Introduction

Sudbury is a city in Ontario that is a vital hub of economic development in Canada, following its diverse and talented workforce and being a regional center for business services. An economic outlook on Sudbury will comprehensively analyze a region’s current and expected economic conditions.

Hence, an economic outlook on Sudbury using various economic indicators will help businesses understand the nature of demand, production, competition, market structure, implications, and concerns in specific industries, which can be used to inform their decisions regarding their investments and operations.

The Summary of the Economic Outlook for Sudbury, Ontario National or Provincial

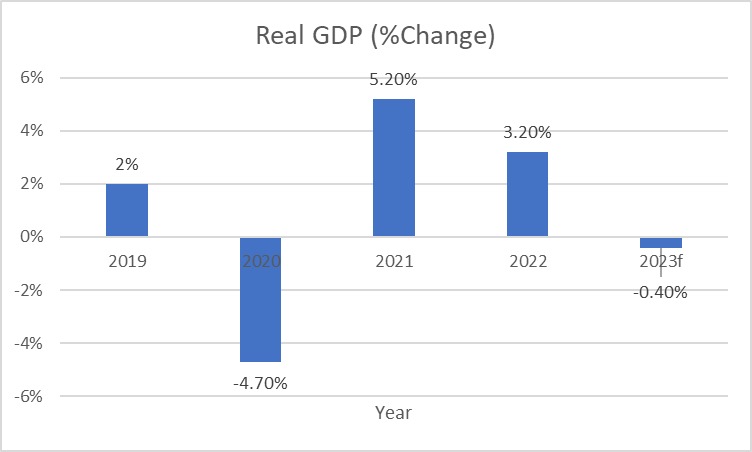

The city has a solid economy, with evidence from various economic indicators such as gross domestic product (GDP), population, investment, and employment rate. A GDP provides information on how healthy a particular economy is. A low GDP rate specifies low growth and a high GDP indicates a thriving and robust economy. Ontario started to see positive economic growth in 2021 with a solid 5.2% after dropping by 4.7% in 2020 following the COVID-19 outbreak. The region then gained a 3.2% growth in 2022, depicting a healthy economy, as shown in Figure 1 (Ontario Chamber of Commerce, 2023). However, the GDP is expected to fall by 0.4% in 2023. Much of the economic growth is attributed to the region’s increased exports and employment gains.

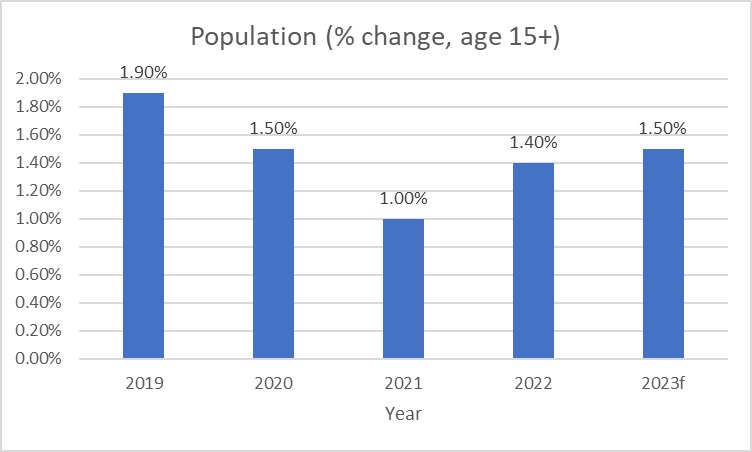

The population is an essential economic marker as its growth denotes a large labor force and increased consumption of goods and services, indicating a high demand for products. Sudbury has gained population growth from 161,531 in 2016 to 166,004 in 2021, a 2.8% increase according to its census profile (“Census profile, 2023”). Furthermore, the country reported a population increase of 1.9% in 2019, 1.5% in 2020, 1% in 2021 and 1.4% in 2022, as shown in figure 2 (Ontario Chamber of Commerce, 2023). This population growth positively influences the labor force, consumption, and investment in the region.

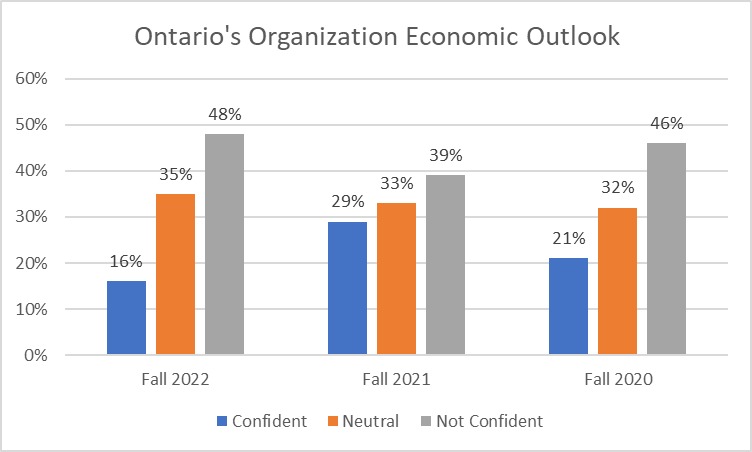

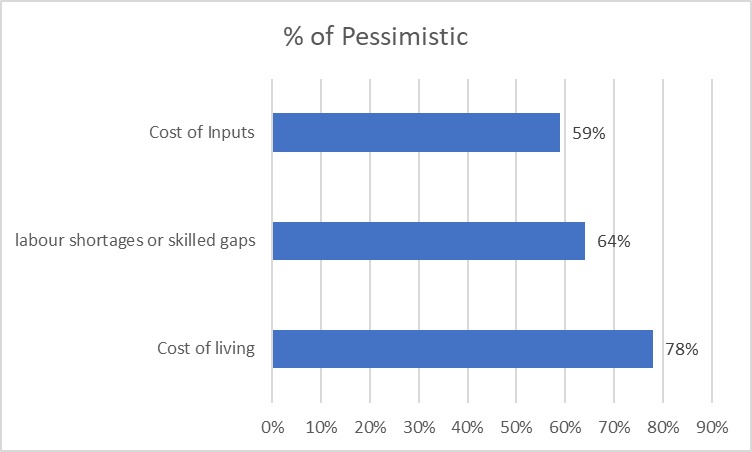

Another vital economic indicator is investments, as they reflect the confidence level that investors and businesses have in the economy of a particular region. Confidence in a stable economy draws in more regional investments in various projects and expands businesses. The confidence level of Ontario has significantly dropped in 2023. According to a survey conducted on 1912 organizations in 2022 by the Ontario Chamber of Commerce, only 16 % of the corporations were confident in Ontario’s economy in 2023, which was a drop from 29% in 2022, as shown in Figure 3 (Ontario Chamber of Commerce, 2023). The survey indicated that the cost of living, labor shortages, and cost of inputs such as capital and raw materials are the top three reasons for pessimism in Ontario’s economy, with 78%, 64%, and 59%, respectively, as shown in Figure 4.

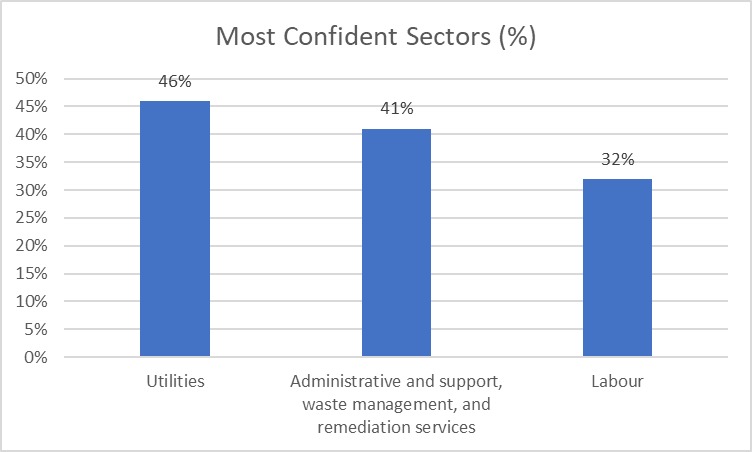

The global economic uncertainty and supply chain barriers have contributed to the drop in Ontario’s confidence level. The infrastructure deficits helped aggravate supply chain blockages in the region, which influenced the drop in confidence. The confidence varied across sectors, with utilities, administrative and support, waste management remedial services, and labor being the most confident at a rate of 46%, 41%, and 32%, respectively, as shown in figure 5 (Ontario Chamber of Commerce, 2023).

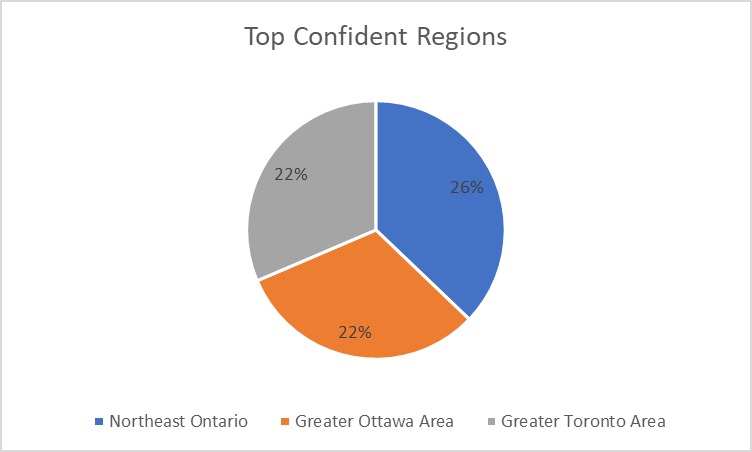

Moreover, larger cities such as Greater Sudbury benefit from high access to markets, services, and talent compared to rural areas through better integration with transport networks, broadband connectivity, and proximity to the capital. Northeast Ontario, with cities such as Greater Sudbury, presents the highest confidence with high employment growth at 26%, followed by the Greater Ottawa area and Toronto, with 22%, as shown in Figure 7.

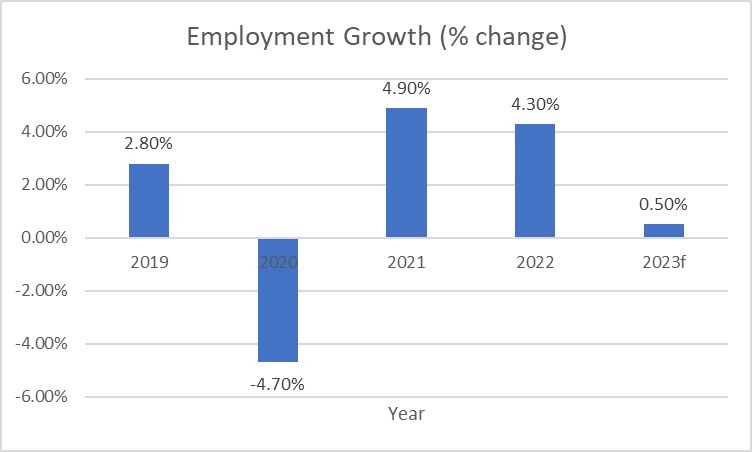

Another significant economic indicator is employment, which ensures that individuals have steady incomes that influence their level of spending. The investments made in Northern Ontario, particularly in Greater Sudbury, in various projects have helped provide stable employment in the region. The region reported a drop of 4.7 % in 2020, but employment rose by 4.9 in 2021. It then dropped to 4.3 in 2022 and is expected to fall further by 0.5% in 2023, as shown in Figure 8 (Ontario Chamber of Commerce, 2023).

Sudbury’s Mining Industry

The city of Greater Sudbury contains the largest integrated mining complex in the world. Its mining industry encompasses over 300 mining supply firms, employs more than 12000 individuals, and generates almost 4 billion dollars in annual reports (Gauld et al., 2021). The industry has high competition, demand, production, and an oligopolistic structure.

Nature of Demand

The mining services sector in Sudbury significantly contributes to Ontario’s GDP annually. Sudbury’s mining sector can generate over 3.3 billion dollars for the GDP of the region of Ontario. Sudbury is regarded as the capital for mining and mineral exploration in Canada. The industry is known to mainly focus on producing copper, nickel, platinum, cobalt, and palladium. The nature of demand for this industry can be described as driven by the use of minerals and metals and product prices. The nature of demand for the mining industry is cyclical and reliant on global economic conditions (Ontario Mining Association, 2022). The demand for mined metals is mainly controlled by the conditions in the global market, which are majorly influenced by geopolitical tensions, economic growth, and technological advancements.

The demand for copper, nickel, platinum, cobalt, and palladium typically increases with periods of economic growth. This is because they are vital in various industries and sectors like technology, construction, and manufacturing. For instance, nickel is primarily used in stainless steel production. Hence, its demand is mainly influenced by the changes in the aerospace and automotive industries. The most significant demand for nickel is 70%, associated with using stainless steel (Gauld et al., 2021).

Increased urbanization has led to a rise in the use of electric vehicle batteries, which has boosted the demand for nickel in recent years (Ontario Mining Association, 2022). For this reason, the demand for metal is expected to rise by 24% by 2030 (Gauld et al., 2021). Furthermore, the increasing operations in the electronics and construction industry have increased the demand for copper, a significant component in these sectors.

Moreover, copper is used in diverse sectors, including construction, transportation, machinery, and general utilities. The construction sector is the largest consumer of copper, claiming a demand of approximately 28% of the metal used, while the general products and utilities take up to 20% (Gauld et al., 2021). However, in times of economic downturn, the demand for these metals may drop as many industries reduce consumption and production.

Moreover, there is an increasing demand for sustainably sourced metals and minerals and for companies to display social and environmental responsibility accountability. For instance, copper is essential in electrical construction and wiring, meaning that renewable energy trends and infrastructure development can influence its demand (Ontario Mining Association, 2022). Advances in automation and cleaner mining technology make companies able to safely and efficiently extract metals and minerals and protect the environment.

Production

Production in Sudbury’s mining industry is characterized by modern, large-scale operations that employ advanced technologies to enable efficient and safe extraction of metals and minerals. The city can produce large amounts of copper and nickel, making it a key player in the mining industry worldwide. Moreover, the industry engages in operations that depict social and environmental responsibility (Ontario Mining Association, 2022). Furthermore, most mining corporations in Sudbury heavily invest in research and development to improve the production process. For example, the application of automation and data analytics and developments in drilling technologies have enabled the industry to improve the efficiency of mining operations.

Diverse factors influence the production levels of the mining industry. First, global market conditions and price fluctuations influence the production of minerals and metals. For instance, a rise in the demand for copper or nickel forces companies to increase production to meet consumption. Second, the production of metals in Sudbury is influenced by environmental regulations, innovation, and technology (Ontario Mining Association, 2022). Environmental regulations limit the amount of mining that can be carried out in a particular area, hence minimizing production. Technology and innovation help improve the efficiency of production in the industry. As a result, mining companies in Sudbury have to adopt new innovative approaches and change conditions to maintain their competitiveness and sustainability in the market.

Competition

Sudbury’s mining industry contains vast competition between different companies. The region has several mining corporations, such as Glencore, Vale, and Kombinat Górniczo-Hutniczy Miedzi (KGHM). These organizations globally compete for market share, skilled labor, and mineral deposits. They are always looking for ways to reduce production costs, improve production processes, and increase efficiency, which enable them to gain a competitive edge (Gauld et al., 2021). One of the main factors of competition in the regions is associated with the high demand value of the extracted metals, including cobalt, copper, and nickel.

Additionally, competition in the mining industry is influenced by the cost of production, innovation, and technology. For this reason, companies can extract minerals at a low cost and more efficiently than their competitors, and they gain a competitive edge only if they can change with innovative mining technology and techniques. Moreover, companies use automation, reduce waste, and optimize processes to reduce production costs and remain competitive in the industry (Gauld et al., 2021). Lastly, companies in the industry have to compete for skilled labor. Sudbury contains a substantial number of mining experts, forcing the companies to compete for these workers if they remain competitive in the market and maintain their operations.

Market Structure

The mining industry of the Sudbury region contains an oligopolistic market structure. This indicates that a small number of large companies dominate the industry and are highly independent. They regularly use strategic behavior to enable them to maintain power in the market. The region is home to companies such as KGHM International, Vale, and Glencore, which dominate a substantial portion associated with the global production of copper, nickel, and cobalt (Ontario Mining Association, 2022). These companies have set operations in mines located both in Sudbury and other regions across the globe as they compete for market share worldwide.

Moreover, these large companies have significant market dominance because of their unlimited access to a skilled workforce, innovation and technology, financial resources, and size. They primarily engage in joint ventures, strategic alliances, and acquisitions and mergers, which help them reinforce their market power and gain access to new mineral deposits. Nonetheless, the mining industry in Sudbury contains other independent but small companies operating in the region (Ontario Mining Association, 2022). These small companies may target specific mineral deposits or niche markets and may be more adaptable and nimbler to changes in market conditions than larger firms.

Implications

The industry’s market structure contains various strategic implications. First, the industry is very competitive, meaning companies must continuously innovate, increase access to mineral deposits and skilled labor, and implement cost-saving measures to maintain their competitive advantage. Second, the sector depends on natural resource availability; hence, the exhaustion of nickel and copper in Sudbury will result in reduced profitability and production capacity. Third, the industry’s market type can cause implications for regulation and policy that ensure mining operations are carried out in socially responsible and environmentally sustainable ways. Failure to comply with the set regulations can be accompanied by fines, penalties, and legal action, proving time-consuming and expensive.

Moreover, the mining industry is plagued with several tactical implications. First, a small number of companies with market power can influence supply and pricing, which can affect downstream industries dependent on these metals. Therefore, failure in supply chain and price management can interfere with mining operations resulting in reduced profitability following production delays and increased costs. Second, the mining industry requires skilled labor, meaning corporations will have to manage their workforce and warrant safety to minimize labor disputes, legal action and increase production.

Key Concerns and Critical Business Issues

Various concerns and issues plague the mining industry in greater Sudbury. First, the mining sector is expected to have new environmental regulations that can be introduced to help move towards a greener and more sustainable economy. These regulations could result in additional expenses and investments in the processes and equipment that satisfy the guidelines.

Second, the global economy easily affects the demand for concerned metals like copper and nickel, which can directly affect the mining business. Therefore, the CEOs must adapt to the market changes and appropriately adjust their operations. Third, the mining sector can be booming only with the support of skilled labor. This means that CEOS will need to invest in development and training programs to attract and retain competent experts.

Fourth, there are rapid technological advancements that help improve efficiency and reduce production costs. This indicates that CEOs must invest and adapt to technological and market conditions and changes in the industry or risk falling out of the competition.

Finally, the mining industry is highly dependable on infrastructure in energy and transport networking for swift business. For this reason, CEOs will need to cooperate with governments and other stakeholders to make sure that the needed infrastructure is improved and maintained to protect and support mining operations.

References

Census profile, 2021 census of Population. Statistics Canada. (2023). Web.

Gauld, C., Gardner, N., Hossack, A., & Puro, G. (2021). (rep.). Technical Report Summary Sudbury Property. Web.

Greater Sudbury sees strong growth in 2022. Greater Sudbury. (2023). Web.

Ontario Chamber of Commerce. (2023). (rep.). 2023 Ontario Economic Report. Web.

Ontario Mining Association. (2022). State of the Ontario Mining Sector. Web.

Second and third quarter of 2022 see economic growth in Greater Sudbury. Greater Sudbury. (2022). Web.