Article Summary

The article titled “Don’t Blame Hedge Funds for Financial Crisis, Study Says,” in 19th September 2012 issue of the The Wall Street Journal, attempts to remove the hedge fund from blame in the global financial crisis. The article reports that banks were the major causes of the global financial crisis.

Introduction

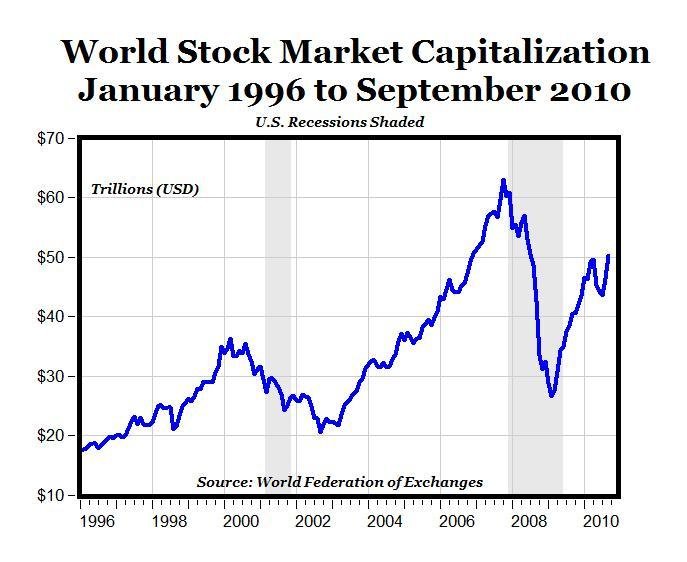

Prior to the global financial crisis, the U.S. had a thriving financial market. The market capitalization of publicly traded companies was approximately $63 trillion. Investors had high confidence in the financial markets. Investors made huge profits from investing in the financial markets. However, the global financial crisis led to the complete disarray of the financial markets.

The global financial crisis led to the collapse of several large corporations that had thousands of employees. Collapse of companies led to the dwindling of investor confidence. In addition, millions of Americans lost their source of livelihoods due to the collapse of the companies. During the global financial crisis, home foreclosures were a common occurrence.

This necessitated the federal government to act swiftly to stop the economy from disintegrating into a depression. The federal government provided bailouts to large corporations. In addition, the government provided a fiscal stimulus to stimulate growth of industries. These measures helped in preventing the disintegration of the US economy.

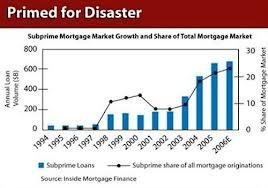

The subprime mortgage market was the main cause of the global financial crisis. Various parties claimed that the hedge fund caused the global financial crisis. However, in reality, the hedge fund was a victim of the global financial crisis. Regardless of whether hedge funds had a part to play in the onset of the global financial crisis or not, the crisis shows the importance of regulation in reducing risks that financial markets face.

Analysis

Overview of Report

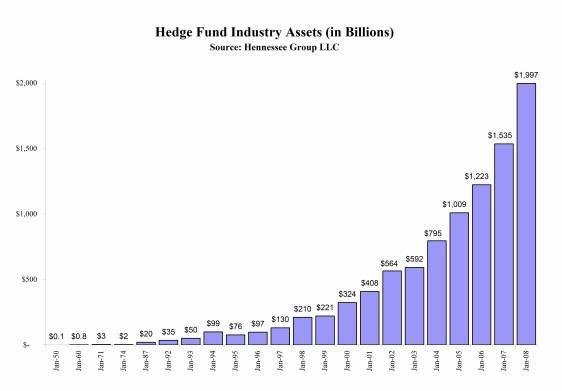

According to the Rand Corporation, the hedge fund did not cause the global financial crisis. However, various parties were of the opinion that the hedge fund played a significant role in initiating the global financial crisis. Hedge funds are “private investment pools that are not available to members of the public.” Hedge funds have a wider investment flexibility than public investments.

Most hedge funds operate as limited partnerships. This enables hedge funds from to benefit from various advantages of limited partnership. Hedge funds usually borrow money to make investments. Borrowing money magnifies the profits or losses of hedge funds.

As of July 2012, the hedge fund controlled assets worth $1.87 trillion. Therefore, due to the vast value of assets under the control of hedge funds, hedge funds may pose significant risks in the financial systems. This necessitates regulation to prevent risks, which may have devastating effects on the financial systems. However, before the global financial crisis, there was no extensive regulation of hedge funds.

The transactions of hedge funds were not under scrutiny from regulators. To prevent hedge funds from becoming a systemic risk, it is critical to have sufficient counterparty credit risk management in major financial institutions. This is because major financial institutions control huge volumes of hedge funds.

Involvement of the hedge fund in the global financial crisis

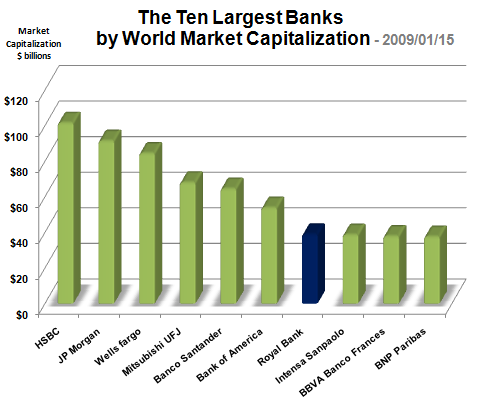

Rand Corporation does not discount the fact that the hedge fund may play a critical role in the global financial crisis. In undertaking the research, Rand undertook a survey of 45 fund managers, regulators and lawyers. The report also reviewed other studies on the effect of the hedge funds in the global financial crisis. Banks had the greatest responsibility in causing the global financial crisis.

Banks bore the greatest responsibility, as they invested heavily in the subprime mortgage market. However, hedge funds “bet both on and against the subprime mortgage market.” In fact, hedge funds bet against troubled assets raised attention on the growth of the housing bubble. In addition, short selling of hedge funds was not a main factor in deterioration of the global financial crisis.

During the financial crisis banks pulled out their money from investment banks. This led to the worsening of the financial crisis, as it investment banks went into bankruptcy. Therefore, banks were the major parties that led to the worsening of the global financial crisis.

Regulation of the hedge fund

The limited impact of hedge funds on the global financial crisis is due the fact that hedge funds are a reserve of a few “sophisticated investors,” who have assets worth more than $1 million. In addition, individuals who have an annual income of more than $200,000 may also invest in the hedge fund.

However, the investment in the hedge fund must not constitute more than 20% of the individual’s net worth. In addition, the net investments of a hedge fund manager must be more than $25 million. These measures restrict the number of investors who may engage in a hedge fund. This reduces the impact of the hedge fund on ordinary investors.

The financial crisis resulted in a significant increase of the regulatory oversight of the hedge funds. The global financial crisis prompted regulators to ensure that hedge funds with assets of $150 million or more register with federal regulators. Registration enables regulators to examine the activities of hedge funds firms to ensure that they undertake financially sound activities.

In addition, the largest hedge fund firms should file quarterly reports with the Securities Exchange Commission (SEC). The SEC in turn shares the information with the Financial Stability Oversight Council, which monitors the systemic risk of the hedge fund. This measures help in detecting potential factors that may pose a significant to the financial systems.

However, these measures may not be sufficient in preventing hedge funds from exposing the financial systems to risks. Small hedge funds, which are not eligible for direct regulation, may pose significant risks on the US financial systems if they act collectively.

Therefore, it is critical for oversight regulatory bodies to formulate a strategy that would detect when small hedge fund firms are acting collectively.

Theoretically, there are three levels of regulation of hedge funds. These levels are the fund itself, the hedge fund manager, and the distribution of the fund. Usually there is no regulation on the hedge fund itself. However, it is possible to regulate the fund managers and the distribution channels of the hedge fund. The primary regulator of the hedge fund regulates hedge funds that operate within the country.

In 2006, 55 % of US hedge funds were offshore. This resulted in minimum regulation of the hedge funds. Hedge fund managers undertake their activities from certain financial centres. However, local fund managers can opt not to register with local supervisors. Hedge fund distributors can register in Europe or Canada and avoid registering in the US. However, this would not prevent them from operating in the US.

In the U.S., regulators do not regulate hedge funds. Regulators mainly target hedge fund advisers. In addition, they require hedge fund advisers to register within their area of jurisdiction. Regulators may take action against hedge fund advisers who engage in illegal activities.

These include insider trading, misappropriation of funds, or presenting falsified credentials. These measures help in protecting investors’ funds and prevent undeserving investors from investing in hedge funds.

Various parties call for more regulation of hedge funds. Direct management of hedge funds would prevent excessive risk taking. Under the current practice, hedge funds firms may take excessive risk taking even after market failure. Risk management does not prevent excessive risk taking during market failure.

Parties that call for direct regulation of hedge funds provide several proposals through which regulators may achieve this successfully. The first approach is ensuring there is mandatory registration of hedge fund managers, or parties that distribute the products of the hedge fund managers.

This approach treats hedge funds as mutual funds. Availability of hedge funds to common investors necessitates regulators to treat hedge funds as mutual funds. Common investors can access hedge funds through a fund of funds, which is available from various hedge fund managers. Regulators may also require prime brokers who are under the regulation of banks to provide more disclosure.

This would increase the transparency of the prime brokers. Transparency would necessitate prime brokers to reduce excessive hedge fund leveraging. This would help in alleviating systemic risk.

Conclusion

Hedge funds are some of the most lucrative investments. Limiting the number of investors who access hedge funds reduces the risk that hedge funds pose to the financial markets. Hedge funds were not the main causes of the global financial crisis. It is widely accepted that the main cause of the global financial crisis was the subprime mortgage market.

The major investors who fuelled the growth of the subprime mortgage market were banks and financial institutions. However, regulators should increase the regulation of the hedge funds to prevent hedge funds from causing the next financial crisis.

Bibliography

Chung, Juliet. “Don’t Blame Hedge Funds for Financial Crisis, Study Says.” The Wall Street Journal, 2012. Web.

Desai, Padma. From Financial Crisis to Global Recovery. NY: Columbia University Press, 2011.

Dolezalek, Holly. The Global Financial Crisis. North Mankato, MN: ABDO, 2011.

Doyran, Mine Aysen. Financial Crisis Management and the Pursuit of Power: American Pre-Eminence and the Credit Crunch. Surrey:Ashgate Publishing Ltd., 2011.

Grant, Wyn & Graham K. Wilson. The Consequences of the Global Financial Crisis: The Rhetoric of Reform and regulation. Oxford: Oxford University Press, 2012.

Hammer, Douglas L. U.S. Regulation of Hedge Funds. Washington, DC: American Bar Association, 2005.

Kolb, Robert. Lessons from the Financial Crisis: Causes, Consequences, and Our Economic Future. Hoboken, NJ: John Wiley & Sons, 2010.

Liu, Henry CK. “The crisis of wealth destruction.” Asia Times, 2010. Web.

Nabli, Mustapha K. The Great Recession and Developing Countries: Economic Impact and Growth prospects. Washington, DC: World Bank Publications, 2011.

Reinert, Kenneth A., Ramkishen S. Rajan, Amy Joycelyn Glass, Lewis S. Davis. The Princeton Encyclopedia of the World Economy. Princeton, NJ: Princeton University Press, 2008.

Stowell, David. Investment Banks, Hedge Funds, and Private Equity. Waltham, MA: Academic Press, 2012.

Strachman, Daniel A. The Fundamentals of Hedge Fund Management: How to Successfully Launch and Operate a Hedge Fund. Hoboken, NJ: John Wiley & Sons, 2007.

Waksman, Sol. “Press Release: TrimTabs and BarclayHedge Report Hedge Funds Redeem $7.4 Billion in July 2012, Assets Down 23.2% Since Peak.” The wall Street Journal, 2012. Web.

Williams, Orice M. Hedge Funds: Overview of Regulatory Oversight, Counterparty Risks, and Investment Challenges: Congressional Testimony. Darby, PA: DIANE Publishing, 2009.