Elasticity of demand

Elasticity of demand gives the relation of the price of a commodity and its quantity demanded by measuring the percentage change in quantity demand that is caused by a percentage change in the price of the same commodity (Riley, 2006, p.1). Elasticity differs for different commodities.

“This is because there are commodities that do not react to changes in price due to their necessity in the life of a consumer, that is, despite an increase in price of the commodity consumers will continue buying the commodity” (Riley, 2006, p.1). Such commodities are said to be inelastic and they are said to have a negative price elasticity of demand.

Examples of commodities that are elastic are the basic needs like food. While others that the consumer can do without will have a great change in quantity demanded in case of even a slight change in price. Such commodities are said to be elastic or having a positive price elasticity of demand. Commodities in this category include the luxury items like jewellery. Elasticity is calculated as shown below. “Elasticity of demand= percentage change in demand/ percentage change in price” (Riley, 2006, p. 1).

The answer to this equation is the elasticity coefficient that shows interrelationship between changes in price and demand. A positive answer shows that the price elasticity is elastic while a negative answer (below one) shows that the price elasticity is inelastic. In case the resulting answer is equal to one, the commodity will have unitary price elasticity (Gibbs, 2001, p. 1).

Cross-price elasticity

Cross-price elasticity shows how two commodities are related in terms of quantity demanded and their prices. It is expressed as a ratio of percentage changes of both the price of one product and the corresponding change in the demanded quantity of a different product. This kind of elasticity is very useful in economics because it is used to evaluate the effect of introducing substitute products or complementary products in the market.

From the stated fact, it is apparent that the computation of cross price elasticity gives the relationship between two commodities. A positive result of the computation indicates that the commodities are substitutes. That is, products which replace each other. Examples of such commodities are coffee and tea. Conversely, the computed value of cross-price elasticity of a complementary product is normally a negative (Taylor, 2008, p. 40).

This implies that when the price of one product increases, the quantity of its complement that is demanded decreases. In the same way, a decrease in the price of a product leads to an increase in the quantity of its complementary that is demanded in the market. Examples of these kinds of products include butter and bread.

Income elasticity

Income elasticity refers to a fraction obtained by dividing changes in the demand of a product with the change in the level of consumer income. It shows the interrelationship of income and demand. It is calculated using the following formula:

Income Elasticity of demand = percentage demand change/ percentage income change (Gibbs, 2001, p. 1).

Elasticity coefficients

Elasticity coefficients in economics refer to the numerical values used to study the relationship between variables. For instance, the number computed to show the responsiveness of quantity of a commodity demanded to a change in the price of the commodity. As mentioned above, commodities whose demand is not affected by price changes are said to be inelastic and they have a negative coefficient of elasticity.

Those whose demand responds to price changes are said to be elastic and they have a positive coefficient of elasticity and those with a coefficient of one are said to have unitary price elasticity (Riley, 2006, p. 1). If products exhibit, positive cross-price elasticity, then the two products are substitutes. On the other hand, a negative coefficient of the same indicates that they are complementary to each other.

Finally, a high coefficient of income elasticity indicates that the commodity is highly responsive to changes in income while a low coefficient implies inelasticity of demand to income changes. This implies that if the coefficient is low, significant changes in consumer income will have a negligible or no effect on the demand of the particular product (Kelly, 2008, p. 19).

Differences of types of elasticity

From the discussion in the introductory paragraph, elasticity of demand and cross-price elasticity are somehow similar. This is from the fact that they use price as their frame of reference. However, it must be noted that in elasticity of demand, the price and demand of the same product is considered.

Contrarily, in cross-price elasticity of demand, the effect of a change of price in one commodity on the demand of another different commodity is considered. Income elasticity is different from the above two since instead of checking the responsiveness of demand on price, it checks the responsiveness of the demand of a commodity to changes in consumer income. The differences among the stated types of elasticity make each of them uniquely important.

Elasticity of demand is most appropriate in cases where suppliers want to change the price of a good that does not have close substitutes or complements. On the other hand, cross-price elasticity will be most suitable for planning a change in the price of a good that has close substitutes and/or complements (Taylor, 2008, p. 32). Income elasticity is uniquely applicable in the determination of the effect of consumer income changes on the demand of a product.

As stated earlier, availability of substitutes makes the demand of products more elastic. Since the products are related, significant price changes in one affect the other’s demand substantially. An example is tea and coffee. If the price of coffee drops significantly, the number of consumers demanding tea will also drop. This implies that the demand for tea is elastic to coffee price changes.

In this case, if the price of one product has to go up, suppliers will be forced to increase the prices of both substitutes in order to have a balanced market. If a share of consumer income is devoted to a good, the income elasticity will be high since the more the income, the more the proportion of it is devoted to the particular good.

It is apparent, therefore, that the demand of the product will tend to be elastic. An example is, if people use a significant portion of their Christmas allowances to buy clothes, the demand of clothes will be elastic to this change in the income of the consumers (Riley, 2006, p. 1). The sellers of clothes may, therefore, be forced to increase the prices of clothes during this time in order to balance supply with demand.

Depending on the type of product being examined, a long consumer’s time horizon will make the demand of the product more elastic while a short time horizon will make the demand of a product less elastic. This is because, if the horizon is long, suppliers will invest in substitutes.

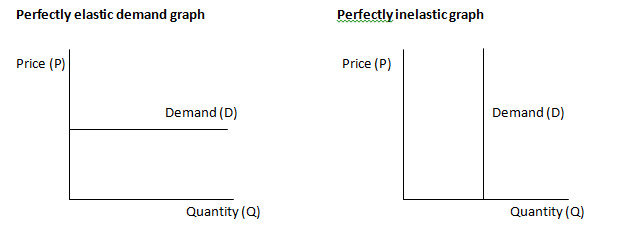

Perfectly elastic demand and perfectly inelastic demand

Demand is said to be perfectly inelastic if the quantity of a given product demanded does not change with changes in price. On the other hand demand is said to be perfectly elastic if “small changes in price are followed by large changes in the quantity of the product demanded” (Taylor, 2008, p. 27). The graphs of the two phenomena are shown below.

Elasticity of demand and total revenue

In the elastic range, total revenue is high due to the demand of more units of the product with a decrease in price which implies more sales. In the unit-elastic range, the revenue does not change significantly with a decrease in price.

This is because additional units demanded, after price decreases are produced at the profit maximization point where marginal cost is equal to marginal revenue. In the inelastic range, total revenue reduces since the demand is not responsive to the price decrease and therefore the change in the number of units demanded is negligible (Taylor, 2008, p. 21)

Reference List

Gibbs, P. (2001). Types of elasticity of demand. Web.

Kelly, E. (2008). Microeconomics. New York. Bell & Bain.

Riley. G. (2006). Income elasticity of demand. Web.

Taylor, J. (2008). Principles of Microeconomics. U.S. Barnes & Noble.