Introduction

The modern day business organizations are faced with numerous challenges as well as opportunities that compel them to constantly adjust to the environment and respond to the challenges presented. In effect, the size and structure of the firms have constantly undergone changes. This has caused the businesses to find themselves in new markets, producing new products, operating in with new structures and so on.

This has mainly been catapulted by the firms’ need to keep up with the new market challenges such as competition without which they would inevitably face the natural selection fate. In order for a firm to survive this turbulent business environment, it is necessary for the firm to constantly evaluate and if need be change its operational processes. This, more often than not leads to a business restructuring with the aim of economic and technical efficiency (Franklin, 2009). In order to remain afloat in the long-term, the businesses will need to either restructure their operations to produce at economies or diseconomies of scale. This paper critically analyses both the economies and diseconomies of scale with a review of four authors’ views on the same topic.

Economies of scale

This simply means the ability of a firm to produce its output at a minimal unit cost. This in effect, reduces the cost of production and the benefits from producing more units to ensure that it reaches the set target. According to Celli (2013), economies of scale are often associated with a reduction in the average unit production cost and hence, higher productivity levels. In most cases firms strategically plan to achieve economies of scale in order to have a competitive advantage over those which are not able to achieve that. As a result a firm is able to sell at a lower cost per unit (Staffan , Phillip, & David, 2006). This arises from the fact that while the company’s variable cost increases with an increase in the number of units produced, the fixed cost remain unchanged and in effect, spreading the fixed cost over more units reduces the eventual total production cost per unit. The following table justifies the economies of scale.

From the above analysis, it is evident that a company producing at a variable cost of $50 and a fixed cost of $10000 will need to produce more items in order to achieve economies of scale. When the level of production is only 100 units, the total cost is $150000 and consequently, the unit cost of production is $150. When the company increases the number of units it produces, the total costs increase but also most importantly, the cost of production per unit reduces significantly. The firm is therefore, able to compete with other firms producing the same product or a substitute through selling at a lower unit prices since the cost of production is low (Celli, 2013).

The other advantage of conducting a business under economies of scale is the possibility of greater market potential. This is proposed by Celli (2013), when he proposed that economies of scale causes a firm to produce large quantity and subsequently selling them at lower prices to the consumers and in effect, the consumers are able to purchase more of the products. Producing many units also compel the company to reach out to new markets and in effect, the company sales and operations grow. Franklin (2009), allude to the same fact that firm can increase their competitive advantage by increasing their output to the extent that their unit production cost reduce.

Economies of scale however, has its own fair share of disadvantages. One of the main demerit of economies of scale is that the firm may experience sales pressure. This could arise where the firm would need to sell more in order to keep up with its production levels (Celli, 2013). This may not be sustainable in the long-run since there are constant pressure from market forces such as product competition, threats by new market entrant who may offer superior products therefore, taking a huge portion of the firm’s market share as so on.

Diseconomies of scale

This is the complete opposite of economies of scale. In this type of business operation, a company is compelled to produce at increased unit costs (Staffan , Phillip, & David, 2006). This arises from a situation where the firm is no longer able to manage its unit cost of production. This may arise from different factors which mainly affect the variable cost of production. In our previous example, the firm may be unable to produce at lower cost per unit in the long-run and therefore, ends up producing at higher unit cost (Coase, 2005).

An example of a diseconomies of scale is where the firm has to hire more staff to increase sales, increase the office overheads such as communication costs in order to enhance efficient communication among the staff and hire new product managers to manage increased sales regions (Staffan , Phillip, & David, 2006). If this increases the cost per unit, the company is said to operate under diseconomies of scale.

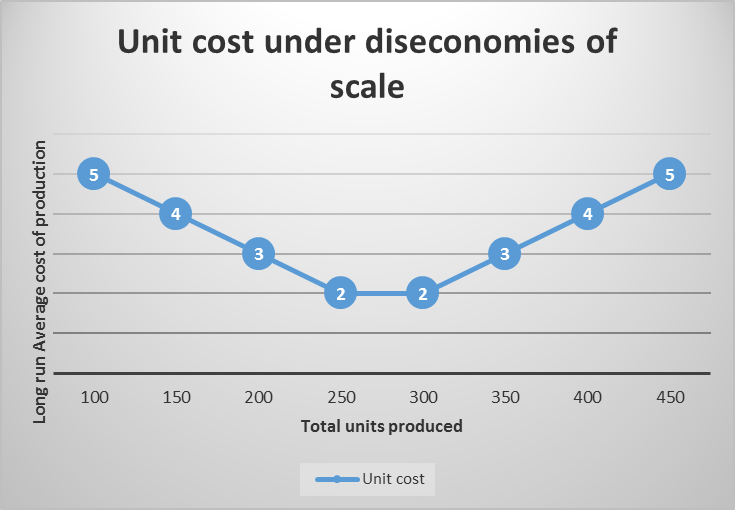

The following graph shows a company operating under diseconomies of scale. As the firm continues to increase its total production from 100 units to 250 units, the unit cost reduces. However, between a total production capacity of 250 units and 300, the firm is no longer able to produce at a lower unit cost. After the 300 unit mark, the firm enters diseconomy of scale and an extra unit means an increased unit cost.

The main discussion that surrounds the concept of diseconomies of scale is the fact that no firm is able to expand inexorably to the extent that it can outcompete all other firms to remain the sole global producer of a commodity (Celli, 2013). This concept was initially proposed by Coase, when he found that there would never come a time where the world will experience a sole global producer of a particular good or service (Celli, 2013).

It is therefore evident that diseconomies of scale is an active market force that provides a differentiation in the market such that firms can only produce so much after which they have to control production in order to enjoy economic efficiency. These two journal articles are in agreement in their quest to propose that under diseconomies of scale, the firms reach a point where an extra unit of an item produced results in a diminishing returns and as such, there is need for the firm to evaluate the level of output level where it maximizes the economies of scale and abates diseconomies of scale.

Conclusion and Summary of the sources

According to Celli (2003), the economies of scale come from the fact that a firm is able to produce its units in large quantities and the fact in doing so, the unit cost of producing that particular product would drop significantly, giving the firm a competitive advantage over the industry peers. Staffan, Phillip, and David (2006) allude to that but warns that the firm should always be aware of the equilibrium point where it ought to optimally operate at without which it suffers the risk of operating under dieconomies of scale.

Coase (2005), builds on that and states that it is in the longrun that the firm truly experiences economies of scale. This is when it is able to produce at lower unit cost Each of the sources seem to agree on the fact that the economies of scale happen when firms operate at their equilibrium. This is the point where the firm maximizes its out put at no extra cost.It is therefore, important for a firm to evaluate the level of output that it can operate under economies of scale. This would ensure the firm operates at its optimal levels of production and achieve economic efficiency. In doing so, the firm is also able to avoid diseconomies of scale hence avoiding operating at diminishing returns.

References

Celli, M. (2013). Determinants of Economies of Scale in Large Businesses—A Survey on UE Listed Firms. American Journal of Industrial and Business Management, 5(3), 255-261.

Coase, T. H. (2005). The Nature of the Firm. Journal of managerial Economics, 15(7), 386-405.

Franklin, B. H. (2009). Economies of Scale: Some Statistical Evidences. Quartely Journal of Economics, 6(2), 232-254.

Staffan , C., Phillip, S., & David, P. (2006). Do Diseconomies of Scale Impact Firm Size and Performance? A Theoretical and Empirical Overview. Journal of Managerial Economics, 13(6), 27-70.