The size and magnitude of America’s problems are on a level only a few nations have experienced. Most people are oblivious to the observable symptoms of such an emerging crisis. While America consistently tends to thrive in its superpower imagery, America is now classified as a second-grade company. Unfortunately, America no longer produces to meet its needs and sustain them. They import more than they produce and rely on asset selling, and taking up a high level of debt financing to fuel and maintain the current standards of living. Unfortunately, this was the way America became a superpower and may be the means of losing its status.

As the world takes notice of such a deficiency in the American economy, competitors have devised a plan to make America completely dependent on foreign goods, innovation, and means of financing. This is resulting in forgone self-sufficiency, leverage in affairs as well as national security. Americans are also unable to identify the discriminating trade practices against them, which are undermining the local industries. And in turn, Americans design products to sell in third-world countries like Mexico and China. (King 167-172)

Economic experienced by the US have been of different forms and magnitudes and served to be one of its worst nightmares. Though the USA provided much focus on the prevalent task environment, the mega environment proved to me the dreaded Achilles heel of their plan. The crux of the strategy lies in the concentration of obvious elements like inflation rates, interest rates, and the business cycle. America found out the hard way that today’s successful strategy can turn out to be lethal for tomorrow if conditions are in constant flux. This is usually the reason for failing corporations in a recession.

American industries failed to recognize the strategic flaws, for example, determining the life cycle of products ad services as well as determining their environment. The main mistake was committing and concentrating on short-term profit-maximizing policies, which highly concentrate on price cuts and firing workers etc., the repercussions of such downturns can be drastic. This can be a countries worst nightmare, even a superpower like America’s in this age of globalization where the remoteness of markets is reduced. The effect of a market slowdown will invariably affect other markers with similar trends.

The seriousness of such an impact depends on many things like the time lag and how well connected two separate economies are. For example, we see that in Indian software houses, a recession in the American market causes a drastic effect as these Indian firms are highly dependent on US markets for-profits, whereas the steel industry might not be affected at all. It will be fitting to point out that recessions and downturns affect all aspects of management of the business, financial, human resources, and marketing. (Hitt 156-164)

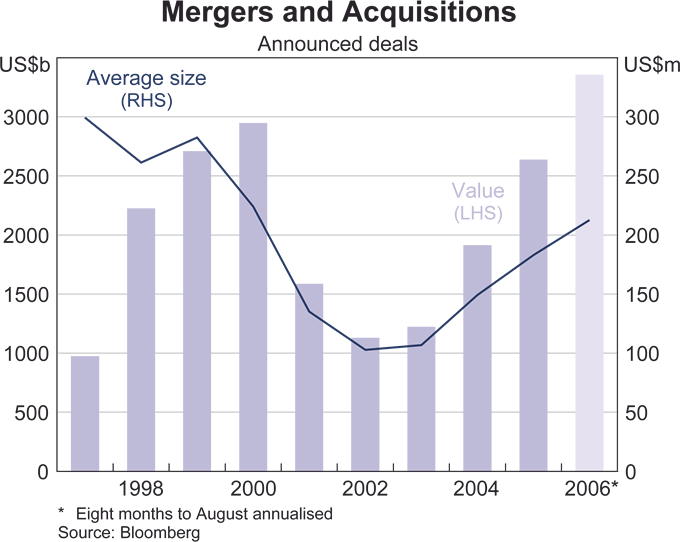

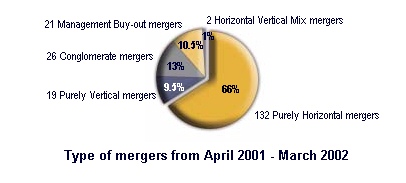

Mergers and acquisitions play an empirical role in economic proceedings. In a usual M&A, there is an acquirer and a target. If terms are agreed by both, then a friendly deal is considered to have taken place. If the target’s management has issues, then it is considered to e a hostile takeover. Mergers are of their sorts, horizontal in which similar firms join, vertical integration, where firms in different stages unite, and diversification where to completely unrelated companies join.

As mentioned earlier, these can be voluntary or hostile. Like in the airline industry, mergers happen in waves; reasons for this aren’t entirely clear. One possible explanation for this may be when the sharing process is low; many firms experience market capitalization that is low n comparison to their assets; these make them attractive buying options. In theoretical terms, different forms of mergers tend to emit different benefits.

However, the dreadful lesson learned from the merger waves in the last half-decade, with the exception of the spate of leveraged buy-outs in America, they have failed to provide any substantial benefits that validate costs. Merger waves were heavily dependent on the crossing of the competitive nature of the market and the irreversibility of mergers in an unstable environment. Acquirers tend to compete harshly for targets. A can ether barge into a takeover or delay it for some time.

By the use of postponement, the acquirer may obtain a better market but runs the risk of being outplayed by his competitors. To engage first, an informational model is set up, and it presents the facts that the tradeoff may lead to a range of sub-games perfection equilibrium in monotone strategies that are ranked according to Pareto. This collective equilibrium shares the fact that all interested acquirers sprint concurrently towards a merger in waves. This model is then stretched to a global level by inducing slightly vociferous information about merger profitability. This game is shown in the theory of Markov’s perfect Bayesian equilibrium strategy. And the timing of a wave can be predicted with considerable ease. Also, the comparative dynamic predictions of the model may be closely linked to stylish facts.

The financial implications tend to hit the economy first. The cash management problems, a recession may lead to excess cash lying idle or severe scarcity. Many existing businesses have a problem growing in terms of size, profits, etc., and therefore cannot recognize lucrative investing opportunities. Most of these first hold on to cash to improve liquidity and thus miss out on investing opportunities.

On the other end of the spectrum, blossoming companies invest all idle cash or profits back into the business. In a recession, what happens is profits level fall and in turn, so does the level re-invested, which leads to a long term degradation of companies profit levels. Another effect on the financials of the country would be the disproportionate increase in levels of Accounts receivables; in a recession, it is obvious that consumer spending patterns are on a decline, the country on the whole experiences increases in accounts receivables as most companies and countries are unable to pay their dues.

For example, an FMCG company selling its goods to wholesalers on credit, who in turn sells it to retailers on credit. As consumer spending patterns fall, the inventory turnover ratio falls as well; this increases the collection period of all businesses in the economy.

It is in this case that many companies are compelled to write these off as bad debts if they consider the pros and cons of the collection of debt outweighing the benefits. Thirdly the increased cost of borrowing. When in need, companies might resort to short-term or long-term borrowing to finance their capital needs or to fuel investments in times of a downturn. This forces companies and economies into the vicious cycle of debt. This is then aggravated when companies resort to further borrowing to pay off the interests on the existing loans. That will eventually lead to an increasing in interest costs. This is also known as the debt trap.

On the other hand, even if the company decides against the use of borrowings, but receives its collections after the stipulated time. This means that the company would find it difficult to re-invest, and therefore the rate of interest on working capital would increase without any obvious increase in debt. And lastly, the problem of spiraling costs, all businesses with whatever motives incur fixed costs, like investment cost, machinery, etc., with the anticipation of growth prospects. When the planned growth is unable to take place, the fixed cost increase but is not spread over a large output; this, in turn, results in considerable sizing down to cut down fixed costs. Other reasons that result in increased costs would be the usage of overcapacity and increasing interest costs. (King 167-172)

Another obvious cause of a recession is the problem of Human Resources. The loss of morale, when businesses are faced with tough times and declining profits, they resort to cost-cutting strategies where branches are closed down that results in an obvious laying off, salaries, bonuses, incentives, promotions, and cut down on employee loans and working facilities degradation affect employees drastically. The brunt is faced by employees at a lower level, who are unable to deduce the full impact of a recession and realize the measures taken by the company are for their survival. Feelings of being left out and uncared for creep in, and they feel they are being neglected.

The feelings are magnified when subordinates are getting laid off to job insecurity and trust levels in the top management. The marketing aspect of the economy faces atrocities as well. Firstly, the an increased slowdown in top-line growth. As mentioned earlier, during an economic downturn, consumer spending declines. This trend causes a proportionate decline in the supply of goods due to falling sales. In the modern-day and age where industries are interdependent, a marginal fall in one industry affects those associated with it in one way or the other. This impact is obviously dependent on how close the industry is to the final consumer and how dependent they are on other industries.

For example, a slowing down in the software industry might affect the printer, hardware, and other peripheral industries. Secondly, the disproportionate increase in the costs of advertising and promotion, the slow down in the top-line growth will compel companies to increase short-term sales to retain investments from shareholders and meet their expectations. In this case, most companies lose sight of all long-term goals of profitability and look at short-term prospects of increasing sales through increasing advertising and promotion, discount offers, and lowering of quality. These tactics lead to short term profitability but hamper drastically long term profits and consumer loyalty towards the product.

Another serious problem is the identification of future growth prospects because of the unstable economic environment, macro-environmental variables, and the future patterns of other businesses, especially those with interdependencies. This makes it very difficult to situate the stars in the Boston matrix. As these factors show maximum volatility, the business usually tends to sit back and watch rather than rush into a decision that can have long-term repercussions. As a result, most strategies are put on hold; when economic conditions do improve, the company or economy may not possess the same level of flexibility or agility to make speedy moves and benefit from market opportunities. (Hitt 156-164)

These implications on all fascists of the economy and business fields can be safeguarded against. The problems that confront companies can be of two distinct kinds; it can either be strategic or operational most firms believe a downturn to be short-term and prefer to treat this by operational issue rather than strategic. An economy can still continue to make profits in a downturn if strategies are devised to battle recessions. In periods of growth, companies usually turn to be in a state of inertia and get complacent, and tend to be content with the status quo growth direction. The economy tends to focus only on the risk environment.

On the contrary, they should try to evaluate important economic elements such as inflation, monetary policies and formulate plans to combat future recessions. In the current situation, strategies may work fine, their viability in adverse times should be determined and altered to suit the situation. As it is wisely said that the prescriptions of today may be the poison of tomorrow if not considered carefully. (Moore, np)

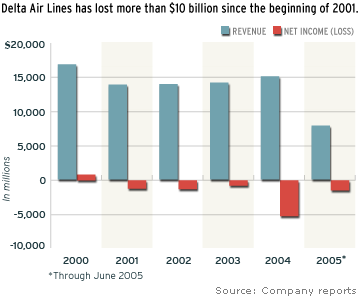

For airlines now to enter into a bankruptcy safeguarding scheme is become as common as for rock stars entering drug rehabilitation. The only distinction is that the airlines come out flying much higher than before. The repercussions are felt by the employees who are left at the bottom by themselves. Financial analyst Dan Akins has statistically shown that airline workers have suffered through wage reductions and other benefits in a total of $11 billion in the last three years.

These discrepancies are undeniable. Airlines have filed profits of over 500 percent. And the profits in 2007 were around about $4 billion. So when workers are suffering to make ends meet, airlines are soaring on cloud number 9. Many public statistics confirm that’s airlines have been provided with substantial compensation by questionable ethical practices, overstated labor costs, and understated assets. The AFA at Northwest Airlines challenged its employer’s reorganization plan deeming it obsolete. One of the more justified acquisitions from the Wall Street point of view is US Airways to buy off Delta Airlines for over $8 billion.

This is because Delta is in a state of bankruptcy, which doesn’t mean much in the airline industry and is expected as a norm. US Airways has been in that state twice already. The problems associated with this are well, firstly the top-level management detests the fact tot have to give in and lose their jobs, Delta’s creditors seem to be undecided on the matter. Employees who belong to a particular union have no option but to take whatever they get, and customers of both airlines will not benefit much from the venture. If the government does allow this amalgamation to go through, the new would be the largest airline in the country. As big as every one of every five would be its passenger. In cities like Carolina and Charleston, the self-proclaimed US-Delta may just have a monopoly.

A pressing problem as oil prices skyrocket, airlines become less capable of paying their dues. Airlines like Alaska and Southwest have a lot of liquid assets while others have to scramble. The airline merger history is a gloomy one. For most of the time, US Airways is in battle with its labor unions after years combining with America West. Merging and acquisition deals are very exorbitant with the current credit crisis. Airlines may go into deals without proper funding. And most merged airlines fail to address capacity in many cities. The problem lies in execution; the industries comes across as disorganized and lacking the realistic vision. (Hitt 156-164)

I drastic times of economic downturn or recessions, economies need to take steps to survive and successfully thrive. Ways to cut costs, preserve cash , importantly sustain market share, and keep motivation levels high, helping the business to emerge strong from a downturn with guile. Good cash management is important. When a downturn can be predicted, then emphasis on an efficient cash flow should be of prime importance while not compromising on customer bases.

It is important not to rely on short term policies that provide a temporary solution but in turn may threaten the long term survival of the business. For example, a business may decide to cut down on research and development and training expenses, and then the firm can possibly lose out on the technological competency and be unable to face market pressures in times of economic downturn.

Another aspect that firms in an economy like America need to focus on the attributes of their firms. Executives should focus more on the company and build its strengths to yield maximum return. Life after a recession should be fruitful and sustainable. As an example, AT&T paid 135 million for NorthPoint which sought bankruptcy-court protection. AT&T plans to use NorthPoint to jump into the market of high speed internet. NorthPoint assets were valued at 300m. (Moore, np)

Works Cited

Hitt, Michael. The Blackwell Handbook of Strategic Management. 5th. Blackwell Publishing, 2001.

King, Sarah. Lessons from the Recession: A Management and Communication. Asia: Sunny Press, 1997.

Moore, Heidi. “Should the Government Encourage Airline Mergers?” The Wall Street Journal 2008. Web.