Executive Summary

Emirates Airlines is one of the most profitable and rapidly developing airlines in the world. It is the part of the Emirates Group and headquartered in Dubai, the United Arab Emirates. The airline company develops according to norms and tendencies of the local and global aviation industry and markets.

At the macro-environment level, operations and the strategic development of Emirates are most influenced by political, economic, and technological forces. To guarantee the effective long-term performance, Emirates needs to address the increasing competition within the market and the negative impacts of political and economic factors.

In spite of using the successful strategy that is oriented to increasing the brand loyalty and quality of services, Emirates can face problems in the future associated with the lack of the appropriate diversification strategy. In this context, it is necessary to propose Emirates to focus more on adapting to market trends in terms of planning to address the larger group of customers.

The competition in the industry increases and recommendations for Emirates should also include the market expansion. This approach will lead to improving the policies regarding customer services and to appearing the budget routes for travelers from different countries. These recommendations are important to contribute to enhancing the company’s long-term performance.

Introduction

Emirates Airlines is one of the rapidly developing airline companies in the world. The aviation industry suffers from a range of political and economic obstacles and challenges today, and much attention should be paid to the strategy followed by Emirates to compete in the market.

The purpose of this report is to provide the results of the Emirates strategic case analysis with the focus on the PESTLE analysis, the Five Forces analysis, the SWOT analysis, and the Stakeholder analysis. The report also aims to identify the potential problems in the strategic development of Emirates and propose recommendations to improve the future performance.

Description of the Emirates

Emirates Airlines is the part of the Emirates Group headquartered in Dubai, the United Arab Emirates (UAE). The airline began to operate in the 1980s, and it is the ownership of the government of Dubai. Today, Emirates provides its services in more than 70 countries all over the globe, and its staff is more than 55,000 employees (“Emirates Home” par. 2).

The company has one of the largest fleets in the industry, and it focuses on applying the latest technologies to its development. In addition, during several years, Emirates realizes the strategy oriented to buying more aircrafts and expanding the fleet. It is possible to speak about more than 6 million of loyal customers using services of the company (Nataraja and Al-Aali 472). Therefore, Emirates is the leading airline in the Gulf region and the Middle Eastern region.

The success and profitability of the company depend on the effective policies adopted by the Dubai government and on the provided financial support for the company. As a result, Emirates operates in the context of the “open skies” policy promoted by the government of Dubai, and its commercial potential is constantly increasing (Oxford Business Group 28).

The company’s vision is based on the idea that customers need to receive high-quality services, and much attention should be paid to gaining the customer loyalty and developing the positive relationship with the community.

The PESTLE Analysis and Macro-Environment Levels

In order to evaluate the strategic management of Emirates, it is necessary to analyze macro-environmental factors that influence the development of the business focusing on political, economic, social, technological, legal, and environmental forces.

Political Forces

Despite the fact that the current political situation in the Middle Eastern region is discussed as unstable, these political forces have the limited effect on the progress of Emirates. During the decade, the company operated with references to the business and political agreements of the UAE with the countries of the Gulf region, the Asia-Pacific region, and the Western countries (Nataraja and Al-Aali 473).

The active political cooperation of the UAE with the countries from the mentioned regions contributed significantly to the development of the aviation sector. However, today trade opportunities for airlines are rather limited because different nations all over the globe changed their courses regarding relations within the aviation sector due to the complicated political situation.

Therefore, depending on the political situation in the region, Emirates had to change their business course, review activities according to recent trends in the open skies policy, and refer to the support of the Government of Dubai (“Emirates Home” par. 3).

Economic Forces

The UAE are discussed among the most rapidly developing countries in the Middle Eastern region. The economic potential of the whole country increases, as well as the income of the state’s citizens. As a result, more people choose Emirates to fly in the country, and they also use the air transportation for flights to the USA, the European countries, and to the Western countries (The Emirates Group 4).

The recent financial crisis caused by the political situation affected economies of developed and developing countries and the airline industry. However, Emirates tries to keep leading positions in the country and region while changing the marketing strategies and orienting to other consumer categories.

Social Forces

Emirates focuses on attracting multicultural employees in order to address needs and interests of all consumers. As a result, the issue of diversity is important for the company. In addition, the social situation in the UAE allows recruiting employees at comparably lower costs than it is in developed countries. The flow of migrants in the UAE is high, and the job in Emirates is discussed as one of the most attractive ones.

As a result, the company allows hiring employees with diverse backgrounds and spends more attention to spending resources on their training rather than compensation (Nataraja and Al-Aali 474). However, the level of benefits remains to be high in the region and corresponding with the social policies in the UAE.

Technological Forces

Emirates pays much attention to using technological innovations in the industry for improving the quality of customer services. Therefore, the company actively uses the latest innovations in the field, and the focus is on new technologies to support operations of the company globally.

The large technological base is important for Emirates because the company operates in many countries, and services in all regions need to be provided in time and in the most efficient manner (Oxford Business Group 32). As a result, the technological platform is expected to be developed, and the company’s leaders pay much attention to recent researches in the field and invest in the most promising technologies.

Legal Forces

Current legal policies and norms regarding operations of the airline industry in the UAE can be viewed as supporting the further growth of Emirates. The reason is that authorities reviewed their approaches to legal norms, tax policies, and laws regarding the operations in the industries supported by the government (“Emirates Home” par. 22). The positive consequences of this process are the creation of the more open airline industry and more possibilities for increasing the competitive advantage globally.

Environmental Forces

The UAE policies regarding the protection of the environment are rather strict, and Emirates is one of those companies that concentrates on the development of effective and working sustainable programs. Emirates regularly launch the environmental projects and participate in the governmental programs oriented to protecting natural resources in the country (“Emirates Home” par. 23). Environmental laws also influenced policies of Emirates regarding the waste management and decreases in the water and energy consumption.

The Five Forces Analysis

The Porter’s Fiver Forces analysis is important to study how specific features of the industry’s development can be used to increase the competitive advantage of Emirates.

Threats of New Entrants

Emirates operates in the airline industry while proposing the high-quality and even luxury services. The threat of new entrants in this industry is minimal because of the necessity to have significant capitals, propose differentiated services, and gain the customer loyalty within the short terms. As a result, new entrants can compete only in the sector while providing low-cost services and flights.

Bargaining Power of Supplier’s

The impact of suppliers in the industry is high because changes in suppliers’ prices and propositions influence the quality and costs of provided airline services directly. The main suppliers in this context are aircraft producers (Davahran and Yazdanifard 3). The costs associated with buying new aircrafts for the fleet are rather high for Emirates today.

Bargaining Power of Buyers

The impact of buyers on the industry development is also high because Emirates is directly oriented to satisfying needs and expectations of their customers. Changes in clients’ interests and attitudes influence the progress of the business because today more passengers choose low-cost services, and they are focused on discounts (Rahman, Azad, and Mostari 24). The customers also use advantages of the highly competitive market.

Threats of a Substitute Products or Services

High prices for tickets make customers choose the alternative variants of transportation. In spite of the fact that the threat of substitutes in the airline industry is rather low, it is high while discussing Emirates as the global company proposing the transportation services (Nataraja and Al-Aali 474). In this context, passengers often choose cheaper services while planning their business or holidays trips.

Rivalry amongst Existing Firms

The level of competition in the airline industry among the market leaders is high, especially with references to concrete regions. Customers can choose among different services proposed by a number of companies in the industry (Oxford Business Group 54). Therefore, the rivalry is intense in the UAE, among the airlines of the Gulf region, and in the Middle Eastern region.

The SWOT Analysis

The SWOT (strengths, weaknesses, opportunities, and threats) analysis is important to demonstrate what internal factors can influence the strategic development of the company.

Strengths

Emirates is the largest airline in the UAE that operates in more than 70 countries all over the globe. One of the main strengths of the company is the support of the government that resulted in many trade agreements for the company abroad. Thus, today Emirates is the widely known brand that has a feature of adapting to the market needs.

The brand is popular because of the company’s strategy to propose customers the high-quality services based on the work of the latest technology and skilled staff (The Emirates Group 8). The company refers to the development of the technological base using the most innovative fleet and infrastructure or supporting services; to the development of the diverse human resource base; to the strategic use of finances; and to the improvement of the brand recognition.

Weaknesses

The weaknesses in the strategy of Emirates are associated with the high reliance on the economic situation as the external factor and on changes in financial and oil markets. The current financial situation in the region also affected the progress of the company, and it had to review its industry for the following fiscal year.

In this context, Emirates depends not only on the changes in the national economy but also on changes in the global markets and aviation industry (Rahman, Azad, and Mostari 25). One more weakness is the limited application of the diversification strategy. The company does not serve needs of middle-class passengers while reducing the number of potential customers.

Opportunities

Emirates can develop and increase its competitiveness while focusing on entering low-cost markets, targeting middle-class passengers, and expanding services in the larger number of countries. In addition, strategic opportunities are also associated with using more advanced technologies in order to compete effectively in the global aviation market. The company can benefit while concentrating more on the liberalization of its main strategy to address the needs of new markets.

At the current stage, the company serves interests of high-income customers, but it is possible to pay more attention to the diversification and enter new markets while addressing expectations of new categories of passengers (Nataraja, and Al-Aali 480). This approach will allow widening the overall scope of services provided and the business’s impact in the world.

Threats

The main threats for the further strategic development of Emirates are the progress of the rival companies in the air transportation or aviation industry; the changes in the fuel prices influencing the economy of the UAE; and the worsening of the current political and economic crises globally influencing the buying capacity of customers.

Rivals of Emirates such as Gulf Air Company and Qatar Airways Group are also oriented to expanding markets, and the competition within the airline industry increases. More problems can be associated with the political, economic, and financial crises because any changes in oil prices affect the development of the business (Rahman, Azad, and Mostari 25). In addition, the unstable political situation can lead to appearing more obstacles for the development of the airline business oriented to high-income persons (Fig. 1).

Figure 1. SWOT Analysis.

Stakeholder Analysis

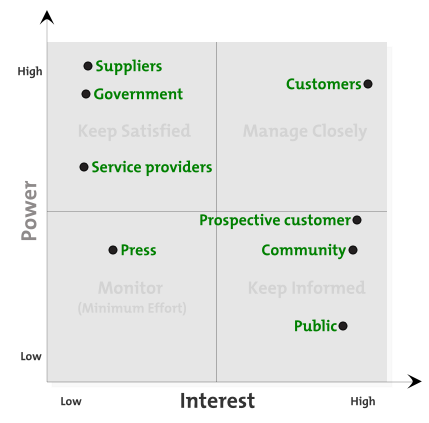

Stakeholders in the airline industry are numerous. For Emirates, the main stakeholders include the government, customers, suppliers, services providers, prospective customers, the press, the public, and the community.

The level of these stakeholders’ impact on the strategic progress of Emirates is different. The most influential are stakeholders that need to be managed closely because their levels of the power and interest are high. These stakeholders for Emirates are customers because their interests and satisfaction are the highest priority for the company.

The other influential group of stakeholders is those ones who also need to be kept satisfied, but their level of interest is lower in contrast to the power level. These stakeholders are suppliers. The power of the government is also comparably high, and the authorities’ interest in the progress and strategies of Emirates is also high.

Therefore, the government of Dubai and the UAE authorities need to be not only regularly informed on the progress of the airline industry but also be kept satisfied (“Emirates Home” par. 14). The service providers, including airports, also belong to this group of stakeholders in relation to Emirates.

The group of stakeholders that needs to be kept informed includes the prospective customers, the public, and the community because the increase in the brand recognition and the customer loyalty will directly lead to the increases in the number of passengers. The less influential group includes the press (“Emirates Home” par. 15). Although the public activities of Emirates are high, the company does not pay much attention to communicating with the press while choosing the other media to promote its services (Fig. 2).

Figure 2. Stakeholder Analysis.

Blocks of the Competitive Advantage

The competitive advantage in Emirates is based on traditional four blocks:

Efficiency

Efficiency is guaranteed through following developed recruitment and compensation policies oriented to decreasing labor costs. Another approach is the improvement of employee productivity with the help of enhanced training sessions.

Quality

The constant improvement of the provided services’ quality is a priority for Emirates. Much attention is paid to training the personnel and to guaranteeing the safety of clients during flights (Nataraja and Al-Aali 476).

Innovation

The innovation is another factor to explain the popularity of Emirates. The company follows the strategy of a pioneer in providing services while addressing individual needs of clients and improving the technological platform. Clients have opportunities to use private suites and entertainment systems on board. Thus, 60% of the company’s costs are associated with investing into the research and development department (The Emirates Group 4).

Customer Responsiveness

The customer loyalty depends on the fact that Emirates provides the most customer-friendly services in the industry with the high responsiveness while allowing easy check-ins and other advantages of the e-ticketing system and comfortable lounges (The Emirates Group 3). The customers associate Emirates with the high-class services, safety, innovation, and comfort.

Emirates Competencies

Emirates have many distinctive competencies, and their progress depends on providing the luxury services globally. The additional advantage is the high-skilled international personnel. Moreover, the company uses only the latest technologies to address the customers’ expectations (Nataraja and Al-Aali 476). Finally, the focus is on providing distinctive VIP services.

Emirates Differentiation Strategy

The company remains to be the marketing leader in the industry while applying the differentiation strategy and providing the high-class luxury services for the VIP clients and wider population (“Emirates Home” par. 16). The company differentiates in the market developing the close relations with suppliers of aircrafts, including Boeing, and it is concentrated on building the high-quality infrastructure while investing in airports and additional services.

Strategic Alliances

Emirates does not participate in airline alliances at the global level because of the specifics of their strategy. The airline develops the competitive advantage focusing on the independent positioning in the market to prevent the dependence on the alliance partners (“Emirates Home” par. 18).

Global Course

Emirates serves the needs of the market not only nationally but also globally. The company further develops the course for expanding the markets. At the current stage, the main focus is on entering the regional markets covered by the North American companies (The Emirates Group 5).

Potential Problems

In spite of the fact that the current strategy of Emirates is effective and leading to the company’s success, it is important to identify the potential problems in the strategic development of the business. The main problem is the possible inappropriateness of the current management and marketing strategies to address the needs of customers in the rapidly changing political and economic environments.

Although the strategies followed by the company today are rather efficient, the problem is in the fact that the airline industry and market can face significant challenges in the future if the economic crisis in the Middle Eastern and Western countries develops. In this context, more attention should be paid to the formulation of the effective adaptation strategy to enter more markets and to compete with rivals effectively (Davahran and Yazdanifard 3).

The other problem is the considerable dependence on the government’s support and oil prices in the global market. If the significant fluctuations in the oil prices and changes in the financial markets are expected, the aviation industry in the UAE is at risk of having high losses because the currently followed strategy is oriented to the context of the rapidly developing economy.

Recommendations for Improving the Long-Term Performance

Having analyzed the strategic growth of Emirates with the focus on the external environment and on internal forces, it is possible to propose certain recommendations for the company to address the potential problems in the future. The first recommendation is to revise the differentiation strategy and pay more attention to the diversification strategy in order to make the company’s approach more adaptable to the changes in the airline industry and markets.

At the current stage, Emirates focuses on serving the high-income passengers, but the discussion of the other group of perspective middle-income customers is also important. This approach will be efficient and provide positive outcomes while being connected with the approach of decreasing overall operational costs.

The other recommendation is associated with the necessity to address the increasing competition in the industry. The rivals in the airline industry market are active, and Emirates need to focus on expanding their services and selecting more routes because such approach guarantees the stable leading positions in the market.

Emirates needs to determine what new travel routes can be discussed as most beneficial for them in order to attract more customers as representatives of different income groups. In this context, the effective implementation of the diversification strategy should be supported by the company’s global expansion. These recommendations can be discussed as effective to contribute to the improvement of the company’s long-term performance.

Conclusion

Emirates remains to be one of the most successful airlines in the Middle East. In addition, the company works to improve the global brand recognition. At the current stage, the company is able to adapt the strategy to the influential external factors, but the problem is in the fact that more approaches can be necessary for the future. From this point, it is important to provide recommendations for Emirates regarding the improvement of the strategic development in the long-term perspective.

Works Cited

Davahran, Ngaveena, and Rashad Yazdanifard. “The Importance of Managing Customer Service, Safety Quality and Benchmarking of Airports and Airlines to Enhance the Performance and Customer Loyalty.” Global Journal of Management and Business Research 14.4 (2014): 1-9. Print.

Emirates Home. 2015. Web.

Nataraja, Sundaram, and Abdulrahman Al-Aali. “The Exceptional Performance Strategies of Emirate Airlines.” Competitiveness Review: An International Business Journal 21.5 (2011): 471-486. Print.

Oxford Business Group. The Report: Dubai 2014. London: Oxford Business Group Publishing, 2014. Print.

Rahman, Khadiza, Sumi Azad, and Sabnam Mostari. “A Competitive Analysis of Airline Industry: A Case Study on Biman Bangladesh Airlines.” Journal of Business and Management 17.4 (2015): 23-33. Print.

The Emirates Group. Emirates Airline Overview. 2010. [PDF file]. Web.