Data gathering

In the process of conducting the study, a number of issues which include the source of data, its accuracy and credibility were taken into account in the process of gathering the necessary data. The study mainly relied on secondary sources of data.

This was achieved by gathering data from published company reports posted on the firm’s official website and from other credible data bases.

For example, the study relied on the financial information published by the Emirates Group on Dnata’s financial performance. As a result, a high degree of credibility, accuracy and reliability was ensured.

In an effort to gather sufficient amount of data, a comprehensive questionnaire was designed. A comprehensive review of the questionnaire was undertaken prior its administration to the respondents in order to eliminate any form of errors and ambiguity.

The questionnaire included both open-ended and close-ended questions. Open-ended questionnaires were used in order to provide the respondents with an opportunity to communicate their opinion while close-ended questionnaires were used where a specific answer was required.

The questionnaires focused on five main areas which include the operational cost, trend of fuel prices, the impact of fuel process on the firm’s operation, logistics and location and how outsourcing can be used to minimize the challenges associated with high fuel prices.

Considering the fact that the respondents are very busy, the questionnaires were mailed in time in order to provide them with ample time to look at them.

The target population for the study included all Dnata Company employees. In an effort to simplify the study process, the concept of sampling was integrated. Fifteen employees were selected to be the respondents. By selecting a small sample size, it was possible to increase the power of the study.

Maxwell (2005) asserts that a large sample size reduces the power of a particular study due to numerous errors. However, a small sample size reduces such errors.

As a result, the researcher was able to improve the degree to which the findings of the study can be relied upon in addition to lowering the cost of the study. Employees from different job categories were selected to be the respondents.

Some of the respondents belonged to the top level management while others belonged to lower level of management. However, it was ensured that the respondents selected were conversant with the impact of high fuel prices on the operation of Dnata Company.

Data analysis

Both qualitative and quantitative data research methods of data analysis were used. This was achieved by integrating descriptive statistics and inferential data analysis methods. Descriptive statistics entails calculating the mean, mode, frequencies and percentages.

On the other hand, inferential statistics entails integrating tests such as t-test and the chi-square. Such tests aid in evaluating the statistical difference between categorical variables.

On the other hand, multivariate analysis will be used to assess the impact of high fuel prices on the performance of Dnata Company. The research questions considered in the study will be analyzed individually.

By using descriptive statistics, the researcher will be able to condense the voluminous data collected. The data collected will be presented using tables, graphs and charts. As a result, it will be easy for a large number of stakeholders to interpret the findings.

Results

Analysis of how the rise in oil price has affected Dnata’s operation

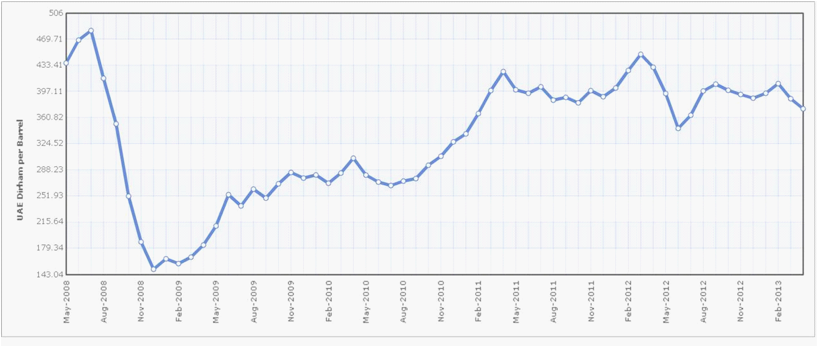

Oil is an important component in the operation of organizations in various economic sectors. The data gathered from secondary sources shows that the UAE has been experiencing a significant fluctuation in oil prices over the past five years.

The chart below illustrates the trend in the performance of crude oil price in the UAE from 2008 to 2012.

The chart shows that the price of oil in the UAE reduced significantly from May 2008 to November 2008. However, the downward trend was reversed from 2009 and the country been experiencing an upward trend with regard to oil prices as illustrated by the graph.

The table below shows a summary of the average oil price per barrel in UAE and the associated percentage change from 2008 to 2012.

The chart shows that oil price from 2009 to 2012 has experienced minimal change. This explains why the cost of doing business in the UAE has been very high.

Figure 2.

High oil prices increases the risks faced by an organization. From the illustrations above, it one can assert that Dnata is exposed to numerous financial risks.

Consequently, it is fundamental for the firm’s management team to conduct a comprehensive analysis and evaluation on the risks that the firm faces. This will result in development of greater insight on the most effective risk control measures.

This will improve the effectiveness with which the firm implements effective risk control mechanisms. The mechanisms integrated should enable the firm balance between the risks faced and the returns gained.

Most of the respondents cited market risk as one of the greatest challenges that Dnata is currently facing. The respondents said that Dnata is currently exposed to a high degree of market volatility as a result of the prevailing fluctuation in oil prices.

The high oil prices in the UAE have persisted since 2008 despite the numerous financial and economic reforms undertaken by the government to address the situation.

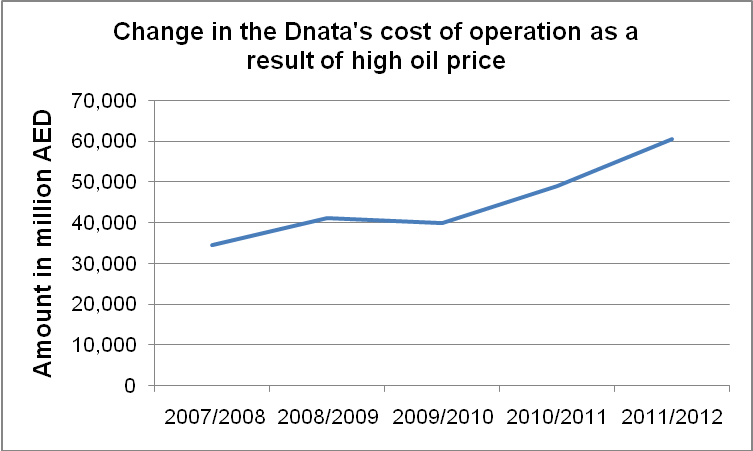

The reforms instituted by the UAE government have significantly boosted business confidence amongst investors in various economic sectors. Dnata has experienced a significant increment in the cost of its operation over the past five years.

The cost has been relatively high compared to the revenue. The increment is as a result of the high oil prices. The chart below illustrates the operating cost that the firm incurred from 2008 to 2012. The chart shows that the cost of operation has been on an upward trend.

Figure 3

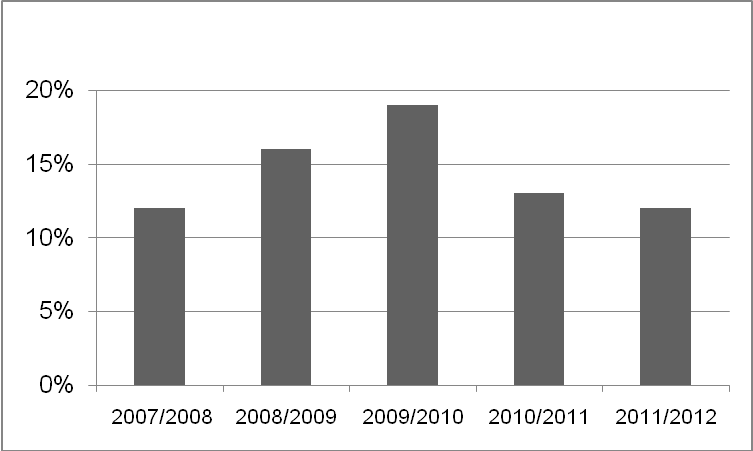

The high oil price has adversely affected the Dnata’s financial performance. The chart below illustrates the firm’s financial performance over the past five years.

Figure 5.

The table above indicates that Dnata has been experiencing a positive financial performance despite the high oil prices. This is evidenced by the increase in the firm’s level of profitability. During its 2011/2012 financial year, Dnata attained the highest level of profitability.

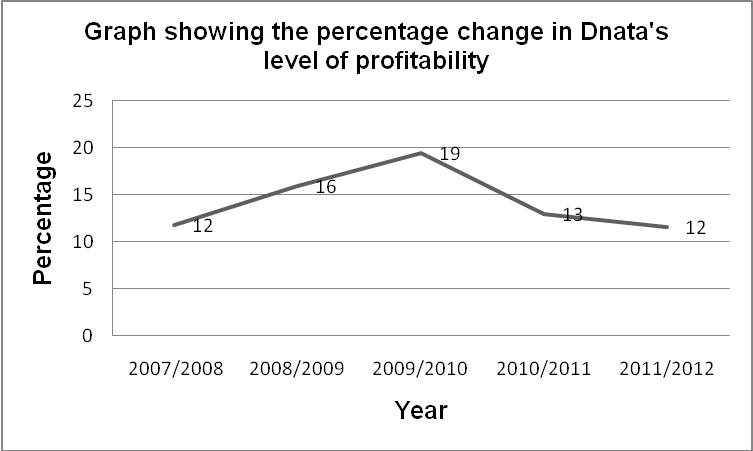

The increment was associated with the aggressive international expansion strategy that the firm has integrated in its strategic management. The graph below shows the percentage change in the firm’s level of profitability from 2008 to 2012.

Figure 6.

Source (Emirates Group, 2012)

The Middle East airline industry is expected to grow with a margin of 6.4% over the next two decades. The growth is expected to emanate from development in both long-haul and short-haul forms of air travel.

An analysis of how outsourcing will help Dnata address the financial crisis

In an effort to enhance its sustainability, Dnata Company entered into a 2-year partnership agreement with Al Ahli Club in 2012. During the two years, Dnata will act as the travel agent for the club.

When asked about the impact of the partnership on the firm’s future sustainability, the respondents were of different opinion. Eighty percent (80%) of the respodents were of the opinion that the partnership will enable the firm increase its profitabilty.

This is due to the fact that the partnershp with Al Ahli Club will stimulate higher sales revenue. The respondent were of the opinion that the partnership presents a unique opportunity for Dnata to market its services to a large number of potential customers.

On the other hand, 90% of the respondents said that the partnership will enable Dnata develop a high level of loyalty amongst its customers. This is due to the fact that Al Ahli is one of the most popular clubs in the UAE and has a strong base of loyal fans.

Discussion

High oil prices have been a subject of concern for many organisaitons. Despite their enormous oil reserves, countries within the MENA region such as the UAE are ranked amongst the economies with the highest oil prices in the world.

One of the reasons that explain the high oil price relates to the high rate of speculation by the various stakeholders.

Business process outsourcing is one of the most effective strategies that Dnata Company have integrate in its strategic manaagement. Effective implemenntation of the outsourcing strategy inncreases the effectiveness with which an organisation survives challenging economic times.

Firstly, outsourcign enable an organisation to minimise the cost of operation. This is due to the fact that some operations are transferred to the outsourced firm.

Secondly, outsourcing plays a fundamental role in attracting and retaining customers. Currently, the UAE is experieincing a financial crisis. Consequently, it is fundamental for Dnata’s management team to be effective in implementing its outsourcing strategy.

Conclusion

The study shows that the airline industry in the UAE is facing a major threat emanating from changes oil prices. Over the past five years, oil price in the UAE has been on an upward trend. This has presented a major challenge to firms within the industry in their quest to maximize profit.

However, Dnata has managed to sustain a positive financial performance despite the prevailing financial crisis in the UAE. One of the factors that have contributed to the firm’s success is effective integration of administrative strategies.

For example, the firm has integrated the concept of merger and acquisition in its operation. As a result, Dnata has been able to achieve higher economies of scale.

The high oil price in the UAE is one of the major challenges that Dnata Company will be required to deal with in order to survive in the long run. Thus, it is crucial for the firm to incorporate effective management strategies.

One of the strategies that the firm should consider integrating is outsourcing. Outsourcing is ranked as one of the most effective strategies that can assist firms within the hospitality industry to deal with challenging economic situations such as financial crisis.

Currently, the firm has entered into a partnership with Al Ahli Football Club. The partnership is likely to promote the firm’s sales revenue. This is due to the fact that the firm will be able to interact and create awareness to a large number of potential customers.

To enhance its competitiveness, it is essential for Dnata conduct a comprehensive market analysis to in order to identify potential firms with which it can enter into a partnership agreement with.

Secondly, to improve the effectiveness with which it deals with changes in oil price, it is fundamental for Dnata Company to incorporate the concept of hedging.

Hedging will enable Dnata to safeguard itself from high oil price hence increasing the likelihood with which it sustains competitive ticket prices. By integrating these strategies, the likelihood of the firm attaining its profit goals will be increased.

This is due to the fact that the firm will attract and maintain a large number of customers. Hedging will enable Dnata to compete on the basis of fair ticket prices. As a result, the firm will be able to appeal to a large number of potential customers.

Upon integrating the above strategies, it is fundamental for the firm to conduct a continuous review of its performance.

Reference List

Emirates Group: Financial report. (2012). Web.

Index Mundi: Crude oil. (2013). Web.

Maxwell, J. (2005). Qualitative research design: an interactive approach. New Jersey: Sage Publication.