Introduction

The world has considerably experienced economic growth despite the major challenges that has occurred in the recent past. There has been an accelerated growth in the emerging markets in Europe, China, Middle East and the USA (Mygatt, 2006). The overall experienced growth rate in the world economy increased from 4.9% to 3.1% this was mostly in the advanced economies of the world. In the new industrial Asian economies it was from 4.7% to 5.3% in 2006. However it is predicted that in the near future the world growth rate will decline considerably (SAMA, 2009).

Table 1: Economic indicators.

Oil Prices in Saudi Arabia

There has been improvement in the oil prices for the last few years, and this has contributed to the good show of the Saudi economy. The average price of oil rose considerably from $50.15 per barrel to $61.05. This increase showed an increase in output that stood at 9.21 million b/d in 2006 higher than preceding years which recorded 9.35 which was a decrease by 1.6%.

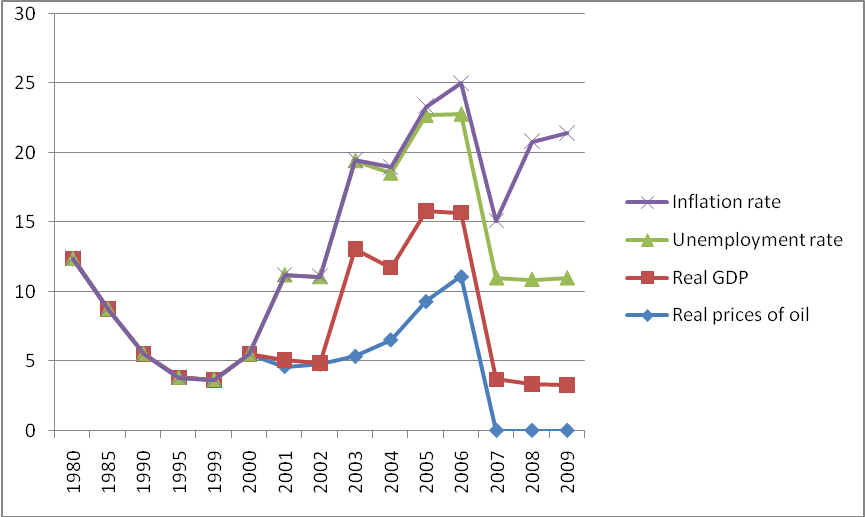

According to the table below the real price of oil indicated a high level in the year 2006 as compared to other years as from 1999 the year it recorded its lowest level (SAMA, 2009).

Table 2: Nominal and Real prices of oil.

GDP of Saudi Arabia

The growth rate of GDP rose by 10.6 percent to Rls 1.3 trillion while the real growth was 4.3 percent, amounting to Rls 798.9 billion (SAMA, 2009).

Table 3: Selected economic indicators.

Unemployment rate in Saudi Arabia

This is generally viewed as one of the major problems that affect the Saudi economy. The number of job vacancies that the population requires over the next several years in order to cope with the labor force and incorporate the current unemployment calls for a higher economic growth rate of an average of between 6 %to 7% per year (Raffer, 2007; SAMA, 2009).

Table 4: Unemployment rates by sex and Nationality.

Table 5: showing Unemployment rate showing the percent of labor force that is without jobs

[source: CIA World Fact book, 2009] (SAMA, 2005).

Inflation rate in Saudi Arabia

Inflation rate as one of the indicators of economic growth is the continuous rise in the general level of prices. Looking at the last five years, most of the countries recorded considerable rates of inflation at an accelerating pace due to increased global economic activity, the high prices of primary goods, and increased shipping charges.

The causes of inflation in an economy vary greatly depending on the nature of the economy, the diversification base of the economy, the type of businesses within the economy and also the seasonal factors (SAMA, 2009; Economy Watch, 2009).

In the year ending September 2009 the inflation rate rose by 6.6% changing considerable the cost of living. This was higher as compared to the average inflation rate for the past years as from 2003 which was 3% (SAMA, 2009).

Q. Can you see any special relation between oil price and GDP? How about unemployment and inflation? Try to explain any relationship between these variable.

Improvement in oil prices leads to the increase in the government spending. This eventually leads to positive developments which contribute to increase in real growth hence the economic activities within the country registers a considerable improvement (i.e. in 2006). Also the growth of 0.16% to R1s 1,296.5 billion in the year 2006 shown against a growth of 26.1% in the preceding year, this shows preliminary figures of GDP at current prices. All these are as a result of the growth experienced in the oil sector which was due to the increase in the world oil prices (SAMA, 2009; Bray and Varghese, 2009).

The average inflation rate is a major determinant of the people’s lifestyles. When the inflation is higher the cost of living goes high too hence reducing the purchasing power of the population. The cost of living index which measures the changes in consumer prices of goods and services is used to measure the inflation (SAMA, 2009).

Table 6: Contribution of oil sector to GDP [source: Central Department of Statistics and Information, Ministry of Economy and planning] (Development Data Group, 2002)

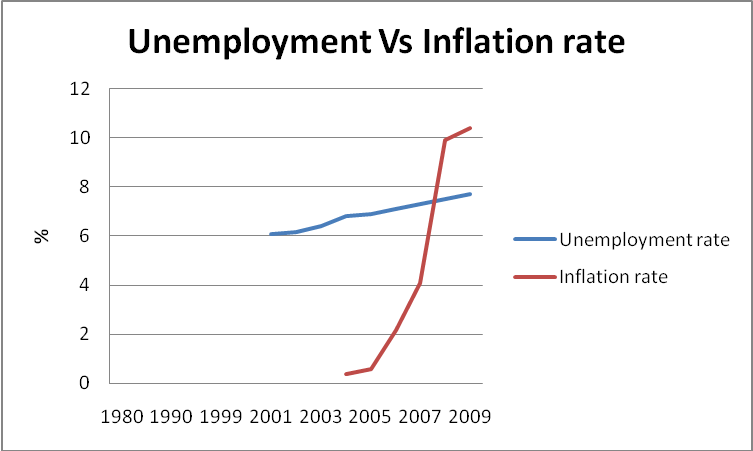

Q. The relationship between inflation and unemployment is called Philip curve, can derive the Philip curve for Saudi in the given period?

The predicted relationship does not hold since the inflation rate is far above as compared to the rate of unemployment. This substantially shows that majority of the population who are unemployed suffers most since they are unable to cope with the cost of living; this calls for a balance by the government on the rate of employment and the inflation.

Conclusion

In the view of all the economic indicators, there is a sign that still opportunities for development are there and must be utilized responsibly by the various sectors. The oil sector should implement policies that will enable the stability of the oil prices irrespective of global inflation.

References

Bray, M. and Varghese N. (2009). Education and the Economic Crisis. Web.

Development Data Group, The World Bank.(2002). World development Indicators. Web.

Economy Watch (2009). Saudi Arabia Economic Statistics and Indicators. Web.

Mygatt E. (2006). Global Economy. Web.

Raffer, K. (2007). Macro-economic Evolutions of Arab economies: A foundation for Structural Reforms. Vienna Austria.

SAMA, Research and Statistics department. (2009). Economic development. Web.

SAMA 43rd Annual Report, (2009). Economic Indicators. Web.

SAMA, (2005). Economic Development. Web.

SAMA, (2009). Inflation Report. Web.

SAMA, 43rd Annual report,(2009). World Economy. Web.