Introduction

Bulgari is a multinational Italian luxury brand founded in Rome in 1884 by the silversmith Sotirio Bulgari. ‘It is one of the world’s largest luxury jewellers and watch-makers whose current offerings also include an haute-parfumerie line, as well as accessories such as scarves and small leather goods’ (Cpp-luxury, 2018). Bulgari built its foundation with its unique and recognizable jewellery.

Its silver pieces, inspired by Byzantine and Islamic art combined with colourful gemstone floral motifs, stood out in the industry where the level of craftsmanship and jewellery creations were unmatched. According to Watches and Culture, Bulgari is recognised as a leading brand in digital. The brand has gone from a company that specializes in craftsmanship and jewellery creations to making a name for its remarkably unique collection of watches. According to Jonathon Parker, Bulgari is listed as the 19th best luxury watch brand in 2022.

While searching for a title for my EE, I decided to choose a topic we studied that I found particularly interesting and curious to explore. I decided on focusing my extended essay on answering the question, “To what extent has Bulgari used diversification successfully?” In this essay, I will be focusing on Bulgari’s use of diversification as a strategy within the Ansoff Matrix topic in Unit 1 part of the Business Management course syllabus.

One of the main reasons for focusing on Bulgari is that I am able to attain the relevant primary research needed to elevate my exploration and answer my question. I settled on diversification as I was curious of the various industries and products a certain business would be able to expand into, and whether or not the ‘high risk, high reward’ strategy was worth the expansion. Furthermore, I wanted to investigate how successfully a brand specialised in jewellery creations is able to grow their brand recognition in the watch industry as well as their portfolio in the hospitality industry.

Methodology

Sources

While the majority of data used to analyse the success of Bulgari’s use of diversification will be collected from secondary sources, primary research will be collected through an interview with the CEO of Bulgari, which will be essential to answering the question. The secondary sources chosen must address the role of the different business strategies, and their success in relation to their benefits and risks, its impact on the businesses market share and financial statistics.

The financial data must be specific to the products that have undergone the diversification strategy to further evaluate its success. The sources will be proofed to guarantee that they are reliable. This will be done by checking to make sure that the publishing sites are credible, and comparing them to other sources to ensure that they are of good quality and are not biased.

Tools

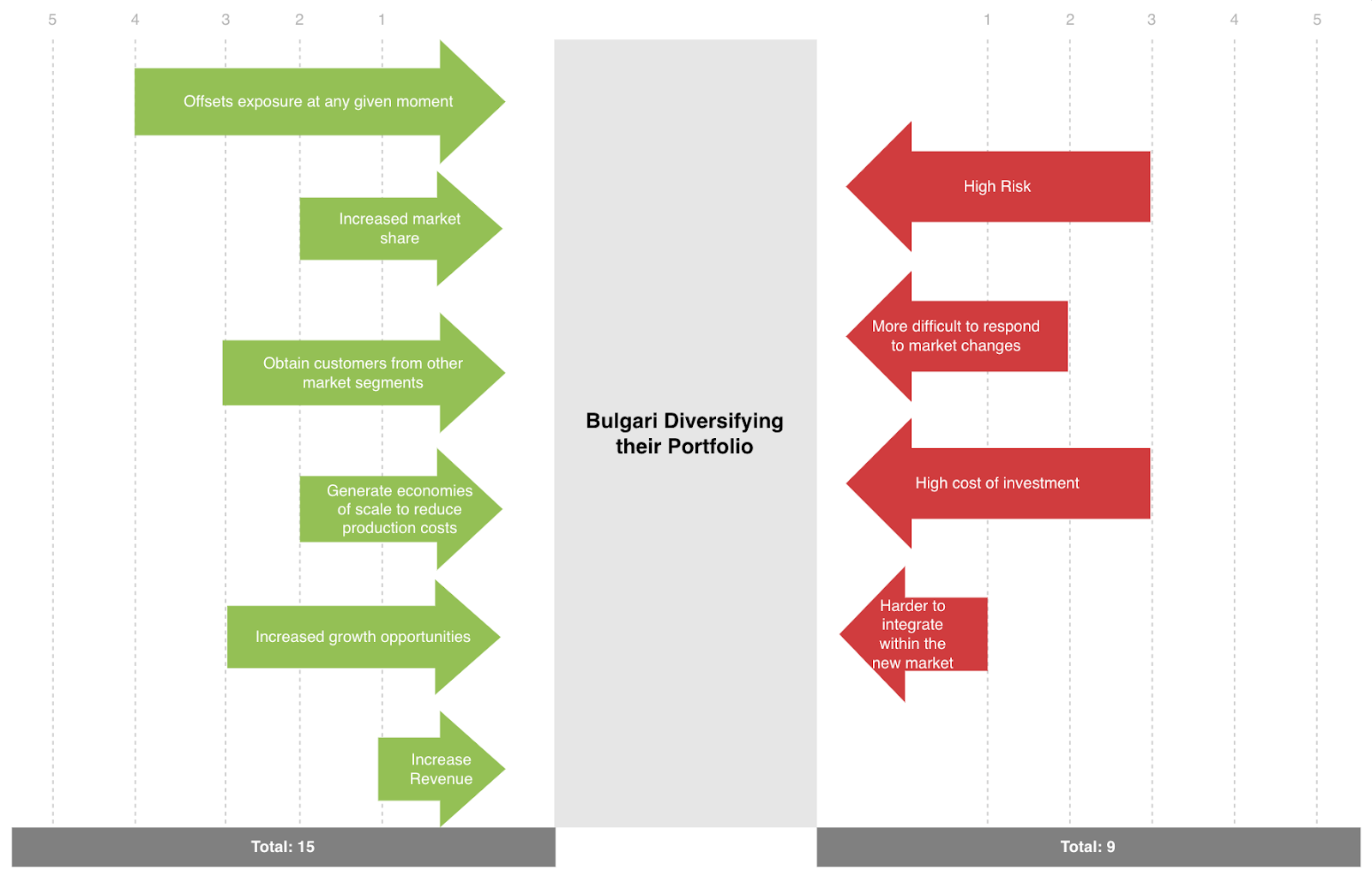

In order to analyse the success of Bulgari’s use of diversification, a range of different tools will be applied. First, a force field analysis (FFA) will be made to evaluate the decision of Bulgari diversifying their portfolio. Secondly, a profit and loss account, which ‘is a financial statement of a firm’s trading activities over a period of time, usually one year’ (Hoang, 2014), will be used to analyse whether Bulgari’s profits and losses were significantly affected when they decided to diversify their portfolio.

Thirdly, a perception map ‘is a visual tool that reveals customer perceptions of a product or brand in relation to others in the market’ (Hoang, 2014). This will be used to show how consumers perceive a certain product that is an outcome of Bulgari diversifying their portfolio. Lastly, the ansoff matrix, ‘an analytical tool that helps managers to choose and devise various product and market growth strategies’ (Hoang, 2014), will be used to compare these strategies used by Bulgari and evaluate whether Diversification was the most successful. It consists of 4 different strategies, Market Penetration, Product Development, Market Development and Diversification.

Main Body

Context

In 1884, Bulgari started off with a product portfolio consisting of only their silver jewellery creations. During World War 2, due to the limited access to materials, yellow gold was integrated into their creations, which resulted with the Serpenti bracelet-watches. By 1980, ‘The Bvlgari Time Company was founded in Switzerland’s capital’ (Luxity, 2021), and in 1992, they launched their first fragrance, Eau Parfumee au The Vert. In 2004, Bulgari entered the hotel industry through a joint venture with Luxury Group, part of Marriott International. The first hotel opened in Milan in 2004, followed by Bali (2006), London (2012), Beijing (2017), Dubai (2017) and Shanghai (2018) (Glion, 2008).

The Decision of Bulgari Diversifying Their Portfolio

The strategy of Diversification is one of four of the strategies shown in The Ansoff Matrix. The Ansoff Matrix ‘is an analytical tool that helps managers to choose and devise various product and market growth strategies’ (Hoang, 2014). The first strategy is Market Penetration. This ‘is a low-risk growth strategy as businesses choose to focus on selling existing products in existing markets’ (Hoang, 2014).

The second strategy is Product Development, which ‘is a medium-risk growth strategy that involves selling new products in existing markets’ (Hoang, 2014). The third strategy is Market Development, ‘a medium risk growth strategy that involves selling existing products in new markets’ (Hoang, 2014). The final strategy is Diversification. This ‘is a high-risk growth strategy that involves selling new products in new markets’ (Hoang, 2014).

Figure 1 shows a Force Field Analysis for Bulgari Diversifying their Portfolio In order to discuss whether Bulgari’s use of diversification was successful, a force field analysis will be used to evaluate the driving forces for change and the restraining forces against change. The driving forces are the advantages of Bulgari diversifying whereas the restraining forces are the disadvantages. This is determined by allocating a weight to each of the forces from 1 (weak) to 5 (strong) and totaling them up to decide whether the driving forces outweigh the restraining forces.

Prior knowledge and further research on the diversification strategy was applied in order to accurately determine the weights of the driving and restraining forces. For example, the driving force that offsets exposure at any given moment was rated a 4 as it is highly significant when it comes to protecting a businesses assets when the markets become volatile. In comparison, the restraining force of having a high cost of investment is rated a 3 as if the costs start to increase, this could depreciate the value of a businesses investment, hence posing a threat to the business to make a profit on their investment.

The FFA shows that the driving forces for the change are much higher compared to the restraining forces hence it was more favourable for Bulgari to diversify their portfolio. Increased market share is crucial for a business as they will have a higher profit margin, higher quality and and higher priced products, reduced marketing costs as a percentage of sales and a declining purchases to sales ratio.

Obtaining customers from different market segments increases sales revenue for the business and further increases brand awareness as consumers may feel loyal to a certain product offered by Bulgari and hence be more inclined to try their other goods and services offered. Benefiting from economies of scale allows Bulgari to reduce the cost of production and increase their revenue.

In turn they can reinvest a portion of their profits back into research and development and improve the quality of their products. This would also attract new investors as they would be more compelled to invest in the business as the achieved economies of scale. Increasing growth opportunities are integral to ensure the business is able to stay relevant in the market. It boosts a businesses credibility and allows them to increase their supply base as well as increasing stability and profit.

Nevertheless, the FFA also shows a high amount of restraining forces of Bulgari diversifying their portfolio. There is always a high risk with the diversification strategy as it involves having a business enter a market they are unfamiliar with. When businesses are involved in multiple industries, it increases the chances of changes in the market which could result in a profit loss for the business. Furthermore, for Bulgari to diversify into the hospitality industry, they have to hire new management that is specialised in the specific industry. This would significantly increase Bulgari’s variable costs and make it more difficult for them to break even on their investment.

Overall, the success of Bulgari’s products that have used the diversification strategy is highly dependent on Bulgari’s marketing strategy. This is because the brand’s current consumers and new consumers would not be aware of the new goods and services they offer as it would need to be marketed accurately to ensure it is targeting the right audience.

Effectiveness of Bulgari Diversifying Their Portfolio

BVLGARI is one of the masters of diversification in the jeweller business. It has continually reinvented itself since the 1920s, following Sotirio Bvlgari’s decision to start developing luxury watches alongside the previous family business of making high-end jewellery (Hotinceanu 2021). The organisation was created in 1884 and has continually exhibited its successful diversification strategy as a critical component of the company (Muñoz-Bullon et al. 2021). The first diversification instance involved making watches, followed by contemporary alterations such as developing the Haute-parfumerie line and accessories such as small leather items and scarves.

BVLGARI had a positive diversification strategy when it opened the Condotti store, an iconic store that remains open to date. BVLGARI’s earliest diversification included embedding Islamic and Byzantine art in its silver pieces that were merged with floral motifs. In this way, the company exhibited its trend-setting design while freeing itself from a set definition with sensible and subtle cues (Carney et al. 2017).

The second world war saw many jewellers turn to gold for crafting as gems became scarce while designs gained a naturalistic feel. By the end of the 1940s, BVLGARI had developed a serpenti bracelet-watch and captured significant customers such as Ingrid Bergman, Anna Magnani, Gina Lollobrigida, Sophia Loren, and Elizabeth Taylor.

Furthermore, BVLGARI sought to enter the watch manufacturing field by introducing the BVLGARI. It founded the BVLGARI Time in Switzerland to run its production of these watches. The company continued its diversification trend in 1993 when it launched its first perfume through the formation of BVLGARI Perfumes and fragrance, Eau Parfumée au The Vert (Carney et al., 2017).

1995 saw the company aggressively develop a growth program that was listed on the Italian Stock Exchange. The organisation founded its accessories collection line in 1996, starting with silk scarves and delving into eyewear and leather accessories. In this instance, BVLGARI saw a tremendous rise in profits and revenue from diversification, growing by 150% between 1997 and 2003 (Bulgari Hotels & Resorts, 2018).

In 2000, BVLGARI made radical changes to its structure, focusing on aggressive verticalization by acquiring watch makers Gérald Genta and Daniel Roth (Hotinceanu, 2021). Furthermore, it acquired Crova, a jewellery firm, while making more purchases related to leather-making and watch-making companies. In this way, the organisation emerged as a high-end and prominent player in the world of Haute Horlogerie. This came as the organisation was acknowledged for its performance, mainly attributed to developing the thinnest tourbillon watch, the BVLGARI Octo Finissimo Tourbillon Automatic watch.

Table 1: Profit and Loss Account

The first instance is the domain encompassing BVLGARI’s industry. The company provides high-end jewellery, fragrances, wallets, sunglasses, watches, handbags, and other accessories in this scenario. In Table 1, it is seen that the company has experienced a rapid growth in the years it implemented diversification strategy. Moreover, it shows that customers perceived the diversification positively and embraced new products.

BVLGARI is connected to a particular group of customers through its values, relating its products and services to luxury and exclusivity (Baron, 2021). High-income earners can afford the organization’s products. At the same time, they remain out of reach for low-income earners, or middle-income earners may find it challenging to purchase its products without incurring huge losses. However, its focus on the high-end income percentile sets it apart as a sought-after luxury goods provider.

Consumer Perception

‘In 2001, BVLGARI formed a joint venture with Marriott Hotels, one of the largest luxury hospitality chains in the world. Since then, BVLGARI Hotels and Resorts chain began to open 5-star hotels in the most prominent global locations, including Milan, Bali, London, and Dubai.’ (Business Essay, 2022)

The effectiveness as well as the customer perception of the diversification strategy show that chosen marketing strategy proved to be successful and beneficial for the company.

The Ansoff Matrix

The organisation is well-known for successfully diversifying its portfolio since its formation in the 1800s. BVLGARI does not leave an industry but focuses on adding more items to its portfolio. These changes have been successful and elicited high growth. BVLGARI has a diversification process that also includes using its power and influence to buy out competitors, as was the case with watchmakers (Baron, 2021). Nonetheless, it does not lower the quality of the products, aiming to improve them and build its brand perception in these businesses.

Furthermore, BVLGARI has developed a personality associated with movie stars and other celebrities that are likely customers of its high-end goods. These icons help propagate its image as a luxury brand and market its products based on quality. Individuals such as Elizabeth Taylor are the perfect example of good marketing as they have a large following and would promote the purchase of BVLGARI’s products by their fans and friends.

Finally, BVLGARI is reflected with a significant connection to royalty. Its designs and fashion are related to powerful empires and utilises high-end materials such as gold and gems to develop expensive products associated with royalty.

Table 2: Ansoff Matrix

The Ansoff Matrix (Table 2) presented above illustrates different product lines that the company has. The diversification strategy used by BVLGARI was successful as it now includes many products that are popular in the market. BVLGARI began using an internationalisation strategy at its formation. Its founder moved the company’s business to Rome despite the original owner’s Greek heritage.

Nonetheless, the family did not renege on its previous business and would move to other areas based on its hotel locations and other aspects, such as the sale of watches and perfume in Switzerland and other European countries (Gibson, 2019). In this way, the internationalisation strategy allowed BVLGARI to develop its portfolio as a major player in global business.

BVLGARI further deals with luxury items in its field, incorporating high-end materials to create products. In this way, it sells its products relatively pricey, with the world’s thinnest watch mentioned in a previous section going for about $4,000 (Lojacono & Pan, 2021). It is essential to note this is not one of the most expensive items on BVLGARI’s list, illustrating its focus on the high-income earners in society. This focus means it operates using high-profit margins as its goods and services are tailored for the rich.

Strategic management is another crucial component of BVLGARI’s business due to its highly competitive market. Various organisations have similar properties to BVLGARI, eliciting why it bought out competitors in the watchmaking industry (Jhamb et al., 2020). In this instance, the company’s strategic management entails using acquisitions and creating high-end products to deal with its competitors.

Conclusion

Finally, BVLGARI utilises the diversification principle effectively in its global growth and expansion. Its focus on different products and services has enabled it to carve out niches in its industries. It is a significant competitor in various fields such as watchmaking, hotel and accommodation, and perfume development. In this case, the organisation mitigates the risk of losing revenues if some of its businesses are affected by macroeconomic or microeconomic problems. It is prudent to consider diversification as the best strategy for BVLGARI to improve its long-term business further.

BVLGARI’s diversification takes place along three different planes: diversification within one industry, expansion into other industries, and geographical expansion across the globe. Being initially a jewellery luxury brand, BVLGARI sought to outdo its competitors in the jewelry market by introducing different materials such as gold and stones into its works.

Moreover, elaborating intricately woven stylish ornaments with different motives borrowed from diverse religious traditions and creeds, BVLGARI managed to attract rich people from all walks of life. The idea to outdo its competitors by the superb quality of work was later transferred into other industries where BVLGARI can boast the thinnest watch, one of the most luxurious hotels, and the best accessories.

BVLGARI’s diversification into other industries proved to be equally successful. The reason for this must be its unchanging standing as a luxury brand that was extrapolated into other industries. Indeed, in all its businesses, BVLGARI aims to produce unique goods and services of the highest quality that only the rich can afford. The second reason for the success of the expansion lies in the fact that BVLGARI chose industries closely related to its initial jewellery business in terms of lifestyle and associated goods. Thus, people who can afford expensive jewellery usually stay at luxurious hotels and wear bags and sunglasses from famous design houses.

Thirdly, having a highly recognizable luxury brand, BVLGARI sought to transfer its fame as a jewellery company into its other markets, where it produces goods of quality and design unparalleled by other companies. Finally, BVLGARI managed to associate its name with famous personalities such as film stars and singers, drastically extending its audience to embrace fans of its key clients.

BVLGARI geographical diversification nowadays includes many countries across the globe and indeed the company has long become an international one. The owner’s decision to open offices wherever it is best for business lies at the heart of BVLGARI’s success in the international market of jewellery as well as other goods and services the company produces.

The strategy of diversification chosen by the company has numerous advantages that by far outweigh any possible drawbacks. First of all, differentiation allowed BVLGARI to secure and extend its market share in its key industry – jewellery business. By introducing different materials and intricate designs into its works, the company managed to successfully compete among other luxury jewellery brands. Secondly, the company managed to obtain customers from other industries which allowed it to dramatically increase its revenue.

Thirdly, the chosen strategy of diversification offers economies of scale and can serve to offset exposure to negative factors within one market, thus minimizing negative circumstances for the company. Any crisis or negative tendencies for the company will be much less pronounced since it operates within diverse markets that have different risk factors and levels of stability. Finally, the chosen strategy of diversification offers BVLGARI increased growth opportunities and, indeed, in recent years the company has grown more due to its involvement in other industries than within its initial jewellery market.

Among the disadvantages of the chosen differentiation strategy, one can name high risk and high level of investment necessary to succeed. Posing itself as a luxury brand, the company cannot afford to produce anything but goods of the highest quality, as any inconsistency with what BVLGARI brand stands for will deal a serious blow to the company’s image. At the same time, extrapolation into other luxury markets demands large investment as it is a highly competitive market with a limited customer base.

Another drawback of the chosen market strategy is that diversification makes it more difficult for the company to respond to market changes. Indeed, having many businesses to support, the company cannot channel all its money and efforts into one sphere in case of a crisis without serious damage to other businesses. Thus, diversification reduces space for maneuver in case of drastic changes necessitating emergency measures to be taken (Lojacono & Pan, 2021).

Finally, the company may find it harder to integrate within different markets as these new businesses will necessitate further studying and development. Moreover, staff with new competencies suitable for new industries will have to be employed and educated, which poses an additional load on the diversification strategy that already demands large investment.

The limitations of this research lie with the fact that only a limited number of data on BVLGARI operations could be got from open sources and there is no possibility to effectively compare the company’s key indicators such as they would have been without pursuing a differentiation strategy and such as they are with the differentiation. To overcome this limitation, more data will have to be gathered for further research so that the company’s financial indicators could be effectively compared against each other.

The second limitation lies with the fact that no future possibilities for diversification were outlined and the work covers only those industries where the company has already extrapolated. However, from the point of view of the company itself, it would be more beneficial to analyze those industries where it may yet come, taking into account its image as a luxury brand and the possible expenses the involvement in other industries may incur. To overcome this limitation, it is necessary to analyze the investment BVLGARI will have to make to extend into the chosen sphere and the possible gains it can make there as a luxury brand.

The issue that remained unsolved in this work is how BVLGARI’s differentiation strategy compares to other strategies the company may have pursued and what would have been the envisaged result if other market strategies were adopted. As there is no comparison, even considering the company’s enormous success, it is too early to claim that the company adopted the best option of market strategy that could have been chosen.

If I did this work again, I would have tried to assess the other possibilities of expanding the company had such as enhancing its customer base by attracting new clients from middle-class segments, creating a line of products at a more affordable price in a bid to compete with companies operating in the middle-class segment and some others. Assessing the pros and cons of different variants would have allowed me to conclude whether the chosen market strategy is the best option for the company’s development.

As it is, BVLGARI’s differentiation strategy compares favorably against that of other similar brands since the company managed to dramatically increase its growth opportunities without incurring any losses. Moreover, diversification allowed BVLGARI to attract more customers to its initial jewelry segment as the brand’s popularity has grown and more and more people want to wear and buy BVLGARI. Finally, the company’s association with movie stars and celebrities has served to underpin its image as a luxury brand – a competitive advantage that few other companies have managed to achieve.

Bibliography

Bulgari (2008). English: Logo of Bulgari. [online] Wikimedia Commons. Web.

Cpp-luxury. (2018). Bulgari Hotels & Resorts, the success behind the jeweler becoming a true luxury hotel brand. [online] Web.

Hoang, P. (2014). Business Management. 3rd edn. Victoria, Australia: IBID

Luxity. (2021). The History & Heritage of Bvlgari Jewellery. Web.

Glion Website. (2020). From rubies to rooms – the rise of Bvlgari Hotels & Resorts. Web.

Harvard Business Review. (1975). Market Share—a Key to Profitability. [online] Web.

Baron, M.D. (2021) Big picture strategy: The six choices that will transform your business, Wiley.

Carney, M. et al. (2017) Family firms, internationalization, and national competitiveness: Does family firm prevalence matter? Journal of Family Business Strategy, 8(3), pp.123–136.

Gibson, A. (2019) Bulgari’s accessible luxury: Handmade chocolates. Jing Daily. Web.

Hotinceanu, R.H. (2021) Reading Quest EXPERT, 다락원.

Jhamb, D., Aggarwal, A., Mittal, A., & Paul, J. (2020) Experience and attitude towards luxury brands consumption in an emerging market. European Business Review, 32(5), pp. 909-936.

Lojacono, G. & Pan, L.R.Y. (2021) Resilience of luxury companies in times of change illustrated., Berlin: Walter de Gruyter GmbH & Co KG.

Muñoz-Bullon, F., Sanchez-Bueno, M.J. & Suárez-González, I. (2018) Diversification decisions among family firms: The role of family involvement and generational stage. BRQ Business Research Quarterly, 21(1), pp.39–52.

The Moodie Report News Room (2003) Bvlgari Q4 2002. The Moodie Davitt Report. Web.