Nowadays, the legalization of marijuana for recreational purposes is still being strongly debated. Many scholars refer to it as a “controversial” and “multifaceted” issue that requires careful consideration (Caulkins & Kilmer, 2016). Initially, the usage and storage of any amount of marijuana were criminalized in the United States, but after finding no severe health or mental consequences, some states considered it reasonable to legalize using, selling, and producing this drug (Caulkins & Kilmer, 2016). For example, in 2012, citizens of Colorado and Washington approved the legalization of marijuana by proposing the most appropriate legal framework and taxation system. Nonetheless, the existence and popularity of the black market throw into question the government’s ability to control the distribution of marijuana and drug trafficking across the country.

Consequently, the primary goal of this paper is to understand the impact of taxes on the financial stability of the market for legal marijuana with the help of the law of supply and demand and price elasticity in Colorado and Washington. Simultaneously, it is essential to determine the structure of the market and emphasize the importance of governmental intervention in this industry. In the end, conclusions are drawn to summarize the main findings of the paper.

Impact of Taxes of the Financial Prosperity of Legal Market

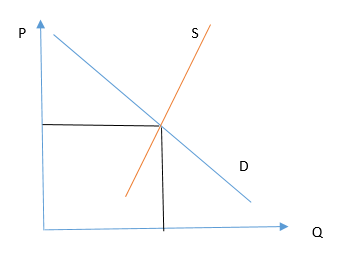

As mentioned earlier, the success and market share of legal marijuana was highly linked to the black market and elasticity of the prices. It could be easily predicted that this governmental intervention would create a favorable environment for the black markets while causing them to thrive and retain more clients. The primary reason for that is the fact that the black markets will offer marijuana for a more appealing price due to the absence of taxation in this segment. Thus, these consequences of imposing taxes can be easily explained by the laws of supply and demand. Figure 1 depicts the current situation in the legal market, where the demand curve (blue) has a downward slope while the supply (red) has an upward slope. In turn, Q stands for quantity and P for the price.

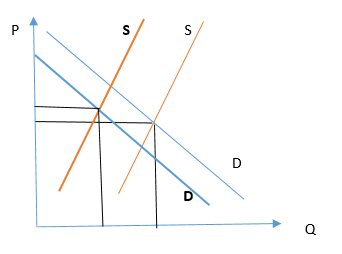

Figure 2 illustrates the changes in positions of the curves after increasing taxes along with the pressure of the black market. In this instance, it is clear that the supply curve will experience a substantial downfall due to high operating costs and taxes. Meanwhile, along with that, the percentage of customers will also drift to the black market or switch to alternatives since cheaper options will continue to exist. Nonetheless, fluctuations of supply and demand will not be as dramatic as shown, since people tend to change their attitudes and give preference to legal drugs during periods of reduced price elasticity (Ingraham 2016).

Market Structure

Initially, marijuana production, sales, and distribution were completely determined by the black market, which was controlled by the basic principles of supply and demand and the invisible hand. Thus, to support the development of the legal market, the government issued several licenses after voting, and this contributed to the creation of a highly competitive environment (The Associated Press, 2014).

These changes were positive for consumers since the number of available options was constantly growing while the prices were decreasing. It shifted the attention from the black market to the legal one, but it was necessary to introduce effective control mechanisms to ensure quality, monitor sales, generate revenues, and develop adequate prices. Without it, the market would not entirely fail, but it would negatively affect both the GDP of the country and households’ wealth.

The changes in taxation modified the structure of the market. For example, companies with well-established brand images acquired small ones, since these smaller companies could not survive intensified competition (Migoya & Baca, 2016). This trend was caused by the fact that the number of licenses per owner was not limited. Meanwhile, in 2017, the Marijuana Club License was introduced, and it established stricter rules to control the sales of marijuana (Colorado General Assembly, 2017).

These matters changed the whole situation by decreasing the number of competitors, increasing the sizes of market shares of big market players, and shifting towards oligopoly and monopoly. It could be assumed that these changes were made by the government intentionally, as reducing the number of rival firms made the current market leaders more attractive to investors including FDIs, and assisted in providing universal requirements and controlling the transactions in this segment. According to these findings, this market has the features of monopolistic competition, since the government has the same regulations for all service providers in this industry while the consumers continue to be responsive to price fluctuations.

Importance of Governmental Intervention

The analysis of the Washington and Colorado markets shows that the recreational drug industry has to be strictly controlled by the government. In the first place, this intervention has a direct impact on price development and the consumption of drugs, and authorities can easily monitor any changes in demand. For example, in 2015, the market share of legal drugs experienced growth while mainly being triggered not only by the growing interest in marihuana but especially by the transfer of consumers from the black market (Ingraham, 2016).

In turn, apart from considering marijuana as dangerous initially, the governmental authorities found benefits in legalizing it. For example, allowing the production and sales of marijuana saved local producers from stagnation, as it was cost-effective to use the services of local manufacturers and farmers (Ingraham, 2016). A combination of these factors established unified quality standards for marijuana sales, increased GDP, reduced unemployment, created unique opportunities for companies and contributed to their financial growth.

Underestimating this intervention may result in misallocation of resources. It is evident that without a well-developed and controlled taxation system, the black market will thrive. The analysis of price elasticity and the law of supply and demand supports this theory. It takes place because the black market not only has lower prices than the legal one but also has an extended variety of drugs. In this case, not controlling it may result in increased popularity of synthetic drugs such as methamphetamine, which is a highly addictive and dangerous stimulant with a disturbing effect on health (Petit, Karila, Chalmin, & Lejoyeux, 2012). In this case, the intervention is necessary to prevent the spread of other dangerous drugs and to make this market beneficial to the country. Regardless of its positive intentions to reduce drug trafficking, the legalization of marijuana may increase the percentage of admitted patients with addiction, the

several accidents due to stoned driving, and the accessibility of drugs to children, and it could ultimately lower the overall health, well-being, and morale of the nation (Caulkins, Kilmer, & Kleiman, 2016).

Conclusion

The analysis of the legal marijuana market revealed that prices continue to be elastic due to the high impact of taxes. Along with that, the development of various entities such as the Marijuana License Club requires companies to have identical offers while complying with the model of monopolistic competition.

This fact shows that the government continuously intervenes in this situation. Nonetheless, apart from evident drug propaganda, the legalization of marijuana has more benefits than drawbacks. It causes a positive shift in GDP, reduces unemployment, and creates a favorable environment for local producers while monitoring consumption and drug trafficking. Similar industries have to be controlled carefully due to their potential negative consequences on health and mental well-being. Without this intervention, the market would not experience failure because, the black market would continue to thrive, but, consequently, the country might face a substantial economic downturn, an increase in crime, unfair competition, and inadequate prices.

References

Caulkins, J., & Kilmer, B. (2016). Considering marijuana legalization carefully: Insights for other jurisdictions from analysis for Vermont. Addiction, 111(12), 2082-2089.

Caulkins, J., Kilmer, B., & Kleiman, M. (2016). Marijuana legalization: What everyone needs to know? Oxford, UK: Oxford University Press.

Colorado General Assembly. (2017). Marijuana club license. Web.

Ingraham, C. (2016). The marijuana industry created more than 18,000 new jobs in Colorado last year. The Washington Post.

Migoya, D., & Baca, R. (2016). For the first time, we know who is behind Denver’s pot industry. The Denver Post. Web.

Petit, A., Karila, L., Chalmin, F., & Lejoyeux, M. (2012). Methamphetamine addiction: A review of the literature. Journal of Addiction Research & Theory, 1(1), 81-90.

The Associated Press. (2014). Colorado’s pot market getting new competition. The Denver Post. Web.