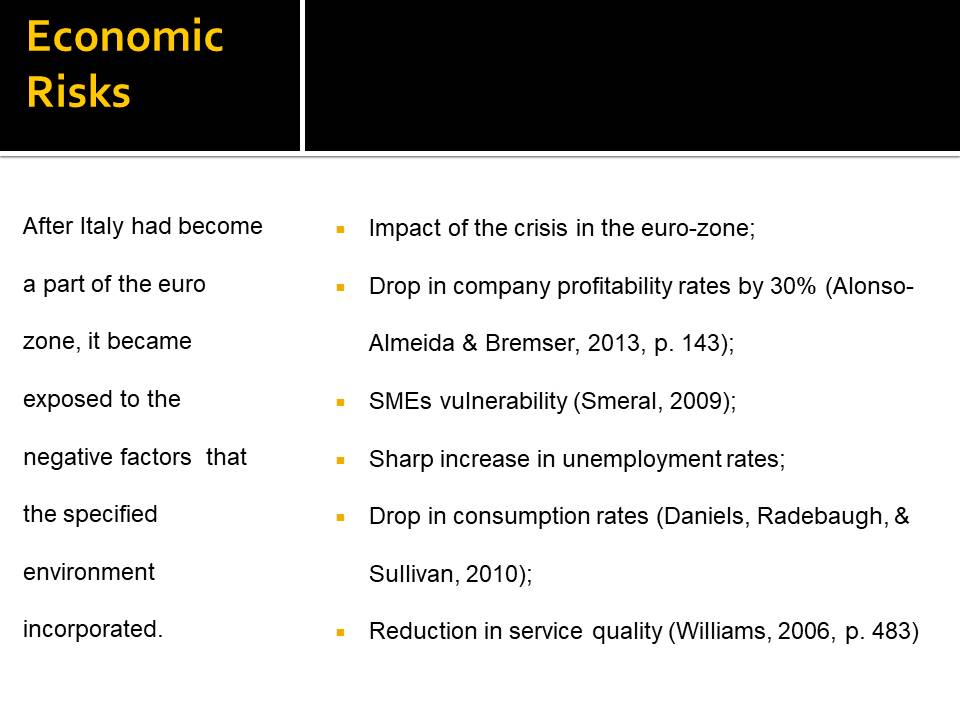

Economic Risks

After Italy had become a part of the euro zone, it became exposed to the negative factors that the specified environment incorporated.

- Impact of the crisis in the euro-zone;

- Drop in company profitability rates by 30% (Alonso-Almeida & Bremser, 2013, p. 143);

- SMEs vulnerability (Smeral, 2009);

- Sharp increase in unemployment rates;

- Drop in consumption rates (Daniels, Radebaugh, & Sullivan, 2010);

- Reduction in service quality (Williams, 2006, p. 483)

Italy is fighting a lot of problems within its economy sector at present. Because of the recent integration in the euro zone, the necessity to rearrange the state’s economic priorities has emerged. A range of companies, which were incapable of altering their structure fast enough, reported a significant drop in performance. Consequently, a range of shutdowns and the ensuing increase in unemployment rates can be observed across the country. Moreover, the increase in emigration, as well as poverty and the following reduction in the consumption rates have affected the revenues of entrepreneurships across the state.

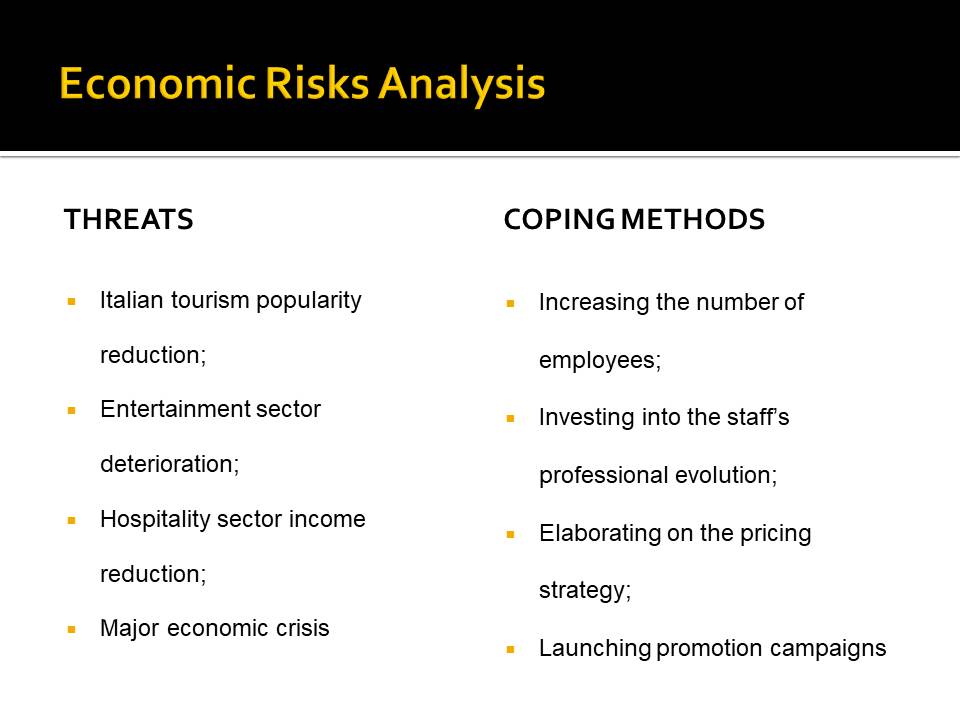

Economic Risks Analysis

Threats

- Italian tourism popularity reduction;

- Entertainment sector deterioration;

- Hospitality sector income reduction;

- Major economic crisis

Coping Methods

- Increasing the number of employees;

- Investing into the staff’s professional evolution;

- Elaborating on the pricing strategy;

- Launching promotion campaigns

Since Italy is a primarily agricultural state that also thrives on tourism, the drop in performance of the state organizations and the reduction of tourism rates may kill the state economy. The hospitality sector is suffering a major crisis at present. The specified phenomenon can be partially attributed to unreasonably high prices and a reduction in services quality.

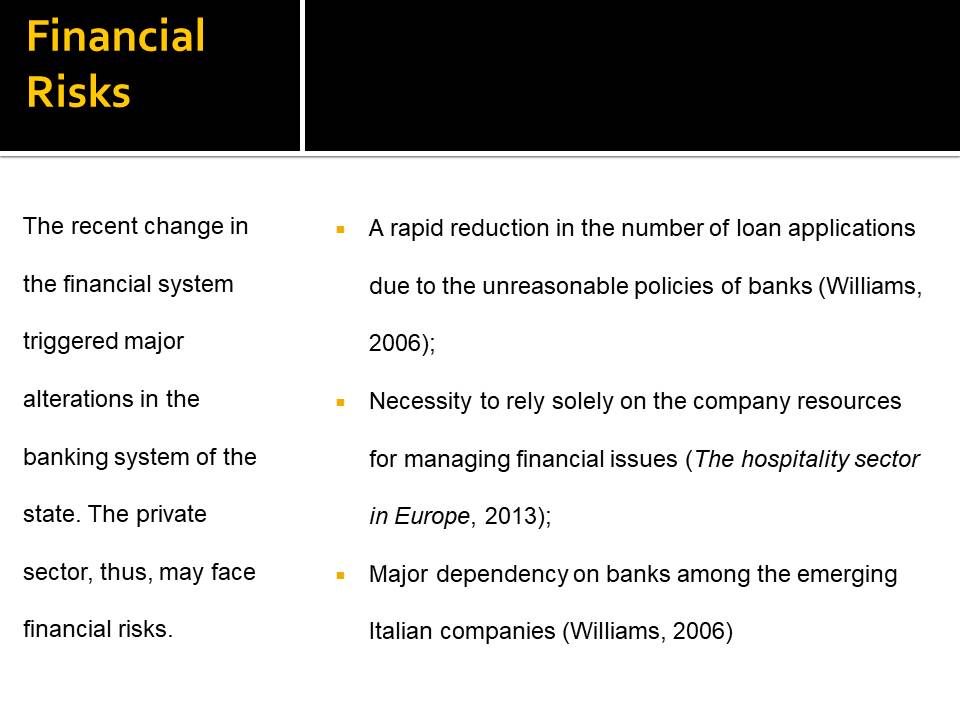

Financial Risks

The recent change in the financial system triggered major alterations in the banking system of the state. The private sector, thus, may face financial risks.

- A rapid reduction in the number of loan applications due to the unreasonable policies of banks (Williams, 2006);

- Necessity to rely solely on the company resources for managing financial issues (The hospitality sector in Europe, 2013);

- Major dependency on banks among the emerging Italian companies (Williams, 2006).

Because of the need to transfer into the euro zone, Italy has altered its baking system. The ensuing complexities concerning financial transactions affected the operations of most Italian companies, which means that the Hilton company may also face major problems in carrying out its own financial transactions. It is highly possible that Hilton may eventually become overly dependent on Italian banks.

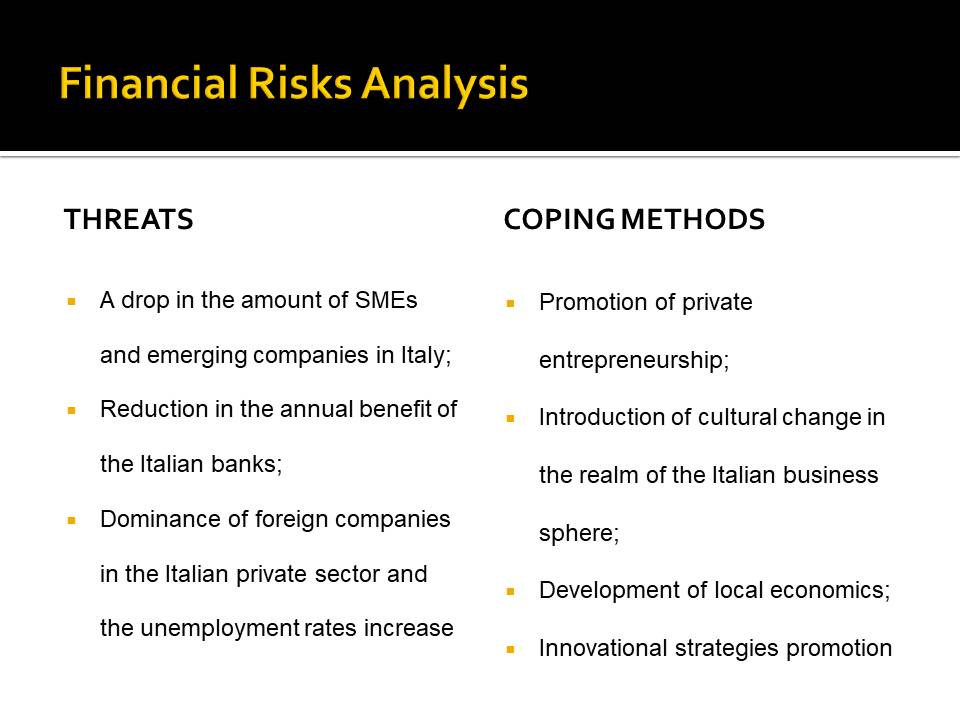

Financial Risks Analysis

Threats

- A drop in the amount of SMEs and emerging companies in Italy;

- Reduction in the annual benefit of the Italian banks;

- Dominance of foreign companies in the Italian private sector and the unemployment rates increase

Coping Methods

- Promotion of private entrepreneurship;

- Introduction of cultural change in the realm of the Italian business sphere;

- Development of local economics;

- Innovational strategies promotion

Because of the weakness of the Italian companies in the home market, there is an obvious threat of the latter being dominated by foreign organizations. Therefore, it is essential that Hilton should incorporate an efficient time management strategy in order to become the leader in the specified realm.

Political Risks

The general political situation within the state can be defined as stable despite certain issues triggered by entering the euro zone (Smeral, 2009).

- The efficacy of the special office for supporting foreign investors may be hampered because of bureaucracy and administrative procedures (Smeral, 2009);

- The changes in tax policies and property laws may affect private entrepreneurship negatively (Alonso-Almeida & Bremser, 2013).

Because of the aforementioned issue concerning the integration into the euro zone and the related changes in the state economy and finances, major political events have occurred. For instance, the special office for supporting foreign investors has faced a threat of stalling in its progress. Consequently, Hilton is likely to deal with several administrative obstacles when starting expansion in Italy.

Political Risks Analysis

Threats

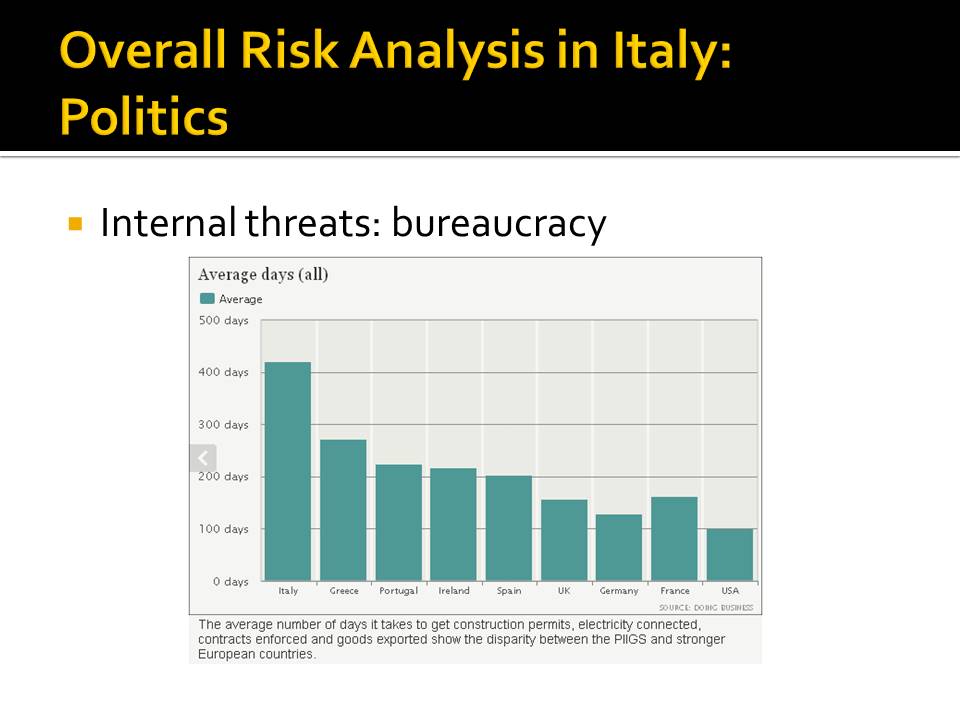

- Bureaucracy growth slowing the growth of the private sector down;

- New tax policies triggering a drop in the amount of private companies;

- Increase in the possibility of tax fraud.

Coping Methods

- Analysis of the factors contributing to the state stability in the past;

- Location of the methods of enhancing the factors in question;

- Design of the strategies for managing the situation.

It should be noted that the Hilton Company may also need to address the issue if tax fraud. When it comes to collaborating with the Italian organizations. It is essential for Hilton to retain its reputation, which is why compliance with the Italian tax policies is mandatory.

Economic, Political and Financial Risks: Summary

- Entering the euro zone has triggered a major confusion in the Italian economy, politics and financial affairs.

- Bureaucracy impedes the evolution of private business.

- The new tax policy creates the premises for private companies to avoid paying taxes due to their unreasonable size.

- Dominance of foreign companies prevents the local organizations from growing and expanding.

- SMEs are becoming increasingly vulnerable to the external economic factors.

The integration into the euro zone has posed a range of questions to the Italian government and stalled a range of financial processes within the country. The resulting economic downfall and the disruption in the Italian companies’ operation have created a rather unfavorable environment in the Italian hospitality industry.

Economic, Political and Financial Risks: Suggestions

- Getting the company’s priorities straight and identify the key steps to be taken so that the bureaucracy issue should not hamper the firm’s progress;

- Reconsidering the company’s expenditures related to logistics (especially transportation) and advertisement so that the taxation issue should not impede its progress in the Italian environment;

- Using the lack of competition as an opportunity for taking a strong position in the Italian hotel industry;

- Redesigning the entertainment sector by providing services of excellent quality and updating the standards accepted in the industry currently.

Hilton should put a very strong emphasis on the reconstruction of the hospitality sector. Thus, the organization will be able to become superior in the Italian market.

Overall Risk Analysis in Italy: Politics

Internal threats: bureaucracy

Bureaucracy and the threat of terrorism can be considered the key threats to the political stability of the state at present. The protective security principles established by the state government may impede successful business operations within the state. It is suggested that official documents (including a copy of the police report) should be provided to the local authorities to avoid issues.

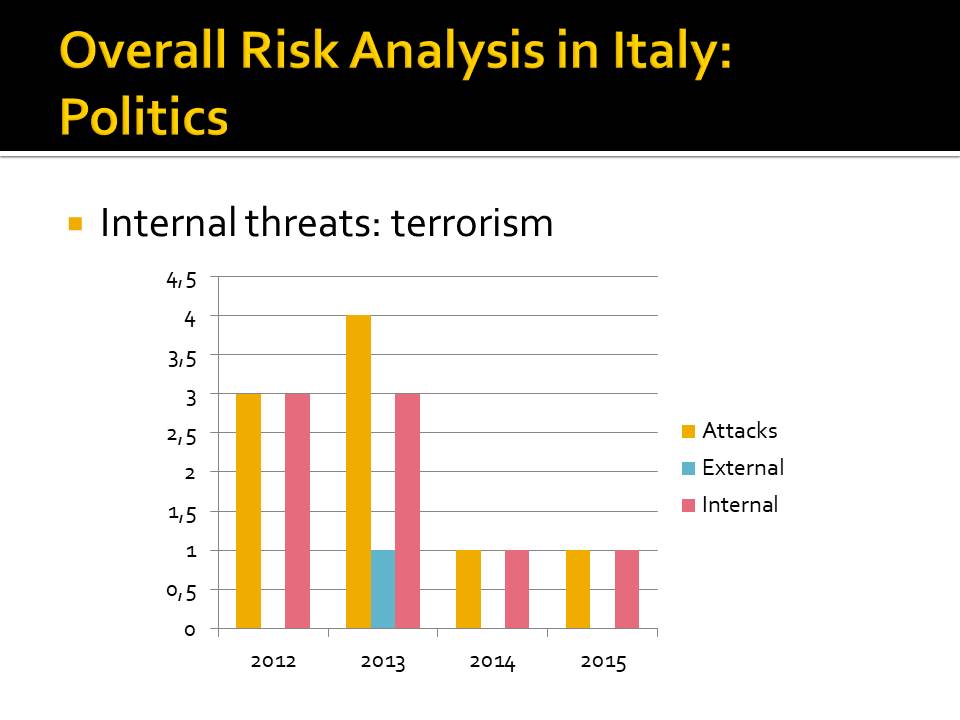

Internal threats: terrorism

As far as the terrorist threats are concerned, the local Italian political groups are of much greater risk than any external influences. Enhanced by the recent drop in the state stability, the rates of terrorist acts are getting increasingly high, which should be a major concern for foreign investors.

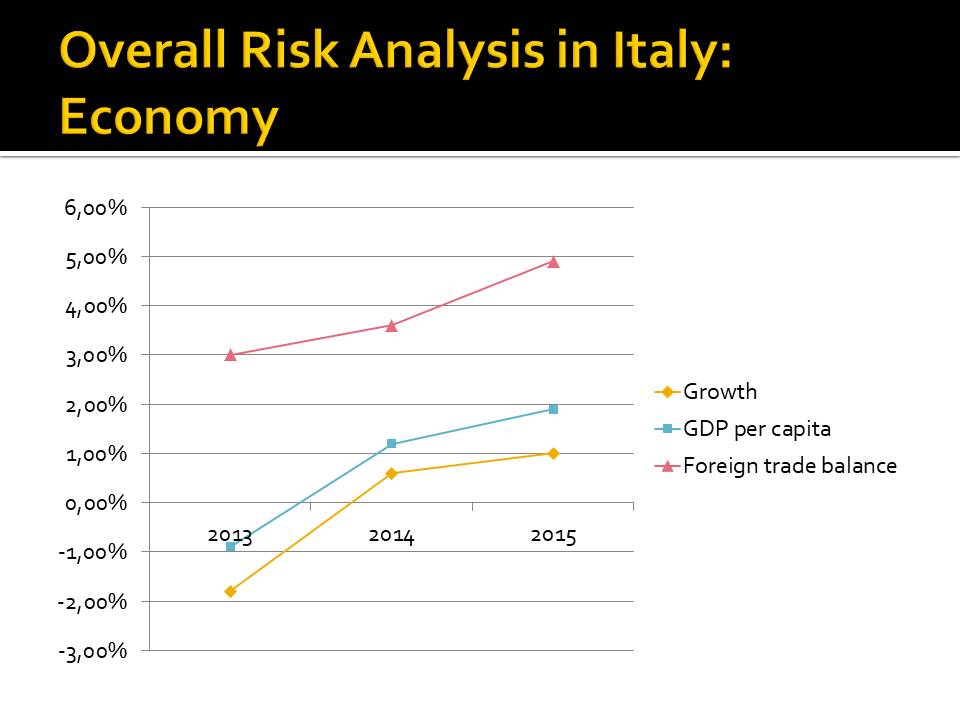

Overall Risk Analysis in Italy: Economy

An overview of the Italian economy will show that the state is attempting at overcoming a recent crisis. Although the steps taken seem rather small, the effects are already quite obvious – the increase in the Italian GDP and foreign tare balance, as well as a steady growth, shows that the local SMEs are getting used to the new environment.

Overall Risk Analysis in Italy: Summary

- The lack of stability within the state is the key impediment to the successful business operations for foreign companies.

- The terrorism issue triggers the need for a company to enhance its security and establish a set of rigid emergency rules for the staff.

- The fact that the state is slowly recovering from the recent economic downgrade shows that further investment may be profitable.

- The bureaucracy issue may become a major obstacle to the progress of investors unless the internal processes occur impeccably.

Lack of sustainability and inconsistency in the political course of the country has made it open to the threats of terrorists. Which is even more deplorable, the threat is coming from within the state, several radical movements being the cause of concern. The analysis of the key risks shows that Italy may be viewed as an option for investments only for the organizations that are completely stable and that may face the threats under analysis without taking big losses.

Summary: Risks and Opportunities

Risks

- Bureaucracy is the key impediment to Hilton’s success in Italy;

- The confusion in economy, politics and finances as a result of entering the euro zone may affect the company’s operations.

Opportunities

- Becoming the leader in the target market;

- Developing a chain of Hilton hotels in Italy;

- Improving the Italian tourism and hospitality sector;

- Attracting more tourists to Italy

The problems related to bureaucracy seem to be of the greatest concern for Hilton at present, as addressing them will require that the current negotiation strategy should be shifted towards a more elaborate approach that will allow for more flexibility for the company. The economic issues, which, in their turn, are closely related to the banking problem, can be resolved by global alliance.

Statement of Support: Go, Go, Hilton

- The hospitality industry in Italy is currently in a state of major depression;

- The Hilton Company is capable of improving the Italian hospitality industry despite the economic, financial and political obstacles;

- Hilton’s negotiation strategy will help address bureaucracy issues;

- The company will be capable of dominating the market and improving its standards;

- Hilton will promote the European values that the Italian business needs to integrate the euro zone successfully.

By encouraging the adoption of the European quality standards along with the European corporate values, Hilton will be able to not only become the leading organization in the Italian hotel industry, but also reinvent the latter entirely.

Reference List

Alonso-Almeida, M. M., & Bremser, K. (2013). Strategic responses of the Spanish hospitality sector to the financial crisis. International Journal of Hospitality Management, 32(1), 141-148.

Daniels, J., Radebaugh, L., & Sullivan, D. (2010). International business. New York, NY: Pearson.

Smeral, E. (2009). The impact of the financial and economic crisis on European tourism. Journal of Travel Research, 48(1), 3-13.

The hospitality sector in Europe. (2013). Brussels: EYGM.

Williams, A. (2006). Tourism and hospitality marketing: fantasy, feeling and fun. International Journal of Contemporary Hospitality Management, 18(6), 482-495.