Introduction

Background of the Study

Russia’s economy is booming as it has been for the past six years; since 1998 its economy has been growing at well over six percent a year with most, if not all, of its economical growth being attributed to increasing oil, gas and mineral prices (Vaknin 2006, p 1).

As indicated by Cukrowski (2004), Russia is one of Europe’s largest suppliers of oil and natural gas especially to Eastern European countries and most importantly the E.U wherein the E.U. imports nearly one quarter of its energy needs from Russia (Cukrowski 2004, p 285 – 292).

It is based on this that Cukrowski (2004) states that “when examining the history of resource trading within the European continent and its dependence on Russian energy exports the best way of tracing this is to go back to the 1970s when pipelines were constructed across Western Siberia to Europe to transport gas and oil and from here determine the extent of Russia’s control over several eastern and central European states” (Cukrowski 2004, p 285 – 292).

It has become glaringly obvious that several European states understand that their foreign policy interests with regard to Russia are that of growing energy dependence.

Robinson (2007) indicates in his study examining changes within Russia’s economy over the past decade states that “what must be understood is that there is a distinct need for the continued and uninterrupted supply of oil and gas from Russia to meet the needs of an ever increasingly dependent European market” (Robinson 2007, p 245 – 259).

Robinson (2007) goes on to state the following factual data: it has been estimated that Russian gas composes around 40% of European gas imports which is also equivalent to 19% of all gas consumed in all of the states comprising the European Union (Robinson 2007, p 245 – 259).

It is from the views of Robinson (2007) and Cukrowski (2004) that a picture emerges of a situation where Russia has slowly but surely expanded its consumer base within Europe since the 1970s and through this poised itself as one of main sources of oil and gas within region resulting in a form of energy dependence that could be utilized in the future for its own political means.

The geographic location of the Central and Eastern European states, their susceptibility to monopoly provisions, the potentiality of stoppages whether intentional or otherwise as well as a lack of sufficient infrastructure in the form of self sufficiency in energy production, all undermine a collective response to Moscow by these states making them vulnerable towards external influences from Russia (Tompson 2005, p 335 – 359).

The Start of Russia’s Economic Expansion

After the collapse of the Soviet Union the Russian economy went through a major crisis. The October 1991 “shock therapy” reform advocated by Boris Yeltsin not only resulted in economic collapse, with GDP declining by roughly 50 percent between 1990 and 1995 and millions being plunged into poverty (L’vov 2001, 71).

In 1998 Russia defaulted on its foreign debts due to its inability to pay them however from 1999 to 2002 rapid economic growth occurred in Russia as a direct result of an enforced devaluation of the ruble, then reinforced by a rise in oil prices and a surprisingly prudent fiscal and monetary policy (Twigg 2005, p 495 – 518).

Rautva (2004) goes on to elaborate on this sudden change by stating that Russia’s rapid economic growth can largely be attributed to the sudden increase in global oil and gas prices which increased the profits of state owned oil and gas companies, particularly Gazprom, thereby resulting in a situation wherein Russia has a great degree of solvency even wealth (Rautava 2004, p 315 – 327).

Vladimir Putin’s, Russia’s President during that particular time of economic growth (2000 – 2007), term in office had been marked by an increasingly assertive foreign policy that appears aimed at regaining some of the influence Moscow had lost in the former Soviet republics and beyond since the collapse of the Soviet Union in 1991

(Darrow 2000, p 52). Using the abundance of natural resources available to it, namely oil and gas, as well as the use of state owned oil and gas companies which export their products to a vast majority of dependant European countries Russia sought to exploit its energy riches to achieve economic and political goals (Shishkov 1996, p 79).

Putin has been quoted as referring to hydrocarbons, which is one of Russia’s mineral resources, as the key to the nation’s economic development in the near future. Powel and Li (2008) say that iIt was seen that Putin’s administration wanted to export and control as much as 80% of all gas consumption into the European Union (Powell & Li 2008, p 49 – 56).

His aim was to turn Russia into a globally dominant “Energy Superpower” before the year 2025; a feat that has not yet been accomplished by any other state (Powell & Li 2008, p 49 – 56).

Petrol Politics

During the start of Putin’s administration Russian foreign policy was formed to force Russia’s interests to its former Soviet neighbors in order to withstand Western influences, whether it was European or American, influence (Warhola 2007, p 75 – 87).

As Warhola (2007) explains while intense competition and government involvement are hardly unusual in the energy industry, in Russia the final arbiter was an individual rather than the market due to the power that Putin wielded at the time (Warhola 2007, p 75 – 87).

Evidence of the use of Russia of energy as a form of statecraft can be seen in its actions regarding Ukraine, a former Soviet Union member (Rice & Tyner 2011, p 208 – 210). On the 26 of January 2006 Russia announced that it would close off the taps of its gas lines leading to Ukraine amidst reports of Kiev’s, Ukraine’s capital, refusal to pay an increased amount demanded by Russia (Rice & Tyner 2011, p 208 – 210).

Moscow was seeking to increase the price of the gas it sold to Ukraine to $230 per 1,000 cubic meters from the previous price $50 per cubic meter – a level that reflected Soviet era subsidized prices (Rice & Tyner 2011, p 208 – 210). During this particular time Ukraine agreed in principle but wanted a transitional period, something which Moscow was doubtful of giving.

Ukrainian officials accused Moscow of using the issue to punish Ukraine for its western leaning government and also its drive to join the European Union and NATO a year after mass protests helped propel Viktor Yushchenko to a presidential election victory beating a Moscow backed candidate (Rice & Tyner 2011, p 208 – 210).

Yuliya Mostovaya, a reporter, once described how the Putin administration linked energy deliveries with political concessions; “We (Russia) sell you (Ukraine) 5 billion cubic meters of gas, and you enter the customs union. We sell you an additional 5 billion cubic meters of gas, and you support our position on the issue of treaties.”

Energy and Economic/Investment Statecraft

Twining (2006) points out that “the potentiality of Russia using energy and economic statecraft to influence the decisions of states in its near abroad area can be seen in its relationship with the CIS states particularly Belarus and Moldova” (Twining 2006, p 29).

The economies of both countries had been firmly embedded in the Soviet economy, and each had specialized in a certain sector, Belarus in heavy agricultural equipment and goods for the military, and Moldova primarily in agricultural products and consumer goods, while relying on other republics for raw materials (Stulberg 2005, p 1 – 18).

Both republics had been especially dependent on Russia for inexpensive fuels, a fact that continued to haunt them after independence. Subsidized fuel, priced well below world prices, had made the goods produced by the two countries inexpensive and affordable by the other Soviet republics (Stulberg 2005, p 1 – 18).

With the loss of these cheap fuels after the collapse of the Soviet Union, both countries were forced to either decrease their fuel consumption (and their output) or improve the efficiency of their industries (Loss 2004, p 99 -105).

Belarus chose the former path, which coincided with the fact that it was selling fewer of its goods because of price and quality considerations, while Moldova tried, sometimes unsuccessfully, to take steps toward improved efficiency (Loss 2004, p 99 -105).

Loss (2004) explains that what must be understood is that to this day Belarus and Moldova still rely on Russia as a market for its goods and several thousand people from both countries actually work in Russia and send remittances back to their home countries which helps to shore up their local economies (Loss 2004, p 99 -105).

This is indicative of not only an energy dependency but an economic dependency as well which does not bode well for any country that seeks to be independent from a country that it used to be beholden to.

Another factor to take into consideration is the view of McDonald (2010) which states that foreign direct investments from Russia is one the main sources for many countries belonging to the CIS however by controlling the proportion and rate of investment to countries such as Belarus and Moldova, Russia can in effect speed up or slow down their economies depending on their compliance to Russia’s demands (McDonald 2010, p 185 – 1888).

Price Discrepancies

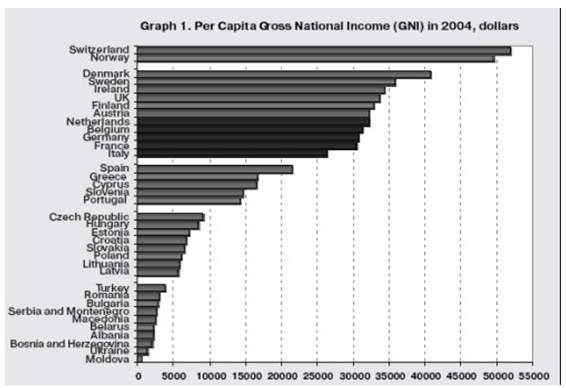

Russia’s use of gas and oil supplies as an instrument for exerting political pressure on the CIS states can be seen at one point wherein the price of 1,000 cubic meters of gas was US$50 for both Belarus and Ukraine while the price was set at $80 for Moldova and the Baltic states.

Now the prices are set at $46.5 per 1,000 cubic meters for Belarus, $120 for the Baltic States and Moldova. The obvious discrepancies between these prices are inexplicable except in the context that Russia is indeed using its resources as a political tool to either gain concessions or to influence the decisions of these states.

Statement of the Problem

Main Questions

How has Moscow used the dependence of the CIS on its oil and gas reserves as well as its foreign investments and economy as an instrument of Russian Statecraft?

Sub-questions

- To what extent is Russia willing to use energy as a form of statecraft in influencing the decisions of states in its near abroad area?

- To what extent is Russia willing to use investments and its economy as a form of statecraft in influencing the decisions of states in its near abroad area?

- What are the reactions of the Central and Eastern European states as to the use of Russia of energy and investments as a bargaining tool in dealing with them?

- What would be the consequences should these states refuse to comply with Russia?

- What are the possible plans of Russia in its use of energy/investment statecraft in its near abroad area?

- Is it viable for Russia to continue using oil and gas as a means of influencing/ intimidating the states in its near abroad area to comply with Russian policies?

- Is it viable for Russia to continue using foreign investments and its economy as a means of influencing/ intimidating the states in its near abroad area to comply with Russian policies?

Variables

The independent variable in this study was the use of Russia of its inherent oil and gas resources as well as investments and its economy ties to the CIS as a form of energy/investment statecraft in order to influence the decisions of states in its near abroad area.

The dependent variable was the resulting action or rather reaction of states in Russia’s near abroad to Russia’s energy statecraft in influencing their actions and decisions and how this translated into power and influence for Russia in that region.

Hypothesis

Using the realist framework, it can be expressed that Russia’s use of energy and investments as an instrument of foreign policy combined with the country’s uniquely strong stance as a major world and European energy supplier, enables Russia to actively pursue its political and economic objectives in its near abroad area.

This is made possible with the current and projected continued demand of the European market for oil and gas resources from the Russian Federation as well as the dependence of the CIS on Russia as a market for its goods as well as a source of foreign direct investments.

As such, Russia is able to achieve its economic and political developments by establishing and maintaining a foreign policy leveraging on this known demand and dependence.

Scopes and Limitations

This study examines Russian foreign policy in general, specifically focusing on its use of energy statecraft and foreign investments as a bargaining tool in its dealings with the CIS states. The resources that the researcher focused on are Russia’s gas and oil reserves as well as subsequent Russian private and public investments into the states selected for examination in this study.

Aside from Russia, the researchers chose to study the cases of Ukraine, Belarus and Moldova. These three countries were once under the Soviet sphere of influence and are currently part of the CIS.

These countries have all experienced the impact of Russia’s energy statecraft and use of public and private investments and as such should prove to be adequate case examples to determine the extent of Russia’s influence on their internal and external political decisions and stratagems.

Based on research that will be elaborated on in the literature review it can be seen that Russia has made significant in-roads into these countries to control the downstream infrastructure of gas and oil pipelines along with their distribution networks which Ukraine, Belarus and Moldova rely on due to Russia being their primary supplier of oil and gas.

This, along with Russia’s significant influence over external investments into the CIS, has greatly increased Moscow’s ability to effectively dictate the foreign policy of several CIS states in a way that conforms to Russia’s plan for the region.

On a relatively minor note, the recent political clashes between Russia and these states, enhanced by the force of energy and investment statecraft, makes them even more significant to the study due to the rather unique situation of both compliance and resistance to Russia’s foreign policy in its “near-abroad” area.

Overall, this study was conducted in a span of 2 months ranging from the initial creation of the outline to the research that was conducted. This paper examined the time of Putin’s period in office, namely 1999 up to 2007 and explores the period thereafter (2008 to the present).

This was done in order to see the progression of Russia’s influence over the CIS states and to determine what possible course of action Russia will undertake in the future based on its behavior in the time line examined.

The events, documents, declarations, and related studies falling in the particular time frame and relating to the topic of study shall be utilized for the purposes of the objectives and significant discussed below. This study was made for the benefit of the members of the academe.

Objectives

Given the nature of the topic, this paper will seek to examine Russia’s use of its oil and gas reserves as well as foreign investments as an instrument of foreign policy.

Using Russia’s current position as a major supplier of oil and natural gas to Europe as well as one of the major sources of investments within the CIS states, the researcher will examine to what extent is Russia trying to exert its influence in the region as well as try to predict what possible course of action Russia might take using energy and investment statecraft as a bargaining tool to influence the actions of the CIS countries and what this could mean for other Central and Eastern European states within the region.

Using the case studies of Ukraine, Belarus and Moldova, the researcher will examine the extent of Russia’s influence and their reaction to Russia’s energy and investment statecraft. With that, the researcher also considered the implications of Russia’s ultimatum if these states do not comply with Russia’s demands.

This study also delved into the reasons and motivation behind Russia’s shift from military power to energy statecraft as a means of influencing the decisions of states in order pursue its interests within the region.

Furthermore, the researcher will also attempt to determine whether Russia’s action in continuing to use oil, gas and investments as a means of influencing or intimidating the states in its near abroad area to comply with Russian policies is a viable means of statecraft.

Study Delimitations

Although the data collection process is expected to be uneventful, some challenges may be present in the collection of data sets examining trade policies, fuel prices, and current rates of investment. Another possible problem that may arise is finding sufficient literature explaining Russia’s view of the CIS countries from a distinctly Russian perspective. Such problems though have been anticipated and will be dealt with accordingly.

Significance

The significance of such a study is how it focuses on the use of a state of energy and investments, not military might, as a means to influence the decisions of other states within its region. The researcher presents this study from the point of view of Russia and how it uses energy/investment statecraft in power politics.

The researcher will seek to integrate and collate the data collected in order to find a common trend when it comes to how Russia makes use of its energy/investment statecraft and what its future implications are for states within Eastern Europe.

Theoretical Framework

Theory

The researcher in this study utilized the theory of Realism in explaining the effects and possible consequences of an aggressive Russian foreign policy which is a result of the dependence of several European states on Russian oil and gas exports as well as Russian foreign investments.

Realism, also known as political realism, in the context of international relations, encompasses a variety of theories and approaches, all of which share a belief that states are primarily motivated by the desire for military and economic power or security, rather than ideals or ethics (Hall 2011, p 42 – 52).

The assumptions of realism are

The international system is anarchic. There is no authority above states capable of regulating their interactions; states must arrive at relations with other states on their own, rather than it being dictated to them by some higher controlling entity

(Hamati-Ataya (2010), p 42 – 52). States mold the system through the use of statecraft. Russia has been making the most of its “energy/investment weapon” to influence decisions of other states especially those states that are dependant on Russia for oil and foreign investments.

Under the Realist perspective sovereign states are considered the primary actors in international relations and as such are the main moves in the international system (Kelanic 2008, p 1 – 14).

When it comes to International institutions such as the United Nations, non-governmental organizations such as Greenpeace, Amnesty international etc., multinational corporations such as the Blackstone Group and other sub-state or trans-state actors, they are all viewed by the Realist perspective as having little independent influence on international affairs (Caranti 2006, p 341 – 250).

Based on subsequent research which will be expanded upon later in the literature review, all of the major oil and gas companies in Russia are no longer privately owned. All are managed and directed by government officials and are officially under government ownership.

Another aspect of the Realist perspective is the view that states are considered rational unitary actors with all of them pursuing actions both internationally and domestically for the sake of their national interest (Turner & Mazur 2009, p 477 – 502).

It is interesting to note that in this particular case Realism presents the assumption that states have a general distrust of long-term cooperation or alliance due to the potential for abuse by the other state that enters into the said agreement (Kapstein 1995, p 751 – 770).

Despite regularly engaging in situations of necessary international cooperation, nation states still continue to strategize in order to maintain the states’ national advantage. Larger nations, such as Russia perceive this move as one that increases their leverage while smaller states accept being seen and treated as trivial characters in the international playing field.

One of the base principles of the realist theory explains that for each state “national interest” becomes the overriding facilitator of decision making due to the necessity of national security and survival. Putin’s priority was on bolstering Russia internally in order to put the economy in order.

He has also been quoted in saying that Russia’s priority is “to protect national economic interests, raise the investment attractiveness of Russia, and to resist discrimination in foreign markets which in turn would serve the cause of the overall development and modernization of the country”.

In pursuit of national security, states strive to amass resources which are exemplified by Russia staking claim to a portion of the Arctic which is supposedly rich in oil and natural gas reserves in order to bolster it current supply.

The last principle of Realism lies in the distinction that relationships between states are actually determined by their comparative level of power (one state being more powerful than the resulting in the more powerful state controlling the weaker state) which is derived from either their military or economic capabilities or even a combination of both aspects (Setear 2005, p 1 – 13).

Russia has transformed itself from a defunct military superpower into a new energy superpower with its gas monopoly utilizing the state owned company Gazprom leading the way.

Since 2000, Russia’s greatest contribution to its security and economy has not been its utilization of its military; rather, Russia has secured its economic prowess through absorbing the surplus labor of regional states, providing markets for processing goods and transferring funds in the form of remittances rather than foreign aid.

Application

The researcher will use the theory of Realism in examining the actions of Russia in its use of energy and investments as instruments of foreign policy. The researcher will examine the possible results of Russia’s use of energy and investments as a way of directly controlling the actions of states without the use of military power using the Realist perspective.

In light of the theory of Realism, Russia’s inherent abundance in resources particularly oil and gas serves as the launching point of this argument which will be supported by research showcasing the economic interconnections between Russia and the CIS countries that it is attempting to influence.

This abundance, which is the main independent variable of this study, necessitates dependence of other European Union/CIS states to Russia for these resources. Seeing this demand and the current power Russia possesses with regards to controlling its resources, Russia, as a sovereign state actor secures its national interests by tapping this known demand and dependence on oil and investments.

To accomplish this, Russia forms an assertive foreign policy with energy and monetary resources at its core. It then uses energy statecraft to pursue its goals and objectives as well as its national interests enabling it to gain more power in controlling other states and in influencing their behaviors and actions.

This use of economic and energy statecraft of Russia in coercing other states to a particular behavior or course of action is the central aspect of this study utilizing the Realist perspective.

Definition of Terms

Commonwealth of Independent States (CIS)

The Commonwealth of Independent States or CIS is an association of sovereign states, without supranational powers, which was founded in 1991 following the dissolution of the Soviet Union (Commonwealth of Independent States 2011, p 1).

The twelve member states (which were former Soviet Union states) are the following: Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Ukraine and Uzbekistan (Commonwealth of Independent States 2011, p 1).

The group can be considered as an alliance wherein members vowed for cooperation in various fields of external and internal affairs in order to improve their domestic economies and external linkages. It was established on the basis of a Charter which states that the formation of CIS was based on sovereign equality of all its members.

Moreover, member states were independent and equal subjects under international law. As for the purpose of CIS, the Charter also states that the purpose of CIA is to “serve the development and strengthening of friendship, inter-ethnic accord, trust, mutual understanding, and cooperation between states” (Commonwealth of Independent States 2011, p 1).

Foreign Policy

Foreign policy, according to Professor Daniel W. Drezner of the Fletcher School of Law and Diplomacy at Tufts University, “is conventionally defined as the means by which a nation-state advances and protects its interests in the world.

It includes fashioning alliances, establishing trade relationships, negotiating treaties, shoring up domestic support for international policies, bargaining with international organizations, crafting military doctrines, and waging war”. From this, it can be seen that foreign policy is the manner with which a state interacts and relates to other states and actors with the aim of protecting and securing a state’s own national interests.

Moreover, foreign policy is “something that a state and its machinery produce on behalf of a nation using all the instruments they can muster in competition with other similar actors in a world that is dominated by the logic of Realpolitik”.

Energy Statecraft

This pertains to a state’s use of energy as a means for diplomacy that is to strategically influence the behavior or actions of other states or non-state actors into safeguarding the state’s own national interest primarily economic security. Energy statecraft is an aspect of economic statecraft, whereby you coerce or entice someone (in this case a state) to do something in one power area.

According to Celeste Wallander, “Energy for Russia, therefore, appears to be truly a great-power asset because it provides the wealth that sustains the economy, balances the budget, funds national defense, and provides strategic leverage over the country’s smaller neighbors” Moreover, energy power as an aspect of economic statecraft is the most important of all “traded commodities” potentially utilized as a policy tool.

Chapter Summary

This section has given a short briefing on the history of Russia leading up to its use of energy/investment statecraft as a means of influencing the internal and external political decision of CIS states. Overall, it details how the researcher will choose to proceed in the literature review and discussion phase and as such can be considered a brief guide as to what will appear in the rest of the study.

Review of Related Literature

Introduction to Literature

This section reviews and evaluates literature examining the energy/ investment dependence of the CIS states chosen for examination in this study and Russia’s use of investment/energy statecraft in order to impose its foreign policy objectives within the region.

The literature in this review is drawn from the following EBSCO databases: Academic Search Premier, MasterFILE Premier, ERIC, and various books and online source. Keywords used either individually or in conjunction include energy statecraft, dependence, foreign policy, gas and oil exports, and investment.

Case Studies of Ukraine, Belarus and Moldova

As Klinghoffer (2007) explains, Russia’s dominance in the oil and gas market of Eastern and Central Europe is undoubted. This dominance is enjoyed because of the apparent dependency of several European and CIS countries on Russian resources.

This dependency is further strengthened by the strategic locations of the dependent countries into which Russia supplies oil and gas (Klinghoffer 2007, p 355). Russian gas exports to Europe transit through three countries: Ukraine, Belarus and Moldova. Among these CIS countries, Ukraine is the most significant passageway as 80% of all gas exports delivered to Europe pass through the country (Klinghoffer 2007, p 355).

Because of their crucial geographical positions, these gas gateways hold a special status for Russian oil and gas trade hence these countries also possess dependence on Russian resources.

This is also echoed by Jonathan Stern in the Oxford University Energy Forum in 2005 when he said “Russian gas exports to (especially) Ukraine, Belarus and Moldova will remain extremely important for these countries and intertwined with transit of Russian gas to Europe. Gazprom has commitments to supply around 90 Bcm/year to CIS countries in the mid to late 2000s, of which 60 Bcm/year will be to Ukraine (more than half of which should be re-exports from Turkmenistan) and up to another 20 Bcm/year to Belarus.”

Having said this, it could be noted that Russian foreign policy on energy/investment is concentrated on these nations such that maintaining viable relations with these countries is necessary for the success of the Russian oil and gas trade. We take a look at the different cases of Ukraine, Belarus and Moldova to understand Russia’s use of energy/investment statecraft in its foreign policy in influencing these CIS states to heed to its interests.

Ukraine

Ukraine is known as a post-Soviet state or a former Soviet republic. On December of 1991, it also became known as a Newly Independent State. Following the collapse of the Soviet Union, Ukraine along with most of the former Soviet republics adopted a new economic system wherein they integrated and incorporated their market according to their needs and capabilities.

The inter-republican economic connections were broken and yet, Russia maintained its position as an invisible controlling factor in their economy.

Role of Ukraine while under the Soviet Union and interest of Russia after collapse

Geographically, Ukraine serves as Russia’s gateway to Europe. It is the closest and most efficient port of entry into Europe’s main stream. Ukraine is Russia’s main “ex-Soviet gas transit state”. On May of 2003, The Russian Cabinet passed a state energy strategy through 2020, calling the energy sector an instrument for carrying out domestic and foreign policy (Lavenex & Stulberg 2006, p 1 – 15).

What must be understood is that during the Soviet Era Ukraine acted as one of its most important economic components. This is due to the fact that Ukraine produces about four times the production output compared to other former Soviet states.

Despite its proclaimed political dependence, Ukraine’s economical dependence on Russia for energy supplies and its lack of significant structural reform have made the Ukrainian economy vulnerable to external shocks (Misiunas 2004, p 385 – 411). Russia’s black gold revolves around two of its companies, Rosneft in oil and Gazprom in gas.

These two tower over a sector that provides for two-thirds of the federal budget and forms the foundation of Russia’s foreign policy. Ukraine depends on imports to meet about three-fourths of its annual oil and natural gas requirements (Misiunas 2004, p 385 – 411).

A dispute with Russia over pricing in late 2005 and early 2006 led to a temporary gas cut-off which was potentially devastating since winter was fast approaching and a subsequent cut-off would have assured that millions would be suffering cold homes during winter.

Ukraine’s vulnerability to Russian policies

Since 2005, Ukraine has been working to reduce Russia’s control over its oil and energy industry. Former President Viktor Yushchenko of Ukraine declared goals which included the diversification of oil and gas supply sources, the reform of the domestic market, and the creation of a strategic oil stock.

Ukraine, under President Yushchenko, had persistently irritated the Kremlin with efforts to move out of Russia’s sphere of influence and become more closely integrated with the West, which included pursuing NATO membership (Brudny & Finkel 2011, p 813 – 815).

Ukraine has also been known to seek out other non-Russian partners for their energy sector. As of March 2008, Ukrainian President Viktor Yushchenko spoke with Kazakh President Nursultan Nazarbaev in hopes of securing new deals for Kazakh energy supplies. As Brown (2008) indicates Ukraine wanted to show Russia that it had alternatives and that it wasn’t afraid to take them (Barnes 2008, p 540).

This was done after renewed disputes emerged between Ukraine and Russian gas giant Gazprom shifted the focus of Ukrainian affairs to trying to strike new deals for supplies of Kazakh oil and natural gas (Barnes 2008, p 540). Ukraine’s interest in Kazakhstan’s energy resources arises from hopes of increasing both oil and gas output in the future. Kazakhstan can potentially meet this need.

Realistically though, Nazarbaev pointed out that actually increasing energy exports to Ukraine hugely depends on Russia. Nazarbaev noted that Kazakh oil is transported to Ukrainian ports through the Russian Transneft oil-transit system, known as the Caspian Pipeline Consortium.

Kazakhstan is ready to boost its exports to Ukraine, but that an agreement would have to be sought with both countries and Russia. Kazakhstan was unlikely to agree to anything that might jeopardize Kazakhstan’s strong ties with Russia (Barnes 2008, p 540).

Ukraine has shown a great willingness to be quite open-minded in terms of getting as many gas deals as possible into other countries. Nazarbaev did venture to say that a deal with Ukraine that does not involve Russia or Russian companies is at least possible through the transportation of oil and energy resources via the Black Sea mainly through Baku.

Proederu (2010) indicates that Yushchenko held out the prospect that Kazakh oil could not only be sold to Ukraine, but also transported through Ukraine to other countries in Europe via a Ukrainian pipeline that begins in Odesa on the Black Sea and will eventually reach the Polish port city of Gdansk (Proedrou 2010, p 443 – 441). Through this venture, Ukraine hoped to grow an industry independent of Russian control.

Counter measures to oppose Russia’s provocation have also been taken up by Ukraine. Ukraine’s Naftogaz company had sent a telegram to Gazprom saying it intended to cut transit gas supplies to Europe by 60 million cubic meters a day (Kurkov 2008, 31 – 33). Ukraine’s move follows Gazprom’s decision to reduce gas supplies to Ukraine over debt and contract disputes (Brudny & Finkel 2011, p 813 – 815).

Naftogaz then further threatened to begin diverting gas supplies headed for Western Europe, after Moscow warned it would halve gas deliveries to Ukraine cut off in a long-running debt dispute.

Naftogaz, said in a statement it “reserves the right to resort to adequate and asymmetrical measures to defend the interests of Ukrainian consumers.” Kurkov (2008) indicates that this is an incredibly brave move on Ukraine’s part considering that most former-Soviet states wouldn’t dare oppose Putin’s Russia (Kurkov 2008, 31 – 33).

Belarus

Belarus at the onset

Before the communist revolution that dethroned the Russian aristocracy Belarus was arguably the poorest region in European Russia due to overpopulation, inadequate industries and poor agricultural yields (Lane 2011, p 587 – 600).

During the subsequent period of industrialization in Russia, Belarus was overlooked and at the first decade of the 20th century Belarus found itself with little industrial potential beyond its small and underdeveloped wood and food processing industries which employed only a small percentage of the population.

Belarus’ pre-war industrialization was dwarfed by that of Ukraine and Russia due to its location on the western frontier of the Soviet Union which was deemed vulnerable to attack which inevitably it was.

If one were to examine post WWII Soviet territory you would find that Belarus bore the brunt of the damage of the war with 209 of its 270 towns destroyed and a citizenry of about 9.2 million reduced to 6.3 million (Lane 2011, p 587 – 600).

Belarus during its industrial spurt

Post war reconstruction was a turning point for Belarus. It was no longer vulnerable rather it became a center for major transit routes linking Russia with East and Central Europe. After some time the importance of these routes became evident when the Soviet Union began selling oil and gas to the West and received food and consumer goods in return (Sokolova 2010, p 25 -30).

From the late 1950s onwards Belarus emerged as one of the major Soviet manufacturing regions specializing in heavy vehicle construction, oil processing, metal cutting, and high tech industrial products however most of the high-tech industry of Belarus was military oriented.

At the onset of the 1990’s Belarus was cited has having one of the better managed regional economies within the Soviet Union with over 80% of its industrial output shipped to other countries (Sokolova 2010, p 25 -30).

Starting out as a country with primitive industries and an appalling agricultural system Belarus 70 years later had to its name several large scale industries as well as a modernized agricultural system with a high employment rate among its citizenry.

How Belarus is dependent on Russia

The Belarusian economy is heavily dependent on Russia for three reasons, first is because of its failure in substantially restructuring its economy after the collapse of the Soviet Union, the second is the absence of significant trading partners besides Russia and lastly its dependence on manufactured goods particularly the resources to sustain the Belarusian industrial sector, namely oil and gas coming from Russia at greatly subsidized prices (Sokolova 2010, p 25 -30).

Belarus after the breakup of the Soviet Union

Currently the economic situation of Belarus can be summed up in a single word, “abysmal”. Its agricultural output is far less than it had been during the Soviet era; there is rampant inflation, absurdly high taxes on its enterprises and industries as well little if next to no local or foreign investment (Feldmann 2008, p 85).

Another indication of the current state of the local economy of Belarus is the fact that nearly 40% of all local transactions are made using the barter system which means that Belarus has in fact devolved.

This situation has largely been criticized as the fault of the current Belarusian government due to its bureaucratic red tape and the image of its previous leader Alyaxandr Lukashenka who had been cited as being the “last dictator in Europe” (Feldmann 2008, p 85).

Russian Interests within Belarus

As Felmann (2008) indicates, an important fact to remember is that some major areas of the Belarusian economy and its vitality are in Russian hands in particular the supply of oil and natural gas which Belarus currently pays significantly less than world prices.

Natural gas is being sold for $22 per 1,000 cubic meters as compared to Ukraine that pays $40 per 1000 cubic meter and Moldova that pays $55 and Poland that pays $75 (Feldmann 2008, p 85). It is due to the fact that the Belarus government actually resells this gas to domestic industrial customers for about $48 that the government has been able to prop up its national budget.

In exchange Belarus does not charge Russia for gas transit through its borders and for the use of its land in the creation of Russian military bases and installations (Godin 2008, p 17 – 20). During the early 1990s Gazprom began a new project to export gas across Belarus to Poland and Germany. The potential the project envisioned was the export of over 200 billion cubic meters of gas per year by 2020 to Western Europe.

The project remains the single largest expansion of gas through Belarus whereas all other Russian gas exports pass through Ukraine (Country Intelligence: Report: Belarus 2011, p 1 -14). The reason for such a gas line was due to the risks of theft and interruption through the Ukrainian gas line as had happened before.

To sum it up, Russian interests in Belarus are the following: to solve the problem regarding Ukraine, namely the fact that should Ukraine siphon off gas illegally from the Russian pipeline Russia cannot punish Ukraine due to the fact that shutting of the pipeline would affect its other European clientele, Ukraine is able to selectively resist the badgering of Russia as compared to Belarus due to its current economic and industrial capability and the fact that it is a major transit line for gas heading into Western European countries (Nichol 2011, p 27 – 35).

Belarus, in the eyes of Russia, could act as an alternative solution to the problem it is facing with a belligerent Ukraine (Country Intelligence: Report: Belarus 2011, p 1 -14). If Russia were able to use Belarus as an alternative transit point for gas heading into Western Europe it would be able to negotiate with Ukraine at a significantly more advantageous position.

Another reason for Russian interest in Belarus is fact that Belarus has long been a staunch ally of Russia and is heavily dependent on Russia as a market for its goods and the subsidized prices of oil that it gets from Russia.

(Marples 2008, p 25) The risk of Belarus becoming another case like Ukraine is unlikely in the eyes of Russia since that in the past and up till the present Belarus has always complied to the whims of Russia due to its past relationship with Russia as a member of the Soviet Union and the fact that it is economically dependent on it (Marples 2008, p 25).

How vulnerable is the Belarusian economy

First and foremost the economy of Belarus has not undergone any significant transformation in the post Soviet era. This stagnation has resulted in Belarus being unable to cope with the current level of industrialization in other European states. One saving grace though is its current economic dealings with Russia.

Russia plays a critical role in the Belarusian economy accounting for 50% of Belarusian exports and 66% of imports into Belarus (White, McAllister & Feklyunina 2010, 344 -365). Belarus’ next largest trading partner is Germany which accounts for 4% of its total imports and 10% of total exports.

The gap between the two shows just how dependent Belarus is on continuing its trade with Russia. Another aspect to consider is that the current export of oil and gas going into Belarus from Russia at subsidized prices is one of the reasons why Belarus has been able to stay afloat (White, McAllister & Feklyunina 2010, 344 -365).

If you were to compare Belarus and the Philippines you would find that they have one thing in common, they both rely on outside resources to keep them afloat. Just as the Philippines is dependent on the money being sent back by Filipino OFWs to keep the country out of dire straits so too does Belarus depend on the subsidized prices of oil and gas from Russia to help prop up its economy.

If you were to take away the OFW labor force the Philippine economy would most definitely crash so too would the economy of Belarus crash should the subsidized oil and gas prices which it needs to stay afloat be taken away (Rotman & Veremeeva 2011, 73 – 81).

Moldova

Interest of Russia in Moldova after the Soviet Collapse

Since gaining independence and sovereignty in August 1991, Moldova reluctantly joined the Commonwealth of Independent States (CIS). However, such independence was not met with peacefulness as guerilla and civil warfare began with the Trans-Dniester region seeking secession (Moldova: Stuck in Russia’s Orbit? 2009, p 16).

It is important to note that this region is populated with many Russians, fearing a Moldovan merger with Romania. Hence in 1992, Russia intervened by sending its troops to the region. In 1997, a peace accord was signed giving the region more autonomy but affirming Moldova to remain as a single state.

Hence, occasional tensions arise between the regional and central governments. In its economic state, Moldova is the poorest country in post-communist Europe with 47% of the population living below poverty line and at least 25% of the working age population has emigrated. The remittances from these people keep the economy alive.

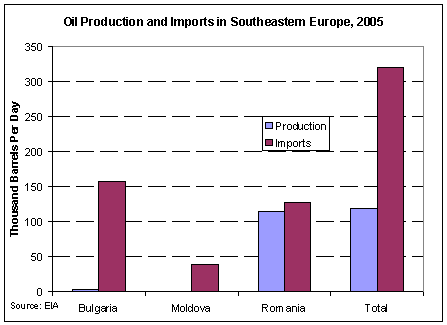

As Southeastern European countries, Moldova, Bulgaria and Romania are considered net oil importers heavily depending on Russia for most of its supplies. Moldova does not produce significant quantities of crude oil as such it imports all the petroleum products it needs.

Moldova’s reserves are estimated at 15 million barrels. In February 2005, Azerbaijan’s AS-Petrol Company signed a 99-year concession contract that called for the company to invest $250 million on the Giurgiulesti Oil Terminal in southern Moldova on the Danube River and construct an oil refinery and about 50 filling stations in Moldova.

In July 2005, the Moldovan fuel trader AS-Petrol opened the $4.0 million oil refinery to process domestic crude (Russia’s Growing Influence in Ukraine and Moldova 2010, p 14). The oil refinery is the first in the country and is located in the southern town of Comrat.

The refinery, which has a processing capacity of 600 bbl/d, processes crude oil extracted from a field in the southern region of Valeni, one of the country’s two oil fields. Meanwhile, Moldova has also no natural gas resources and is entirely dependent on Russia to meet its consumption (77 Bcf in 2004).

Russian oil giant, Gazprom has reduced supplies to Moldova in recent years as a result of the country’s delinquent debt of $780 million (Russia’s Growing Influence in Ukraine and Moldova 2010, p 14). In June 2004, Gazprom also announced plans to stop natural gas supplies to Moldova’s separatist republic of Transdniester until its debt to the Russian company has been addressed.

According to Dr. Mark A. Smith in his paper “Russian Business and Foreign Policy”, Transdnestr’s debt as of 2003 is $400 million. With these, Russia’s interests to Moldova are seemingly due to its market potential as a net oil and gas importer. Moreover, Russia sees Moldova as a ground for gaining control and influencing decisions in the Trans-Dniester region (Dangerfield 2011, p 215 – 230).

True enough, “Russia has been a serious player in Moldova’s affairs, mostly due to the state of a strip of land in eastern Moldova which borders Ukraine, known as Transdneistria.” This is due to the fact that the area is primarily Slavic (mostly Russians and Ukrainians). Thus, the Slavs have been unofficially supported by armed local Soviet troops despite Russia’s claims of neutrality over the territory.

To this day, Russian troops are still stationed in the region despite beliefs that once Russian troops leave the area, there would be no resistance to Moldovan authorities regaining control (Moldova: Russia’s Next Target? 2010, p 3).

It is still a mystery as to what exact benefit Russia gets from intervening and asserting control over Transdneistria as the region is small with no natural resources and moderate number of troops (Moldova: Russia’s Next Target? 2010, p 3). Other than the fact that it has been a point for drug and human trafficking in the early 90s, it still remains unclear as to why Putin continues Russia’s involvement toward the region.

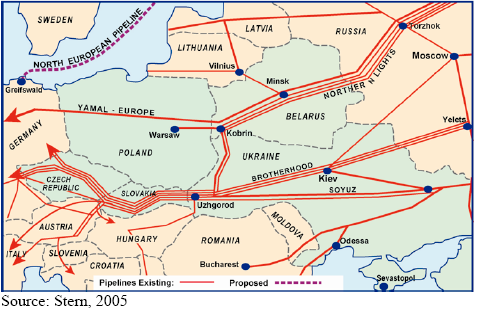

Generally speaking, the interest of Russia to Moldova can be related to its geographical position as a gas gateway of delivering Russian gas to Europe. This could be seen with the existing pipelines across the region (Danii & Mascauteanu 2011, p 99 – 101).

The red lines in bold represent the existing natural gas pipeline system. Most of Russia’s natural resources pass through Ukraine, Belarus and Moldova. From Russia, the pipeline passes through Belarus, namely two of its cities, Minsk and Kobrin.

From there, the pipeline leads to Warsaw (Poland) and to other cities in Germany. While the pipelines that pass through Ukraine lead to multiple countries in Western Europe, some even leading north to Latvia.

There are multiple pipeline systems in Ukraine and Belarus making them strategic hubs in the distribution of Russia’s resources. On the other hand, the pipeline from Russia to Moldova supplies mainly Romania. The dotted lines above that run through parts of the Baltic Sea, represent the proposed North European Pipeline.

The map above highlights the pipeline system in South Eastern Europe, once again showing Ukraine as one of the focal points for the pipelines to cut across.

Level of Economic Relations and Vulnerability to Russian Policy

After gaining independence from the former USSR, Moldova tried to convert itself into a market economy by launching a privatization program. Despite this, the country still lags industrially and has been considered one of the poorest nations of Europe.

This is in stark contrast with Russia, who has been on an economic and political revival in recent history. Hence, at the outset, Moldova’s economy is largely dependent on Russia for its exports and importation of vital oil and gas resources (Danii & Mascauteanu 2011, p 99 – 101).

Russia is one of the principal trading partners of Moldova with the country primarily exporting agricultural products to Russia. It must be noted though that from 2003 to 2005 Russia implemented new and radical changes to its policy regarding Moldova (Foreign relations 2011, p 7).

This came in form of a gradual weakening in economic ties culminating in several bans on Moldovan fruits and vegetables and finally Moldovan wines and brandies. Apart from these economic sanctions it is also important to consider the political backdrop affecting the economic relations between the two countries (Foreign relations 2011, p 7). Following the said bans, Russia shifted to support the Moldovan opposition.

The opposition members reportedly paid visits to Moscow pledging loyalty and support to the Kremlin. This was a surprising move as famous Moldovan opposition leaders such as Serafim Urechean, Dumitru Braghis, Nikolae Andronik, were well known for their nationalistic and Anti-Russian sentiments

(Trenin 2011, p 38 – 53). Thus, in the parliamentary elections of 2005, despite gaining support from Russia, the opposition bloc failed to win over the ruling Communist party. The situation between the two countries aggravated and this caused adverse effects to both countries. The economic sanctions imposed by Russia cost around 200 million dollars to Moldova in 2006.

Principally hit by such are Moldovan wineries, which are largely Russian owned as well as Russian consumers who could not purchase anymore however cheap but high quality wine resulting in the proliferation of fake wine within the Russia’s market. Moreover, Russia’s prestige to Moldova waned as it supported the nationalist opposition (Trenin 2011, p 38 – 53).

Dispute on Prices and Cutting of Supplies

Bruce (2007) states that “perhaps the most striking example of Moldovan economic vulnerability to Russia is the Moldovan republic’s dependence on Russian oil and gas resources” (Bruce 2007, p 29). A dispute over energy resources has caused serious damages to the Moldovan economy and republic.

Before the peak of the Russian-Moldovan, price dispute on gas in January 2006, there have been suspicious and questionable events that have been initiated by Gazprom (Bruce 2007, p 29). In March 2003, Gazprom specifically expressed its intention to reduce the price of gas to Moldova from $80 per cubic meter to $50.

According to speculations, the Moldovan government allowed Russian businesses to buy and acquire assets in Moldova in exchange to the lowering of prices. This claim was linked to the five large Moldovan enterprises bought by Russian companies in 2002.

In July 2005, following the striking move suggestion of Ukrainian President Yushchenko that gas tariffs should be moved to “European levels” and paid in dollars and the proposal of Gazprom for the possibility that countries would pay European market prices for Russian gas, the Russian Duma unanimously agreed to set a mandatory rule that CIS countries of Georgia, Moldova, Ukraine, Estonia, Latvia and Lithuania should pay “world” or (European prices) for gas.

In 2006, Gazprom increased gas prices to $3 per thousand cubic feet up from $2 per thousand cubic feet after Gazprom stopped natural gas supplies to Moldova in January due to a lack of agreement over prices (Russia: Sharing the Wealth Within the FSU 2009, p 12).

Since the price increase, the Moldovan government has begun talks with Kazakh company Ascom to supply more than half of its natural gas supply for a price that is lower than Gazprom. Transportation of the natural gas is a major obstacle to these negotiations. Gazprom halted its gas deliveries in Moldova starting January 1, 2006 due to disagreements on pricing.

Gazprom demanded an immediate doubling of price per 1000 cubic meters from $80 to $160 (Russia: Sharing the Wealth Within the FSU 2009, p 12). Meanwhile, Moldova rejected this and proposed a gradual transition agreeing only to 30% hike in 2006. In the previous years Gazprom has sold gas at less than market prices to former Soviet Union nations.

Thus, Gazprom says that these favorable deals should stop and market prices should apply. However, critics observed that those countries retaining close ties with Moscow were offered more favorable deals suggesting that the move to cut supplies was of political nature. The dispute caused rippling regional tensions that prompted the European Union to collectively respond to the issue seeing the gravity of its effects to Moldova.

Thus, on January 9, the EU’s Austrian Presidency appealed to Russia and Moldova to “urgently recommence negotiations and reach an equitable compromise. (Basapres, January 10). The action by the EU was in response to the joint appeal by Presidents Viktor Yuschenko of Ukraine and Vladimir Voronin of Moldova asking for the EU intervention with Russia in favor of the Ukraine-Moldova position.

This appeal was initiated by Voronin with Moldovan senior presidential adviser Mark Tkachuk drafting most the document. However, on January 4, Ukraine reached a deal with Russia and thus immediately voiding its appeal request leaving Moldova grappling for support. To address the urgent gas needs of Moldova, Ukraine had been supplying Moldova, 50% of its daily gas requirements (Socor 2011, p 2 – 4).

This urgent emergency supply deal between the two countries came without any contract and agreed pricing. Thus, Ukraine instantly became the sole source of support of Moldova.

Acting in support for Moldova, on January 5, Ukraine’s Fuel and Energy Minister Ivan Plachkov declared a joint venture of Naftohaz Ukrainy with the RosUkrEnergo company (operator of gas deliveries to Ukraine) carrying the burden of supplying gas to Moldova beginning February.

However, the Ukrainian move was implicitly denied by Gazprom as it informed MoldovaGaz company that it was a violation of the prohibition of gas “re-export” from volumes dedicated to Ukraine (Socor 2011, p 2 – 4). The said prohibition was part of the Russia-Ukraine agreement signed on January 4.

The emergency supplies given by Ukraine to Moldova enabled the latter to reach negotiations with Russia without having to suffer complete supply cut-off. Finally, a Russian short-term deal was reached with Moldova agreeing to pay $110 per 1,000 cubic meters of gas instead of $80 for the next four months. The two countries have yet to talk on longer term deals.

Analysis

Russian Energy Statecraft in Action

In late 2006, Gazprom, a gas company owned by the Russian government, pressured Belarus to sell to it control of the Beltrangaz natural gas firm and other significant Belarusian energy firms. Beltrangaz controls the pipelines on the Belarusian territory. Based on reports, Belarus would either sell the pipelines and energy firms to Russia or face the quadrupling of the buying price for Russian gas.

On January 1, 2007, Gazprom threatened to cut-off energy to Belarus if Belarus did not agree to pay. Belarus agreed to pay $105 per 1000 cubic meters in comparison to the $46.48 per 1000 cubic meters that Belarus paid Russia in 2006. Belarus also agreed to sell Gazprom a big portion of Beltrangaz. In this case Russia used the threat of a cut off of a much needed resource to Belarus.

Since Belarus has no gas producing industries of its own losing its supply of gas or oil or even both would be disastrous to the Belarusian economy especially since that Belarus is heavily dependent on Russia for its oil and gas imports. The reason for this action is evident.

It is due to the fact that Russia wants to use Belarus as a new transit point for gas heading into Europe as an alternative to its current transit point: Ukraine. This is due in part to the ability of Ukraine to effectively resist Russian energy statecraft.

Level of Effectiveness

Russian energy statecraft works exceedingly well on Belarus because of: the dependence of Belarus on Russia as its largest trading partner, the fact that it has no other trading partners who even comes close to the level of trade between Russia and Belarus, the fact that it is dependent on the subsidized prices being given to it by Russia and that its economy would collapse should trade with Russia start to falter especially in its oil and gas imports.

Russian application soft power and its level of effectiveness

For many years, Russia has been cutting and reconnecting its energy service to Ukraine. Just months after Ukraine’s Orange Revolution ushered in a Western-leaning government, Gazprom abruptly announced its own brand of shock therapy in December 2005, cutting subsidies to Kiev and drastically raising gas prices.

When Kiev couldn’t pay, Gazprom shut the taps, reducing shipments not only to Ukraine, but also to Europe, which gets some 80 percent of its Russian gas shipments through pipelines that crisscross the country. On January of 2006, Gazprom cut supplies to neighboring Ukraine in a price dispute wherein Ukraine refused to meet a year-end deadline for accepting a fourfold price increase.

Russia contends the price spike is justified by high world gas prices. Another issue was that Gazprom accused Ukraine of siphoning off gas bound for Europe.

Ukraine accused Russia of using the gas question to punish Ukraine’s pro-Western leadership, which has sought to wrest Ukraine from Moscow’s sphere of influence and towards greater integration with Europe. The Kremlin, on the other hand, has denied the charge, saying these are purely business rows.

In Russia’s point of view, the cutoff raised immediate fears that the 48 million residents of Ukraine, which relied on Russia for about a third of its natural gas, would struggle to heat homes and operate key industries as supplies run low. In this case, with Kremlin control over most of Russia’s energy giants, President Vladimir Putin had managed to boost his country’s importance in international economic matters.

That was at least the anticipated international perception of Russia. However, during mid-March of 2008, Gazprom suffered a “failure” when it was forced to restore gas supplies to Ukraine after a “threat” from Kiev to disrupt exports to Europe. Gazprom restored supplies of gas to Ukraine without any conditions amid an ongoing row over unpaid debts between Gazprom and Ukraine.

Gazprom cut supplies to Ukraine by 50 per cent over the latter’s non-payment of a $600m bill. The conflict revolved around a disagreement over how much of the gas Ukraine had received since the beginning of the year had come from Russia, and how much of it originated in Turkmenistan. Turkmen gas is much cheaper than Russia’s.

Ukraine had argued that it had received mostly Turkmen gas and is thus being overcharged by Gazprom. Russia had unsurprisingly argued that it had supplied the majority, and thus should be paid accordingly. The other point of contention is RosUkrEnergo, an opaque trading group owned by Gazprom and a pair of businessmen that makes huge profits on the sale of Gazprom’s gas to Ukraine.

Ukrainian officials had said that they don’t oppose market-driven price changes, but any increases should be phased in with proper announcement along within appropriate time delimitation. A sudden, huge price increase would cripple Ukraine’s economy, which depends on energy-intensive heavy industries.

Ukraine’s oil and gas monopoly Naftogaz then threatened that it would be forced to divert Russian gas earmarked for Europe transiting through its territory. Ukraine’s threat of reducing the transit of Russian gas through its territory proved efficient because Gazprom was afraid the European Union would seek alternative sources of energy.

The European Union depends on Russian gas transiting through Ukraine for around a fifth of its supplies. About 80 per cent of the gas that flows from Russia to Europe passes through Ukraine. Gazprom is equally dependent, with almost all of the company’s exports going to EU states.

Ukraine sounded a defiant note, saying that even if Russia totally cut off its oil and energy to Ukraine, the country could survive for another month by drawing on its own natural gas production and some reserves.

How Russia applies its soft power and its effectiveness

During Putin’s presidency, Russia has tapped new mechanisms to influence the CIS countries (i.e. use of energy as a means of exercising soft power). This came at a very appropriate time for Russia because of its economic boom, high energy prices, investment in the economies of neighboring countries and an inflow of seasonal migrant workers who sent their money back to home countries, in which Moldova benefitted.

The Russian-Moldovan gas dispute especially highlights Moldova’s vulnerability once Russian gas supplies are cut off. Ukraine abandoned the joint deal leaving Moldova almost with no gas contract. Both Russia and Moldova have leverages on settling disputes. However, Russia apparently holds more power and influence because of being the sole gas supplier for Moldova.

Moldova’s only counter leverage is its transit service to Russia enabling the delivery of more than 22 billion cubic meters of Russian gas to Balkan countries. Moldova, of course, can increase its transit charges for Russian gas, which remained unchanged at $2.50 per 1000 cubic meters per 100 kilometers of Moldovan pipeline.

However, this course of action is highly unlikely as the territory covered by the transit pipeline in Moldova is very short. Thus, we see the use of Russia’s energy leverage to push its capitalistic and political interests against the smaller, former Soviet Union states such as Moldova. Thus, the action of Russia to focus and cut gas supplies to CIS states apart from Ukraine could be safely assumed as politically motivated.

The Russian action against Moldova (i.e. price increase) supports this claim as Moldova belongs to countries which had either left the Soviet Union (the Baltic countries) or those which had elected pro-European (rather than pro-Russian) governments.

The previous president of Moldova, Vladimir Voronin is pro-market and pro-European Union, hence the move by Russia to subdue Voronin’s European tendency during his tenure as president. Moreover, the Kremlin’s decision to double gas prices for Moldova, aside from being political, could also be interpreted as punitive due to the snowballing debts of Moldova and the conflict in Transnistria.

From 1996 to 2005, Moldova was already paying $80, the highest price paid by any CIS country during the said period. Moreover, Moldova is annually paying its gas year 100% cash. Furthermore, Gazprom exerts significant control on the Moldovan gas industry as it holds 50% plus one share in the MoldovaGaz company, with the Moldovan government only owning 34% and Transnistria’s authorities 13%.

Gazprom has been supplying Transnistria for more than a decade and it has failed to collect its debts. Thus, as Paolo Pontoniere, News America Media European commentator suggests a new and different cold war might be under way. It is not a battle of military supremacy but of gaining control “directly or through commercial proxy, of energy resources.”

Russia, with Putin’s desire to transform it to a new and oil gas superpower, is at the heart of this war. Pontoniere adds, “Russia could, as many of its hardliners have suggested, ban products from Moldova and Georgia or block the transit of their unemployed jobseekers to Russia, thus causing these countries’ economic collapse.

Moscow could also destabilize Georgia, Ukraine, Moldova and Kazakhstan and then agree to annex — as these populations have requested — their pro-Russian minorities living near the borders of the old motherland.

Future of Gas Relations between Ukraine and Russia

As of March 2008, Ukraine sought for a long-term agreement on gas supplies from Russia’s Gazprom. This agreement states the detailed supply volumes and prices for 2008. Gazprom will supply almost 50 billion cubic meters of Central Asian gas at $179.5 per 1,000 cubic metres before the end of the year. This agreement hopes to remove or lessen any instability in the energy market.

It is predicted that Ukraine will continue to utilize whatever leverage it has over Russia. Ukraine has the means and geographic position that Russia lacks. Ukraine is continuously trying to make new partners with other countries in order to break away from Kremlin supremacy. Only about one-quarter of the gas imported by Ukraine is of Russian origin; the rest comes from Turkmenistan and Kazakhstan.

Ukraine is searching and trying out its other options. So far, it is working for Ukraine’s advantage. Naftogaz, which is the Ukrainian state gas and oil supplier, has promised not to divert gas bound for Europe to make up for the shortfall and any possible future “gas wars” with Russia. Ukraine would instead make use of gas from its underground reserves.

Ukraine is also backed up by the other European countries in agreeing that there is no reason why the rest of Europe should be dependent on Russia when in fact, it is Russia that is greatly dependent on Europe. Vladimir Milov, a former deputy energy minister, has been quoted saying that “Putin’s legacy is largely a bunch of heavy discussions with few delivered projects…

Putin’s presidency has mostly focused on the redistribution of ownership and using energy resources as a tool for expanding Russia’s international influence.” Milov, who became a Kremlin critic after leaving the Energy Ministry in 2002, speaks of how Putin’s presidency has been one of “disappointed expectations.”

Pricing disputes with neighboring countries prompted Gazprom to pursue a strategy of direct shipments to Europe, including the Nord Stream pipeline, which will pump gas directly to Germany, and South Stream, which will send gas to the Balkans.

Putin has spent the past few years eagerly pushing “strategic reciprocity,” hoping to gain a solid foothold in the European market beyond long-term gas supply deals and pipeline agreements. But despite these plans, the future doesn’t seem too bright for the Russian oil and energy exports. Russia may soon face the prospect of failing to produce enough oil and gas supplies to feed growing markets both at home and abroad.

In Putin’s Russia, it is impossible to separate politics from the economy. This will only lead to Russia being even more solely dependent on the energy industry more than it ever was.

On September 2007, the European Union issued proposals on unbundling of Russia’s power industry which was seen as a move to bloc Gazprom’s access. The European Union has grown weary of Russia’s growing greed for more power and control and also finds it unsettling that Russia incorporates heavy politics to its economic market.

Summary and Conclusion

For many years, Russia and Ukraine have been engaging in an energy dispute. Russia insists on continuing to use its influence in the “near abroad” in order to increase its political leverage. Ukraine, on the other hand, is exploring different means in order to break away from Russia’s influence.

In order to protect and enliven its sovereignty, Ukraine has sought aid from other states, both former soviet and non-soviet, to better exercise its economic market and political independence liberated from Russia. Since the collapse of the former Soviet Union, the relationship of Belarus and Russia has been characterized by a crucial economic dependency of the former to the latter.

Hence, Russia is able to effectively exert is energy statecraft to take control of the Belarusian oil and gas industries in its pursuit of seeking an alternative transit pipeline to the rest of Europe. With the promise of Belarusian integration with Russia looming, the transformation of Belarus as a hub for gas transit to Europe looks like a sealed deal.

Russia might just secure an alternative to strengthen its hold as oil and gas exporter to the larger European market. Like Belarus, Moldova maintains a huge economic dependency on Russia being its major trading partner and source of oil and gas supplies. Similarly, Russia’s use of energy statecraft puts effective pressure on the Moldovan government to yield to Russian interests.

These interests are primarily of political nature and are focused on the secessionist Moldovan Transnistria region safeguarding of Russian image and influence to Moldova and the region. These political motives are especially highlighted by the apparent pro-European stance of Moldovan President Vladimir Voronin, which Russia sees as a threat.

Thus, the punitive Russian actions have been detrimental to Moldova in general as its only counter-leverage of serving as a gas transit hub for Russian gas to the Balkan territories have minimal impact to Russia due to the small territory actually passing through Moldova.

However, Moldova is also considering options of seeking for gas supplies to Kazakh companies such as Ukraine in the hopes of finding an alternative to its Russian monopolized energy supplies.

Russia’s use of energy statecraft is entirely dependent on the kind of state that it is trying to influence. States such as Moldova and Belarus are states which are easily susceptible to Russian influences due to their dependence on Russian exports of oil and gas however just because a state is dependent on oil and gas doesn’t mean that energy statecraft will immediately work on it.

Other factors must be considered before its application. First and foremost is the level of dependence of the state. States such as Moldova and Belarus have been dependent on Russia since the outset of the Soviet Union due to their level of industrialization.

States such as Ukraine were adequately industrialized in such a way that though they were dependent on Russia for oil and gas they were still adequately industrialized to have other means of acquiring the resources they need. Another matter that must be considered under level of dependence is the trading partners of the states in question.

Do these states have other trading partners with percentages close to Russia or are they heavily dependent on the Russian economy for the import and export of goods? Another matter for consideration is what these states did after the collapse of the Soviet Union. Were the attempts of these states at independence fruitful or did they in the end revert back to their old ways of dependence.

Finally to what extent is their vulnerability? Are the economies of these states capable to stand up to the pressures of Russian energy statecraft or are they unable to do so?

It is in the opinion of the researcher that should these questions be answered they will show whether or not Russia is able to influence a state using energy statecraft or not. Meanwhile, Russia’s foreign policy toward the CIS states has been primarily driven by its robust economic power from its energy resources.

The use of energy statecraft is evident in the cases of Ukraine, Belarus and Moldova. Under the leadership of President Vladimir Putin, Russia has been aggressively reviving its sphere of influence to the region by tapping and using its oil and gas capabilities to attempt to influence and consequently pressure these CIS states to fulfill its interests.

Recognizing the importance of Ukraine, Belarus and Moldova as transit hubs for oil and gas to the rest of the European market, Russia directs its actions to these states for the fulfillment of its prospects of expanding and extending its influence to the European community in the hopes of necessitating a dependency.

With these, Russia tries to gain control of the gas and energy firms such as Beltrangaz of Belarus and MoldovaGaz of Moldova so as to secure its grip on utilizing these countries as gas gateways to Europe by principally controlling the pipelines under the current jurisdiction of these companies.

Despite the aggressiveness and seemingly punitive nature of Russian actions toward Ukraine, Belarus, and Moldova; we can see that the effectiveness of the use of Russian energy statecraft is contingent on the level of resistance or non-resistance of the target countries.

Thus, we see the interplay of actions and reactions among Russia and the three CIS states studied. The success of exertion of statecraft and the corresponding reactions to resist it depends on who has a stronger leverage.

Reference List

Barnes A. 2008. Well-Oiled Diplomacy: Strategic Manipulation and Russia’s Energy Statecraft in Eurasia. Political Science Quarterly, 123(3), 540.

Brudny Y. M., & Finkel E. 2011. Why Ukraine Is Not Russia: Hegemonic National Identity and Democracy in Russia and Ukraine. East European Politics & Societies, 25(4), 813-833.

Bruce C. 2007. Power Resources: The Political Agenda in Russo-Moldovan Gas Relations. Problems Of Post-Communism, 54(3), 29.

Caranti L. 2006. Perpetual War for Perpetual Peace? Reflections on the Realist Critique of Kant’s Project. Journal Of Human Rights, 5(3), 341-353.

Commonwealth of Independent States. 2011. Columbia Electronic Encyclopedia, 6th Edition, 1.

Country Intelligence: Report: Belarus. (cover story). 2011). Belarus Country Monitor, 1- 19.

Cukrowski J. 2004. Russian oil: the role of the sector in Russia’s economy. Post- Communist Economies, 16(3), 285-296.

Dangerfield M. 2011. Belarus, Moldova and Ukraine: In or Out of European Regional International Society?. Journal Of European Integration, 332), 215-233.

Danii O. & Mascauteanu M. 2011. Moldova Under the European Neighbourhood Policy: ‘Falling Between Stools’. Journal Of Communist Studies & Transition Politics, 27(1), 99-119.

Darrow D. W. 2000. The Politics of Numbers: Zemstvo Land Assessment and the Conceptualization of Russia’s Rural Economy. Russian Review, 59(1), 52.

Feldmann L. 2008. Russia, Belarus & Ukraine. Library Journal, 133(17), 85.

Foreign relations. 2011. Background Notes on Countries of the World: Republic of Moldova, 7.

Godin I. 2008. Russia and Belorussia. Russian Politics & Law, 462), 17-23.

Hall I. 2011. The Triumph of Anti-liberalism? Reconciling Radicalism to Realism in International.

Hamati-Ataya, I. 2010. Knowing and judging in International Relations theory: realism and the reflexive challenge. Review Of International Studies, 36(4), 1079- 1101.Relations Theory. Political Studies Review, 9(1), 42-52.

Kapstein E. B. 1995. Is realism dead? The domestic sources of international politics. International Organization, 49(4), 751-774.

Kelanic R. A. 2008. Carl Schmitt, the Friend/Enemy Distinction, and International Relations Theory. Conference Papers — Midwestern Political Science Association, 1-33.

Klinghoffer A. A. 2007. Well-oiled diplomacy: strategic manipulation and Russia’s energy statecraft in Eurasia. Choice: Current Reviews For Academic Libraries, 452), 355.

Kurkov A. 2008. Ukraine Between a rock and a hard place. New Statesman. pp. 31-33.

Lane D. 2011. The Impact of Economic Crisis: Russia, Belarus and Ukraine in Comparative Perspective. Journal Of Communist Studies & Transition Politics, 27(3/4), 587-604.

Lavenex S. & Stulberg A. N. 2006. The ENP and Russia: Wielding Soft Power on Common Energy and Environmental Security. Conference Papers — International Studies Association, 1-37.

Loss C. P. 2004. Party School:Education,Political Ideology,and the Cold War. Journal Of Policy History, 16(1), 99-116.

L’vov D. 2001. Russia’s Economy, Free from Stereotypes of Monetarism. Problems Of Economic Transition, 44(3), 71.

Marples D. R. 2008. Is the Russia-Belarus Union Obsolete?. Problems Of Post- Communism, 55(1), 25.

McDonald D. 2010. Russian Statecraft after the “Imperial Turn”: The Urge to Colonize?. Slavic Review, 69(1), 185-188.

Misiunas R. J. 2004. Rootless Russia: Kaliningrad — Status and Identity. Diplomacy & Statecraft, 152), 385-411.

Moldova: Stuck in Russia’s Orbit?. 2009. Stratfor Analysis, 16.

Moldova: Russia’s Next Target?. 2010. Stratfor Analysis, 3.

Nichol J. 2011. Foreign Policy. Congressional Research Service: Report, 27-36.

Powell B. & Li Y. 2008. How the KGB (and friends) took over Russia’s economy. (cover story). Fortune International (Europe), 158(4), 48-57.

Proedrou F. 2010. Ukraine’s foreign policy: accounting for Ukraine’s indeterminate stance between Russia and the West. Journal Of Southeast European & Black Sea Studies, 10(4), 443-456.

Rautava J. 2004. The role of oil prices and the real exchange rate in Russia’s economy—a cointegration approach. Journal Of Comparative Economics, 322), 315-327.

Rice S. & Tyner J. 2011. Pushing on: petrolism and the statecraft of oil. Geographical Journal, 177(3), 208-212.

Robinson N. 2007. So What Changed? The 1998 Financial Crisis and Russia’s Economic and Political Development. Demokratizatsiya, 152), 245-259.