Introduction

Qatar Petroleum is a state owned company that was nationalised in 1977 by the state’s acquisition of a 60% stake of the company. To become an effective competitor in the market, the company entered the market with an underlying oligopolistic model that characterised the overall market structure through mergers and creation of subsidiaries (Kern, Kuzemko and Mitchell 2). The key characteristics of the market environment that Qatar Petroleum operates in include long run profits and the interdependence of the company with smaller companies and other major players such as ExxonMobil. Here, the market structure is defined on a non-price option economic competition model.

Qatar Petroleum Detailed Case Study

Ritz, argues that Qatar petroleum deals in petroleum products which include oil and gas besides the production, development, and exploration of crude oil and liquefied natural gas (LNG) defined in its upstream and downstream activities (4). Here, three endogenous variables define the characteristics of the firms, which include exploration, discovery, and success. The oil market structure has changed significantly both in the internal and external markets.

Subsidiaries and joint ventures

This is typical of the state owned company, which was established by Emiri under the decree no. 10, is the third largest in the world that has established joint venture with Ras Gas Company Limited, Ras Laffan Liquefied Natural Gas Company Limited, atar Liquefied Gas Company Limited Q.S., and Qatex Limited among others. QP Ras Gas (III) Limited, Qatar Holding Intermediate Industries Company Limited, and Industries Qatar Q.S.C. constitute its subsidiary companies (Rodriguez and Scurry, 11).

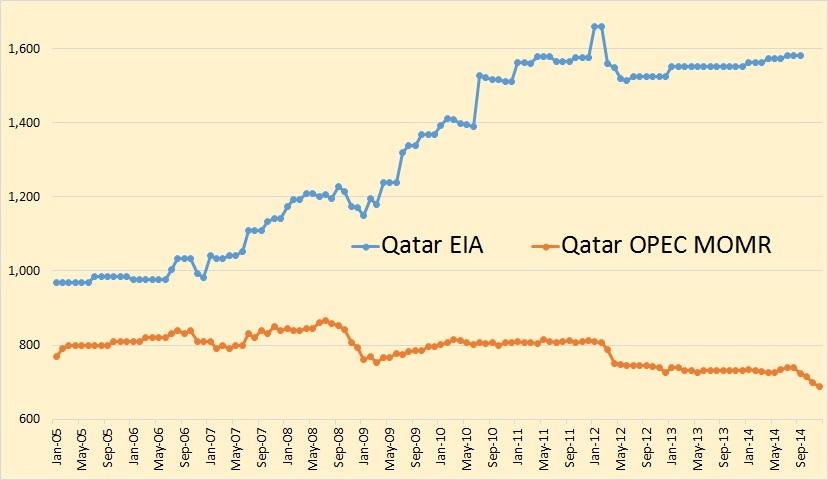

Besides, the subsidiaries and its joint ventures, the company has invested in the Arab Petroleum Pipelines Company and the Arab Maritime Petroleum Transport Company among others. Because of the high stakes of the state in the company was officially nationalised in 1977 after a sequence of events such as the acquisition of 60% of its shares. Oil production by Qatar petroleum is served by a network of pipes to the export terminals and refineries from the onshore and offshore oil fields. A typical production graph is shown in figure 1.

Oligopolistic model

Qatar petroleum is characterised by an impure oligopolistic economic model that is defined by limited competition, but high initial capital investment (Growitsch, Hecking and Panke 2). The company has partnered with other oil companies such as Occidental, TOTAL and ExxonMobil for the production and export of oil to North America and European nations.

Characteristics of the oil industry

The oil industry’s operational mode is characterised by major, independent, and diversified oil firms that allow them to operate in the exploration, production, and transportation of the commodity segments of the petroleum market. However, the concentration ration is not 1 as the game theory depicts.

Major oil companies

Major oil companies usually have their own experts and equipment for the exploration, production, and transportation of oil. Companies conceptualised as diversified are characterised by a smaller share of participation in the oil industry. However, some oil firms are classified as independent because the firms operate in a market structure that is defined by smaller capital investments.

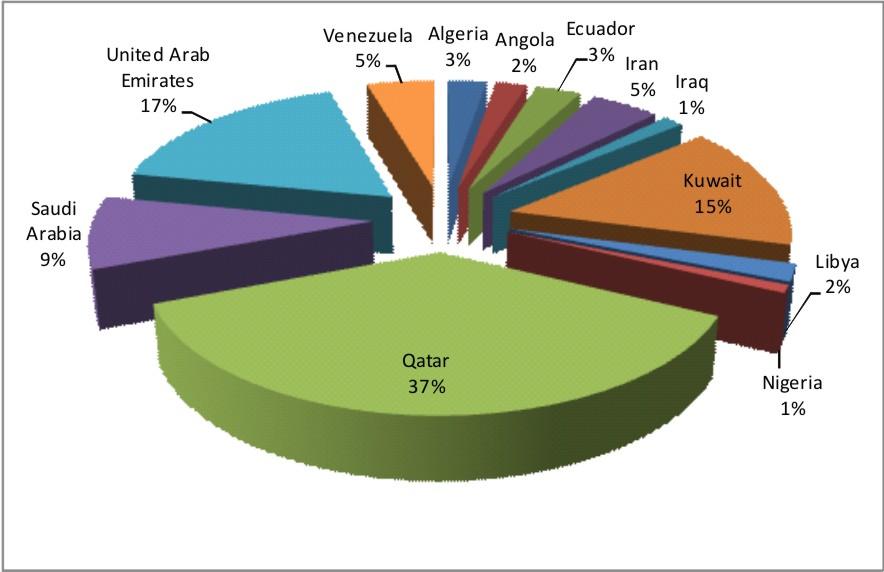

Figure 2 shows the distribution of oil production with Qatar occupying 37% of the world’s total volume (Cetorelli and Strahan, 2). Different forces in the market depict the behaviour of different companies that respond to the forces of perfect competition as failing to perfectly obey the laws of demand and supply as detailed in the game theory where the seller sets the prices and the buyer has no option but to accept the price offerings as illustrated in figure 3.

Pricing

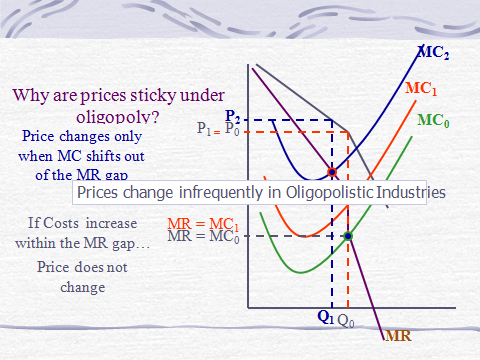

While the trend of setting oil prices has been in the domain of oil producing and exporting countries for many years, the current trend has changed significantly, making it an important variation of the basic Hoteling model. However, the market structure of the petroleum industry is defined by the inter-temporal profits maximization in the context of an oligopolistic competition as depicted in figure 3.

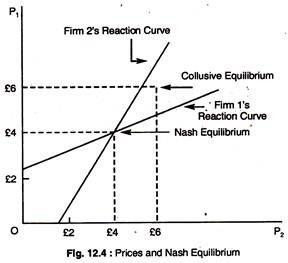

The analytical results show that the industry is characterised by a few firms that dominate the market that is driven by major oil companies besides the companies that have formed mergers and subsidiaries to be competitive in the market. The Pricing mechanism P1 and P2) and the other response variables MC and MR provide evidence of the failure of the firms to collude to manipulate the price of oil. The market trend is evidently conceptualised in Saudi Arabia’s refusal to cut production quantities to raise market price of oil (Vivoda, 5).

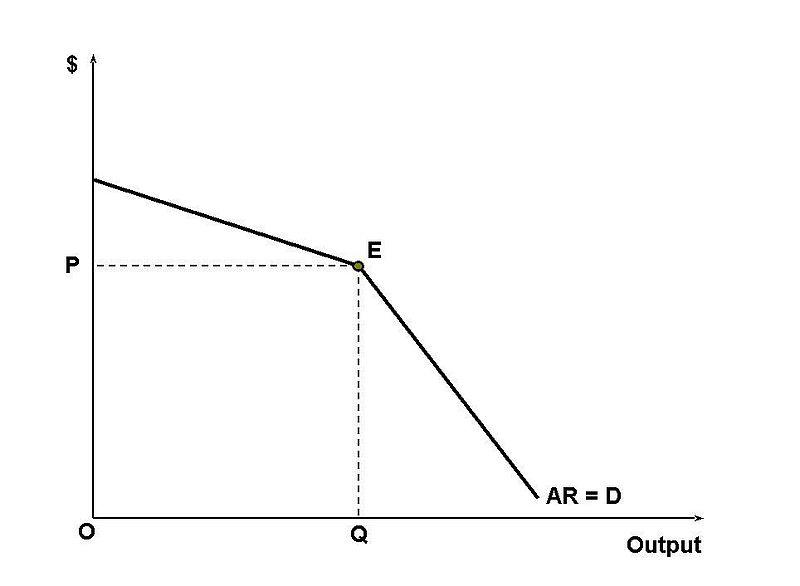

Typically, oligopolies operate in rather unique ways because when the price of oil is decreased by one country, other countries follows suit and that is reflected in the current behavior of price changes in the oil market. The demand and supply curves and the underlying economic models and theories sometimes do not explain the behavior exhibited in the oil market. Here, the supply (output) can be defined by a continuum of market variables and the levels of agreement among the oil producing companies as depicted in figure 4.

Besides, it is evident that the external oil competitors have a strong influence on Qatar Oil Company’s oil production and exploration because even if the company intends to raise the price of oil, other oil exploring, producing, and exporting countries could optimise the resulting gap to increase their market shares, which makes Qatar oil company vulnerable to the loss of customers.

However, because of the need to increase profits and not paint the company as an oil cartel, price maximization should underpin the policies and business strategies and the economic models adopted by the company.

Competition in such markets can either be cooperative or non-cooperative. The cooperative competition model is evident in the current market oil structure where firms create mergers, subsidiaries, and sometimes cooperate at different levels of the exploration, production, transportation, and exporting oil.

Contrast the economic efficiency of the outcomes under market structure

It is possible for firms to make significant gains in terms of profits and market dominance if the level of cooperation is high resulting in an economically efficient market structure.

Economic efficiency

This is in response to the demand where a smaller number of firms in the oil market operate efficiently. In theory, one notes that because the firms are few, the economic efficiency of the outcomes are high because firms find it easy to cooperate at the same level by agreeing to make production quotas that perfectly obey the economic model of demand and supply. An oligopoly based market structure enables companies to set high oil prices. The whole mechanism is illustrated in figure 5 where an equilibrium condition is reached depending on the behavior of the market forces.

Conclusion

In conclusion, the typical points that emerged from the study are that Qatar petroleum is a national oil company that has developed mergers and subsidiaries and partnered with major companies in the exploration, production, and transportation of oil besides endeavouring to set the price of oil. The market structure is oligopolistic in nature and it is characterised by companies with the ability to set prices if the level of cooperation is high.

Works Cited

Cetorelli, Nicola, and Philip E. Strahan. “Finance as a barrier to entry: Bank competition and industry structure in local US markets.” The Journal of Finance 61.1 (2006): 437-461.Print.

Growitsch, Christian, Harald Hecking, and Timo Panke. “Supply disruptions and regional price effects in a spatial oligopoly—an application to the Global Gas Market.” Review of International Economics 22.5 (2014): 944-975. Print.

Kern, Florian, Caroline Kuzemko, and Catherine Mitchell. “Measuring and explaining policy paradigm change: the case of UK energy policy.” Policy & politics 42.4 (2014): 513-530. Print.

Ritz, Robert A. “Price discrimination and limits to arbitrage: An analysis of global LNG markets.” Energy Economics 45 (2014): 324-332. Print.

Rodriguez, Jenny K., and Tracy Scurry. “Career capital development of self-initiated expatriates in Qatar: cosmopolitan globetrotters, experts and outsiders.” The International Journal of Human Resource Management 25.7 (2014): 1046- 1067.Print.

Vivoda, Vlado. “Natural gas in Asia: Trade, Markets and regional institutions.” Energy Policy 74 (2014): 80-90.Print.