Background

The meaning of diversification has been given in different ways. The dictionary meanings of the diversification are (Trellis 2005) “to give variety to, or to vary” or “to extend business activities into disparate fields,” or “to distribute investments in order to average the risk of loss.” Each of these meanings provides a separate rationale for diversification, if properly applied and relevant to the situation.

Business Diversification

Hunter, John and Hickman (1997) states that “[i]n the corporate arena, diversification usually refers to companies pursuing several unrelated lines of business. The ultimate diversified firms have subsidiaries in dozens of completely unrelated areas”. In finance, diversification is a risk management technique, related to hedging, that mixes a wide variety of investments within a portfolio. “Because the fluctuations of a single security have less impact on a diverse portfolio, diversification minimizes the risk from any one investment” (Wikipedia 2008). In the market level, diversification is a form of growth marketing strategy for a company. Balaji (2008) provides that

“It seeks to increase profitability through greater sales volume obtained from new products and new markets. Diversification can occur either at the business unit or at the corporate level. At the business unit level, it is most likely to expand into a new segment of an industry in which the business is already in. At the corporate level, it is generally entering a promising business outside of the scope of the existing business unit”.

Strategies

The strategies of diversification can include internal development of new products or markets, spread the financial risks in several investments, acquisition of a firm, alliance with a complementary company, licensing of new technologies, and distributing or importing a products line manufactured by another firm. Generally, the final strategy of the diversification contains an arrangement of these options.

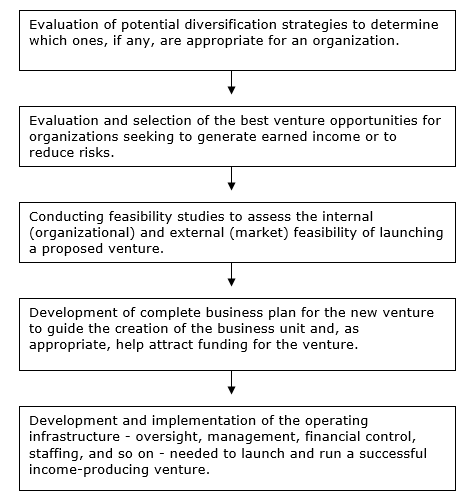

Diversification Steps

For diversifying, anyone may maintain these steps (Social Entrepreneurs 2007):

Result

Diversification can reduce as well as increase risks at any level of business

Practical Diversification

Question # 01

An innovation organization is growing rapidly. Because the company has reached its maximum potential in its current domain, the CEO wants to expand into new domains. The CEO wants to pursue diversification. What advice can the CEO give?

Answer # 01

Background

Although it is clear that the company has reached its maximum potential in its current domain, there is no assurance that the company will be successful in its new domains. Even new domains may not be successful as the key business and affect on the key business future achievement. It is not so easy to make right and fruitful decision in the initial stage of a business; even it is a new domain of a successful business. The CEO must be faced some difficult decision making and challenges. So, the CEO must be aware about the core decisions of new domain.

Difficult Decisions to Expand the New Domain

Organization design is a major task of managers (Simpson 1994). Some of the difficult design decisions managers make are:

- How should tasks be divided to achieve maximum efficiency?

- How should activities be grouped and what is the optimum size of a work unit?

- What is the optimum number of levels in the organization?

- What kinds of integration mechanisms should be used?

- Who should make what decisions?

- How strictly should the organization control employee activities?

- How is the organization going to influence the informal personal relationships in the organization to motivate employees?

Key Challenges to Expand New Domain

In response to these questions, there are five basic design challenges that managers may face:

- 1st challenge: balancing vertical and horizontal differentiation

- 2nd challenge: balancing differentiation and integration

- 3rd challenge: balancing centralization and decentralization

- 4th challenge: balancing standardization and mutual adjustments

- 5th challenge: managing the relationship between key and domain organizations.

Decision Making Comparison or Scenario

Starting with Criticisms

“Diversifying into other lines of business, however, may or may not increase profit or reduce one’s risk. The most risky time for any new business is the start-up phase–when the market is being established. Approximately three-quarters of all new businesses fail in the first year, and about half of those that survive will fail within the first five years” (Trellis 2005). Diversification may also increase the risk of failure in the CEO’s core business, since a major cause of business failure is a lack of management focus on key objectives. Trellis (2005) states that “[b]y trying to run more than one business at a time, management focus can be scattered and ineffective”.

If the CEO is simply looking for a new challenge because he’s bored or tired of the routine, then diversification will probably increase his risk, not dilute it. In the business, routine is a good thing. Trellis (2005) also imports that “[t]here is enough excitement in dealing with new clients and the challenges of business new designs without compounding it by adding new enterprises”. More likely, the CEO may want a different challenge due to burnout from client demands and the constant grind of dealing with unexpected situations. In that case, the CEO might want to diversify by increasing the percentage of changing the focus of his business.

Supporting in Diversification

Moreover, if the CEO wants to diversify his business for achieving his organization’s primary objective, then there are some motivations and options for diversification for him.

Motivations

- New market opportunities: “An important motivation for diversification may be a perceived market opportunity (Trellis 2005). If remodelling or light commercial construction is booming in market, the CEO may want to increase the business profits by using skills to meet the market need. In that case, the danger is that in going after new business segments the CEO may become distracted from focusing on the CEO’s primary business, leading to profit loss, not gain.

- Reduce financial risk: Another motivation may be a desire to protect the CEO’s financial assets by spreading risk among several different investments. Trellis (2005) states that “[i]t’s the old adage of “Don’t keep all your eggs in one basket.”And sometimes that’s a smart idea”. But often it’s also a smart idea to do as Mark Twain suggested (Stern 2002–2008): “Put all the your eggs in one basket. And then WATCH that basket”

The CEO need to distinguish between diversifying the organization’s investments (nearly always a good idea if risk reduction is the business objective) and diversifying the primary business (sometimes a good idea).

Diversification Options

According to Trellis (2005), “[t]here are two major diversification options for builders: horizontal and vertical”.

Horizontal

“Horizontal diversification is when a business is diversified between same-type investments. It can be a broad diversification (like investing in several companies) or more narrowed (investing in several stocks of the same branch or sector). For the example, the move to invest in both umbrellas and sunscreen is an example of horizontal diversification. As usual, the broader the diversification the lower the risk from any one investment” (Wikipedia 2008).

Vertical

Vertical diversification is investment between different types of businesses. Wikipedia (2008) provides that “[a]gain, it can be a very broad diversification, like diversifying between bonds and stocks, or a more narrowed diversification, like diversifying between stocks of different branches.Continuing the example from the above, a vertical diversification would be taking some money from umbrella and sunscreen stock and investing it instead in bonds issued by the government”.

Finalization

There is no simple answer to the question of whether or not the CEO should diversify. It all depends on what the CEO want and what is the primary goal of his key business organization.

Question # 02

A large defense company has decided to open a nuclear plant as a subsidiary. What design characteristics should the structure of this plant have?

Answer # 02

Basic Requirements that the Plant must have:

Whether planning to build a new nuclear plant or operating an existing facility, having a solid capital strategy plan is instrumental in determining future success. However, those planning or developing a new plant must realize that times have changed. Proposed project can differentiate itself include (Wyka 2007):

- Feedstock control through its own crushing assets and strong grower alignment, long-term supply contracts or other captive supply arrangements.

- Feedstock flexibility

- Advantaged location

- Transportation flexibility

- Sustainable cost advantage

- Existing asset leverage (e.g., brownfield sites)

- Superior margin management with offtake and origination contracts with credible partners

- Credible project development and management team

- Capacity to expand scale and scope of operations to reduce unit costs and/or diversify risk.

- Sustainable incentive structure

The various scenarios that nuclear plant directors and owners should consider include (Wyka 2007):

- Vertical integration to reduce feedstock and/or marketing risk;

- Horizontal diversification into other business areas (such as ethanol processing) to reduce risk;

- Innovative and sustainable feedstock strategies;

- Acquire or merge with other companies even with Government;

- Improve efficiencies through energy and operational optimization;

- Refinance debt to improve long-term cash flow; and

- Recapitalize the company to provide liquidity to existing shareholders and reduce risk (Wyka 2007):

Design Requirements or Characteristics that the Plant must have (Small Business Encyclopaedia 2002): “The diversification process is an essential component in the long range growth and success of most thriving companies, for it reflects the fundamental reality of evolving business opportunity. But the act of diversifying requires significant outlays of time and resources, making it a process that can make or break a company”. For designing the new subsidiary nuclear plant, requirements or characteristics are sated below –

Financial Health

This is the most basic consideration of all. The nuclear plant directors or owner(s) should undertake a comprehensive and clinical review of their present fiscal standing and future prospects; before expanding a business into a new area.

Attractiveness of the industry and/or market

Small Business Encyclopaedia (2002) provides that “[a]nalysts attach varying level of importance to this factor. Obviously, diversification into an industry or market that is flagging, whether because of general economic conditions or local problems, can result in a significant loss of income and security. Some businesses attach little significance to this, relying instead on vague beliefs that the industry or …. market is a good fit with its existing operations, or that the industry or market is headed for an upturn. Another common reason for ignoring the attractiveness test is a low entry cost, they added.

Sometimes the buyer has an inside track or the owner is anxious to sell. Even if the price is actually low, however, a one-shot gain will not offset a perpetually poor business. Finally, some businesses mistakenly interpret recent market or industry trends as indications of long term health.”

Work force resources

“When considering diversification, companies need to analyze the ways in which such a step could impact their current employee work forces. Are you counting on some of those employees to take on added duties with little or no change in their compensation? Will you ask any of your workers to relocate their families or their place of work as a consequence of your business expansion? Does your current work force possess the skills and knowledge to handle the requirements of the new business, or will your company need to initiate a concerted effort to attract new employees? Business owners need to know the answers to such questions before diversifying” (Small Business Encyclopaedia, 2002).

Not only native government but the international regulation should be considered before diversifying the nuclear subsidiary plant.

Community Adjustment for defense as well as nuclear industry

“Community diversification is an orderly community transition from dependence upon one industry sector for employment such as defense to a more balanced mix of private sector employment opportunities for the community. There is an assessment that should be conducted as part of the economic adjustment process” (Office of Economic Adjustment (OEA), n.d.).

Assessing your local community is defined “by the community’s degree of defense dependency. How vulnerable is the community to defense cuts? How will defense cuts affect the community?” (Office of Economic Adjustment (OEA), n.d.). (Office of Economic Adjustment (OEA) states that “[i]n this effort, the following data should be obtained the followings:

- The number of defense prime contractors and subcontractors in the community

- The percent of the local labor force tied to defense spending, directly and/or indirectly

- The proportion of sales those are defense-related

- The community’s dependence on a particular industry (e.g., aerospace) or weapon system that is scheduled to be eliminated or is at risk

- The community’s tax and labor force at risk

- The community’s level of dependence compared to state and national averages for percent of employment, tax base, and/or purchases

Mutual Contract with the Government and International Influential Groups

The defense company must have a Mutual Contract with the Government and International Influential Groups, such as United Nation and other power taker countries. Because the nuclear subsidiary plant need very big amount of investments, so it unavoidably needs a mutual contracts with international influencial groups.

Finalization

The defense company should consider the above stated requirement or characteristics that its subsidiary nuclear plant must have.

References

Balaji, K. (2008). “Strategic Management”. Balaji and His Brain. Web.

Hunter, Hugh., John Byrd, and Kent Hickman, (1997). Diversification: a broader perspective. Business Horizons. Web.

Office of Economic Adjustment (OEA). (n.d.). “Community Defense Industry Adjustment and Diversification”. Web.

Simpson, Barbara. (1994). How Do Women Scientists Perceive Their Own Career Development?. International Journal of Career Management. Volume 6, Issue 1. 19 – 27.

Small Business Encyclopaedia. (2002). “Diversification” Encyclopaedia of Small Business. The Gale Group. Web.

Social Entrepreneurs (2007). “ Strategic Development”. Social Entrepreneurs Inc. Reno. Web.

Stern, Marnie. (2002–2008). “Put all Your Eggs in one Basket and Then Watch That Basket!!!”. Last.fm Ltd. Web.

Trellis, Al (2005). Why diversify? Diversifying your business can cut your risk—or raise it. Custom Home. Web.

Wikipedia, (2008). “Diversification (finance)”. Web.

Wyka, Susan. (2007). “Capital Strategies to Position a Biodiesel Business”. Issue of Biodiesel Magazine. Web.