Introduction

The European low cost airline sector has grown tremendously in the past few years. This trend is predicted to increase in the next few years (Binggeli 2005, p. 1). However, some researchers note that the airline sector is going to falter in coming years because they can’t continue to enjoy profitable markets since their primary market is not an indefinite profit making platform (Binggeli 2005, p. 1).

From this point of view, many pessimist economists have noted that some of the primary markets low cost airline companies enjoy in North and Central Europe are slowly going to be saturated because of demand exploitation (Mayer 2007, p. 15). Nonetheless, the success of the European low cost airline sector has increased because the airlines have exploited the growing demand for low cost airlines in Europe.

However, there is increased optimism among researchers who note that the potential for Europe’s low cost airlines is still high because in as much as the low cost airline sector is slowly being saturated, there is more demand from markets dominated by some mainstream European airlines (Binggeli 2005, p. 1).

Because of this reason, other researchers observe that there is going to be a bruising price war battle between the two categories of airline companies (Drummond 2005, p. 113). Some analysts also observe that mainstream airline sectors are going to tremendously lower their prices due to their large economies of scale and this will probably make the low cost airline companies lose their competitive edge (Binggeli 2005, p. 1).

From this analysis, it therefore becomes increasingly complex to comprehend the future of European’s low cost airline sector, but amid the whole confusion, this study seeks to demystify the ambiguity of this analysis.

Practically, this study seeks to carry out a comprehensive analysis of the European low costs airline sector, but more emphasis will be laid on Italy as a special European market. Italy is the seventh largest economy in the world; with a totally diversified economy (even though it’s economic performance still lags behind most European nations).

In the 2009 global economic slump for example, the European nation suffered a sharp Gross Domestic Growth (GDP) decline of 4.8% (Dimireva 2010, p. 9).

In the year 2009, it was estimated that the GDP (in terms of purchasing power parity) was $1.756 trillion and the low cost aviation sector contributed a significant percentage of this figure (CIA World Factbook 2010). Current estimates project that the growth of the low cost aviation market will be well over the GDP growth (Aviz Europe PLC 2011, p. 9).

These statistics make Italy’s economy very interesting for the analysis of the low cost airline market in Europe. Nonetheless, some of the major areas to be covered in this study will include the nature of demand, nature of supply, customer behavior and the competitive environment. The work will be structured by first undertaking a PEST analysis, sector analysis, and lastly, a performance analysis.

PEST Analysis

The PEST analysis will entail the political, social, economic and technological analysis of the Italian low cost airline sector (Robert 2006, p. 116). It is important to undertake this study because the macroeconomic environment surrounding the operations of the Italian low cost airline sector has been noted to influence the dramatic growth of the country’s airline sector.

Political

There have been increased terrorism threats on major Italian mainstream airline companies, prompting low cost airline companies to capitalize on this development, by restructuring the way customers behave, with regard to air travel, because they are not an easy target for terrorists (when compared to mainstream airlines) (Martelli 2011, p. 3).

Economic

Italy has been experiencing an increased boost in tourism over the past few years, which has in turn expanded the growth of the low cost airline sector. Martelli (2011, p. 3) notes that the sector is doing well in providing its customers with two of the most important elements in airline travel: cost and safety. This has boosted the mobility of tourists who look for cheap flights to enable them travel further into neighboring tourist destinations.

Social

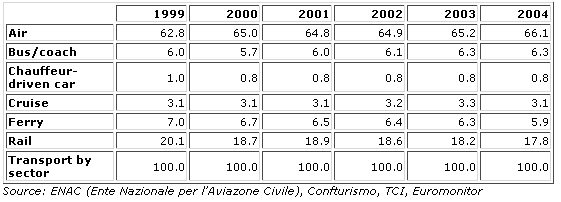

It is noted that a great majority of low cost airline sectors in Italy are increasingly using air travel for leisure purposes (Graham 2010, p. 111). This has greatly improved the performance of low cost airline sectors, although its impact is increasingly being felt by train and ferry companies, as observed by Martelli (2011, p. 7) who notes that:

“….this result had a strong negative effect on the other means of transport especially the railway and ferry sectors: now that Italians can fly over the country for lower prices, they are no longer using the rail and ferry transports so much”.

This fact is further reiterated by the diagram below

Technological

On the technological front, many low cost airlines have tried to invest in technology, especially to increase customer service, bookings and similar services. However, in other aspects, low cost airline companies have tried to use technology to improve their airline safety standards.

On the customer service front, many low cost airline companies in Italy have made significant strides in improving their customer services, and eventually boosting sales. However, on the safety front, Italy’s low cost airlines are perceived more unsafe than mainstream airlines, because of the increase in airline accidents over the recent years (Martelli 2011, p. 13).

Sector Analysis

Demand

The demand for Italy’s low cost airline sector has slowly been on the increase in the past few years. This has been brought about by an awareness of most low cost airline companies of specific market segments which have not been fully exploited by past airline companies.

For instance, there is an increased demand for business class travel which most traditional low cost airline companies operating in the past never exploited (Martelli 2011, p. 13). Currently, companies like Corpflex and Volare Web are specifically exploiting this market (Martelli 2011, p. 3).

Also, as mentioned earlier in this study, most local airline companies in Italy have increasingly realized the potential that exists in the tourism sector, as a distinct market segment.

This is also a new market segment for the low cost airline companies. The realization of the fact that most traditional tourist destinations are saturated and more tourists are now seeking quiet but exotic destinations (which these local airline companies are warming up to); has resulted in new tourist destinations developing, as can be observed from the increased attractiveness of many Middle Eastern tourist destinations, close to Italy (Martelli 2011, p. 14). This has been the new frontier in new market demand for Italy’s low cost airline sector.

Supply

In analyzing the supply side of Italy’s low cost airline sector, we will use the critical success factor as the main basis for the analysis. One critical success factor for the Italian low cost airline sector is the short haul nature of flights. This fact is based on the analysis that short haul flights constitute approximately 96% of the entire market share in the airline sector (Martelli 2011, p. 14).

These statistics were complimented by the severe dent long haul flights took after the September 11th attacks. No-frill airline companies have also been noted to constitute a greater majority of airline companies in Italy, majorly because they have a strong presence on the internet. For instance, Ryanair, Easyjet and Volare web have continuously dominated the Italian low cost airline sector because of this fact.

This is the reason why Ryanair, for example, was able to rake in more than 230 million pounds in 2004 alone (Martelli 2011, p. 16). It therefore comes as no surprise that 95% of all sales were achieved through online purchases (Martelli 2011, p. 23).

Performance Analysis

Concentration Ratio

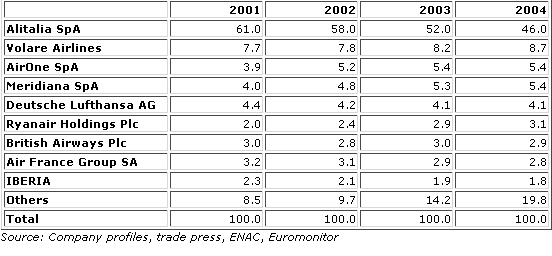

Italy’s low cost airline sector is specifically dominated by local airline companies. From the year 2001-2004, Alitalia had a strong market share of 61% but in 2004, this market share decreased to 46% (Martelli 2011, p. 23). From the decrease in market share, other companies such as Jet one, Easyjet, Meridiana and Volare Web have been able to significantly increase their market shares respectively.

Currently, Volare Group is the number two airline in the country, with the second highest market share (with an annual turnover of over 600 million Euros) (Martelli 2011, p. 23).

Meridiana features third, in terms of market share, although recent developments have seen Volare Group experience a number of financial problems, thereby improving Meridiana’s confidence in reclaiming its once strong market share before the year 2000. This analysis can be further described below:

The figure above represents market share in percentage across four years.

Sensitivity Analysis

The sensitivity analysis of the Italian low cost aviation industry basically relies on a few variables. These variables are competition from traditional airline companies (into the low cost airline sector); the threat accidents mean for the low cost aviation sector; safety and costs.

The threat of traditional airline companies in the industry would obviously mean increased competition in the Italian low cost airline market, and this would in turn imply increased pressures for specific airline companies to be unique. It is important to note that many airline companies would improve their safety records to maintain their market share, in light of increased competition.

This would in turn improve the performance of the low cost aviation sector. The threat of accidents, though unavoidable, could also significantly spell doom for the low cost airline industry because customers lay a lot of emphasis on their safety, and the most unfortunate thing is the fact that an airline accident in one company could significantly affect the performance of all other low cost airline companies.

This would probably be the justification traditional airline companies would base for their high pricing if an accident occurs.

In further analyzing the performance of the Italian low cost aviation sector, we can see that Volare’s return on equity in the low cost aviation market is -37.02%; for Ryanair is 19.28% and for Easyjet is 4.43% (University of Rome 2010, p. 64).

These figures show that the return on equity is quite varied in the low cost airline market and many companies can achieve different outcomes in the same market. With regards to the return on investments, Easyjet records 3.74%, Volare Web records -4.50% while Ryanair records 10.68% (University of Rome 2010, p. 64). These figures show that Ryanair is performing exceptionally well when compared to other low cost airlines.

The same situation is replicated when we analyze Ryanair’s return on assets because it stands at 4% (ADVFN PLC 2011). Its liquidity ratio is also 1.85, meaning that the company can easily pay its debts (ADVFN PLC 2011). Easyjet also has the same capability because according to its company website (cited in Easyjet 2011); it

has sound liquidity ratios. With regards to the return on sales, Easyjet posts 4.37%; Ryanair posts 31.2% and Volare Web posts 66.81% (University of Rome 2010, p. 64).

From this analysis, we can see that Ryanair is performing exceptionally well when compared to the other two airline companies, meaning that the Italian low cost aviation industry has a lot of potential when right managerial practices are adopted. Also, on an unrelated front, there is a strong demand potential if the airlines expand their operations in the Middle East and Africa; especially to capitalize on the increased potential in the tourism sector, as a unique market segment. Generally, these factors spell out more opportunities for the low cost Italian aviation sector.

Conclusion

This study establishes that there is still immense potential in the Italian low cost aviation market, considering there are emerging markets in tourism and corporate travel. These factors are bound to spearhead growth in the sector. However, we also note that there is an eminent threat of accidents which can bring the sector down.

In addition, increased competition from traditional airline companies (which are also entering the low cost market) is also another threat to the industry. Nonetheless, when analyzed in general terms, there is increased potential in the Italian low cost aviation sector.

References

ADVFN PLC. (2011) Ryanair. Web.

Aviz Europe PLC. (2011) Market Analysis. Web.

Binggeli, U. (2005) The Battle For Europe’s Low-Fare Flyers. Web.

CIA World Factbook. (2010) Italy Economy 2010. Web.

Dimireva, I. (2010) Italy Investment Climate 2010. Web.

Drummond, G. (2005) Introduction to Marketing Concepts. London, Butterworth-Heinemann. Easyjet. (2011) Easyjet. Web.

Graham, A. (2010) Aviation and Tourism: Implications for Leisure Travel. London, Ashgate Publishing, Ltd.

Martelli, A. (2011). Forecasting the Italian Airline Sector. Web.

Mayer, F. (2007) A Case Study of EasyJet and the Airline Industry. London, GRIN Verlag.

Robert, J. (2006) Chapmansimple Tools and Techniques of Enterprise Risk Management. London, John Wiley and Sons.

University of Rome. (2010) The Effects of Low Cost Airlines Growth in Italy. Modern Economy, 1, 59-67.