Introduction

This analysis report demonstrates how various mutual funds such as DLQAX, FDGFX, and GAGVX have contributed to multiple economic developments through the investments in these mutual funds. The comparisons of the fund’s performances have been made for five years, and the best-performing fund was selected. The mutual fund performance analysis, measures of risks associated with investment strategies, financial ratios, and vital information have been presented in this report.

Based on the historical data from Bloomberg between March 2017 to February 2022, which shows five-year returns of the fund performances, the average returns of DLQAX, FDGFX, and GAGVX were 13.72%, 8.66%, and 12.85%, respectively. In addition, there is a significantly high Sharpe ratio in GAGVX with 0.78 compared to other funds, indicating that it is one of the best funds worth investment.

The analysis reports focus on the fund description, comparisons of the fund against its competing funds, the asset managers, economic outlook, strategies, and various management mechanisms adopted by investors to ensure that they attain higher returns from these selected funds. The mutual funds have the objective of providing long-term appreciation in capital invested. Therefore, these mutual funds usually invest 80% of their total asset base to the large companies primarily focused on equity securities.

Economic Outlook

The Russian-Ukrainian war has contributed to various costs and economic crises across the globe. The Russian-Ukrainian wars, specifically on the economy, have led to a significant downfall in the growth of multiple sectors and the financial industry. 2022 has witnessed economic depression across various parts of the world, with the key participants in financial and other economic sectors affected negatively (Borgo, Goodridge, & Haskel, 2019). Specifically, there has been a drop in the Ukrainian GDP, contributing to the spillover in the financial markets and mainly on the mutual fund investments.

The high inflation rate has negatively affected the balance of trade between the various country’s exports and imports as most of the central banks across the globe face challenges of protecting their citizens against the exploitation and maintaining economic growth in their countries. As the interest rates rise, the central banks implement strict measures to contain the growing pressure of reducing the value of the currencies and developing their economies (Borgo et al, 2019). The Russian-Ukrainian war has led to economic erosion as the value of share prices in the stock market has significantly dropped, and most investors are unwilling to purchase the shares from various companies.

Most investors have been reluctant to invest in mutual fund shares due to the current global challenge of increased inflation and high-interest rates. As the world aims at economic recovery as the impact of the global pandemic reduces slowly, the investment in DM, IT sectors, and pharmaceuticals is considered to be amongst the bests strategy for realizing a high return on investment. The benefit of investing in these sectors results from their growth and stability in their stock performances in the current global market.

Style And Strategy

Based on the current economic outlook in the entire globe, the primary strategy for ensuring an economic recovery after the invasion of Russia on Ukraine and high inflation on the essential commodities would be the value growth strategy. This strategy of value addition assists the investors in identifying the potential markets of their investment and attaining high returns from the invested capital (AI-Haija & Syed, 2021). The current stocks underperforming in the market would likely be bought by large and established companies to be combined into a single capital unit. Therefore, the value-added approach is essential to the new and potential investors who aim to grow their capital base within the shortest period.

As estimated, by 2023, the economy in the entire global market might start increasing after undergoing recessions. Therefore, this period of growth would be beneficial to the investors who may intend to purchase the shares from various companies. These mutual funds have invested in a large corporation with a stable capital base to mitigate losses and protect the investors against the potential risks of inflation and the interest rate. The funds consider the most powerful corporation, with a net market capital base of more than $5 billion at a time when they are purchasing its shares. The selected funds have primarily focused on the large and well-established companies in the financial market, which they consider to have good financial track records and can efficiently respond to the growing needs of the investors.

Brief Description of The Asset Managers

Invesco Inc. is one of the most reputable asset management firms in the financial market. The company has a total net asset base of more than $1.6 billion, and they offers high-quality services for the investment in mutual funds. Therefore, before selecting the advisory management company for the mutual fund investment, it is appropriate for an investor to consider the firm’s reputation and quality of service. The three selected mutual funds have their investment advisors from Invesco Inc.

These investment advisors are also the fund asset managers since they offer consultation and advisory services to the fund scheme on the asset’s investment strategies to be undertaken at any economic change. The mutual fund also has its portfolio managers, including Thomas Lee and Donald Sauber, who have been asset managers for more than four years. These managers are also the asset managers of this fund and act as the advisory company’s critical financial analyst for the DLQAX funds.

Brief Description of the Funds

Three mutual funds were identified from the consideration and advisory service software asset managers. These funds include FDGFX, DLQAX, and GAGVX. These mutual funds are open-end funds in the equity financing from DM with value growth strategies. Both DLQAX and GAGVX have higher returns on investment, and they have risk diversification through a portfolio of medium and large market shares. The three mutual funds’ net assets base include $5 billion, $4.7 billion, and $6.10 billion.

The allocation of the funds in various sectors is diversified, and the critical investor arises from the IT and pharmaceutical sectors. The DLQAX mutual funds are considered more diversified funds since it suit the needs of all investors from the critical sectors of the economy, and it has sustainability plans to ensure the investors’ capital and returns are attained for more extended periods. Therefore, investing in these funds is very favorable to the investors, and it is considered the best strategy for attaining high returns at the end of maturity.

Summary of Fund Performance Analysis

All the historical data of the three mutual funds have been retrieved from March 2017 to February 2022 via Bloomberg, and US T-bill chooses the risk-free rate. The US T-bill has been chosen since it is issued directly by the government and has no default risks. The S & P index has been used as a benchmark for conducting performance comparisons. All the funds are invested in the DM.

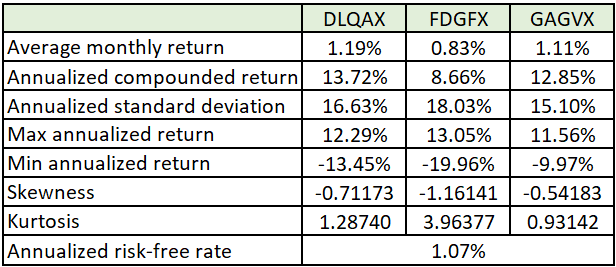

Table 1: Fund Performance and Descriptive Statistic

From table 1, the DLQAX funds are the most likely to perform better than other funds since it has the highest return level of 13.72% with the lowest volatility of 16.63%. The returns and volatility levels of FDGFX and GAGVX funds are 8.66% and 12.85%, respectively. GAGVX has the lowest kurtosis compared to DLQAX and FDGFX, indicating an extremely low probability of returns in the GAGVX than DLQAX and FDGFX.

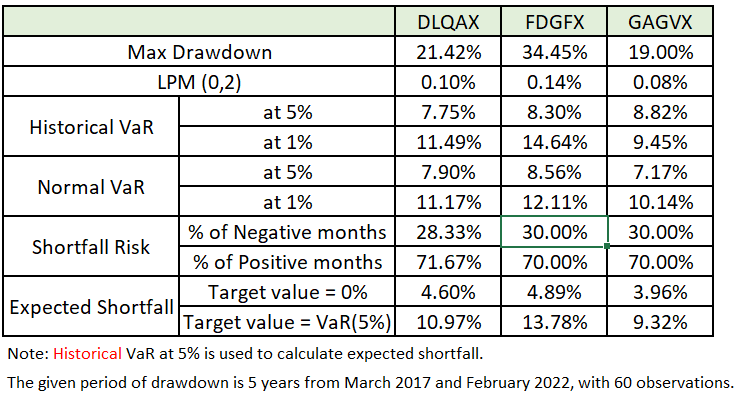

Table 2: Risk Measurement

From Table 2, all the mutual funds have a high probability of falling prices equally for the next three consecutive months from February to May 2022. However, this period was associated with the COVID-19 pandemic and high inflation, which affected most parts of the world. The maximum loss expected from these funds is not different at 95% or 99% confidence level. The expected shortfall of the mutual funds in both 0% and VaR (5%) is approximately 4.6% and 10.97%, respectively.

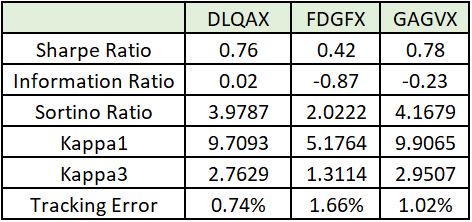

Table 3: Ratio Measurement

Table 3 indicates that DLQAX and GAGVX have higher performance in terms of the Sharpe ratio than FDGFX funds. The Sharpe ratio in the first two funds is 0.76 and 0.78, respectively. This performance trend shows that the two funds have high volatility ratio in the market than the other mutual funds.

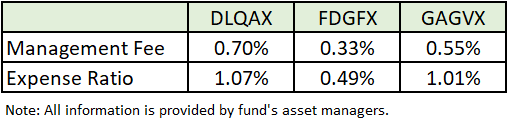

Fund Expense Ratios and Investment Manager’s Fees

Table 4: Management Fee and Expense Ratio

Other Comparisons of Key Financials

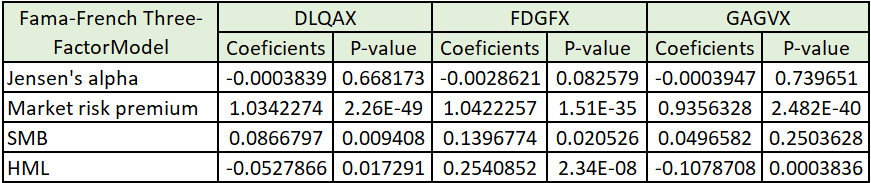

Table 5: Regression Results of the Fama-French Three-Factor Model

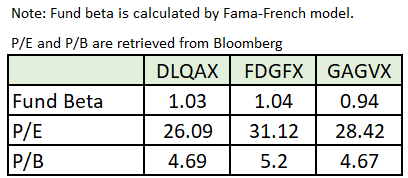

Table 6: Fund Beta Fundamental Ratios

Recommendations

As investors who are willing to attain maximum payout in terms of their share capital, it is recommended that proper analysis of the mutual funds is undertaken. For easy and effective management of the capital investment, the investors should consider the DLQAX funds due to the variety of its benefits to the investors. When properly utilized, these funds would ensure that the investors are consistently prevented from the regular financial losses due to making wrong investment decisions.

Reference List

AI-Haija, E. & Syed, M., 2021. Islamic real estate investment trust: comparative study between Emirates Islamic REIT UAE and Al Salam Islamic REIT Malaysia. Journal of Islamic Accounting and Business Research, pp. 12(6): 904-918.

Borgo, M., Goodridge, P. & Haskel, J., 2019. Productivity and growth in US industries: an intangible investment approach. Oxford Bulletin of Economics and Statistics, p. 75: 806–834.

AI-Haija, E., & Syed, M. (2021). Islamic real estate investment trust: a comparative study between Emirates Islamic REIT UAE and Al Salam Islamic REIT Malaysia. Journal of Islamic Accounting and Business Research, 12(6): 904-918.

Borgo, M., Goodridge, P., & Haskel, J. (2019). Productivity and growth in US industries: an intangible investment approach. Oxford Bulletin of Economics and Statistics, 75: 806–834.

DLQAX: Web.

DLQAX Commentary: Web.

FDGFX: Web.

FDGFX commentary: Web.

GAGVX : Web.

GAGVX Commentry : Web.

Largest managers: Web.