Executive Summary

The determination of whether an organization is on track or not in terms of meeting its key deliverables and objectives calls for the evaluation of employees’ performance and appraisal by the organizations’ managers. Using the National Bank of Kuwait as a case example in this report, the report reveals that there exists a dissonance or rather conflicts between employees and the evaluation managers on matters of appraisal.

The report therefore recommends that organizations’ managers should guide employees in order to make their appraisals high. Besides, the management should give employees some goal that they should achieve every year. Above all, organizations should test and hire good quality human resource managers to help in bringing on board a promising workforce.

Introduction and Overview

The report addresses the problem of employee appraisal, bonuses, and conflicts in organizations. The research goes deep into carrying out a research interview with the human resource manager at the National bank of Kuwait. The research adopts the use of questionnaires with close –ended and open-ended questions as research tools.

From the findings of this interview, the research adopts various variables as parameters of organizational behavior. These variables include interpersonal skills, accountability, attention to details and quality focus, teamwork, customer focus, attitude, commitment, and sense of energy.

The research proceeds to weigh the scores from each variable on the scale of 100% comprising (A+) for ‘outstanding’ for scores above +100%, (A) for ‘exceeds expectations’ for scores between 100%- 90%, (B+) for ‘meets expectations’ for scores between 89%- 74%, (B) for ‘below expectations’ for scores between 73%-63%, and (C) for ‘unsatisfactory’ for scores between 63% and below.

The research goes on to evaluate various motivational methods applied by the National Bank of Kuwait especially the use of bonuses. These include December bonuses, March special bonuses, and April promotions. The impact of the appraisal and the bonus program is also evaluated. After analyzing the findings, the report offers several recommendations directed towards elimination of the problems in question.

Problem Statement

In many organizations, employees do not appreciate the results of appraisals carried out by the human resource managers in their organizations. Employees will therefore discredit the competence of the human resource manager who carried out the evaluation instead of focusing on the results and their failures.

On the other hand, human resource managers face tough times in their bid to explain and convince employees to accept the results of their appraisals. This report hypothesizes that employees in the National Bank of Kuwait disregard the results of their performance appraisals due to the incompetency of human resource managers.

Failure of employees to appreciate performance appraisals is rooted on the idea that management does not provide employee with guidance towards organizational and individual goals. As Baroda, Sharma, and Batt put it, it is vital for workers to be well versed on the organization’s situation so that they can know what it is that they are required to change (53).

Findings

The research relied on data collected from a sample of 1000 employees of the National Bank of Kuwait. The sample was randomly selected from the possible “4000 workers of the bank all the 17 countries across the four continents” (National Bank of Kuwait Para. 2).

Data Presentation

The findings were presented in the tables and pie charts as illustrated below

Table 1.0 performance of various employees on a 100% scale

Pie chart 1.1 performance appraisal for employees and their scores on a 100% rating scale

Table 2.0 Reasons for employee disagreements with organizational appraisals

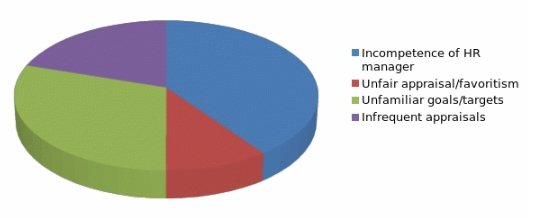

Pie chart 2.1 Reasons for employees’ disagreement with the performance appraisal

Discussion of Findings

From the findings presented above, various deductions and analysis can be realized. The research indicated that employees vary in performance and various areas of appraisal based on the evident difference in capabilities as put forth by Baroda, Sharma, and Batt (54). From table 1.0, when employee performance was coded and averaged, the research realized that the highest percentage of employees scored below average (80%).

The finding concurred with Khazal’s revelation that majority of institutions within the eastern region of Kuwait have to fight back the unwelcoming financial circumstances (2). Most of the employees therefore scored between 73% and 63%, which was rated as below expectations on the appraisal rating scale.

From the pie chart 1.1, it can be interpreted that the performance of the largest segment of employees in the National Bank of Kuwait performed below the organization’s expectations. The larger segment of 80% percent of all the employees performed below standard. However, within this range, there is potential to improve this performance in time. Such a group of employees can change for better performance in a small period.

There is quite a considerable level of laxity on the side of the management to train and direct employees based on the high number that performed below the expected standard yet they have the potential to perform better within a little duration of time depending on the ability of the human resource department and the management to train employees. From table 1.1, it is clear that 14% of the employees scored below the level of satisfaction of the organization and hence unsatisfactory.

It is also quite disturbing that the organization is not sure whether the 14% employees in this segment can be reformed. From the pie chart 1.1, this segment is the second largest in degrees. The interpretation is that the National bank of Kuwait is in the verge of either being forced to lay off these employees or develop an intensive training program for them. From the rating scale, it is almost impossible to revive the employees’ performance standard.

The other important result that came up from this research was that a very low percentage of employees at the National bank of Kuwait scored above B+. From table 1.0, only 3% of the employees scored between 89% and 74% (B+) hence meeting the expectations of the organization. Out of 1000 employees, only 30 whose performance was at the required standards set by the management of the national bank of Kuwait.

The expectations were that most of the employees from the bank would meet this threshold. Although most of the experienced employees are supposed to be in this range, the research proved otherwise. Having only 30 employees scoring a grade that indicates competency and experience is below the expectations of a competent national bank.

Therefore, the highest percentage of employees was not competent. The performance and quality of service in that bank is below the standard especially when one looks deeper into parameters like interpersonal skills, accountability, attention to details and quality, and customer service, which are crucial in the delivery of service in a banking system.

The high percentage of employees who scored below average (94%) is an indication that the National bank of Kuwait offers services that are below standard. In contrast with many other banking organizations, the research also realized that the standards of the national bank of Kuwait targeted only 30 employees to be awarded grade (B+).

Hence, the target of the National Bank of Kuwait is therefore below standards since, if (B+) is the expected performance and it is the grade that should comprise most of the competent employees, more than 3% of employees should attain it. The segment that this percentage represents on pie chart 1.1 is very low.

From table 1.1, the research also indicates that 2% of the employees scored between 100% and 90% to score (A). Only 20 employees exceeded the expectations of the National bank of Kuwait. The research interpreted that, since this data was gathered from a national bank, the number of employees who scored this grade should have been higher. Employees that are self-motivated are likely to exceed the limit.

Therefore, the level of motivation in National bank of Kuwait is below the expectations of the employees. When employees appreciate the motivation offered by their company, they work hard to achieve it. The fact that employees are rewarded in various months of the year does not seem to inspire them to work.

Only 20 out of 1000 employees exceeded the expected results. However, it is also worth to note that the order of the National bank of Kuwait targets only 20 employees to attain grade (A). One can therefore infer that a higher number of employees would not have reached the grade since the principles of this organization did not allow them. Such a limitation can act as a source of discouragement and de-motivation to work hard.

Employees with the ability of scoring between 100% and 90% may not work hard to achieve this target while they know that only two of them will be awarded with grade (A). In fact, employees will completely become disinterested with the rewards emanating from attainment of this score once they realize that certain employees are already scoring better marks or are going to be favored by the supervisors.

This great source of demoralization perhaps reveals why only 20 employees out of a whole 1000 score this grade. On the top-most grade (A+), the research realized that only one employee was allowed by the principles of National bank of Kuwait to be awarded with this grade.

Such a percentage was interpreted to mean that the employee had depicted a very high level of proficiency and was competent in the job. The bank also recommends that special notes be made about such an employee. It is also a requirement of the bank that such a performance be rated among the best 5% in the organization.

From pie chart 1.1, the grade had the least segment. A very small sector of the whole employee was able to attain it (only 1%). Therefore, from the standards of the national bank of Kuwait, it was very hard for employees to attain grade (A+). Attaining this grade would mean that an employee was very proficient in the variables used to measure performance.

The special notes that were to be made mean that such an employee would call for a special attention and consideration by the management. The level of competency and proficiency of employees in the National bank of Kuwait was very low, as many employees did not show any commitment, which is a key requirement for employees. Since the bank is a people-oriented organization, proficiency in execution of duties cannot be an excuse.

Employees in this organization should exhibit great proficiency in areas like attention to detail and quality focus. A banking institution ought to have a very high percentage of employees scoring high marks in this area. Winning customers’ trust calls for great efficiency, proficiency, and attention to details in execution of duties. Having only one employee score (A+) would therefore be interpreted to mean that this was not the case in national bank of Kuwait.

The reward and motivation program that the national bank of Kuwait applies may be a great hindrance to performance. For example, the bonuses that the bank gives every December are awarded to all employees meaning that all the 1000 employees of the bank would receive 25% of their basic salaries as bonus.

From table 1.1, even the 14% of employees who scored (C) are also given the bonuses and hence another reason for laxity in the organization. Every employee is aware that, even when he or she fails to attain the standards that are set by the bank, he or she will still receive the December bonuses.

Every bonus ought to have a score pegged on it to motivate employees. In fact, pie chart 1.1 indicates that the majority of employees (94%) did not attain the standards set by the organization. Consequently, the national bank of Kuwait will have to reward the entire employee with a 25% of each one’s salary amounting to a huge amount of money. The December bonuses may not motivate any employee to work extra hard towards the attainment of the bank’s mission since they are meant for all employees.

The only difference that the bonuses can bring about is that of making the employees want to remain in the organization for long. The December bonus may not increase the output of the organization, but it can reduce the rate of job turnover. Perhaps most of the employees are within below 63%, and between 73% and 63%.

The other bonus that is awarded as special bonuses in March is pegged on profit. From the data collected, the profitability of the national bank of Kuwait may not be very feasible based on the low percentage of employees who scored above 73%. If the performance of the employees is low, it means that their output is low. Hence, the profit of the organization is also low. The officer in charge of these rewards in the national bank of Kuwait awards these bonuses by performance.

Since this research indicated that only one person attained this percentage, the special March bonus will be awarded to one person only. It is also worth noting that 4% of the total profit that the bank realizes is a huge amount of money especially when it is given to one person. Perhaps the national bank of Kuwait should consider increasing the number of people who can attain this grade.

Employee Conflicts

The major problem with performance appraisals in most of the organizations in the world today is that a big number of employees do not appreciate the results. In fact, some past researches show that more than a half of the employees disagree with the results of performance appraisal in their organizations meaning that they disagree with the findings of the evaluation manager (Baroda, Sharma, and Batt 58).

From table 2.0, a considerable number of employees in the National Bank of Kuwait disagreed with the outcome of the November appraisals. The research indicated that employees had various reasons for their disagreements. The pie chart 2.1 also illustrates clearly various segments of employees and the reasons why they disagree with the appraisal results. From table 2.0, 400 of the employees cited incompetence of the human resource manager as the reason that would make them disagree with the results.

These employees comprised a 40% of the total number of employees in the national bank of Kuwait. From pie chart 2.1, the segment that the employees represent is also very huge compared to others. In fact, they take the largest sector in the pie chart. Therefore, incompetence of the human resource manager and other human resource officers in an organization may result in employees discrediting the appraisal processes (Baroda, Sharma, and Batt 61).

Consequently, organizations like the bank of Kuwait need to be very careful when hiring human resource managers and officers. Only the very competent and skillful employees are supposed to be hired as human resource managers.

They should be well inducted into the organization by experienced predecessors. If the human resource officer or manager is coming from another organization, proper induction should be done before such an officer is left to perform his or her duties since every organization has its own culture and that the culture of a banking organization cannot be learnt overnight.

Therefore, new comers in the office of human resource have to be properly inducted into the customs of the organization. The best practice in employee appraisal calls for understanding of the human resource manager on the duties, roles, and responsibilities of employees under him or her, support of on the employees, and cooperation between him or her and employees.

With such knowledge, employees can regain their confidence in the human resource department of their organization. When organizations hire competent human resource managers, they may not experience the problem of employees’ act of disregarding on performance appraisal results. Therefore, from the findings of this research, the national bank of Kuwait needs to hire competent human resource and evaluation managers in order to instill employee confidence in the appraisal results.

This step will lower the percentage of employees who refute the appraisal results citing this problem from 40% to a considerable level. From pie chart 2.1, the next largest segment of employees cited lack of information on the targets and goals set for employees by the bank.

Approximately 30 0employees from this bank cited this issue as the reason why they would disagree with appraisal results amounting to 30% of employees of the national bank of Kuwait. From table 2.0, the reason took a high percentage. In fact, from pie chart 2.1, it is clear that it took the second largest sector after incompetence of human resource managers.

One can therefore argue that 30% of the employees in the National bank of Kuwait do not know the parameters that the human resource managers and other evaluation officers use in appraisals. When employees do not know the goals that they should attain by the end of a given working period, they cannot work towards the same direction that the larger organization is working. Organizational goals can only be attained if they are subdivided among individual employees.

When employees are well informed about the goal and target that they should achieve, they gain a sense of direction. In every step that such employees take, they will be gearing their efforts towards the accomplishment of such a goal. When they reach their goals individually, the organization is also able to attain its larger goal and mission.

The larger goal of attaining larger customer base, offering better quality service, enhancing teamwork, and being proficient in service delivery can only be achieved if these goals are subdivided into sub-goals. Such sub-goals are then allocated to individual employees to ease the realization of the larger mission.

It is therefore important that employees be made aware of their goals and the expectations that the management has about them. Information and communication in performance appraisal is important. Employees should be provided with frequent feedback on their performance. Communication is power. When employees have information, they will know when they are headed for success and or when they are making the wrong progress.

The human resource management of the national bank of Kuwait and other institutions that can infer from this research should therefore ensure clear and complete communication to their employees. It is only through good communication and feedback that employees can raise the performance appraisal of their organization (Baroda, Sharma, and Batt 61). The 30% segment of employees who cited lack of information about goals and targets require being properly informed and their feedback evaluated occasionally for better results.

The third segment of employees cited infrequent appraisal as their reason for disregarding the results of performance appraisals. From table 2.0, the issue comprised 200 employees, which translated to 20% of the total number of employees. Therefore, this reason is also a problem to reckon when carrying out performance appraisal. Performance appraisal should be done frequently and when the employees are aware of the parameters used for evaluation.

Consistencies of performance appraisals make the employees develop a culture of high standard performance at all times. Performance appraisal at the National bank of Kuwait is normally done in November every year meaning that the bank carries out evaluation of its employees only once in a year. Several points of evaluation should be initiated to develop a performance culture in the employees. The intervals of evaluation should therefore be consistent throughout the year.

Whenever the organization decides to remove or add an evaluation parameter, employees should be informed are aware and or be become conscious of their conduct and the quality of service that they deliver. From such a development, the institution develops in terms of performance.

It is important that the feedback of every stage of evaluation be communicated to the employees. Workers should be made to know about information that concerns them before other publics of the bank. Such efforts by the human resource department and the appraisal team make the employees more responsible. It will also make them appreciate the need for continuous competition in performance.

The parameters of evaluation should remain constant over a given period. The inconsistency in evaluation that 20% of employee cited may also be linked with alterations in the parameters of performance appraisal. Finally, from table 2.0, 100 employees comprising a 10% of the total employee were for the idea that they would disagree with the results of performance appraisal if they realize bias or unfairness in the process.

The 100 employees thought that the appraisers were not objective in appraising them. The result of such thoughts were that employees would therefore refuse to sign the appraisal sheet making the human resource manager waste a lot of time in convincing them and the senior officers that the results were accurate. In some instances, employees would accept the results of the appraisal. However, when they realize that their workmates who they deem to be of lower performance than them scored better, they object the results.

Human resource managers are supposed to demonstrate high levels of accuracy and consistency to avoid conflicts with employees. Whenever there is conflict of interest from their point of view, the human resource managers should exempt themselves from evaluating such employees for example when appraising relatives and friends.

Every employee should be fairly and equally evaluated. Employees should also be trained to avoid being jealous of their workmates who perform better. Instead, they should be encouraged to work harder to attain their targets.

Conclusion

The process of employee appraisal is crucial to every organization. Performance appraisal enables an institution to know its position in performance, realize the ability in its workforce, develop training programs and predict its future performance. In the performance appraisal of the national bank of Kuwait, the research realized that only 1% of employees scored (A+), 2% scored (A), and 3 % scored (B).

The rest majority scored below the expected standards by the human resource manager and the organization. The research also realized that a high number of employees from the National bank of Kuwait are bound to disagree with the results of performance appraisal.

The research informed that 40% of employees would disagree with the results due to incompetency of human resource managers, 30% would do so due to lack of information on targets and goals, 20% would object the results due to inconsistency, and 10% would object it due to bias and unfairness.

Therefore, report therefore concludes that most of the employees in organizations in the world are bound to object the results of performance appraisal. In most instances, this conflict will be caused by incompetency of the human resource managers, unfamiliar goals and targets, infrequency of appraisals, and biasness by the evaluating officers.

This report also concludes that some institutions like the national bank of Kuwait limit the potential in their employees by setting very low targets and by limiting the number of employees that can achieve high scores. Therefore, the performance of the employees cannot be pegged on the available bonuses or rewards.

Recommendation

This report recommends that national bank of Kuwait and other similar institutions should involve direct managers in guiding employees on performance appraisal. Such guidance should indicate to the employee the parameters of evaluation, the points of evaluation, and the need for evaluation to avoid conflicts.

The direct manager should also establish constant communication and feedback with the employee. This strategy will enable them appreciate the results of performance appraisal. Secondly, the report also recommends that National bank of Kuwait and other institutions of the sort should provide their employees with information about their goals and targets. Such moves should be done at the beginning of every financial period.

Employees should be told what to have achieved at a certain time of the year. Informed employees will work hard to reach the goals that the organization sets.

Achievement of individual goals will then translate to achievement of organizational goals. The third recommendation that this research offers is that the national Bank of Kuwait and other similar institutions should hire qualified and competent human resource managers.

The research recommends that such human resource officers should go through a series of personality tests to assess whether they qualify to lead and to appraise others.

It is also the recommendation of this report that human resource managers that are hired from other organizations should have recommendation letters to approve that they are able to perform performance appraisal successfully to ensure that employees gain confidence in the human resource managers. Confidence and trust in the human resource managers will ensure that there are reduced objections and hence conflicts to performance appraisals.

Works Cited

Baroda, Syatawan. “360 Degrees Feedback Appraisals: An Innovative Approach to Performance Management System.” International Journal of Management & Technology 1.2(2012): 53-66. Print.

Khazal, Ahmad. Influence of Customer Loyalty on Performance: The Case of National Bank of Kuwait. Netherlands: Maastricht School of Management. Print.

National Bank of Kuwait. Careers, 2012. Web.