Introduction

Understanding a company’s internal and external structure is necessary for deciding on the best course of action that will enhance sustainability. According to Shqairat and Sundarakani (2018), value chain categorises all the processes and activities within an organization to convey products from its conception to final usage. It may be difficult for the managers to determine whether the current supply information is sufficient for timely and secure provenance of goods and services (Katsioloudes and Abouhanian, 2016). The blockchain technologies (BT) provides solutions by using decentralised databases which allows high volume process disintermediation and transactions between stakeholders (Nayak an Dhaigude, 2019).

The aim of this project to is to analyse the past and present performance of Emirates National Oil Company (ENOC) and then propose a BT strategy that will enable the company’s sustainability of production process.

ENOC Background

The ENOC is represented in NAICS codes as 21 and 211 implying that the ratio is 21:3 and 211: 39. The six digits NAICS code for the company is 21, 211 and its SIC code is 13, 131 (Zoominfo, 2020). The growth of ENOC within the oil and gas industry is evident in the sales volume in which there was a 24% rise to $16,415 in the financial year 2016-2017 (ENOC, 2017). The total current assets as of the end of 2017 was worth 197,818, 000 where as its total liabilities was 80,174,000 (GuruFocus, 2020). The company, founded in 1993, is headquartered in Dubai, United Arab Emirates (UAE). and owned by the Government (ENOC Official Website, 2020). The company’s vision is “to be an innovative energy partner, delivering sustainable value and industry-leading performance” (ENOC Official Website, 2020, par.2). Its mission is striving for operation excellence, employee pleasure, and innovation that enables delivery of world-class energy solutions that are sustainable and integrated. The main values of the company include:

- Teamwork

- Integrity

- Transparency

- Respect

- Customer Focus

Analysing firm’s past performance, environment and strategies

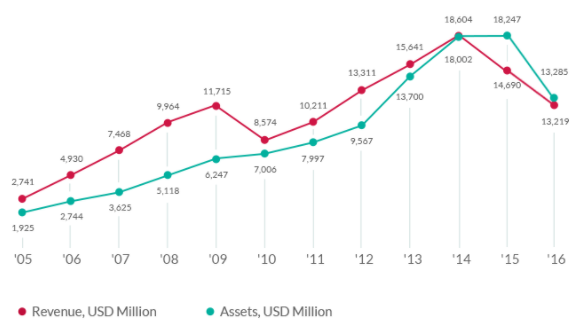

Since its foundation, the company realised a stable financial growth until 2015 when there was a drop in oil and prices that resulted in depreciating revenues (See figure 1). However, in 2017 the global oil price increased by $10 to reach $55 per barrel (ENOC, 2017). The main reason for the growth was the decision of Organization of the Petroleum Exporting Countries (OPEC) and Non-OPEC countries to work together in reducing the cost of production. The demand for oil was also great during that period. The company would have made more profit but there was a 7% decrease in production due to some challenges in the field (ENOC, 2017). The COVID-19 pandemic which started in 2019 through 2020 has had negative implication on fuel prices and demand. Many flights and other transport were cancelled leading to losses for the company although ENOC has not publicly provided their financial reports for 2019 and 2020.

Liquidity Ratios

Liquidity management is an essential tool for firm management as it reflects the company’s capacity to repay its operating and financial expenses. The table below provides a comparison of ENOC and ADNOC.

Liquidity ratio shows the capabilities of the company to pay back its short debts. From the table and the graph, it is clear that in the years 2016 ENOC had a better capacity to repay loans. However, in 2017, ADNOCs position was fairer. The competition between the two companies is stiff is stiff hence adjustment of the

Profitability Ratio

The profitability ratio is used for measuring the general profitability of a company to the extent of its operating efficiency. The ration determines how profitability on sales and investments are. ENOC has better gross margin, net profit and return of assets. This indicates that ENOC had better performance in that the company invested in resources that generated more profit.

Asset Management Ratio

The asset managements that have been selected for the analysis include the inventory turnover and the asset turnover. The implication is that ENOC has better strategies for utilising their assets to generate revenue for their company. ENOC has invested in modern machines that enhance efficiency and make it possible to earn more returns.

Both the inventory turnover ratio and the asset turnover for ENOC exceeds that of ADNOC

Firm and Industry Analysis

There are many instruments designed to harmonize organisations with their economic interests. The management Key performance indicators (KPI) provide effective means for channelling complex activities to achieve a strategic goal (Brui, 2018). The growth of ENOC within the oil and gas industry is evident in the sales volume in which there was a 24% rise to $16,415 in the financial year 2016-2017 (ENOC, 2017). Comparatively, ADNOC (its primary competitor) had a revenue of $22, 893 which was 15.9% increase from previously recorded profit of $19, 756 (ADNOC, 2018).

The company has also internationalised to more than 60 countries, and in 2017 it achieved 83% customer satisfaction and fuelled more than 72 million vehicles (ENOC, 2017). The net profit for the company from 2012 to 2017 was 20,000 and in the 2018 financial year, the revenue was $21, 022 (ENOC, 2018). The firm has 30 subsidiaries specialising in lubricant, refining, storage, aviation, blending, and retail. The 2017 annual report also records that the company Lost Time Injury Frequency Rate (LTIFR) from 0.51 to 0.36 in 2016 and 2017 (ENOC, 2017). The firm is also innovating new strategies to promote renewable energy.

External Analysis

The external analysis of a company is the environmental factors which the firm cannot control. The focus is objectively assessing the changing world within the business context so as to receive an early warning for knowing potential opportunities and threats (Sivalingam, 2018). The PESTEL and Porter’s Five Forces for ENOC are as follows:

PESTEL

- Political: The political environment of the Middle East and North Africa (MENA) is unstable, which negatively impacts the company. However, according to United Arab Emirates oil and gas report – Q4 2018 by Fitch Solutions (2018), the UAE has relished some period of political stability that has promoted economic growth. The advantage that ENOC has is that Dubai is a major power in regional politics; hence, it gets to influence key decisions that are favourable to the nation.

- Economic: The company enjoys a growing economy with an increasing number of people gaining higher education. The UAE has a vast conventional reserve of raw materials for more extended operations. The country also enjoys high gross domestic product (GDP) per capita. According to Trading Economics (2020), it recorded a GDP of USD 41420.50 in 2019. The other economic advantage is that the costs of oil lifting are low based on global standards.

- Social: The major social issue is absence of gender balance among the employees of the company. For instance, all the executive members of the company are men based on their 2018 annual review (ENOC, 2018). Moreover, all of the top officials are Arabs, although, at junior levels, there are expatriates from diverse ethnic backgrounds. Yet, according to Karami (2016), diversified work environments likely to have a global outlook.

- Technological: Infrastructure, such as roads and information technology systems, is well-developed in the UAE and related regions. However, the company may face challenges in transporting its products by road to some of the clients in African countries that have poor infrastructure.

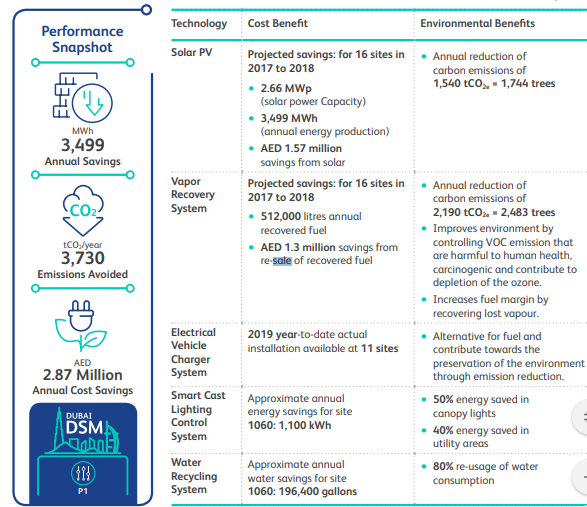

- Environment: There is increasing emphasis on firms to make their production environmentally friendly. According to Bowen et al. (2020), sustainability can only be achieved by organisations which consider corporate social responsibility. As stated by ENOC Official Website (2020) the company has health and safety environment programme that aims to protect its community. ENOC has also innovated solar power energy, which is clean, to contribute to the sustainability of the environment (Aldoukhi, 2018). The company also established the Jebel Ali refinery expansion project to promote clean energy, electrical charger system, smart cast lighting and water recycling system (ENOC, 2019). However, the mining process leaves dangerous holes. Furthermore, oil is a major air and water pollutant which causes damage to the ozone layer.

- Legal: Companies in the oil and gas industry must comply with local and international regulations. The laws are categorised into environmental, oil pricing and employee safety. The procedures to follow when putting up such a firm is lengthy. Yet, the company has survived this far by “maintaining compliance to regulations through stringent application of policies and procedures” (ENOC, 2017, p. 37). Following the procedures from all bodies makes operations for the company run smoothly.

Porters Seven Force Analysis

Porter’s five force model is a framework used to analyse competition in the market so that managers can determine the balanced power between different firms on an international scale. The tool can be utilised in determining the structure and the corporate strategies of the enterprise.

- Competitive rivalry: In oil and gas industry, there is stiff competition in the upstream sector. ENOC has several rivals, including ADNOC, Oman Oil Co SAOC Petroleum Development Oman LLC, Partex Oil and Gas, and Dubai Petroleum Company. These companies are also well established in the industry; hence, ENOC must always ensure that it innovates tactics to succeed.

- Threat of New Entrants: Starting an enterprise in the industry requires colossal capital. The entrant will have to negotiate with the government, which controls a significant percentage of the reserve. Such requirements make the threat to new entrants’ low, which is advantageous for ENOC.

- Threats of Substitutes in Oil and Gas: Some of the possible substitutes for Oil and gas include biofuels, nuclear energy, coal, and hydrogen. Some of these energies are more environmentally friendly. However, their productions are still done in low quantity, hence presenting low to moderate threats.

- Bargaining Power of Buyers: Buyers can have high negotiation if they understand the product, and there are many alternatives to purchase from. Buyers’ bargaining power is low since there are a few benchmarks for prices globally (Maqsood et al., 2019). Apart from Dubai/Oman, the only other benchmark for prices are Brent Blend and West Texas Intermediate (WTI).

- Bargaining Power of Suppliers: The company’s supplier chain integrates suppliers; hence they are subsidiaries. The ENOC Official Website (2020) documents that supply trading processing is a major segment for the company. Resultantly, the supply power is low.

- Relative power of other stakeholders: It is commonly known that all stakeholders have the ability to impact business operations in any given industry (Henry, 2018). In the oil and gas industry and specially ENOC, the government plays a vital role since it can influence the sector strongly by implementing new laws and policies that can affect the procedures and operations of the organisation. In addition, the employees of the organisation can support the business operations providing higher sales opportunities through premium services.

- Power of complementors: The existence of the complementors can provide a strong backbone to the competitive structure of an organisation (Henry, 2018). An example of a complementor for the oil and gas industry is the automobile industry, the increased production and demand for fuel vehicles supports positively the oil and gas sector.

Internal analysis

The internal analysis comprises of intangible factors and tangible resources that can be changed or adjusted by the company to enhance performance. The relevance of internal management is that it helps the organization to either revise past practices or stimulate them for competitiveness.

Resource-Based Theory

The organisation has the tangible resources such as land and machinery and intangible ones such as brand and intellectual property. The assets are controlled by the firm during implementation of effective and efficient strategies (Rockwell, 2019). Below is the analysis of ENOC:

- Financial Resources: The revenue for the company in the 2017 financial year was US$16,415 million, which was a rise of 24% from the previous year. The firm also has high command for both the long-term and short-term debts (ENOC, 2017). Huge revenues can e managed to enhance competitiveness.

- Physical Resources: ECON owns several wells, transit vehicles, land, and buildings for industrial processing and offices (Oil and Gas, 2016). The physical assets are managed by the government to enhance maintenance.

- Human resources: The company benefits from a large pool of skilled employees, both local and expatriates

- Organisational resources: A good relationship with the employees through Dragon Oil and the ISO 50001 certification has significantly enhanced the company’s brand. Also, ECON has a good supply chain and global networks that make it sustainable.

VRIO model

It is relevant for companies to evaluate resources’ capabilities and determine whether it offers a competitive advantage. In the evaluation process, each asset is analysed to determine if it is valuable, rare, costly to imitate, and the degree of organisation of the firm to capture the value (Nicoulaud et al., 2020). The following is a simplified VRIO of ENOC

ENOCs Strength

R1-S1: Ownership of a bigger percentage of the oil reserves

R2-S2: The company operates with huge revenue scale

R3-S3: Young, well educated workforce with high proficiency in technology.

R4-S4: ENOC is owned by the government and has assets such as land, buildings and machines which reduces expenditures such as renting

C1-S7: ENOC has made several initiatives to save energy and produce renewable fuel

C2-S8: Employees are well compensated and customers well served to promote positive culture within the company.

C3-S9: The company has significant international presences

C4-S10: The ENOCs products are known internationally as being of high quality.

ENOCs Weaknesses

R2-W1: The global COVID-19 pandemic has had negative implication, especially, for companies in the oil and gas industry.

R5-W3: There are other giant companies such as ADNOC which have higher economies of scale

C1-W4: The residues from the company has many environmental hazards that are difficult to manage

C3-W5: There are other major companies that compete for the global market

C4-W6: A good reputation is never permanent unless the company works hard to ensure that it remains at a competitive edge against the competitors

VRIO Summary

- Value: The ENOC has enhanced its business process re-engineering (BPR) by assembling the needed resources to make the enterprise’s workflow meaningful. For instance, as of 2017, the firm had “83,952 barrels daily crude production” and a 24-hour capacity of 140 000 barrels of refined fuel products (ENOC, 2017, p.4). The company has also digitalised its process to enhances efficiency.

- Rarity: Oil and gas are scarce mineral resources mostly found only in MENA. The government owns most of the wells in Dubai, making it difficult for competitors to penetrate.

- Imitatively: It is difficult for another company to successfully imitate the complex production process of ENOC due to financial and experience restrictions.

- Organisation: The company has a proud record for international leadership, given its investments in sustainability. The organisation of the board members and the executives also ensures smooth running of all processes. However, given the numeracy of subsidiaries and complexity of operations, coordination is challenging.

Critical Assessment of Past Strategies

The primary competitive advantages of ENOC include high-quality products, good brand, sustainable projects, skilled employees, and economies of scale. In the oil and gas industry, the key resources for competitiveness include having a large mining reserve, technological advancement, good supply chain, and skilled workforce (Rawan et al., 2018). The industry’s future performance is likely to be affected by laws on environmental conservation, rivalry, and regional political instability. With these analyses conducted below The TOWS clearly indicate that ENOC has in the past maintained a good competitive edge against its rivals.

TOWS Matrix

Threats

The rising regional instability is a major threat since political disagreements can easily affect production and pricing of oil and gas. The main rival, ADNOC, threatens the company’s growth due to its large scale of economy and long period of operation.

Opportunities

There are many oil and gas reserves that the government is yet to explore. The company also has an opportunity to invest more in refinery to become a net exporter of the refined oil. Liberalisation of the fuel prices by the government will result in some of the smaller competitors being pushed out of the market.

Weaknesses

Large volume of reinjection limits marketable production of gas. The company’s workforce does not have gender equity. Subsidising energy depresses the prices and can result in fluctuating revenues. ENOC also experiences challenges in logistic management regarding transportation of products.

Strengths

The company has a larger scale of economies compared to other smaller competitors within the region. The good governance of ENOC, its stable supply chain and happy employees results in better workflow. Also, Dubai is politically and economically stable for global business operations. The company has a strong brand appreciated by customers due to quality products and mechanisation. The firm is also active in corporate social responsibility.

Summary of the critical assessment of TOWS Matrix

The TOWS clearly indicate Some key strategies used by the company include investment in technology, fixed assets and clean energy, competent leadership and employees, and sustainable supply chain. The company, however, faces threats from other giant brands in the Oil and Gas industry and other unfavourable external environments such as regional conflicts. However, the company can still capitalise on available opportunities to remain sustainable. The BT adoption will have a positive impact on the overall performance of ENOC.

Analysing Firm’s Current Competitive Environment

One of the main competitors is the Abu Dhabi National Oil Company (ADNOC), a major giant owned by the state. The annual revenue of ADNOC in 2019 was $5.81 billion, with a gross profit of $1,355.57 (Dun & Bradstreet, 2020). Concerning employees, Dun and Bradstreet (2020) states that ADNOC has more than 13000 employees. The active refinery for ADNOC is 800000, while that of ENOC is 140000 (Fitch Solutions, 2018). There are also lesser competitors in the industry who increase the rivalry.

Defining the Strategic Problems of ENOC

There are some notable problems facing ENOC and its competitors such as the threat from conflicting regional politics on oil reserves. Notably, the MENA region primarily depends on their mining for economic sustenance due to the geographical and climatic conditions that only support little farming. There are also cultural issues such as the defined gender roles which may not be appreciated by some countries. The international laws on environment and oil pricing also impact the company. Based on such external factors and the internal outlook of the company, the following are the primary problems and their impacts on people, resources, and processes in the company.

Demands for Environmental Conservation (Urgent)

The oil and gas industry are characterised by high greenhouse gas emissions which makes it the focus of many environmental policies. According to Anis and Siddiqui (2015), the production process involves flaring, venting and possibility of release of methane which is largely responsible for global warming. Moreover, the drilling of mines and production process use heavy machinery that emit pollutant gas. Wildlife and humans are also negatively impacted when the land is left with quarry. For instance, a person may fall inside the pit or get injured, thus, raising major public health concerns. Destruction of habitat and displacement of residence are also a significant concern for ECON. The UAE became a non-Annex 1 nation after ratifying the United Nations Framework Convention on Climate Change (STA Law Firm, 2020). Resultantly, ENOC has to adhere to the Kyoto Protocol and federal policies on environment. Demands for even stricter rules may increase the expenses of the company.

Regional Conflicts and Corruption (Important)

The regional conflicts on the oil reserves have negative implication on ECONs revenue, brand and operations. When there is a conflict with neighbouring countries, war can erupt at any time and disrupt business operation. Moreover, ENOC is the government’s property; there are a few corruption cases in the way business is handled. The company does not publish its financial reports publicly; hence, it is difficult to validate the auditing processes. It is also not clear how tenders are awarded. Such issues are important and should be addressed.

Fluctuation of Oil Prices and COVID 19 Pandemic (Urgent)

The price of oil per barrel significantly affects the overall revenue of the company. Understanding the matrices that influence demand and supply of oil is important in answering to the market needs (ENOC, 2018). For instance, during the pandemic the consumption of oil reduced; hence, there was significant underutilisation of resources. The impact affects all the stakeholders, thus leading to disruption in the supply chain. The implication is that the work process can neither be effective nor efficient.

Field and Technological Challenges (Important)

Heavy machinery is needed in the drilling, processing and transportation of the refined products. The rapid growth of population globally is likely to result in increased demand for fuel. The implication is that better machinery and continuous innovation is required to enhance efficiency. According to ENOC (2017), the revenues of the company were affected by some field challenges. Such issues can easily be solved by digitalizing the firm processes. Communication issues within the company and with other stakeholders may also have a negative influence on the efficiency.

Information Analysis

The information analysis for ENOC and its competitors for specific problems are as follows.

Problem Statement

The guiding research question for this study is: What are the BT strategies that ENOC can implement to enhance its competitiveness within the industry? The hypothesis for the project includes:

- Null Hypothesis Ho: Stakeholders in the Oil and Gas industry are interested in adopting BT to enhance their competences in the future

- Null Hypothesis: The complexity in BT operations deter many people from adopting BT

Implementation and Evaluation of Strategies

The ENOC is expected to have a complex supply chain as the demand for oil and gas increases worldwide. There is an exponential growth of people, which implies that the energy need will escalate. The company needs to make its production process to be efficient, cost-effective, and conservative. According to Koeppen et al. (2017), Blockchain can offer transactional verification instantly across a network without relying on a central authority” (p.1). The implication is that it streamlines operations and reduces human labour; thus, providing a cheaper alternative.

Formulate Strategies

To mitigate the challenges that ENOC has been facing while enhancing the competitiveness of the company. There are three levels of adjustments that can be applied to positively transform the firm. Functional techniques are intended to increase efficiency in different departments. For instance, ENOC can decide to use cloud computing for data storage and communication, thus increasing efficiency. There are also business level strategies such as premium pricing and good quality (Cavaleri & Shabana, 2018). Some changes are also made at the corporate level to promote good governance.

Function Level Strategies

Functional levels strategies comprise of goals and actions assigned to different departments to support the initiatives at corporate level and business level.

- Sales and Marketing: The company can focus on using its website and increasing its social media presence through search engine optimisation.

- Research and Development: The company should include an annual budget to be directed to alternative energy and reduction of pollution.

- Finance: ENOC should minimise expenditure by adopting BT technologies

- Production and Mining: ENOC should budget on mining based on the demand. Investment in machinery is also needed to enhance efficiency and minimise cost of paying workers since the machines perform faster.

- Human Resource: The company can consider gender equity and start a reward system for innovative ideas

- Information Technology: The company should integrate BT which works well with artificial intelligence since both embrace digital technologies to ensure production efficiency. Therefore, ENOC will benefit by combining the two strategies and implementing the IoT to merge critical infrastructures among stakeholders. Smart contract for automation of the supply chain and transparency compliance to curb the threat from regional political instability.

Artificial Intelligence (AI) technologies: Internet of Things (IoT) and Cloud Computing

One of the company’s challenges is the complexity of operations, given its operations in 60 countries. Merging the critical infrastructures of all operations through internet will help in digitalization; hence, increase efficiency (Balasubramanian et al., 2019). The only drawback is the risk of cyber threats, which can compromise the whole system.

Blockchain Technologies (BT): Smart Contract

Tracking is a major challenge for big companies, which can be resolved by blockchain. The smart contract allows ENOC and its partners to draft agreements that facilitate bookkeeping automation and enhance seamless supply chain (Hayrutdinov et al., 2020). The distributed ledger strategy will make it possible to understand the schedules for each task (Marinakis et al., 2020). The disadvantage is that it requires agreement of all stakeholders and may be difficult to implement in the initial stages.

Transparency and Compliance

There are many regulation, internal and external, that organisations in the oil and gas industry must comply with. This strategy will be designed in such a way that there is transparency among all companies in the gas and oil industry with and aim of resolving the regional conflicts.

Integrating Blockchain Strategy

The Blockchain can be integrated to business process to revolutionise interactions and enhance the busines processes. The blockchain enhances accountability and makes the firm operate efficiently with its stakeholders.

Blockchain for Cost Management

Using smart contract, the company can budget for each of the schedule task effectively thus enhancing forecasting for future growth. The estimations help in allocation of finances to different departments in the company. Transparency and compliance will also ensure that there are no fraud and misappropriation of the funds.

Blockchain Compliance Management

The blockchain will enhance compliance to the laws and regulations that govern oil and gas industry. This is important since the GEMA has been facing regional conflicts due to issues with non-compliance in the oil reserves. The BT will ensure that compliance process is automated since all file storage, edits and communication will be automated.

Blockchain for Competition

BT strategies helps in streamlining the supply chain which makes the company’s processes to be efficient. The us IoT ensures that there is connection between all the stakeholders and the company which increase generation of information and coordination. Overall, BT has a significant impact on both national and international competition.

Align the Recommended Strategies with BSC dimension.

Formulate Blockchain Strategies using the primary data collected

Collecting and analysing field data is important when deciding to adopt a new strategy or technology in an organisation. The BT is likely to improve the performance of ENOC by enhancing efficiency, increasing revenue, and making the governance more transparent. For this study, 18 participants took part in answering a survey which was divide in three sections: one with demographic information and the others with a Likert scale. This section presents the analysed data and discusses the results based on the findings.

Data Analysis

Demographic Information

The characteristic of the research participants is such that 79% were males while females were 21%. Regarding the level of education, majority of the participants 68% had master’s degree while 32% had bachelor’s degree. Majority of the respondents were between 30 to 40 years and had worked in the company for less than ten years.

Reasons for Not Adopting BT

Blockchain is a relatively new technology, which is gaining popularity, especially in the oil and gas industry. Only 5.6% of the participants strongly agreed that their organisation does not understand how to use BT. The majority of the participants (44.4%) strongly disagreed and 16.7% disagreed with the statement that organisations lack knowledge of block chain technology. Since all participants were employees in the oil and gas industry, the implication is that the BT is not a new concept for ENOC. The understanding that they have is, however, abstract because they lack experience working with BT.

Knowing about BT does not necessarily guarantee its adoption when there are fears about its impact. Change is never easy, as most people prefer to maintain their status quo. When asked whether they perceived BT as demanding extensive experience, 38.9% of the participants stated that they strongly agreed compared to 11.1% who strongly disagreed. Although majority of the respondents (68%) had a master’s degree, they did not think that they had the necessary experience to implement BT. Training and creation of awareness is, therefore, important when considering adoption of BT.

Intention to use BT

The advantages of BT are clear but findings from the current study indicate that most people are steal reluctant about integrating the technology in their business enterprise. 38.9% of the participants responded that they were neutral about the idea of adopting BT in the future. The number of respondents who strongly agreed to the idea was 27%. The ENOC organisation may not readily adopt BT strategies in the near future unless they are provided with an evidence-based rationale for change.

Alignment of recommended strategies with Blockchain Technologies

Conclusion and Managerial Implications

The ENOC company operates in the oil and gas industry which faces strong upstream competition. Issues such as regional conflict, complex supply chain system, and fluctuation of prices and demands are but a few challenges that the company faces. Nonetheless, since its foundation the company has experienced significant growth and acquired many reserves since it is a government entity. To reduce its production cost, enhance transparency and make work more efficient to the employees’ adoption of BT technologies is proposed. Findings from this study reveal that the oil and gas industry has educated employees at their prime age, which is good for productivity. There is some reluctance in adopting block chain by most of the workers despite being aware of the technology. The implication is that more in-depth training is needed before adoption of the BT. When advantages of the technology are highlighted, it will be easier for ECON to see the need to integrate the change. This study has a few limitations since the participants were only 18. The implication is that the results cannot be generalised to a larger setting. Future researchers can replicate this study in a cross-sectional area and include a bigger sample.

References

ADNOC (2018). Annual report 2018: Driving growth delivering value. Web.

Aldoukhi, H. (2018, April). ENOC Retail Smart Station UAE First Solar-Powered Service Station. In SPE international conference and exhibition on health, safety, security, environment, and social responsibility. Society of Petroleum Engineers.

Anis, M. D., & Siddiqui, T. Z. (2015). Issues impacting sustainability in the oil and gas industry. Journal of Management and Sustainability, 5(4), 115. Web.

Balasubramanian, S., Al-Ahbabi, S., & Sreejith, S. (2019). Knowledge management processes and performance. The International Journal of Public Sector Management, 33(1), 1-21. Web.

Bowen, G., Appiah, D., & Okafor, S. (2020). The influence of corporate social responsibility (CSR) and social media on the strategy formulation process. Sustainability, 12(15), 6057. Web.

Brui, O. (2018). Implementation of strategic management based on the balanced scorecard in a university library. Library Management, 39(8), 530-540. Web.

Cavaleri, S., & Shabana, K. (2018). Rethinking sustainability strategies. Emerald Group Publishing.

Dun &Bradstreet (2020). Abu Dhabi National Oil Company (ADNOC) for distribution. Web.

ENOC (2017). 25 years of inspiring energy: ENOC Annual Review 2017. Web.

ENOC (2018). Providing Energy for Life: ENOC Annual Review 2018. Web.

ENOC (2019). Energy & Efficiency Report. Global Mindset Local Impact, Web.

ENOC Official Website (2020). ENOC – Emirates national oil company U.A.E. Web.

Fitch Solutions (2018). United Arab Emirates Oil & gas report – Q4 2018. (2018). Web.

Fleisher, C. S., & Bensoussan, B. E. (2015). Business and competitive analysis: Effective application of new and classic methods. Pearson Education.

GuruFocus. (2020). ENOC current ratio | EnerNOC – GuruFocus.com. Value Investing | Market Insight of Investment Gurus. Web.

Hayrutdinov, S., Saeed, M. S. R., & Rajapov, A. (2020). Coordination of supply chain under blockchain system-based product lifecycle information sharing effort. Journal of Advanced Transportation,2020,10. Web.

Henry, A. (2018). Understanding strategic management. Oxford University Press

Karami, A. (2016). Strategy formulation in entrepreneurial firms. Routledge.

Katsioloudes, M., & Abouhanian, A. K. (2016). The strategic planning process: Understanding strategy in global markets. Taylor & Francis.

Koeppen, M., Shrier, D., & Bazilian, M. (2017). Is blockchain’s future in oil and gas transformative or transient? Deloitte Development LLC. Web.

Maqsood, A. S., Tareq Zayed, A. A., & Wikström, K. (2019). Benchmarking the strategic roles of the project management office (PMO) when developing business ecosystems. Benchmarking, 26(2), 452-469. Web.

Marinakis, V., Doukas, H., Koasidis, K., & Albuflasa, H. (2020). From intelligent energy management to value economy through a digital energy currency: Bahrain city case study. Sensors, 20(5), 1456. Web.

Nayak, G., & Dhaigude, A. S. (2019). A conceptual model of sustainable supply chain management in small and medium enterprises using blockchain technology. Cogent Economics & Finance, 7(1) Web.

Nicoulaud, B., Rudd, J., & Lee, N. (2020). Marketing strategy and competitive positioning (7th ed.). Pearson UK.

Oil & Gas. (2016). ENOC: Expansion through diversification. oilandgasmiddleeast.com. Web.

Rawan, A. S., Sweis, R. J., & Firas Izzat, M. S. (2018). Investigating the impact of hard total quality management practices on operational performance in manufacturing organizations. Benchmarking, 25(7), 2040-2064. Web.

Rockwell, S. (2019). A resource-based framework for strategically managing identity. Journal of Organizational Change Management, 32(1), 80-102. Web.

Shqairat, A., & Sundarakani, B. (2018). An empirical study of oil and gas value chain agility in the UAE. Benchmarking, 25(9), 3541-3569. Web.

Sivalingam, R. (2018). Strategic Management. Industry Analysis, Strategic Drift and Re- Strategizing. München GRIN Verlag.

STA Law Firm. (2020). Environmental law and practice in the United Arab Emirates: Overview. Lawyers in Dubai | UAE Law Firms | Lawyers in Abu Dhabi & Sharjah, UAE. Web.

Trading Economics. (2020). United Arab Emirates GDP per capita | 1975-2019 data | 2020- 2022 forecast | Historical. Trading Economics | 20 Million Indicators From 196 Countries. Web.

Zoominfo. (2020). ENOC. Zoominfo Web.