Option 1: Status-Quo – Do Nothing

Under this strategic option the company Dollar Tree will not go in for any new strategies to be adopted but will pursue the existing strategies of store expansion and changing the product mix to increase the product value to the consumers. The merits of status quo is that the company can reap the benefits of the money already invested in the new store openings during the future period when the economic recession results in enhanced sales for the company. However the company has to think of overcoming the competition from other players in the industry and the impact of the revival of the economy in the future when the consumers who trade-down now will go back to their original preferences of branded items.

Strategic Option 2: Revise the Strategy to Move Backward or Low Cost Strategy

This strategic option advocates Dollar Tree to maintain its current position in the industry and at the same time take strategic actions to improve upon its working. This option identifies itself to project Dollar Tree as a low cost company and that is the advantage of this strategic option. Bringing up improvements in the supply chain management and making it sustainable is one option that Dollar Tree can look into under this head. The company by doing this can reduce the cost of bringing the merchandise to the shelf and the cost advantage can be passed on to the customers to increase the customer base. The second strategic action that the company can look into is to increase its presence in the online market place. This will position the company in a strategically advantageous position to ensure an enlarged consumer reach of its promotional activities. The third option would be to increase the number of items that the company supplies in its own label especially in grocery. This ensures cost advantages to the company and quality products to the consumers.

Strategic Option 3: Revise the Strategy to go forward to Differentiation

This option envisages Dollar Tree to go in for product differentiation and change the pricing strategies. The company can make product offerings of more specialty products and move away from the concept of $ 1 price point. Another option that can be considered under this category is to expansion into international markets like Canada. These alternatives will become more experimental and involve additional costs and manpower. The company will enter into unknown product ranges and unknown market areas. With the present economic scenario it is absolutely not advisable that the company goes into any of these strategic options.

Recommendations

Based on the above discussions the recommendation for Dollar Tree is to pursue low cost strategic option 2. In order that Dollar Tree sustains its sales, profit and growth it should concentrate on certain key sustainable capabilities in its supply chain like:

- higher in-stocks,

- accountable vendors/partner,

- increased inventory velocity,

- Flexible capacity,

- lower shelf-landed costs,

- import and private label sourcing,

- flexibility. (Rogers & Rogers).

Therefore this report stresses the importance of Dollar Tree concentrating on these key sustainable capabilities on the supply downstream. On the marketing upstream the recommendations are increased focus on the internet marketing strategies and increased private label merchandising.

According to Scarborough research almost 11 percent of the people in the US go online to get grocery coupons. This increase has been estimated at 83% of the figure in the year 2005. (Sacrborough, 2008) Therefore Dollar Tree can rethink its marketing and advertising strategies. Places like mails, in-store coupons, customer loyalty cards, product packages, daily newspapers and magazines are some of the other ones the shoppers look for deals. Dollar tree can look in to these avenues to enhance the customer base. (Hoovers, 2008).

One of the Nielsen’s reports indicates that there is a marked increase in the private label penetration. According to the report while the growth rate of manufacturers’ brand is 2% the private label grew by 10.2% for the year 2008. While private label accounted for $ 81 billion sales in the US 63% of the consumers surveyed believe that the brand quality of the private label is as good as name brands (Wong, 2008). Therefore Dollar Tree should concentrate on selling more products with their private labels.

Strategy Implementation

Strengthen Supply Chain

In order to gain competitive strength Dollar Tree has to strengthen its supply chain and improve the efficiency of the supply chain management. To improve upon the efficiency and to maintain the key values of sustainability the company has to increase its exposure on the latest information technology (IT). By investing more in the IT functions the company would be able to operate more effectively to manage its inventories better and to get its products to its shelves more quickly. The company can further lower the cost of procuring its merchandise and offer low prices to the customers to increase the traffic.

Change the Advertising Strategy

The company has to increase its visibility in the internet by making its website attractive. Banner ads which make the name of the company appear in all major websites will promote the growth of sales of the company. Free and discount coupons to the people visiting the online marketing website of the company can be considered as the best option to increase the customer traffic to the stores. As it is today’s trend that most of the consumers look for discount coupons on the internet and various other print media the company should make use of the opportunity to attract new customers by offering them discount and freebies on purchases exceeding certain amounts. This offer can be made through internet.

Expansion of Private Label Merchandise

As per the industry survey private label merchandise are being accepted by most of the consumers and therefore the company would do well to increase the percentage of private label merchandise being offered by the company especially in groceries. By increasing the private label merchandise the company will be able to increase the percentage of margin on the products and at the same time the company will be able to maintain the quality of the merchandise which will fetch repeat customers to Dollar Tree.

Bibliography

AnnualReport. (n.d.). Annual Report 2007 Dollar Tree. 2008. Web.

AOLMoney. (2008). Dollar Tree 3Q same-store sales rise 6.2 Percent. Web.

AOLMoney&Finance. (2008). Dollar Tree Inc Profile. Web.

Chapter 6. (n.d.). 2008. Foundations of Business Strategy: Analysis of the Macroenvironment: Web.

CorporateInformation. (2008). Dollar Tree Incorporation. Corporate Information snapshots. Web.

Deutsche Bank Research. (2005). China & India: A Virtual Essay: 2008. Web.

DollarTree. (2008). Ordinary Poeple Doing Extraordinay Things. Web.

DollarTree. (2008). Dollar Tree Third Quarter Sales Increase 11.6%. Web.

DollarTree. (2008). Mission & Values. Web.

DollarTreeForm10K. (2008). Form 10K Dollar Tree. Euromonitor. Web.

FamilyDollarsInc.From10K. (2008). Family Dollar Stores Inc Form 10-K. 10k Wizard.

FirstResearchInc. (2007). Discount Retail and Department Store Industy Report.

Form10K. (2008). 99 Cent Only Form 10-K. SEC.

Hoovers. (2008). DollarTree competition. Web.

InternationalBusinessTimes. (2008). Ahead of the Bell: Dollar Tree Upgraded. Web.

Lou, H., & Nguyen, M. (2008). Dollar Tree Stock Price Analysis.

Morrison, W. M. (2008). China’s Economic Conditions. Web.

Rogers, R., & Rogers, B. (n.d.). Marketing Profiable growth in Value retailing. 2008. Web.

Sacrborough. (2008). Internet Coupon Usage Up 83% in American Households. Web.

Sangani, P. (2008). The Economic Times. India China to Impact Global Economy. Web.

Standard&Poor’s. (2008). Dollar Tree Inc. Stock Report.

Wong, E. (2008). Nielsen: Private Label Deemed Equal to Name Brands. Web.

World Bank Report. (2008). Web.