Dividend policy

Payment of dividends only when a company has no investment options which could generate returns that are higher than the cost of capital. This helps to ensure that the value of a firm is not eroded through dividends. There are a number of theories that informs dividend payment such as the MM dividend irrelevance theory, bird-in-hand theory, signaling theory, tax differential theory, and clientele effect theory (Kapil 26).

Modigliani and Miller proposed that dividends are irrelevant determinants of the value of a firm since such is only dependent on the earnings of the firm. They argued that the value of a firm is dependent on investment rather than dividend decisions. This was based on the assumption that there are no taxes, no transaction costs and that the capital markets are efficient. The bird-in-hand theory contends that shareholders prefer dividend payment to reinvestment of earnings to grow the company and thus earn capital gains.

They therefore observed that companies that pay regular dividends are likely to be attractive to investors. Thus, they noted that dividend decisions are relevant determinants of the value of a firm. The tax differential theory was based on the argument that where taxes on dividends is higher than the capital gains rate, companies which pay dividends are likely to have lower value than those that do not. In this case, the value of decision on whether to pay dividends or not is dependent on tax laws (Tuller 73).

Another theory explaining the relevance of dividends is the signaling theory which contends that due to inefficiencies in the market, dividends are useful signals to investors. Where management pays higher dividends, it signals that a company will have higher than average profits and thus its share prices are likely to increase. The clientele effect theory as advanced by Richardson in 1977 with the argument that different groups of investors will have varying preferences.

For instance, investors who are advanced in age are likely to prefer a regular income to meet their upkeep and thus attracted to companies that pay a regular dividend. On the other hand, young investors are interested in capital appreciation and thus might prefer companies that retain earnings to fund future growth and thus achieve high capital gains (Collier 60).

About BlackRock World Mining Trust

BlackRock World Mining Trust is a British investment trust. The company was established in 1993 and it deals with investment in mining and metals. The company is a publicly traded entity based in London, United Kingdom. The company is listed on the London Stock Exchange. Besides, it is a component of the FTSE 250 index. The firm’s objective is to maximize the returns of the shareholders through investing in a number of securities of mining and metal securities. It is the largest investment trust company in London. This paper carries out an analysis of dividend payment for the company.

Relationship between the share prices and dividend payment

For the past three years the company has continuously paid an annual dividend amounting to £0.14 per share. In 2012, the dividend was paid on March 7. Before the announcement of the dividends the share prices increased from £6.87 on 20/01/2013 to £7.08 just before announcing of dividends. On the day the dividends were announced, the share price was £6.81. The value increased to £6.85 on 19th March 2012 thereafter it declined.

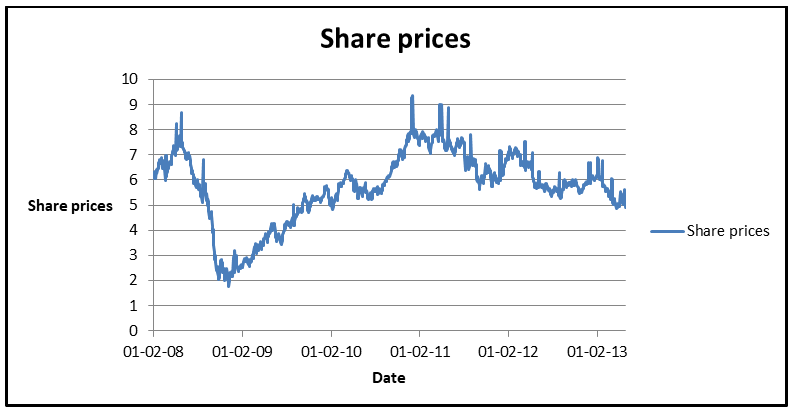

In 2013, the company paid a dividend of £0.14 on 6th March 2013. In 2013, there were no significant changes in the value of the share prices before and after the dividends were paid. It is an indication that the share prices of the company are not responsive to the payment of dividend. This relationship is consistent with the Modigliani and Miller theory of dividend irrelevance. The graph below shows the trend of the share prices of the company since 2008.

The graph presented shows that the share prices declined between the period 2008 and 2009. This is attributed to the global financial crisis. In 2010 and part of 2011, the share prices of the company were recovering from the crisis. The prices reached the peak in 2011. Thereafter, they started to decline gradually. Thus, it can be observed that the amount of dividends paid by the company does not have an impact on the share prices of the company.

Regression analysis

The regression analysis will be carried out for the return of dividends for the company. The dependent variable is the return on shares while the independent variable is the share prices (Stoltz 89). A sample of share prices will be collected over time. The regression line can be simplified as shown below.

Simplified regression equation Y = b0 + b1X1

Y = Return on shares

X1 = share prices

The theoretical expectations are b0 can take any value and b1 > 0.

Regression Results

From the above table, the regression equation can be written as Y = -0.0202 + 0.0039X1. The coefficient value of 0.0039 implies that as the share price increases by one unit, the return on shares also increases by 0.0039 units. The positive value of the coefficient implies a positive relationship between the share prices and return on shares. The intercept value is -0.0202. It represents other factors that determine the return of shares other than the share prices. Examples of such factors are news about the company, retrenchment, and declining performance. These factors contribute negatively to the return of shares.

Evaluation of regression model

Evaluation of the regression model can be done by testing the statistical significance of the variables. Testing statistical significance shows whether the share prices are a significant determinant of the return on shares. A t – test will be used since the sample size is small. A two tailed t- test is carried out at 95% level of confidence.

Null hypothesis: Ho: bi = 0

Alternative hypothesis: Ho: bi ≠ 0

The null hypothesis implies that the independent variable is not significant determinants of the explanatory variable. The alternative hypothesis implies that the variable is significant determinant of return on shares. The table below summarizes the results of the t – tests.

In the table presented above, the values of t – computed are greater than the values of t – critical for both the intercept value and coefficient. Thus, the null hypothesis will be rejected and conclude that the two values are significant determinants of the explanatory variables at the 95 % level of confidence. This implies that the model is strong enough and can be used to determine future variables.

R-square value

The value of R2 is 1.12%. This implies that the share prices explain only 1.12% of the variation on the return on shares. It is an indication of a weak explanatory variable. Also, the value of adjusted R2 is high at 1.04%. The value of R2 can be improved on by adding more variables in the regression model. Further, different models can be used for analyzing the relationship between the two variables. Examples of such models are probit and polynomial models (Bierman 72).

Conclusion

The above analysis reveals that the share price is a significant determinant of the return on shares. However, the share prices do not adequately explain the variations in the return of shares. It indicates that the share prices of the company are less sensitive to dividend payment but depends on other economic conditions such as the economic swings. The results are not consistent with the various dividend models discussed above. It contradicts the dividend irrevance model which states that dividend payment is not relevant in determining the value of the firm.

Works cited

Bierman, Harold. An introduction to accounting and managerial finance, Boston: World Scientific Publishing, 2010. Print.

Collier, Paul. Accounting for managers, London: John Wiley & Sons Ltd, 2009. Print.

Kapil, Sharma. Financial management, India: Person Education, 2010. Print.

Stoltz, Andre’. Financial management, New Jersey: Financial Times Prentice Halls, 2007. Print.

Tuller, Micheal. Finance for non-finance managers and small business owners, Ohio: Adams Media, 2007. Print.