Company Overview

Electronic Arts are the world’s leading independent developer and publisher of interactive entertainment software for advanced entertainment systems. Founded in 1982, the company combines diverse media, such as computer animation, video, photographic images, motion capture, 3D face and body rendering technologies, computer graphics, and stereo sound. It brings together the contributions of story writers, film directors and musicians, using technology and creativity to develop mainstream entertainment through an interactive medium.

Electronic Arts has expanded its business rapidly in the home video game sector, primarily by developing close working relationships with the major hardware manufacturers, such as Sony, Nintendo, and Microsoft. The company has developed software for the Sony PlayStation, PlayStation 2 and PlayStation Portable systems, for Nintendo’s GameCube, Game Boy Advance and Nintendo DS, and Microsoft’s Xbox. It has also developed games for next-generation consoles, including Xbox 360, PlayStation 3 and Nintendo’s Wii.

Electronic Arts (EA) develops and publishes interactive entertainment software for entertainment systems such as the PlayStation 3, PlayStation2, the PSP (PlayStation Portable) system, Xbox 360, Nintendo Wii, Nintendo GameCube, Game Boy Advance and the Nintendo DS. It also develops games for PCs and mobile phone devices. The company owns major brand names include EA, EA Sports, EA Sports Big and Pogo as well as Hollywood films game series including The Lord of the Rings, The Godfather, Harry Potter, and Batman.

The company has operations in North America, Europe and Asia. The interactive software games are categorized as: EA studios products; and co-publishing, distribution products and third party development. EA develops package goods games at development and production studios in the US, Canada, England, Sweden, Germany, Singapore and China. The company also engages third parties to develop games. The company acquired JAMDAT Mobile in 2006 and merged existing cellular handset software game development and publishing business into JAMDAT’s to establish EA mobile business.

The company engages third parties to develop games for cellular handsets for its and develops cellular handset games internally at development and production studios located in the US, Canada, England, Romania and India. The company also develop online games and content internally at development and production studios located in the US, Canada and Singapore. In 2007, the company acquired Mythic Entertainment, a developer and publisher of massively multiplayer online role-playing games. Further the company engages third parties to develop online games. The co- publishing, distribution products and third party development activities of the company includes contracts with other game development companies to assist with the development of own interactive software games, which EA will publish, market and distribute. These activities are carried though EA Partners group. The company also distributes interactive software games that are developed and published by other companies.

The company’s distribution products include Half-Life 2: Episode One, which was developed and published by Valve and distributed worldwide by EA. The company also engages third parties to develop games. These games are published, marketed and distributed by the company. EA’s four major brand names include EA, EA Sports, EA Sports Big and Pogo. The company publishes a range of games under the EA brand including Need for Speed Carbon, The Simstm 2 and The Godfather. EA Sports brand offers sports simulation games including Madden NFL 07, FIFA Soccer 07 and Tiger Woods PGA Tour 07.

The EA Sports Big brand offers arcade-style extreme sports and modified traditional sports games including Def Jam: Icon, NBA STREET Homecourt and FIFA Street 2.The Pogo offers online casual games and downloadable casual games. EA’s console, PC and handheld games are made available to consumers as packaged goods that are typically sold in retail stores and through online stores. The company sells these packaged goods products primarily to retailers, including mass market retailers such as Wal-Mart, electronics specialty stores such as Best Buy and game software specialty stores such as GameStop. The company publishes interactive entertainment software playable on cellular handsets, including games, ring tones, images and other content through EA Mobile. It offers mobile games in alliance with service providers including Verizon Wireless’ Get It Now, Sprint PCS Vision, Cingular Media and Vodafone live! The company primarily publishes four types of games online: online casual games, massively multiplayer online games, mid-session games, and online-enabled packaged goods.

Indeed, the company describes its most important strategic initiative as maintaining and growing its leadership position on the next generation of consoles. In its 2006 annual report the company gave the following initial results of this strategy:

Xbox 360 – In fiscal 2006, Electronic Arts produced three of the ten most popular games in both North America and Europe. Although the number of units sold at the launch of the hardware was limited, revenue from its Xbox 360 titles more than offset the decline in sales of those for the original Xbox. The company has published 15–20 games for this system during fiscal 2007.

PlayStation 3 – Electronic Arts has released 8–12 titles in fiscal 2007 for this next-generation console from Sony, which was launched in the US and Japan in November 2006. It recently demonstrated a new motion capture technology that brings authentic athletic performance to sports franchises, such as its Tiger Woods PGA Tour series. Wii – Electronic Arts has several games in development for this new system from Nintendo (launched in autumn 2006), including Madden NFL, Need for Speed, Harry Potter and The Sims. The company identifies additional growth opportunities in the online and mobile gaming. It supports both the PlayStation 2 console from Sony and Microsoft’s Xbox Live capabilities on the console, and it continues to build its online functions for the PC.

The company has expanded through acquisition in key areas of its operations. For example, its acquisition of Jamdat Mobile, a California-based global publisher of wireless games and entertainment applications, in February 2006 positions the company for further growth in the mobile entertainment market. This means that the company has relationships with over 90 wireless carriers in more than 40 countries, with a dedicated team delivering some of the world’s most popular mobile games.

Similarly, in October 2004, the company completed its acquisition of Criterion, a UK developer of video games and provider of middleware solutions for the game development and publishing industry. In 2006, it also completed the acquisition of DICE, a Swedish developer of games for personal computers and video game consoles. During 2006, the company also acquired Mythic Entertainment, a developer of massively multiplayer online (MMO) games, which it describes as a category displaying rapid growth, which is linked in turn to the increased usage of PCs.

Electronic Arts places a significant emphasis on investing in its employees to optimize their skills in developing and marketing new and creative games on increasingly complex systems. To this end, in September 2004, the company announced the opening of the EA Game Innovation Lab at the University of Southern California, with an $8 million grant provided by the company. This builds on its worldwide programme of educational input in some 75 schools, which is designed to help students to develop the knowledge and skills needed for careers in the video game industry.

Total net revenue for the year ended March 2006 was down by 6.9% to $2,951 million. The company attributed this result primarily to the impact of the transition to next-generation consoles, which reduced the demand for the software titles used with existing consoles. This followed several years of strong revenue growth, which reflected the increasing sales of Electronic Arts’ major software titles.

The operating loss recorded in 2001 reflected heavy investment in the research and development to support the launch of the Sony PlayStation 2. A similar effect was evident during fiscal 2005 and 2006, which was related to investment in software development for the next generation of hardware.

During fiscal 2006, Electronic Arts reported that net revenue from PlayStation 2 products increased by 1% to $1,330 million, although this represented a slightly reduced proportion of total net revenue. By contrast, revenue from Xbox and Nintendo GameCube products expanded both in absolute terms and as a proportion of total revenue, which reflected the increased penetration of these hardware units. The company also recorded a positive sales trend for mobile products, due to the release of new titles for the launch of Nintendo DS and PlayStation Portable platforms in North America and Japan.

For the period April–June 2006, Electronic Arts reported a 13% increase in net sales, driven primarily by the success of titles such as 2006 FIFA World Cup, Battlefield 2: Modern Combat, Need for Speed Most Wanted, The Sims and EA Sports Fight Night Round 3.

SWOT analyses

Strengths

Brand loyalty- popular titles: Brand is all-important. EA is one of the most established and strong video game brands in the world, and has very loyal customers that advocate the brand. As a result EA not only recruits new customers, it retains them i.e. they come back for more products and services from EA, and the company also has the opportunity to extend new products to them.

Diversification of Games: The Company develops many different games under of its four brands. There are benefits and disadvantages to this. However, a key strength is that the company has a diversified portfolio of games, which means that while some games are underperforming, others are out performing. Innovative technology allows them to spot successes and focus upon them, creating and maintaining competitive strength.

Console/Platform Independency: EA introduces games for several different platforms including PlayStation 2, Game Cube, Xbox, Game Boy Advance, Game boy Color, PlayStation, PCs, and on-line play. ‘State-of-the-art tools use to allow for more cost-effective product development and to efficiently convert games designed on one game platform to other platforms’. Over the past 20 years, EA had published games for 42 different platforms.

Good Relationships with Console Manufacturers: EA has a very strong working relationship with the three major console manufacturers, i.e. Sony (PlayStation 2), Microsoft (Xbox) and Nintendo (GameCube). EA published games for 42 different platforms creating a broad and diverse market.

Good relationship with retailers for shelf space: It is very hard in this competitive market to create shelf space for the video games. Due to a good marketing strategy and relation with mass market retailers – like ‘Wal-Mart, Toys “R” Us, Best Buy’, EA can guarantee this shelf space for its products.

Human Resource Management: A focused strategy is in place for human resource management and development. People are key to EA and it invests time and money in training people, and retaining and developing them. Public credit of the developer is included (ref case).

Social responsibility EA funded the curriculum regarding video game development of the University of Southern California’s Interactive Media Division. In addition the EA staff members have been active teaching and lecturing at the school (Smith, 2004).

Game Development strategies: EA has a virtuous strategy for the game creation and evaluation strategy. ‘To create new game, small teams of EA game developers put together quick prototype. After green lighted, every 90 days a large group of managers and executive gather to report the update their works in progress. If a game did not come across as promising, EA pulled the plug on further work’.

Research & Development (R & D) revenue: EA can invest heavily in the development of tools and technologies that would facilitate the creation of new games for the existing (and future) game-playing platforms. Due to the considerable amount of capital it can invest and its sound development strategies, it can create greater revenue.

Strong alliance with Movie industry, Sports & other entertainment companies: In the course of creating a number of its games, EA acquired intellectual property and other licensed content from sports leagues, player associations, performing artists, movie studios, music studios, and book authors.

Weaknesses

Employment policy: EA aggressive market strategy by buying smaller development studios primarily for their intellectual property assets, and then requesting the developers to produce mediocre games. If this acquired studio produces a poorly performing game, it will shut down. The historical pattern of poor sales and ratings of the first game shipped after acquisition suggests however that EA’s control and distribution as being primarily responsible for the game’s failure rather than the studio. Loyal fans of particular developers criticize this behavior and refuse to buy the EA games any longer leading to bad publicity.

Labor groups have criticized the dismissals of large groups of employees and favorite developers during the closure of abovementioned studios (Nut, 2005).

Between 2001 and 2006 Electronic Arts has been criticized for employees working extraordinarily long hours—up to 80 hours per week— and not just at “crunch” times leading up to the scheduled releases of products. The employees claimed that mandatory hours are from 9 a.m. to 10 p.m.—seven days a week—with the occasional Saturday evening off for good behavior (at 6:30 p.m.)” (Life Journal, 2004). EA settled the lawsuit brought by game artists to compensate for “unpaid overtime” and awarded them with $15.6 million. As a result, many of the lower-level developers (artists, programmers, producers, and designers) are now working at an hourly rate. A similar suit brought by programmers was settled for $14.9 million (Jenkins, 2006).

Sales policy: EA is releasing updated versions of their game at retail prices equal to newly release game price which is not appreciated by the customers.

EA doesn’t have its console: Companies like Sony, Microsoft and Nintendo are in both hardware (consoles) and software (games) business and enjoying their chunk in both markets. Although EA produces games for the consoles of other companies, it doesn’t have it’s console.

No online functionality for Xbox games: Microsoft’s policy of not allowing EA (or any other game developer) to earn any revenues from online play of Xbox games had prompted EA management, after months of back-and-forth negotiations, to refuse to program online functionality into its Xbox games. This has made a bad impact on the sales of its games of Xbox.

Faulty Games: Electronic Arts has a reputation for new product development and creativity. However, they remain vulnerable to the possibility that their innovation may falter over time.

Opportunities

Video Game Consumer Growth: There has been a strong sales increase in the video game market over the past few years and there is still plenty of room for growth. Household penetration of console game systems has not substantially increased in recent years. It seems clear that much of industry growth has come from increased usage with existing customers. There are still plenty of new customers waiting in the wings.

The Interactive Family: Sales figures indicate that there is increased usage of game systems within households. Interactive entertainment is no longer just for the kids, it is now for the teenagers, and increasingly the parents, many of whom grew up with Atari and Nintendo systems. This means more households have several users, own multiple systems, more disposable income and have a tendency to purchase more software per system. Each segment user has different preferences for games. ‘The preference of female players has not been fully addressed in the video games’ (Alpert).

Worldwide Market Growth: For a company to be successful in the interactive entertainment business it must operate on a worldwide basis. Five years ago this was not the case, and some companies could do well focusing on a single market such as the U.S. or Japan. In recent years, the importance of the Japanese market has declined and much of the market growth has come from North America, Europe and emerging worldwide markets. In the next few years, the console manufacturers are likely to make a major push to enter markets like China and Russia (Market Research, 2007).

Mobile Gaming: The mobile gaming market may have started with Nokia, but it is currently dominated by publisher Jamdat, which was founded in 2000. Market share is quite lopsided to say the least, with Jamdat claiming a stake in nearly one-third of the market at 31 percent and total 2005 revenues expected to hit $80 million. EA is hoping that its sizable acquisition of Jamdat will put it on top of the mobile gaming food chain (Datamonitor, 2007).

Online Gaming: Another growth driver for EA is in online gaming. Online game segment growing by leap and bounds. The major factor driving online game playing is increased broadband penetration. Broad band capability in households began to rise sharply in 2002.

Threats

Piracy is threatening the industry as a whole. With current technology it is difficult to protect games from being illegally copied thus missing out substantial income.

Intellectual property is protected in most countries by patents. However, if EA is expanding its business to countries in Asia (China, Russia), it will be more difficult to gain adequate protection for its products.

- Soaring Development and Marketing Costs: Today’s games have entire teams of programmers, graphic artists, game designers, producers and audio technicians. Many games have expensive licenses, utilize Hollywood talent and have high-quality soundtracks. Consumers now expect non-interactive introductions and cut scenes that feature movie-quality computer-generated graphics and/or video with live actors. To get consumers to notice these high-end titles usually requires a marketing budget that equals or exceeds the development budget. As an average game reaches development costs of $5 million and approximately the breakeven point is reaching 500,000 units.

- Trends in the consuming markets: video games are luxury products. If the economy of a particular country declines (e.g. USA after the Iraq War) it could imply that these products are the first to suffer a decline in sales below the breakeven point.

- Access to distribution channel: Currently, in video game industry, competition is not only in making state of the art games but also in getting for shelf space for their games.’ With more than 500 titles for PlayStation, 200 titles for Xbox, and 150 titles for Game Cube, retailers struggled to find shelf space for even the most popular titles’.

- Competition: The software segment of the video game industry is highly competitive, characterized by the continuous introduction of new games and updated game titles and the development of new technologies for creating and playing games. EA has been facing competition from small companies with limited resources to large corporations with significantly greater resources for developing, publishing, and marketing video game software.

- Low sales for the new released consoles: Initially, the sales for the new released consoles are slow; as buyers are waiting for the more compelling and sophisticated games. That was happened when Sony launched PlayStation2 and Microsoft launched Xbox Live. And this is the threat for EA again, as all console manufacturers are ready to launch their new 128 bit consoles.

- Seasonal Sales: EA’s business is highly seasonal. ‘Sales are highest in the calendar year-end holiday season (about 40-50 percent of the annual total) and lowest in the April-May-June period’.

Electronic Arts pursues the best-cost strategy. ‘EA’s strategy was to focus on doing fewer things and doing them better and getting more leverage out of the titles that we ship. Roughly 70 % came from new releases of existing games’. ‘To create new game, small teams of EA game developers put together a prototype. After green lighted, every 90 days a large group of managers and executive gather to report the update their works in progress. If a game did not come across as promising, EA pulled the plug on further work’. With this strategy, EA explores many new products and brings best quality and most successful games to the market. This strengthens brand-loyalty of the customers which is necessary to position itself in the market and being able to ‘deliver a high-quality product at an average and sometimes slightly higher price’ (Thomson, Strickland & Gamble, 2007, p.151). EA uses different parts of the value chain in its strategy to differentiate from competitors. ‘Embracing different technologies and servicing several market relationships simultaneous formed the backbone of EA’s strategy in this fast-changing environment’ (Readman & Grantham, 2006, p.6).

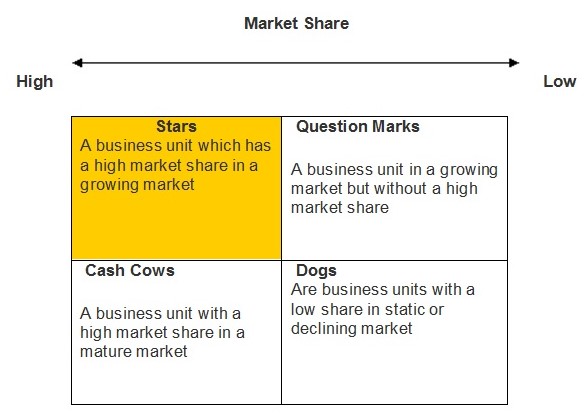

The SWOT analysis is a tool for auditing an organization and its environment. It is the first stage of planning and helps the organization to focus on key issues (Marketing teacher, 2000). SWOT stands for strengths, weaknesses, opportunities, and threats. Strengths and weaknesses are reflecting internal factors. Opportunities and threats reflect external factors. Internally identified strengths and weaknesses show that EA is an established organization with a strong brand name, strong relations in the supply chain, high capacity to develop its technology in this strong competitive market. Amongst other factors, it strengthens its position in the market by buying small developers’ studios. This ensures EA a competitive strong position. Ethical issues are prevalent in EA’s weaknesses.

The human resource management of EA’s employees and acquired developer studios has occasionally left an indignant impression amongst its buyers. EA has addressed these issues by compensation and changing its HR policy (i.e. more free lance contracts). Another weakness is that EA does not manufacture its console. However, this enables EA to focus on its core business (developing and publishing video games) and gain its competitive advantage in this segment. Due to it huge market share, issues like a few faulty games that have been issued, the smaller margins or higher breakeven point of a product do not affect EA significantly while the market is still growing and demand is still considerate.

Externally, analyses shows that EA has opportunities to penetrate the market to new segments, like online and mobile gaming. According to Alpert (2005), the preferences of female players of video games (accounting for 40 % of all users) have not been fully addressed. Furthermore, currently segmentation of the users is based on age, genre or region. Redefining those segments could reveal new preferences of users that could be addressed when EA innovates its product. Most threats like soaring development and marketing costs, ensuring shelf-space, seasonal sales, piracy and intellectual property rights are an essential part of this business and faced by all competitors and part of the game. To address these issues and remain competitive, EA needs to remain exploring new markets (segments) to be able to compensate possible decline of existing market (region, disposable income, and seasons). This implies that development and marketing budgets should remain relatively high.

The dominant economic features for the video gaming industry are the market size and growth, scope of rivalry, buyer needs and requirements, pace of technological change and product innovation. ‘In 2003, the video game industry represented $ 31 billion on the global market which meant a tripling of the market share since 1995 ($10 billion). It operates globally and ‘consists of makers of video game consoles, handheld players and arcade machines [hardware], game developers [software], retailers and online video game company producers’. The video game industry actors are described in appendix A. The hardware (i.e. console) manufacturers experienced ‘a huge industry shake-out’ before 1998. Maturity set in with Sony (playstation) as world leader in 2005 with 70 % of the market share, Nintendo at 26 percent. Microsoft entered with its Xbox in 2002, to make it a three-way contest at hardware level. There are roughly 200 independent video game developers in the US (Shah, 2005, p 15).

The developers of software ranged from small companies with limited resources for developing, publishing, and marketing video software to bigger ‘ independent game developers like Electronic Arts (EA), Activision, Take-2 Interactive, Capcom, Eidos, Acclaim entertainment, Sega and Lucas Arts , THQ and many more’. ’Small developers were struggling and forced to consolidate to a smaller number of larger developers’ hereby also entering early maturity stage. Specific data on the lifecycle stage of all actors are depicted in appendix A. The market growth is considerable as the financial data show: The growth in interactive entertainment as game-playing hardware and software continued to improve, hardware and broadband penetrated more homes, and technology continued to evolve resulting in broader game content, integration of movies and sport icons in the video game. In addition, players continued playing the games as they grew older, which meant that they had more disposable income (Shah, 2005, P7). ‘But besides growth in the developed economies, gaming console market is also seeing huge adoption in the emerging economies especially Brazil, Russia, India and China’ (Market Research, 2007).

Rivalry in the video game industry market is high, ‘characterized by continuous introduction of new games, updated titles and development of new technology for creating and playing the games’. Competition of video game development is based on game features, product quality, timing of releases, access to distribution channels and retailer shelf space, brand-name recognition, marketing effectiveness, and price. Software developers also competed with other form of entertainment like movies and TV. To be successful in the interactive entertainment business the company must operate worldwide. A decade ago companies functioned well focusing on a single market such as the U.S. or Japan. In recent years, much of the market growth occurred in North America and Europe and the new emerging worldwide markets as mentioned above. To address the needs and requirements of the buyers, console manufacturers cooperated with developers in the area or were based in their operating areas. The buyers in 2003 were 250 to 300 million people worldwide that were active or frequent players of videogames and ‘another 100 million were infrequent players’.

Players that started in a younger age category continued playing videogames. These players have substantial more disposable income to spend (Shah, 2005, p. 7). The bargaining power of the customer is relatively low. Due to the necessary procurement of a console to play the videogames, the buyer would experience switching costs if he wanted to switch to some other brands of videogames. Having said that, the supply of video games per console is still considerable with ‘more than 500 titles for Playstation, 200 titles for Xbox and 150 titles for Game Cube’. The consumer is ‘brand’ sensible’ and chooses games based on game features, product quality, timing of releases. Due to the price of the videogame and the amount of time that a user can spend with one game, this product is not bought in large quantities. The gaming Industry is knowledge based industry with high degree of innovation. Through technological innovations, technologies progress over time (Kayla, 1998). Between 1990 and 2003, the capacity of the consoles increased considerably from the 8-Bit device in 1989 to 128-bit in 2002. Simultaneously, the video games evolved to ‘push the limits of each new generation of consoles’. As a result, the costs of this innovation increased accordingly due to the extended time needed to explore increased possibilities. Advanced technological skills are required and huge capital investment influences the capacity of the players in the market.

The rivalry among video game developers is strong. To gain competitive advantage, the video game companies need fast innovation of the products and produce high quality products. As a result, smaller video game companies were forced to consolidate to a smaller number of large developers. The demand for video games is steadily growing due to increased amount of players (regional expansion and addition of new players whilst the existing players continue buying the games) and the attractiveness and quality of the product (better technology induced more features, introduction of sport and movie idols). There are a large number of videogames and rivals are competing for shelf space in retail to the point that ‘retailers demanded hefty slotting fees to stock lesser known or slow selling games’. The rivalry between the console manufacturers is much weaker because there are only three major console manufacturers and each is focusing on their segment in the market. The customer loyalty and switching costs for the buyer are high.

The video game industry has high entry barriers for both the hardware and software component in the industry. Appendix A specifies the possibilities to enter the market of each component in the video gaming industry. The fast pace of development in the video game industry requires continuous innovation of technology to introduce updated and new products at a fast pace. This requires access to large amount of capital for research and development, skilled labor and industry experience. Outlays exceeding levels that maximize short-run joint profits for going firms can build entry barriers (Porter & Caves, 1977). New entrants have to make a unique product without the infringement of the already existing patents. Moreover, established relationships of the major publishers with retail make it difficult for new entrants to enter this market. As a result, the market of console manufacturers has established their market segment and does not experience threats of new entrants. The software component still has new entrants to the market. The relatively new concept of online gaming that is not dependent on strong retail relationships, has the most new entrants.

The competitive threat of a substitute product increases as it comes closer to fulfilling a similar function to the original product. The closest substitute for video gaming is ‘other forms of entertainment i.e. movies, television, music and sports’. According to Alpert (2005), the major differences are that entertainment software is continuously interactive at the individual level, the experience with the video game is longer than any other entertainment product and it has a learning curve and requires skills. Although the switching costs to substitute products are low and these products can be purchased at a lower price, the performance of the video games as described above reduces the competitiveness with its substitute products. The video gaming industry has initiated competition by integrating themes of movies and sports in video games creating mutual increase of profit and popularity.

The bargaining power of the hardware suppliers is high. There are only three major manufacturers that serve different segments of the markets. There are switching costs involved for the buyer since the console is relatively expensive. Suppliers innovate their products thus able to charge premium prices for these consoles. In addition, the console manufacturers are vertically integrated in the video game development (software). The bargaining power of software suppliers is weaker. Numerous videogame developers have to adjust their product to the existing consoles. Moreover, ‘console manufacturers have final approval over all games for its consoles’. Due to the amount of titles and the relatively low price, the buyer has greater power when choosing their product. The online game suppliers do have relatively more power since they do not rely on strong retail relationships. The customer has a relatively weak bargaining power about the hardware. Three major brands produce consoles and the switching costs to another console are rather high. Due to the great amount of video games, ‘more than 500 titles for Playstation, 200 titles for Xbox and 150 titles for Game Cube’ and its price, the buyer has more bargaining power over the software supply. ‘The consumer is ‘brand’ sensible’ and chooses games based on game features, product quality, timing of releases.

The market is very attractive for the existing hardware manufacturers due to its high entry barriers which provide them a strong position in the market. They have a high bargaining power which allows them to set a marginal profitable price. The market is slightly less attractive for the software component. They experience more rivalry and have less bargaining power. As a result, entrants to this market are subject to the’ ‘hit or miss’ adoption’ (Shah & Haigh, 2005, p.1); if the company can produce good quality and establish a name, it can survive but when it misses its aim, it looses its position and high capital investment (skilled labor, R & D). The market becomes more attractive by ‘consolidating to a smaller number of large developers.

The trend in the market for video games is heavily dictated by the introduction of new game consoles. Software prices decline once a generation has been on the market for some time. Premium prices are reduced in response to competitor’s products reaching the market, to stimulate the sales of an older product before the new console is launched. ‘The introduction of various new consoles was launched around the end of 2006’ (Datamonitor, 2007) which was later than expected. This has caused a decrease in revenues compared to the previous years. EA recorded revenues of $ 2,951 million during the fiscal year that ended March 2006, a decrease of 5,7 % from 2005. The operating profit was $ 325 million during fiscal year 2006, a decrease of 51,4 % from 2005 and net profit was $ 236 million in fiscal year 2006, a decline of 53,2 % from 2005 (Datamonitor, 2007).

However, EA still has the largest market share of all software producers with 16,8 %. Its runner up is Konami that is taking a 10 % market share (Appendix D). Market Line (2007) reports that North America is EA’s largest market, accounting for 53,9 % of the total revenues in fiscal year 2007. Europe accounted for 40,8% ($1,261 million) of total revenues and Asia was responsible for 5,3 % ($164 million) of EA revenues in fiscal year 2007. EA acquired 19,9 % stake at UbiSoft Entertainment (developer and publisher), 59 % controlling interest in Digital Illusions, and 100 % in JAMDAT Mobile, Phenomic game Development, Singshot Media. It made several agreements for joint venture with others. EA has strengthened its position by ongoing acquisitions of several players in the videogame industry and has gained significantly in market share. This trend could already be derived from the financial analyses and the SWOT analysis conclusion and has proved to be a strong strategy to gain a high market share in a growing and competitive market.

Concerning the key financial ratio calculations of 2007 included in Appendix C, analysis of the financial data of EA indicates an overall strong competence. Return on capital employed measures the returns that a company is realizing from its capital. The resulting ratio represents the efficiency with which capital is being utilized to generate revenue. EA is enjoying the profit against the capital of 25.56%, which is good by all standards. The Gross Profit Margin indicates the total margin available to cover other expenses beyond cost of goods sold, and still yield a profit. EA’s gross profit margin of 56.78% means that for every dollar generated in sales, the company has 56.78 cents left over to cover basic operating costs and profit. Net Profit Margin is an indication of how effective a company is at cost control. The higher the net profit margin is, the more effective the company is at converting revenue into actual profit. A net profit margin of 18.38% is high, but comparison with gross profit margin shows that administration expenses are high whilst EA’s cost of sales and operating costs are relatively low. Return on stockholders equity measures the profits earned for each dollar invested in the firm’s stock. It is used as a general indication of the company’s efficiency; investors aim for companies with high and growing returns on equity.

EA can generate approximately 18 % profit which exceeds the average range of 12-15 %. Earnings per Share are the fundamental investor ratio and show the average amount of profits earned per ordinary share issued. EA’s average earnings per issued ordinary share ($2.17) tripled since previous year ($0.71). This is an excellent result as profits available for shareholders have increased significantly from £101,509 to £317,097. The Current Asset Ratio indicates the company’s ability to meet short-term debt obligations; the higher the ratio, the more liquid the company is. If the current assets of a company are more than twice the current liabilities, this company is generally considered to have good short-term financial strength. At 2.78: 1, EA has excellent short-term financial standing.

The Quick Asset Ratio measures the company’s ability to pay off its short-term obligations from current assets, excluding inventories. The ratio 1.66: 1 shows that for every dollar of current liabilities, there are 1.66 dollars of easily convertible assets. The interest cover ratio shows the safety margin of the business in terms of being able to meet its interest obligations. In 2003, the EA had no problem with its interest obligations since it was a net receiver of interest: the interest it earned was greater than the interest it might have had to pay.

Overall, EA’s financial data show that it can maximize its profit. It has a solid liquidity and can handle any unexpected setbacks. The expectation is that this upward trend will continue, especially after the launch of the new generation consoles.

Future Prospects

Electronic Arts has developed a strong position as a leading developer and marketer of video game software. It enjoys established relationships with the major hardware suppliers and has shown early promise in achieving its objective of developing a leadership position in software for next-generation consoles. The company has released or is developing software for Microsoft’s Xbox 360, Sony’s PlayStation 3 and Nintendo’s Wii.

The company envisages significant growth potential in the games played on wireless phones. It estimates that there are some 1.5 billion handsets worldwide, of which less than 40% are game enabled. These may become a viable alternative for those who are not able to afford new hardware consoles, and Electronic Arts has an aggressive plan to bring its most popular franchises to the mobile platform, thus expanding its business in North America and its presence in both Europe and Asia. Electronic Arts holds a leading position in the video game software sector. The company will continue to nurture its established collaboration with leading console players and will also seek to internationalize its operations, with a particular emphasis on expansion in Asia.

The company is building a wide-ranging expertise, both organically and via tactical acquisition, to add creative value to new titles and to reduce its reliance on licensed properties by increasing the number of games it creates within its studios.

The company has also recognized the trend towards new mobile and handheld platforms and will further extend its success in mobile gaming beyond phones into the online sphere of downloading content, paying for premium content and online gaming. In conclusion, EA has been a player in the industry since 1982. It has strengthened its position by buying publishers and developer’s studios. As a result it is a strong player in the market with competitive advantage to be able to finance the required R & D and marketing. Since EA has developed state-of-the-arts tools to convert a video game quickly from one platform to another, it can focus on its core business and serve rather than compete the console industry (that has very high entry barriers). Being a significant developer games for many consoles, it has build a strong brand name and experiences loyalty from its users. Since the market is extremely competitive, EA needs to remain developing on strategic level (acquisition of crucial players in the industry), products (development in the newest markets such as online and mobile gaming) and marketing & sales (addressing the needs of existing and new segments in the market). EA could reconsider reducing its overhead costs by reducing the number of offices and the amount of staff.

Works Cited

Botten, N & McManus, J 1999, Competitive strategies for service organisations, Macmillan, Basingstoke, UK.

Datamonitor, 2007, Electronic Arts. 2008. Web.

Hsu, C L& Lu, H L 2004, Why do people play on-line games? An extended TAM with social influences and flow experience, Information and Management, Vol. 41, No.7, pp. 853.

Johnson G, Scholes, K & Whittington, R 2005, Exploring Corporate Strategy, Text and cases, 7nd Edn, Prentice Hall, USA.

Kayal, A 1998, Measuring the Pace of Technological Progress Implications for Technological Forecasting, 2008. Web.

Life Journal 2004, EA: The Human Story, 2008. Web.

Macinnies, I, Moneta, J, Caraballo, J & Sarni, D 2007, Business Models for Mobile Content: the case of M-games, Electronic Markets, Vol. 14, issue 4, pp 218-227, 2008. Web.

Marketing Teacher 2000, SWOT Analysis: Lesson, 2008. Web.

Nutt, C 2005, Layoffs and Restructuring at EA LA; EA’s Southern California office “rebalanced”, 1up Platform, 2008. Web.

Porter, M E 1996, What is strategy?, Harvard Business Review, Vol. 74, Issue 6, p.61-77.

Readman, J and Grantham, A 2006, Shopping for Buyers of Product Development Expertise: How Video Games Developers Stay Ahead, European Management Journal, Vol. 24, issue 4, pp 259-269, 2008. Web.

Shah, N & Haigh, C 2005, The video game industry, Center for digital strategies, Darthmouth, UK/US.

Shankar, V & Bayus, B L 2003, Network effects and competition: An empirical analysis of the home video game industry, Strategic Management Journal, Vol. 24, Issue 4; pg. 375.

Smith, D 2004, EA Establishes Interactive Media Program At USC, B-net Research Centre, 2008. Web.

Thomson, A A, Strickland, A J, Gamble, J E 2007, Crafting and Executing Strategy: The quest for competitive Advantage, 15th Edn, McGraw-Hill, USA.

Appendix A

Video game industry lifecycle:

Appendix B

Customers of video games

The five forces model of competition

Appendix C

Appendix D