Ticker: MESC Recommendation: Buy

Price: 18.45

Price Target:14.20

Highlights

The revenue and net income of the company declined by a large margin. The revenue declined by about 30% while the net income declined by about 50%. The decline of key components of the financial statements hasserious implications on the profitability of the company. The decline in profitability has significantly impacted on the share prices of the company. The share prices have been declining in the recent past.

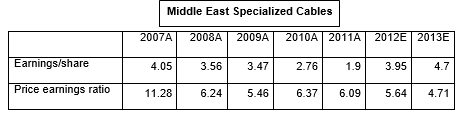

The trend has a serious implication on the investor confidence. The company has experienced a significant drop in the financial performance between 2007 and 2011. The earnings per share declined significantly. However, the estimates for the next two years indicate the company expects to increase profitability. The price earnings ratio was quite volatile and the management anticipates that the volatility will persist in the coming years.

Decline in profitability is attributed to an increase in selling and marketing expenses, depreciation, and finance cost. The net income is expected to grow to SAR13, 317,185 in 2013. The management expects to increase profitability by increasing the amount of sales. The return on average equity and return on average assets declined between 2007 and 2011. This was attributed to the decline in profitability through the years.

However, the returns are expected to increase in the next two years. Despite the declining trend in profitability, the ratios for the company are greater than those of the competitors. The liquidity of the company is quite low. The current ratio and quite ratio were fairly stable though less than one. It could be an indication that the company is experiencing difficulties in paying off current debt. The trend is exhibited by the increasing trend in the value of the average payment period. The average collection period also increased over the years. It implies that the debtors are taking longer to pay their debt. The management expects that the liquidity position of the company will remain at the same amount in the next two years.

The efficiency of the company significantly dropped during the past five years. For instance, payable turnover declined significantly declined over the years. It is evident that the management is working on improving the values of the ratios (Zughaibi & B. Kabbani General Partnership 1). Debt to equity ratio increased from 358.29% in 2011 to 395.6% in 2008. It implies that the amount of debt in the capital structure is far much more than the amount of equity in the capital structure. The leverage ratio of the company is quite high and it is not a good indication to potential shareholders. The management is determined to reduce the leverage level thought it might take longer than it was expected.

On average the management estimates that the growth in operating performance of the company will be 5% by 2013. Key variables such as revenue, operating profit, net income and total income will grow at that rate. Further, total assets will grow by 16.9% while the total equity will grow by 21.0%. The growth in equity might not be achieved due to high leverage. The company needs to reduce the leverage level so that they may be able to attract potential investors. The share prices of the Middle East Specialized Cableshave been fairly stable for the past five years. The share prices of the company do not respond significantly to positive news about the company. It is an indication of a stock with a small spread.

The company is adequately capitalized over the past five years. The country is categorized under micro capitalized companies in the stock exchange.

The most recent amount of dividend paid by the company was SR2.00per share. This gave rise to a high dividend yield of 5.13%. The value is higher than the industry average. Some of the main risks that the company faces are market volatility risk because the company operatesin a constantly changing industry. The other risks are credit risks and volatility risk.

Business description

Middle East Specialized Cables is a public limited company that is based in the Saudi Arabia. The company has engaged about 67 employees. The external auditor of the company is Ernst & Young. Middle East Specialized Cables were started in the year 1992. The first factory of the company was erected in the year 1994 and the operations of the company started in the year 1995. The company is ISO certified. The company became a public limited in 2007.

The key shareholders of the company are Abdullah M. S. Al Namlah (8%), Abdulaziz M. S. Al Namlah (7.80%) and Mansour A. M. Kaaki (6.30%). The company is listed on the Saudi Stock Exchange. Further, it operates in the building and construction industry. The company has presence in over seventeen countries.The company is engaged in the production and sale of a variety of construction products. Some of the products that the company deals with are flexible, electrical, axial, and rubber cables. The company also manufactures and sales telephone, anti – fire cables, and computer cables.

Industry overview and competitive position

As mentioned above, the Middle East Specialized Cables operates in the construction industry in Saudi Arabia.Some of the competitors of the companies are Saudi Ceramics Co. – SCERCO, Gulf Cable & Electrical Industrial Co. – CABLE, Zamil Industrial Investment Co. – ZIIC, Combined Group Contracting Co. – CGC, Saudi Arabian Amiantit o., Oman Cables Industry Co., Ras Al Khaimah Ceremics Co., Arkan Building Materials Co., Galfar Engineering & Contracting Co., and National Industries Co. This makes the market quite competitive because all the three key players have a large capital base and their products are equally appealing to customers. Also, more giant companies are expected to join the industry in future years. With the growing young population in the region, the industry is expected to grow rapidly.

Besides, the market is characterized by a vigorous economy since it is an oil producing country. The economy is highly liberalized. This creates room for the forces of demand and supply to regulate the market. This creates room for growth and expansion. With the constantly changing technology, the companies in the industry face a great challenge of making massive capital investments on a frequent basis so as to match the speed of change in technology.This can account for high depreciation rate observed in the financial statements of the company (Zughaibi & B. Kabbani General Partnership 1).

The construction industry is closely regulated and monitored by a unit in the government of Saudi Arabia. The institution offers licenses and regulates prices and conducts of companies operating in the industry. Besides, the unit ensures that the construction laws are adhered to. The company has grown from a duopoly to an industry with several companies.An increase in the number ofcompanies in the industry has been beneficial to customers since the gain from lower prices (Zaywa 1).

Investment summary

Currently, the share prices of the company trade at SR18.45. The intrinsic value of the company is SR14.20. Both qualitative and quantitative approaches were used to evaluate the stock of the company. The estimated true value of the shares of the company was estimated by the product of expected earnings per share and the earnings multiplier. The price to book value of the company was used to estimate if the shares of the company were accurately valued. The ratio declined over the three five years and it is expected to decline further.

The management changed the capital structure of the company by adding debt in 2008. This fundwas required for expansion and acquisition of several subsidiaries. The increase in debt financing affected the financial performance of the company. The increase in cost outweighed the increase in revenue thus leading to a decline in profitability.

In as much as the company is considered as the leader in the construction industry, it has low liquidity and efficiency. The company needs to improve these areas so as to lead the market in all areas.

Some of the risks that the company facesarethe commission rate risk, liquidity risk, credit risk, currency risk, and financial risk.

Valuation

The two valuation tools that are used to evaluate the company are price earnings ratio and price to book value ratio. Despite the declining trend of the price earnings ratio of the company, the ratios for the company were higher than those of the industry average for the past five years. The ratio it expected to decline further in 2012 and 2013. A high price earnings ratio could be an indication that the shares of the company are highly valued.

Further, the price to book value declined from 1.95 in 2007 to 1.25 in 2011. The ratio is expected to decline further in 2012 and 2013. As the value declines. It implies that the share price of the company is approaching the intrinsic value and it indicates that the shares of the company are neither overvalued nor undervalued (Euromoney Institutional Investor Company1).

Financial analysis

The profitability ratios for the company declined significantly. A downward trend can be observed in key profitability ratios such as gross profit margin, operating profit margin, net profit margin, return on average equity, and return on average assets. The declining trend is a bad indication to a potential shareholder and it may make investors lose confidence. Besides, it impacts negatively on the share trading in the stock market. The declining trend in profitability can be attributed by stiff competition from new companies joining the market.

The activity ratio of the company similarly declined over the years five years.For instance, the payable turnover declined from 3.4 times to 2.60 times. The ratio started to increase in 2010 and the increasing trend is expected to increase until 2013. Further, receivables turnover declined from 5.56 times to 4.43 times. A decline in efficiency ratios could be an indication of poor management of resources. Finally, fixed asset turnover and total asset turnover remained fairly stable over the five years.

The liquidity position of the company is quite low. Both current and quick ratios were less than one in past five years. Besides, the values were fairly stable. The forecasts for 2012 and 2013 shows that there are no significant changes that are expected in the coming years. It could be an indication that the company is facing liquidity risk.

The leverage ratio of indicates that the company has a large amount of debt financing in its capital structure. The debt to equity ratio was above 100% in the four year period. The management expects that the ratio will decline by a small margin in 2012 and 2013. Finally, the equity to total assets and total liabilities to total assets ratios shows the proportion of total assets that is financed by debt.It is not a good indication to potential shareholders.

From the analysis above, it is apparent that the company has been experiencing a declining trend in financial performance. The poor performance can be attributed to a number of reasons such as acquisition of a large amount of debt in 2008. The second reason is competition. In 2008, three companies joined the construction industry increasing the number of companies from two five. Thus, it is evident that Middle East Specialized Cables is struggling to match the increasing competition in the industry. The estimates for the year 2012 and 2013 can only be achieved if the company employs turnaround strategies. It is advisable to buy the shares of the company since it is expected that the financial performance and the share prices will improve.

Work Cited

Euromoney Institutional Investor company 2010. Middle East Specialized Cables (MESC). Web.

Zaywa 2013. Middle East Specialized Cables. Web.

Zughaibi & B. Kabbani General Partnership 2013. Middle East Specialized Cables Co. – MESC. Web.