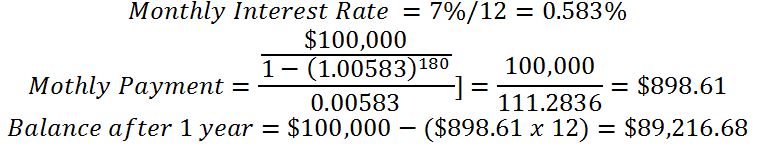

Refinancing a mortgage may be viable decision for a wide variety of reasons. For instance, one may decide to refinance to reduce the overall interest paid to the loaner even at the cost of increased monthly payments. It is beneficial to look at the decision-making process based on an example. Assume that a person needs to make a refinancing decision of a $100,000 mortgage of 15 years for 7% interest rate. After one year, the person receives a chance to refinance the mortgage with a 5.5% interest rate for 15 years. One should consider refinancing if the monthly payment decreases and if the payback period of the closing cost is reasonable (Treece, 2022). Calculation provided below demonstrate how the decision can be made using quantitative analysis.

Current Mortgage:

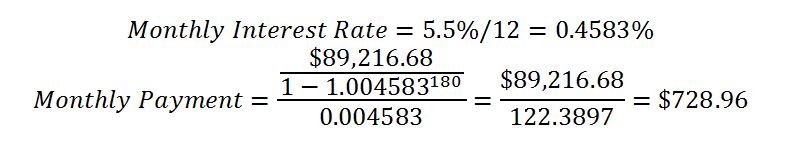

New Mortgage:

Monthly Savings

Thus, the monthly savings after refinancing will be $169.65, which is a significant decrease. However, the above calculations demonstrate that gross savings without considering the tax rates. Assuming that effective tax rate is 20%, the net saving after deduction of taxes can be calculated using the following way:

It is also crucial to determine the payback period of the closing cost. The breakeven point can be calculated by dividing the closing cost by monthly savings. The breakeven point is calculated below:

Thus, it is clear that the person should refinance the mortgage, as the monthly savings will be $135.72, which will cover the closing cost of the current mortgage 15 months. However, there are some non-quantitative factors that should be considered. The first qualitative factor that should be considered is the period that the owner will hold on to the property. The reason why it matters is due to the ability to benefit from decreased monthly payments. For instance, in the case discussed above it would be incorrect to refinance the mortgage if the person expects to hold on to the property for less than 15 months, as the person would be unable to benefit from decreased interest rates.

Considering individual capacity of paying back the loan is another qualitative factor to be considered in the process of ensuring that financing the loan has been reached at. This is justified by the fact that mortgage lenders are always motivated to know individual ability of financing the mortgage in the event the application process goes through. It is always prudent to considered changes in the interest rates which have a significant impact in determining how refinancing the mortgage is to be done (Parameswaran, 2011). For example, if the economy is poor, Federal Reserve Bank lowers interest rates with the intention of encouraging investing, maintaining normal process of lending and preventing chances of inflation occurring within the economy.

Another crucial factor that contributes to the decision-making process is personal preference. A decision-maker needs to feel that it is acceptable to stay I debt for another year (Parameswaran, 2011). Thus, psychological factors may have a significant role in the decision-making process.

References

Parameswaran, S. (2011). Fundamentals of financial instruments: Stocks, bonds, foreign exchange, and derivatives. Hoboken, NJ: John Wiley & Sons.

Treece, K. (2022). Mortgage Refinance Calculator: Should I Refinance My Home?